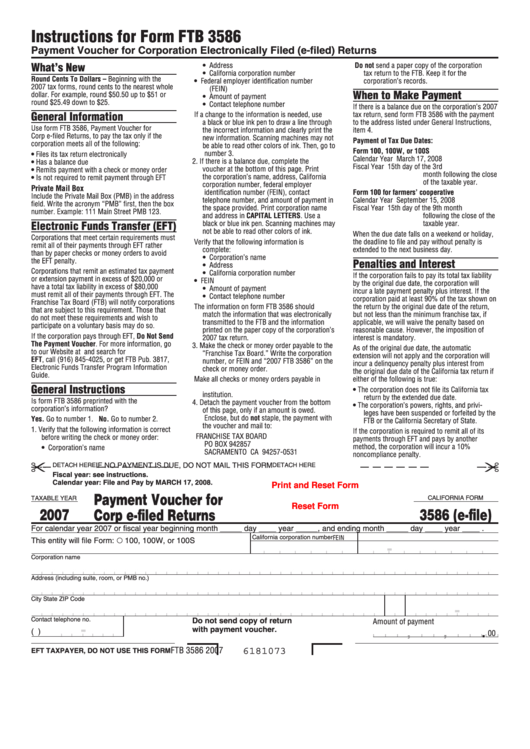

How To Pay Form 3586 Online

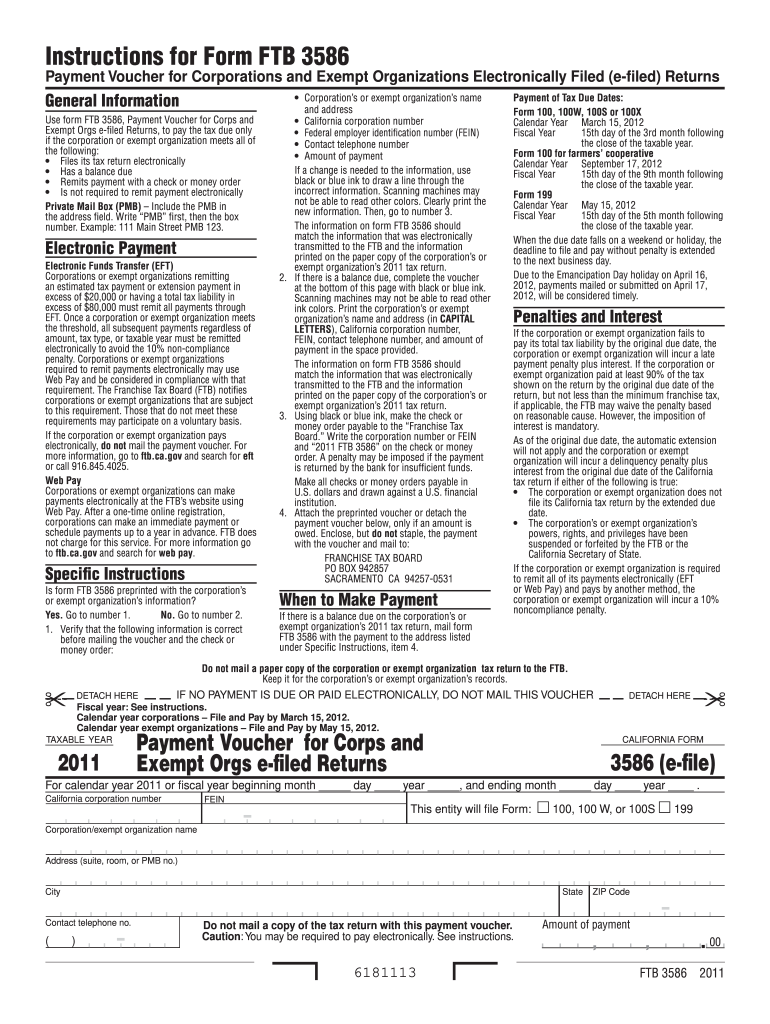

How To Pay Form 3586 Online - Corporations or exempt organizations can make an immediate payment or. Web can i pay ca form 3586 online? Sign up and sign in. Register for a free account, set a strong password, and proceed with email. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‑fled returns, to pay the taxdue only if the corporation or exempt organization meets all of the. Get your online template and fill it in using progressive features. You will need to create an irs online account before using this. Enter on line 3 the total. Make sure the information you add.

