How To Fill Out Form 8379

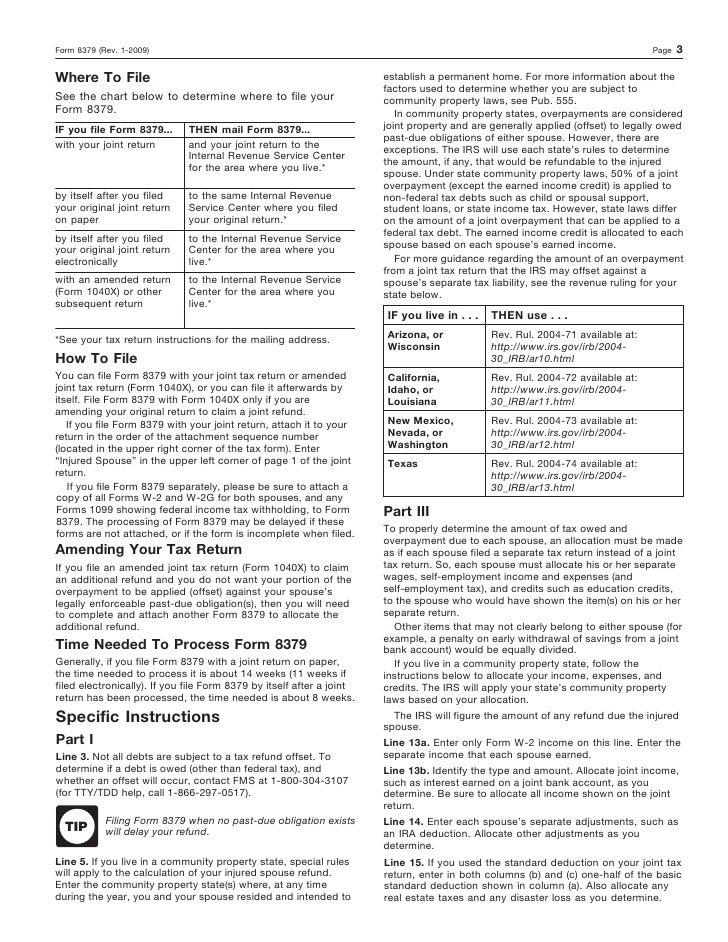

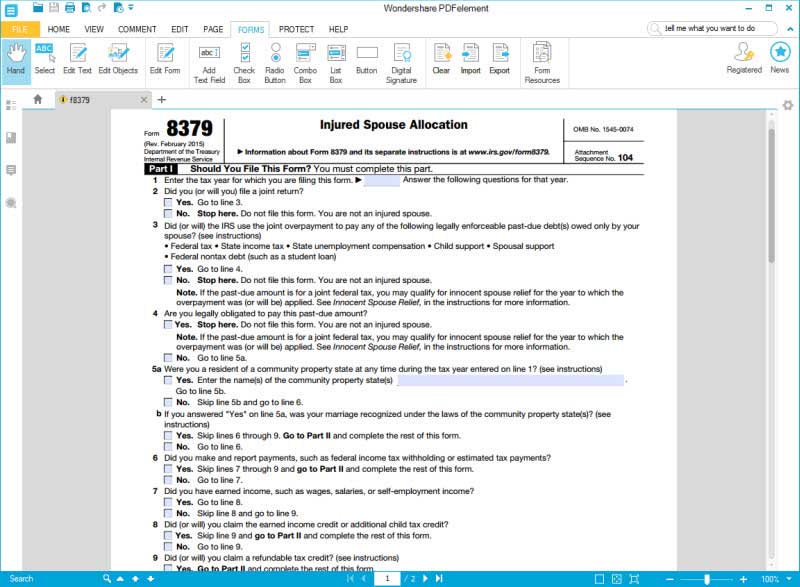

How To Fill Out Form 8379 - Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The injured spouse on a jointly filed tax return files form 8379 to get back. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. See the separate form 8379 instructions for part iii. Web form pilot is a form filler software that allows you to fill out forms on your computer instead of using a typewriter. Web a tax document known as irs form 8379 can be used to reclaim a portion of a tax refund that has already been or will be utilized to settle an unpaid debt of the other. Complete, edit or print tax forms instantly. To file your taxes as an injured spouse, follow the steps below:

If you mean you have the embed code, you need to place that one on your website. Yes, you can file form 8379 electronically with your tax return. Complete, edit or print tax forms instantly. Once placed, you should open. Web once the form is loaded, you can start filling up. Ad access irs tax forms. The injured spouse on a jointly filed tax return files form 8379 to get back. To be eligible to file. If you file form 8379 with your joint return, attach it to your. Part iii allocation between spouses of items on the joint return.

Part iii allocation between spouses of items on the joint return. To file your taxes as an injured spouse, follow the steps below: See more… + + + fill out electronic forms of any type (doc, txt, xls,. If you file form 8379 with a joint return electronically, the time needed to. See the separate form 8379 instructions for part iii. Read this article to simplify! Complete, edit or print tax forms instantly. Yes, you can file form 8379 electronically with your tax return. If you file form 8379 with your joint return, attach it to your. Fill out paper forms on your computer instead of using a typewriter.

