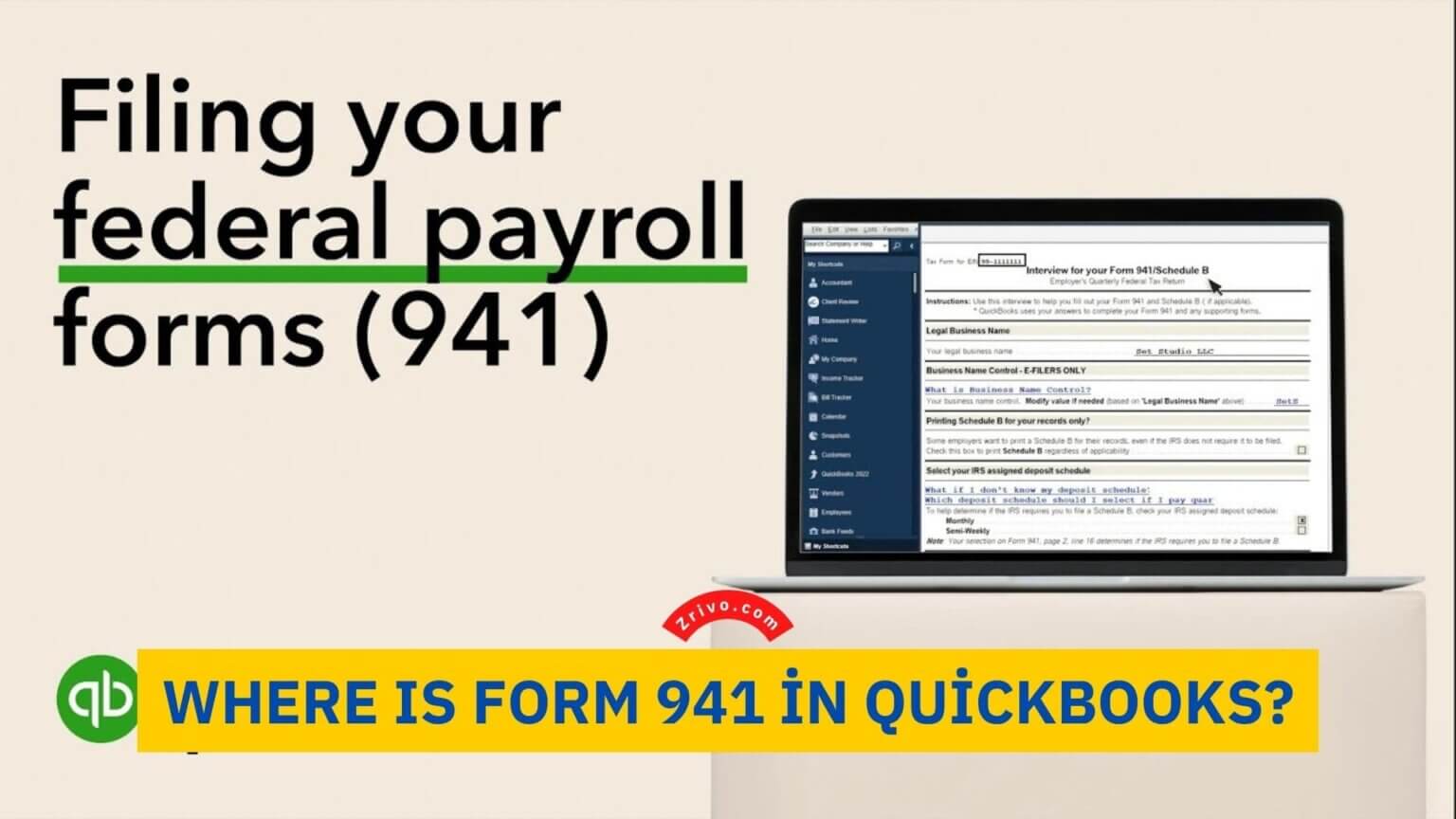

How To Find Form 941 In Quickbooks

How To Find Form 941 In Quickbooks - Select trust center from the left menu, then click trust center settings. But how do you file it online? Web to print form 941 or 944. Web click the file tab from the microsoft office. Choose ok and click open draft. Then select the payroll centre from the employees menu. Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. On the left panel, choose the taxes menu to select payroll tax. In the forms section, tap the view and print archived forms link under quarterly. Web how to file federal payroll form 941 in quickbooks online?

