How To Form A Nonprofit Llc

How To Form A Nonprofit Llc - Select a name for your organization once you’ve decided on the nonprofit’s purpose and you’ve identified a way to fulfill the unmet need in your community, it’s time to start thinking of a name for your organization. Choose a purpose, form a corporation, file paperwork with the irs, comply with state and local. Hold a meeting of the board. Ad easy 3 steps to form a legal llc. Web your loans must be federal direct loans. Our business specialists help you incorporate your business. You'll need to list a registered agent,. Web up to 25% cash back file formal paperwork, usually called articles of incorporation, and pay a small filing fee (typically under $125). You can trust us to file your llc! Web yes, a limited liability company (llc) can be a nonprofit.

Legally binding form a llc. This initial step is crucial as a nonprofit needs a name that ultimately establishes its brand and image. Apply for your federal and state tax exemptions. Web starting a nonprofit is easy, just follow these simple steps: Select your state & get started! Web use of an llc by a nonprofit. 2023's 5 best services for registering your new llc. Select a name for your organization once you’ve decided on the nonprofit’s purpose and you’ve identified a way to fulfill the unmet need in your community, it’s time to start thinking of a name for your organization. Unless your state has laws that specify otherwise, your nonprofit will not be. Our business specialists help you incorporate your business.

You'll need to list a registered agent,. Some states will allow you to file articles of conversion to convert your llc to a nonprofit. We detail the irs rules around this subject. We've filed over 300,000 new businesses. A nonprofit may want to establish and own an llc for multiple reasons, including: Unless your state has laws that specify otherwise, your nonprofit will not be. Web learn the rules on llcs and nonprofits and if you can form an llc as a nonprofit. Web yes, a limited liability company (llc) can be a nonprofit. Ad easy 3 steps to form a legal llc. 2023's 5 best services for registering your new llc.