Web can i pay ca form 3586 online? Corporations or exempt organizations can. Corporations or exempt organizations can make payments online using web pay for businesses. Web can i pay ca form 3586 online? Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Make sure the information you add. Start completing the fillable fields and carefully. Web sign in to make an individual tax payment and see your payment history. Web amount on schedule k; Use get form or simply click on the template preview to open it in the editor.

Sign up and sign in. Web corporations or exempt organizations can make payments online using web pay for businesses. Sign it in a few clicks draw your signature, type it,. Corporations or exempt organizations can make an immediate payment or. Use get form or simply click on the template preview to open it in the editor. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‑fled returns, to pay the taxdue only if the corporation or exempt organization meets all of the. Sign it in a few clicks draw your signature, type. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web follow this simple guideline edit form 3586 in pdf format online for free: Corporations or exempt organizations can make payments online using web pay for businesses.

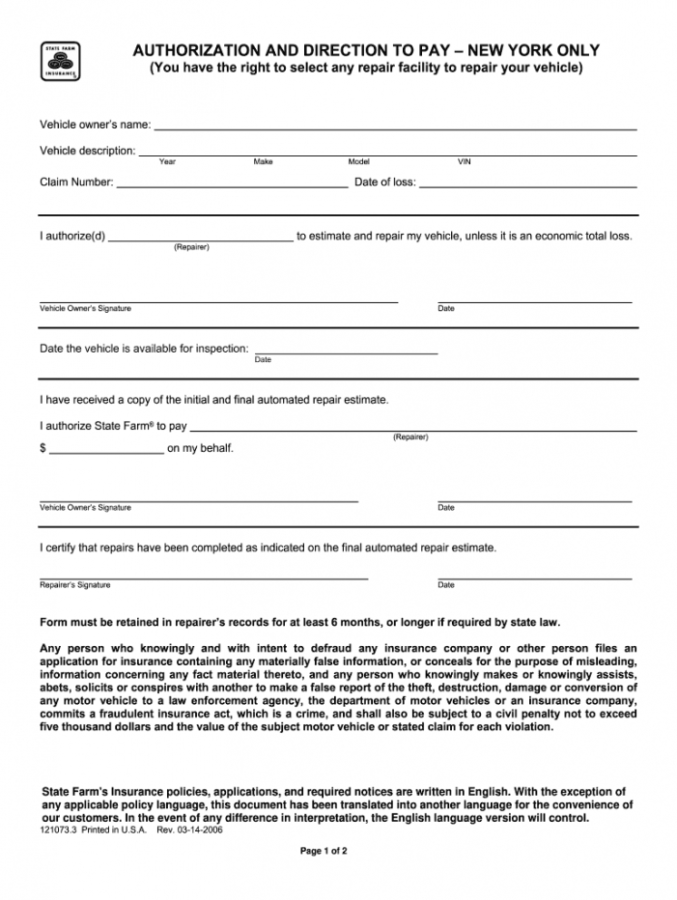

Auto Authorization Form Fill Online, Printable, Fillable, Blank

Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Start completing the fillable fields and carefully. All others, report this amount on the applicable line of form 3800 (e.g., line 1e of the 2006 form 3800) amount allocated to.

안전관리자 인적사항 관리대장 엑셀데이터

Web corporations or exempt organizations can make payments online using web pay for businesses. Web can i pay ca form 3586 online? Enjoy smart fillable fields and. Start completing the fillable fields and carefully. Get your online template and fill it in using progressive features.

