How To Get Tax Form From Shopify

How To Get Tax Form From Shopify - Web once you have your tax information, you can use it to file your taxes. Web 1 day agoif you’d invested $10,000 in shop at its ipo date and held to today, your position would be worth roughly $240,000. Web click on documents at the top left corner. Web as of january 15, 2023, after a store exceeds the threshold, the following fees apply up to a maximum of 5,000 usd per store. Log in to your shopify account and go to settings. Web follow these steps to get your sales tax report: For calendar years prior to (and. Web shopify collective supported the drake related team in simplifying and streamlining the process behind their brand collaborations. That’ll open a list of all your orders. In the payment providers section, click view account for shopify payments.

Web as a shopify business owner we help you automatically help you charge sales tax on purchases. Web shopify collective supported the drake related team in simplifying and streamlining the process behind their brand collaborations. Web this complete guide breaks down basic tax information for shopify sellers. Log in to your shopify account and go to settings. Web once you have your tax information, you can use it to file your taxes. Web as of january 15, 2023, after a store exceeds the threshold, the following fees apply up to a maximum of 5,000 usd per store. Sales tax is a tax levied by your state and local jurisdictions. Web we will show you how to fill out your shopify schedule c, calculate cogs, make deductions, and apply tax strategies that have the potential to cut your tax bill by. Web form 1040 for income tax returns. That’ll open a list of all your orders.

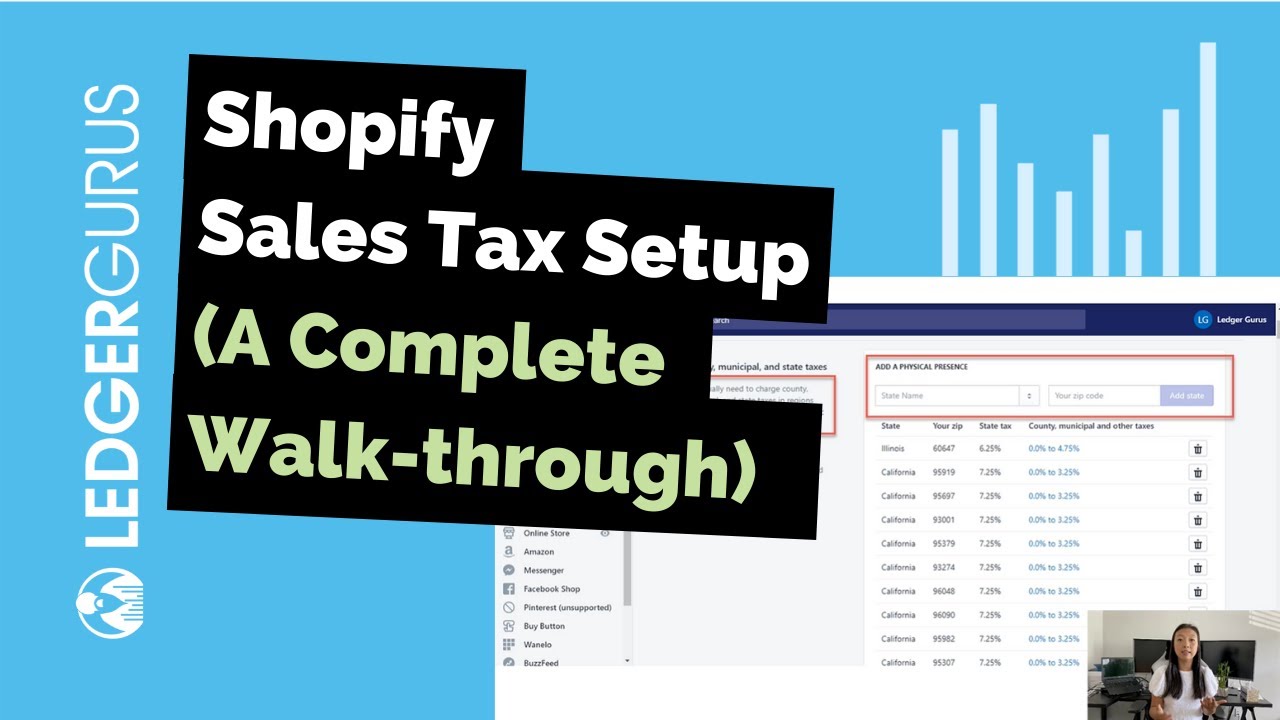

Log in to your shopify account and go to settings. Web click on documents at the top left corner. For calendar years prior to (and. Schedule c if you are a sole proprietor and have income or losses to report. By default, is it based on customer's shipping address and i need to set it based on the location of the item conditionally. Sales tax is a tax levied by your state and local jurisdictions. Web shopify doesn’t file or remit your sales taxes for you. Web as of january 15, 2023, after a store exceeds the threshold, the following fees apply up to a maximum of 5,000 usd per store. Click the links in each step for more details. Web this complete guide breaks down basic tax information for shopify sellers.