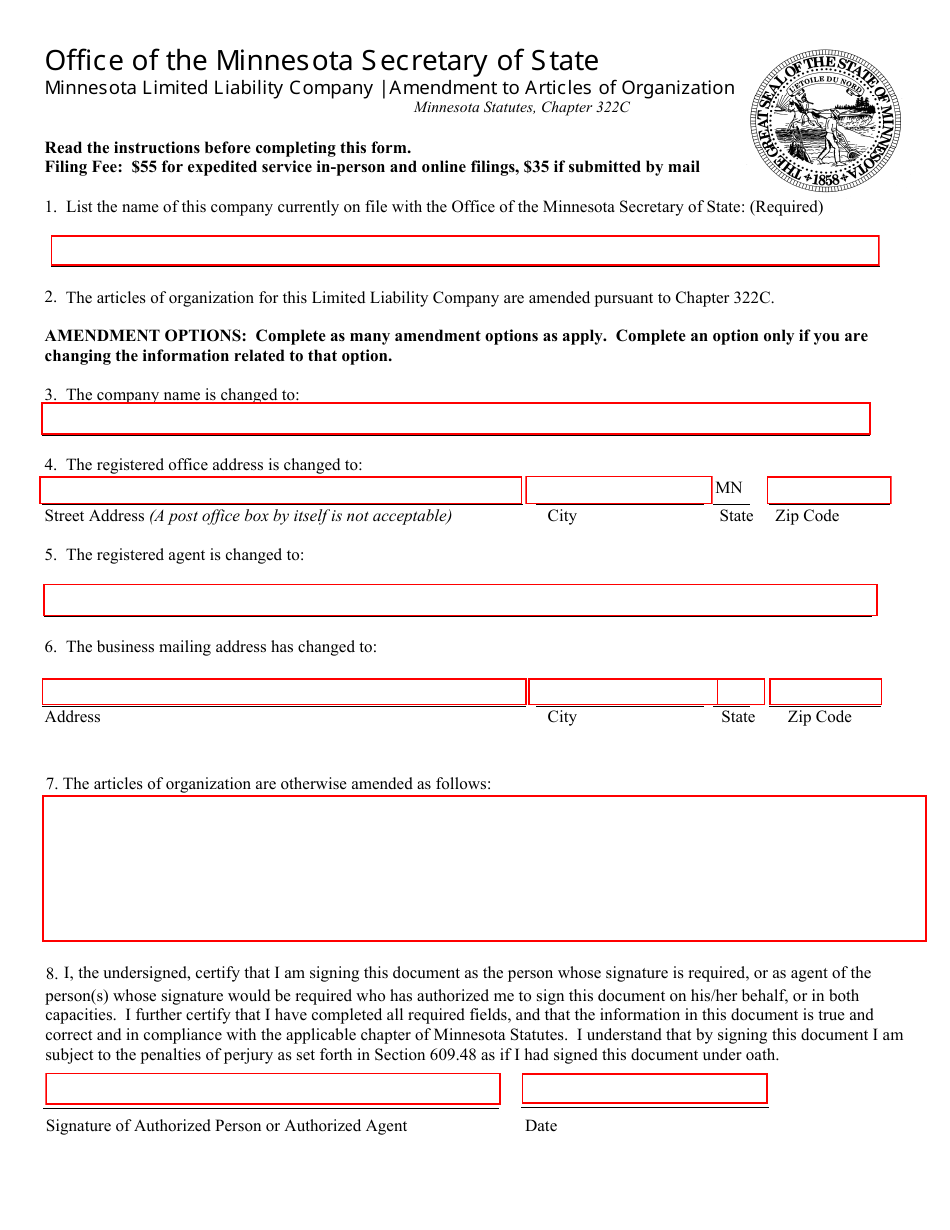

Minnesota Minnesota Limited Liability Company Amendment to Articles of

Web get started everything from economy plus: Our business specialists help you incorporate your business. Web what are the steps to change an llc to a nonprofit? Ad start your llc today. Web up to 25% cash back 7.

[Download] How to Form a Nonprofit Corporation (National Edition) A

Is a nonprofit corporation a c corporation;. Ad easy 3 steps to form a legal llc. A nonprofit may want to establish and own an llc for multiple reasons, including: Web the answer to the question can a nonprofit be an llc is yes, but it's not as straightforward. Web can a non profit be an llc;

Product Detail

For an llc, that’s whatever the main business offering is. Our business specialists help you incorporate your business. Web yes, a limited liability company (llc) can be a nonprofit. You can trust us to file your llc! A nonprofit may want to establish and own an llc for multiple reasons, including:

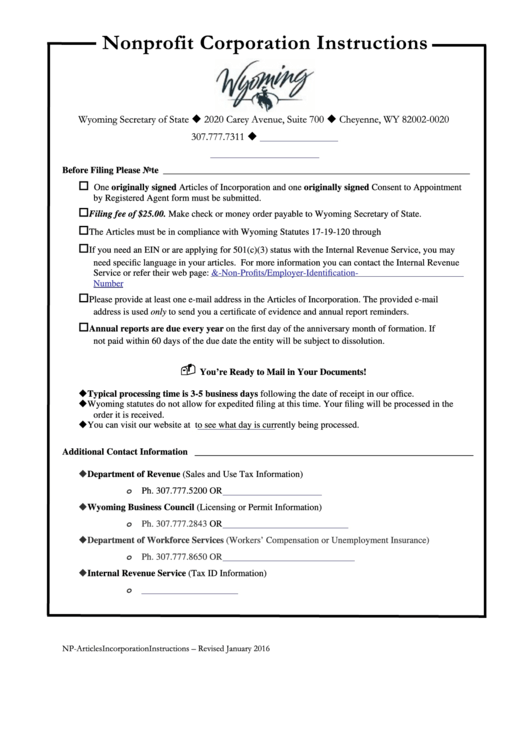

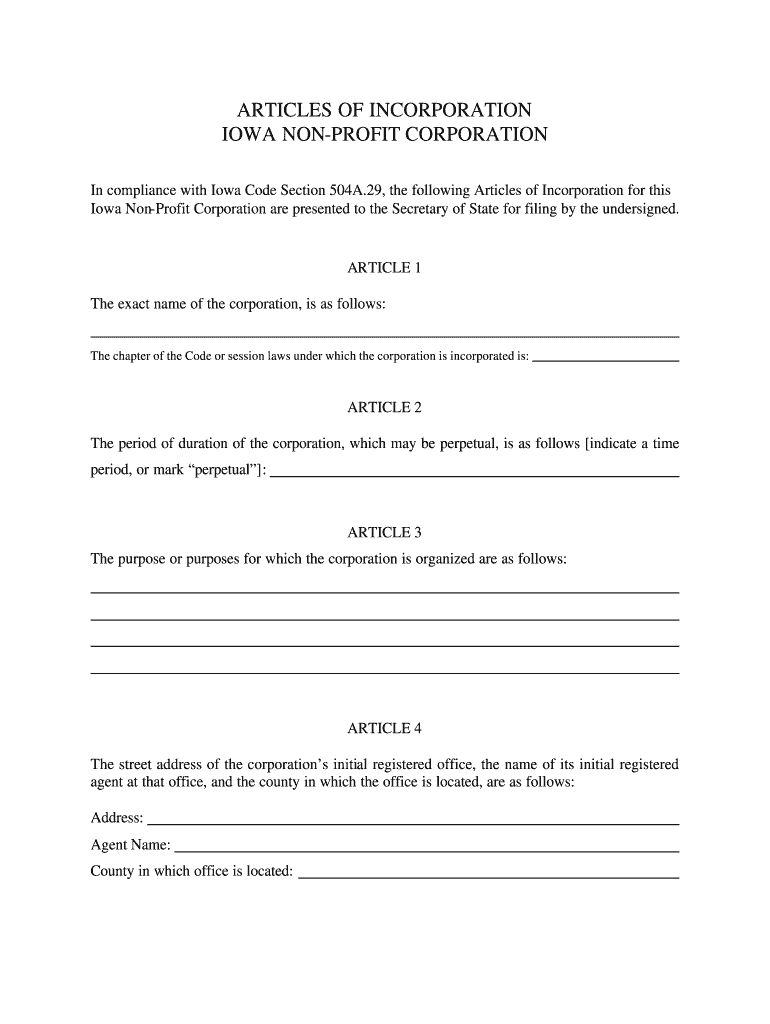

Fillable Form Np Nonprofit Corporation Articles Of Incorporation

Find startup costs research your market make a business plan licenses & permits. Unless your state has laws that specify otherwise, your nonprofit will not be. Resolve to convert from an llc to a corporation. Web both types of organizations can sell products and services. Some states will allow you to file articles of conversion to convert your llc to.

990 Forms For Nonprofit Organizations 2016 Universal Network

Should a nonprofit be an llc or corporation; Web up to 25% cash back 7. Web your loans must be federal direct loans. Select your state & get started! Web learn the rules on llcs and nonprofits and if you can form an llc as a nonprofit.

CARES Act Nonprofit Application Form IS NOW ONLINE

To change an llc to a nonprofit organization, do the following: Select your state & get started! We've filed over 300,000 new businesses. Ad customizable llc agreement templates. Ad easy 3 steps to form a legal llc.

How to Form a Nonprofit Stanko & Senter LLC

Apply for your federal and state tax exemptions. Web the answer to the question can a nonprofit be an llc is yes, but it's not as straightforward. We detail the irs rules around this subject. Find startup costs research your market make a business plan licenses & permits. Web use of an llc by a nonprofit.

Articles Of Organization Alabama Template

2023's 5 best services for registering your new llc. Choosing a name for your nonprofit organization is the first and most. Choose a purpose, form a corporation, file paperwork with the irs, comply with state and local. Select your state & get started! Web learn the rules on llcs and nonprofits and if you can form an llc as a.

Comparing a Nonprofit to an LLC or Corporation Non profit, Commercial

2023's 5 best services for registering your new llc. Some states will allow you to file articles of conversion to convert your llc to a nonprofit. Web the five steps to becoming a 501 (c) (3) corporation are: Web get started everything from economy plus: Web can a non profit be an llc;

How To Form A Nonprofit Llc In California Armando Friend's Template

Web can a non profit be an llc; Web up to 25% cash back file formal paperwork, usually called articles of incorporation, and pay a small filing fee (typically under $125). Find startup costs research your market make a business plan licenses & permits. Ad start your llc today. Ad we make it easy to incorporate your llc.

At The First Meeting Of The Board Of Directors, The Directors Take Care Of Formalities Such As Adopting The Bylaws, Electing Officers,.

For an llc, that’s whatever the main business offering is. Web the answer to the question can a nonprofit be an llc is yes, but it's not as straightforward. Some states will allow you to file articles of conversion to convert your llc to a nonprofit. This initial step is crucial as a nonprofit needs a name that ultimately establishes its brand and image.

Web This Means That Your Nonprofit Does Not Have A Legal Status Separate From Its Members.

Select a name for your organization once you’ve decided on the nonprofit’s purpose and you’ve identified a way to fulfill the unmet need in your community, it’s time to start thinking of a name for your organization. Ad we make it easy to incorporate your llc. We've filed over 300,000 new businesses. Web starting a nonprofit is easy, just follow these simple steps:

Should A Nonprofit Be An Llc Or Corporation;

We detail the irs rules around this subject. Ad our easy online form can be completed in just 10 minutes or less. Legally binding form a llc. Ad easy 3 steps to form a legal llc.

Web Up To 25% Cash Back 7.

Hold a meeting of the board. Resolve to convert from an llc to a corporation. For nonprofits, that revenue is typically in. Unless your state has laws that specify otherwise, your nonprofit will not be.

![[Download] How to Form a Nonprofit Corporation (National Edition) A](https://image.slidesharecdn.com/txthowtoformanonprofitcorporationnationaleditionastep-by-stepguidetoforminga501-181119192629/95/download-how-to-form-a-nonprofit-corporation-national-edition-a-stepbystep-guide-to-forming-a-4-1024.jpg?cb=1542655640)