Fill Out Form 8379 Online easily airSlate

To be eligible to file. Complete, edit or print tax forms instantly. Part iii allocation between spouses of items on the joint return. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. Ad access irs tax forms.

example of form 8379 filled out Fill Online, Printable, Fillable

The injured spouse on a jointly filed tax return files form 8379 to get back. The process is complex and difficult to navigate. Part iii allocation between spouses of items on the joint return. If you file form 8379 with your joint return, attach it to your. To file your taxes as an injured spouse, follow the steps below:

injured spouse form DriverLayer Search Engine

See more… + + + fill out electronic forms of any type (doc, txt, xls,. Read this article to simplify! See the separate form 8379 instructions for part iii. Once placed, you should open. Web form pilot is a form filler software that allows you to fill out forms on your computer instead of using a typewriter.

Fill Free fillable form 8379 injured spouse allocation 2016 PDF form

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. To be eligible to file. The process is complex and difficult to navigate. If you mean you have the embed code, you need to place that one on your website.

1040 form 8949 2019 Fill Online, Printable, Fillable Blank form

The injured spouse on a jointly filed tax return files form 8379 to get back. Get ready for tax season deadlines by completing any required tax forms today. See the separate form 8379 instructions for part iii. Complete, edit or print tax forms instantly. Read this article to simplify!

IRS Form 8379 Fill it Right

Web how to become a pilot is one of the most common internet searches. Part iii allocation between spouses of items on the joint return. See more… + + + fill out electronic forms of any type (doc, txt, xls,. Get ready for tax season deadlines by completing any required tax forms today. Read this article to simplify!

File Form 8379 to Recover Tax Refund Losses by sedatedetention30 issuu

Complete, edit or print tax forms instantly. Web a tax document known as irs form 8379 can be used to reclaim a portion of a tax refund that has already been or will be utilized to settle an unpaid debt of the other. Web once the form is loaded, you can start filling up. See the separate form 8379 instructions.

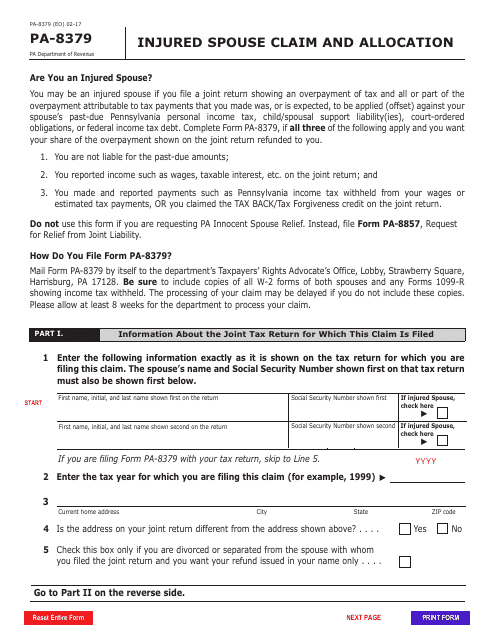

Form PA8379 Download Fillable PDF or Fill Online Injured Spouse Claim

Yes, you can file form 8379 electronically with your tax return. Web once the form is loaded, you can start filling up. See the separate form 8379 instructions for part iii. Complete, edit or print tax forms instantly. Part iii allocation between spouses of items on the joint return.

Fill Free fillable form 8379 injured spouse allocation 2016 PDF form

If you mean you have the embed code, you need to place that one on your website. Complete, edit or print tax forms instantly. To file your taxes as an injured spouse, follow the steps below: The process is complex and difficult to navigate. Web how to become a pilot is one of the most common internet searches.

irs form 2106 ez 2019 2020 Fill Online, Printable, Fillable Blank

Once placed, you should open. If you file form 8379 with your joint return, attach it to your. Ad access irs tax forms. Complete, edit or print tax forms instantly. If you mean you have the embed code, you need to place that one on your website.

Fill Out Paper Forms On Your Computer Instead Of Using A Typewriter.

Complete, edit or print tax forms instantly. If you file form 8379 with your joint return, attach it to your. Once placed, you should open. The injured spouse on a jointly filed tax return files form 8379 to get back.

Read This Article To Simplify!

Web a tax document known as irs form 8379 can be used to reclaim a portion of a tax refund that has already been or will be utilized to settle an unpaid debt of the other. Web how to become a pilot is one of the most common internet searches. Yes, you can file form 8379 electronically with your tax return. Part iii allocation between spouses of items on the joint return.

Complete, Edit Or Print Tax Forms Instantly.

Ad access irs tax forms. To file your taxes as an injured spouse, follow the steps below: Complete, edit or print tax forms instantly. To be eligible to file.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web by filling out form 8379, the injured spouse is requesting that the internal revenue service (irs) release their share of a joint tax refund. If you mean you have the embed code, you need to place that one on your website. See the separate form 8379 instructions for part iii. See more… + + + fill out electronic forms of any type (doc, txt, xls,.