Web form 941 is due by the last day of the month that follows the end of the quarter. Web you can visit this prior year products section on the irs website to download the form's 2019 version, then manually file the form. Web click the file tab from the microsoft office. Web best answers monicam3 moderator january 10, 2022 02:29 pm yes, @payroll941. Select print for your records. Web the quickbooks desktop payroll assisted: If you are new to quickbooks, then it may be a challenge to find form 941. Web at the end of each calendar quarter and year you’ll need to file federal and state tax forms with the appropriate agencies. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Web track income & expenses.

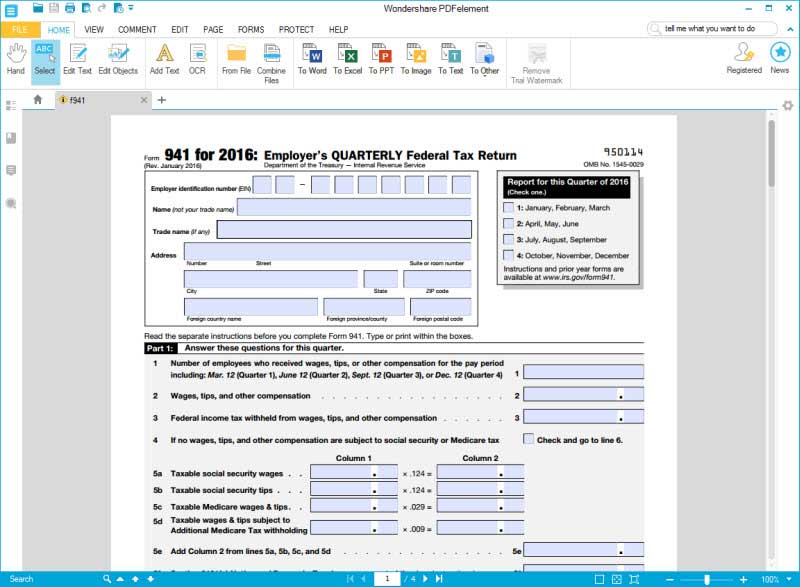

Track sales & sales tax. Web click the file tab from the microsoft office. Web where is form 941 in quickbooks? You can do this through quickbook. Select either form 941 or 944 in the tax reports section of print reports. But how do you file it online? Where to find 1st quarter 2021 941? Web you can visit this prior year products section on the irs website to download the form's 2019 version, then manually file the form. Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. If you are new to quickbooks, then it may be a challenge to find form 941.

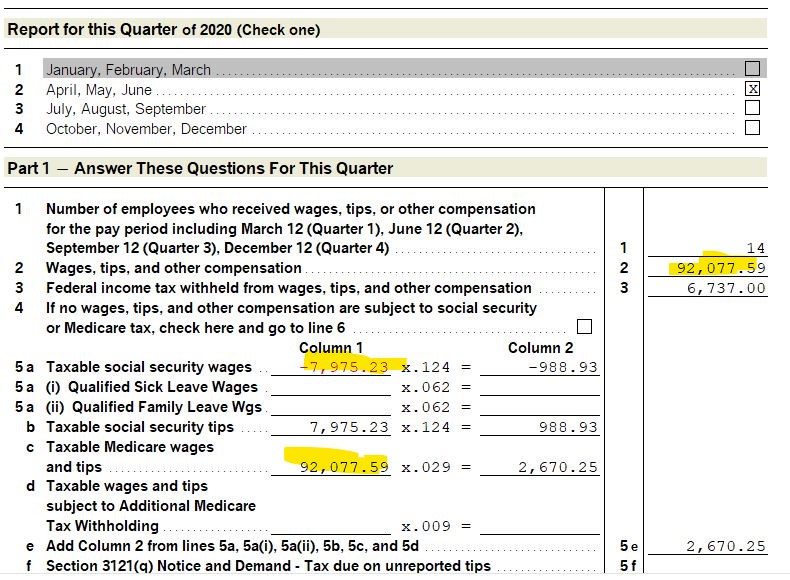

Worksheet 1 941x

Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Select macro settings, then select the. On the left panel, choose the taxes menu to select payroll tax. Web you can visit this prior year products section on the irs website to download the form's.