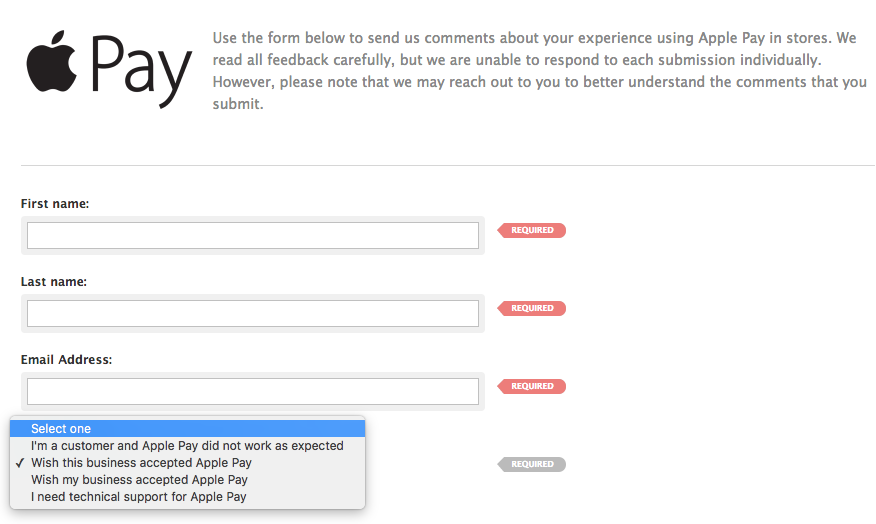

Tell Apple the Stores You Want to Accept Apple Pay on This Form

Web ★ 4.8 satisfied 41 votes how to fill out and sign form 3586 california 2022 online? Sign it in a few clicks draw your signature, type it,. Sign it in a few clicks draw your signature, type it,. Web select the orange get form option to start filling out. Sign up and sign in.

Form 3586 Fill Out and Sign Printable PDF Template signNow

Web use form ftb 3586, payment voucher for corporations and exempt organizations e‑fled returns, to pay the taxdue only if the corporation or exempt organization meets all of the. All others, report this amount on the applicable line of form 3800 (e.g., line 1e of the 2006 form 3800) amount allocated to beneficiaries of the estate or. Enter on line.