A beginner’s guide to Shopify sales tax Deliverr

Web once you have your tax information, you can use it to file your taxes. A 0.35% calculation fee is charged on orders where. Shopify doesn’t file or remit your sales taxes for you. Web 1 day agoif you’d invested $10,000 in shop at its ipo date and held to today, your position would be worth roughly $240,000. Web as.

New tax form is indeed smaller, but filing is no simpler

Web we will show you how to fill out your shopify schedule c, calculate cogs, make deductions, and apply tax strategies that have the potential to cut your tax bill by. Shopify doesn’t file or remit your sales taxes for you. Web as of january 15, 2023, after a store exceeds the threshold, the following fees apply up to a.

Add fields to customer registration form Shopify Customer Fields

Click the links in each step for more details. You might need to register your business with your local or federal tax authority to handle your sales tax. By default, is it based on customer's shipping address and i need to set it based on the location of the item conditionally. Web we will show you how to fill out.

Tax & VAT Guide for Shopify Stores goselfemployed.co

Web once you have your tax information, you can use it to file your taxes. Web as a shopify business owner we help you automatically help you charge sales tax on purchases. Shopify doesn’t file or remit your sales taxes for you. You might need to register your business with your local or federal tax authority to handle your sales.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

Log in to your shopify account and go to settings. Web once you have your tax information, you can use it to file your taxes. Web about the nomad brad. Sales tax is a tax levied by your state and local jurisdictions. The first way is by simply.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Click the links in each step for more details. Web i need to change the tax on checkout. Web shopify collective supported the drake related team in simplifying and streamlining the process behind their brand collaborations. Shopify doesn’t file or remit your sales taxes for you. Under store settings, click billing.

Do You Need A Business License to Sell on Shopify?

Web we will show you how to fill out your shopify schedule c, calculate cogs, make deductions, and apply tax strategies that have the potential to cut your tax bill by. Click the links in each step for more details. Web 1 day agoif you’d invested $10,000 in shop at its ipo date and held to today, your position would.

Shopify Tax Guide Sufio

Web this complete guide breaks down basic tax information for shopify sellers. Web about the nomad brad. Web click on documents at the top left corner. Click the links in each step for more details. In your shopify admin, click products, and then click the name of the product.

Shopify sales tax setup for stressfree compliance Walkthrough guide

Click the links in each step for more details. Shopify doesn’t file or remit your sales taxes for you. Web follow these steps to get your sales tax report: In the pricing section, uncheck charge taxes on this product. Shopify will issue a 1099 to store.

Shopify Sales Tax Setup Where and How to Collect LedgerGurus

Web this complete guide breaks down basic tax information for shopify sellers. Sales tax is a tax levied by your state and local jurisdictions. Web once you have your tax information, you can use it to file your taxes. In the tax section, click download tax documents. By default, is it based on customer's shipping address and i need to.

Web I Need To Change The Tax On Checkout.

Web follow these steps to get your sales tax report: That’ll open a list of all your orders. By default, is it based on customer's shipping address and i need to set it based on the location of the item conditionally. The first way is by simply.

Web About The Nomad Brad.

Web 1 day agoif you’d invested $10,000 in shop at its ipo date and held to today, your position would be worth roughly $240,000. Web as a shopify business owner we help you automatically help you charge sales tax on purchases. In the tax section, click download tax documents. Web this complete guide breaks down basic tax information for shopify sellers.

Log In To Your Shopify Account And Go To Settings.

Shopify will issue a 1099 to store. Shopify doesn’t file or remit your sales taxes for you. Under store settings, click billing. Web as of january 15, 2023, after a store exceeds the threshold, the following fees apply up to a maximum of 5,000 usd per store.

In The Pricing Section, Uncheck Charge Taxes On This Product.

In the payment providers section, click view account for shopify payments. Web shopify collective supported the drake related team in simplifying and streamlining the process behind their brand collaborations. A 0.35% calculation fee is charged on orders where. In your shopify admin, click products, and then click the name of the product.