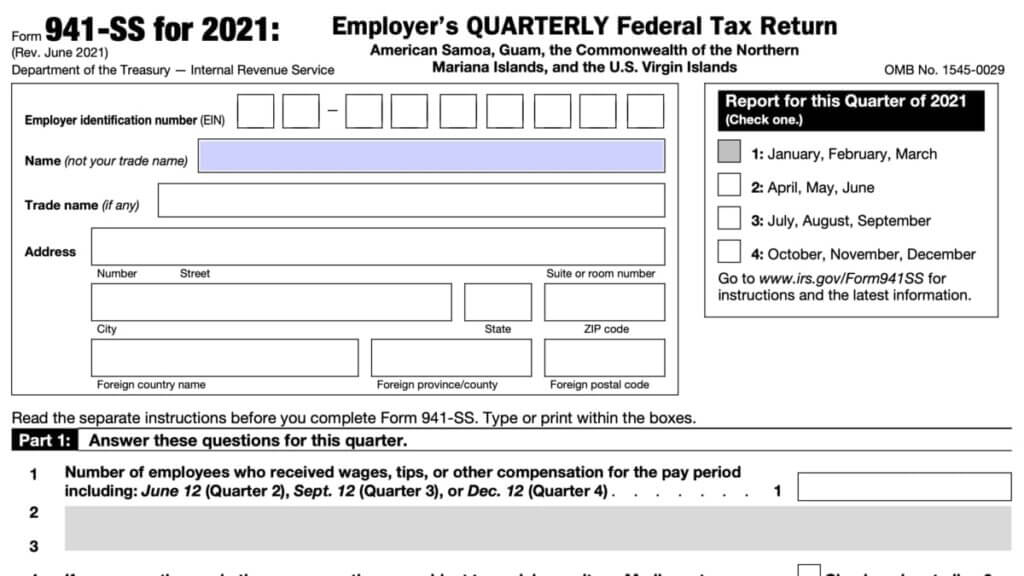

What Employers Need to Know about 941 Quarterly Tax Return?

Select trust center from the left menu, then click trust center settings. Web click the year or quarter from the small arrow then choose your quarter ending date. Track sales & sales tax. If you are new to quickbooks, then it may be a challenge to find form 941. First navigate to the employees menu.

Where Is Form 941 In Quickbooks?

If you are new to quickbooks, then it may be a challenge to find form 941. First navigate to the employees menu. Select trust center from the left menu, then click trust center settings. Click taxes on the left navigation menu and choose payroll tax. Choose ok and click open draft.

Form 941 Payment Voucher Unclefed justgoing 2020

The process to pay and file quickbooks form 941 manually how to print form 941 from. Web the quickbooks desktop payroll assisted: Select print for your records. Click taxes on the left navigation menu and choose payroll tax. Here's an article you can read to.

941 Form Mailing Address 2023 941 Forms Zrivo

Indicate the appropriate tax quarter and year in the quarter and year fields. It must be filed at least quarterly and sometimes. On the left panel, choose the taxes menu to select payroll tax. Select either form 941 or 944 in the tax reports section of print reports. Web best answers monicam3 moderator january 10, 2022 02:29 pm yes, @payroll941.

941 2020

In general, employers who withhold federal income tax, social security or. Web the quickbooks desktop payroll assisted: Web you can visit this prior year products section on the irs website to download the form's 2019 version, then manually file the form. Select macro settings, then select the. In the forms section, tap the view and.

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

Web best answers monicam3 moderator january 10, 2022 02:29 pm yes, @payroll941. Web click the file tab from the microsoft office. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. On the left panel, choose the taxes menu to select payroll tax. Then select the payroll centre from the.

941 Cant find them

Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Web you can visit this prior year products section on the irs website to download the form's 2019 version, then manually file the form. Then select the payroll centre from the employees menu. Web form 941.

Find Transactions in QuickBooks Desktop Pro Instructions

Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. In the forms section, tap the view and print archived forms link under quarterly. It must be filed at least quarterly and sometimes. Web intuit accountants community industry discussions tax talk where to find 1st quarter 2021 941? On the left.

Form 941 PDF is Watermarked "Do Not File"

Here's an article you can read to. Web you can visit this prior year products section on the irs website to download the form's 2019 version, then manually file the form. On the left panel, choose the taxes menu to select payroll tax. Web form 941 is only filed if you are a business paying employees and withholding taxes from.

You Can Even Start To Think That The Software Doesn’t Include.

Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Web to find your form 941: Web track income & expenses. Web click the file tab from the microsoft office.

Select The File Forms Tab And The.

Select trust center from the left menu, then click trust center settings. If any due date for filing shown above falls on a saturday, sunday, or legal holiday, you may. It must be filed at least quarterly and sometimes. In general, employers who withhold federal income tax, social security or.

Choose Quarterly Tax Forms And 941 As Your Filter.

Click taxes on the left navigation menu and choose payroll tax. Web form 941 is due by the last day of the month that follows the end of the quarter. In the forms section, tap the view and print archived forms link under quarterly. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment.

Web How Do I Get My Form 941 From Quickbooks?

Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Choose ok and click open draft. Web how to file federal payroll form 941 in quickbooks online? The process to pay and file quickbooks form 941 manually how to print form 941 from.