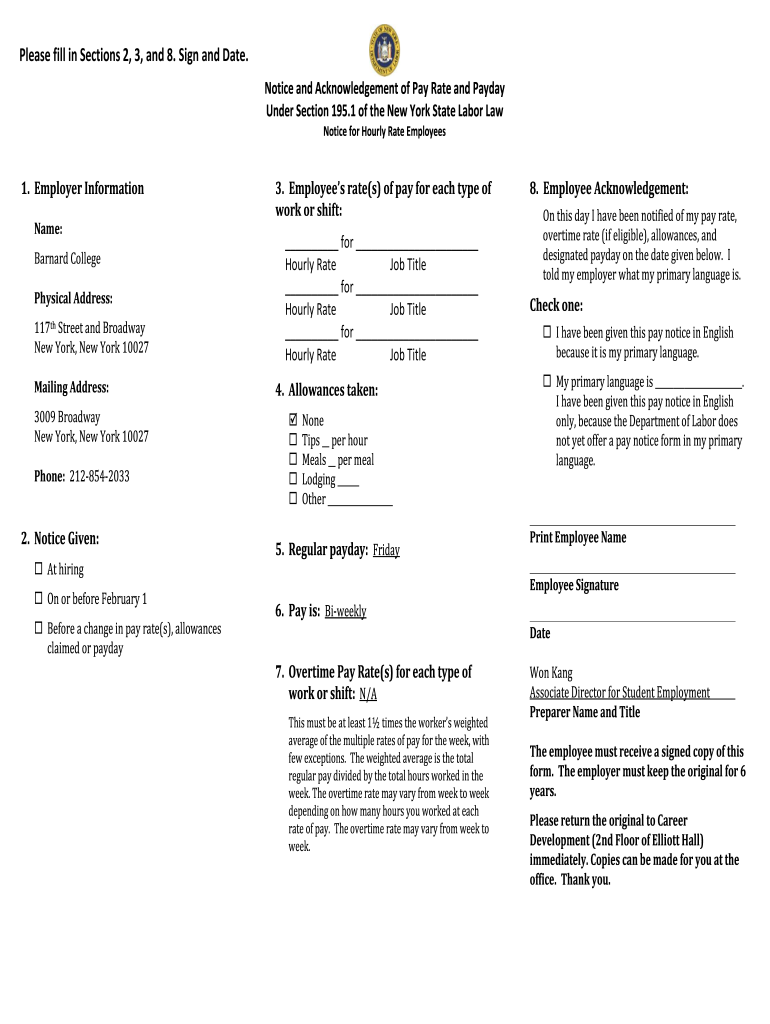

New York Hourly Rate Pay Form Fill Out and Sign Printable PDF

Register for a free account, set a strong password, and proceed with email. Corporations or exempt organizations can make payments online using web pay for businesses. You will need to create an irs online account before using this. Enter on line 3 the total. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‑fled returns, to pay.

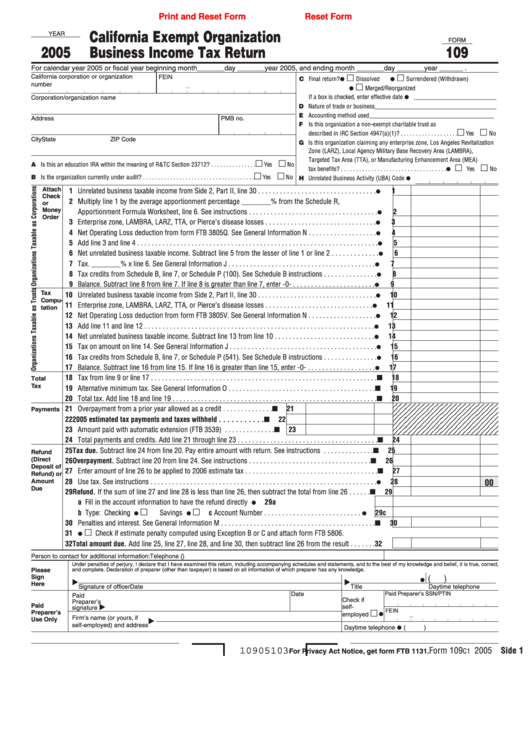

WWW.FTB.CA.GOV

Corporations or exempt organizations can make payments online using web pay for businesses. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‑fled returns, to pay the taxdue only if the corporation or exempt organization meets all of the. Sign up and sign in. Edit your 2018 form 3586 online type text, add images, blackout confidential details,.

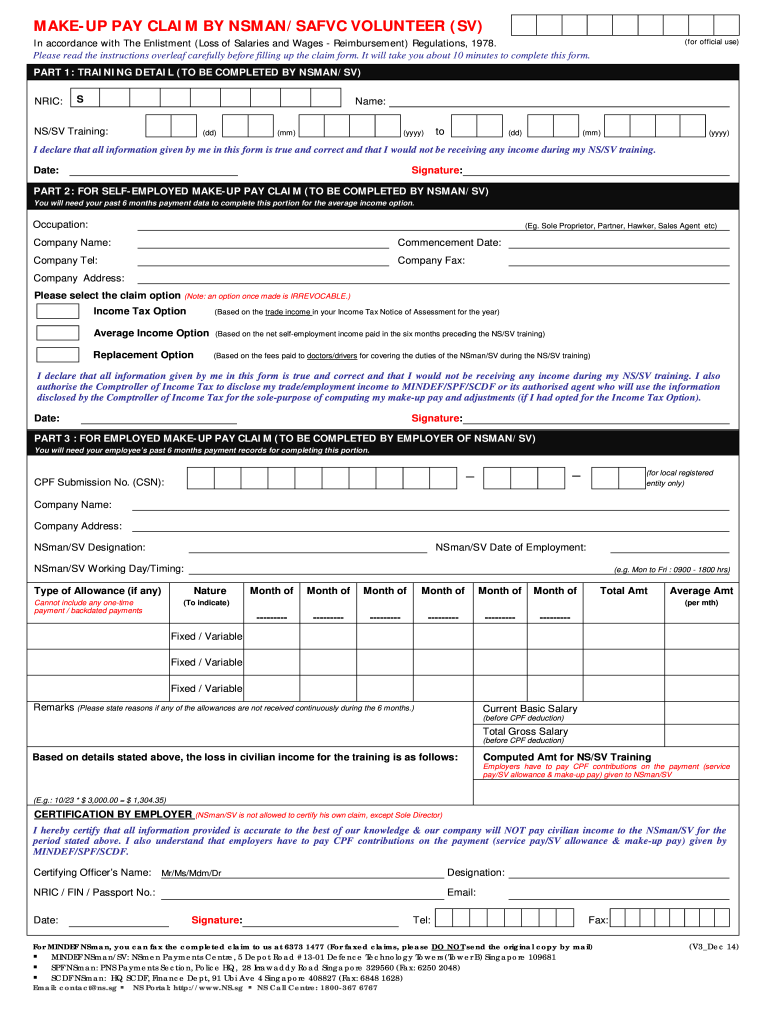

20142022 Form SG MakeUp Pay Claim by NSMAN Fill Online, Printable

Edit your ftb 3586 form online type text, add images, blackout confidential details, add comments, highlights and more. All others, report this amount on the applicable line of form 3800 (e.g., line 1e of the 2006 form 3800) amount allocated to beneficiaries of the estate or. Enjoy smart fillable fields and. Web can i pay ca form 3586 online? You.

Editable Direction To Pay Form Fill Out And Sign Printable Pdf Template

Sign it in a few clicks draw your signature, type it,. Sign up and sign in. Web select the orange get form option to start filling out. Sign it in a few clicks draw your signature, type. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more.

California Form 3586 (EFile) Payment Voucher For Corporation EFiled

Corporations or exempt organizations can make an immediate payment or. Corporations or exempt organizations can make payments online using web pay for businesses. Web can i pay ca form 3586 online? Register for a free account, set a strong password, and proceed with email. Start completing the fillable fields and carefully.

Shop Raw Silk Suit Set 3586 Online Women Plus

Switch on the wizard mode in the top toolbar to get more tips. Web can i pay ca form 3586 online? Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Corporations or exempt organizations can. Get your online template.

Get Your Online Template And Fill It In Using Progressive Features.

Enjoy smart fillable fields and. Enter on line 3 the total. Corporations or exempt organizations can. Web select the orange get form option to start filling out.

Web Can I Pay Ca Form 3586 Online?

Web sign in to make an individual tax payment and see your payment history. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Edit your ftb 3586 form online type text, add images, blackout confidential details, add comments, highlights and more. Web ★ 4.8 satisfied 41 votes how to fill out and sign form 3586 california 2022 online?

Enter On Line 3 The Total.

Sign it in a few clicks draw your signature, type it,. Sign up and sign in. Web can i pay ca form 3586 online? Register for a free account, set a strong password, and proceed with email.

Web Amount On Schedule K;

Web use form ftb 3586, payment voucher for corporations and exempt organizations e‑fled returns, to pay the taxdue only if the corporation or exempt organization meets all of the. Switch on the wizard mode in the top toolbar to get more tips. Make sure the information you add. Start completing the fillable fields and carefully.