How To Sign A W9 Form On The Computer

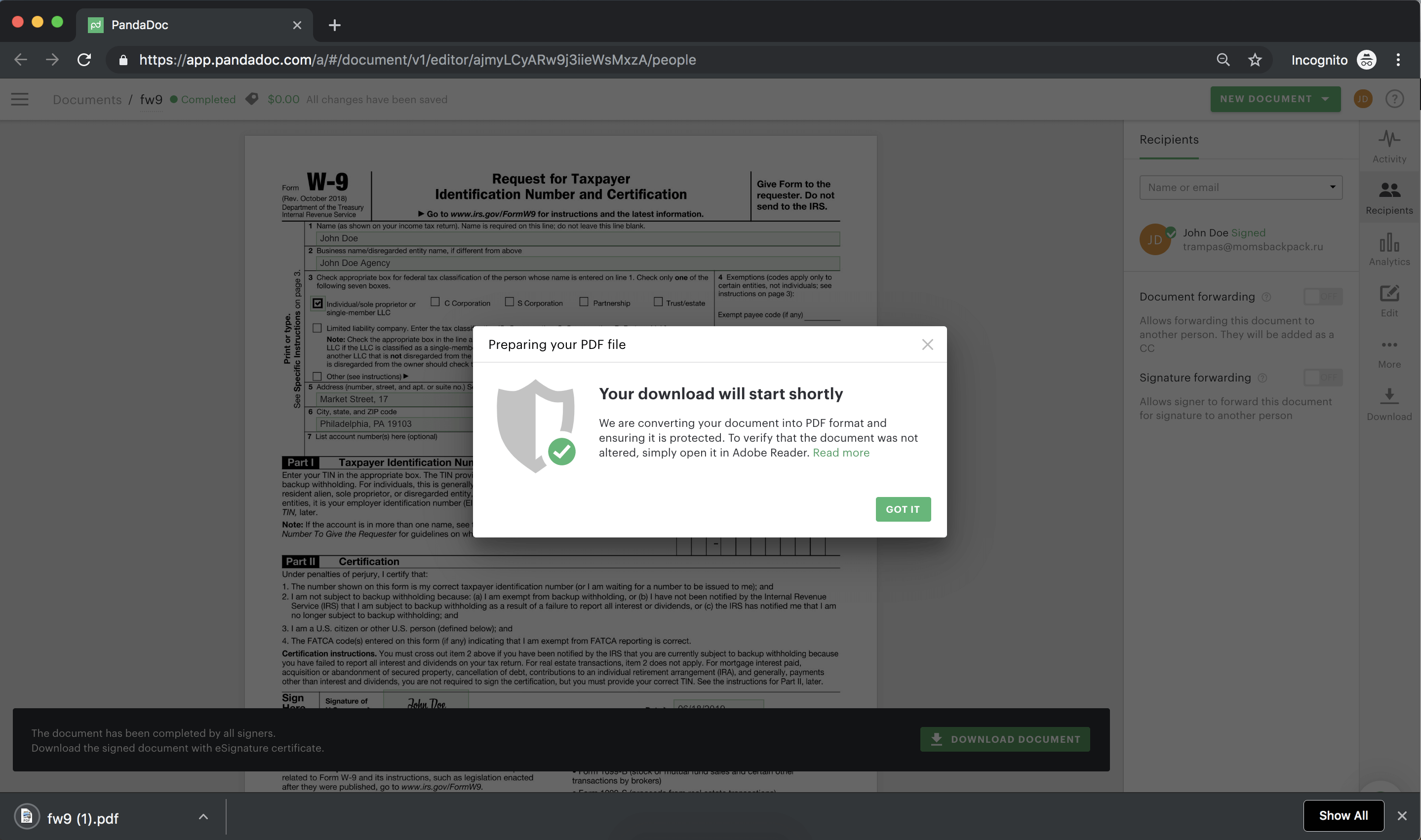

How To Sign A W9 Form On The Computer - Web generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct tin. See the instructions on page 3. You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. Pandadoc® offers safe, secure & touchless esigning experience you’ve been looking for. We have successfully verify your tenant information and will send you copy of. Web how to sign w9 with esignature: Whether you’re an individual or. Log on to your signnow profile. Web enter your ssn, ein or individual taxpayer identification as appropriate. Sign in to the microsoft 365 admin center with your admin credentials.

Web enter your ssn, ein or individual taxpayer identification as appropriate. Your quick guide on tax form by krisette lim it’s that time of year again when the dreaded tax forms surface. Choose a document get the robust esignature features you need from the company you trust select the pro service created. Alternatively, you can get a blank w9 template. Web generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct tin. For a joint account, only the person. Pandadoc® offers safe, secure & touchless esigning experience you’ve been looking for. Web how to sign w9 with esignature: And • require as the. Go to billing > bills & payments > payment methods.

You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. You can certify your account online by visiting us at the website on the reverse side of this form. Web add a payment method. Web how to sign w9 with esignature: Sign in to the microsoft 365 admin center with your admin credentials. Log on to your signnow profile. And • require as the. See the instructions on page 3. Web generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct tin. We have successfully verify your tenant information and will send you copy of.

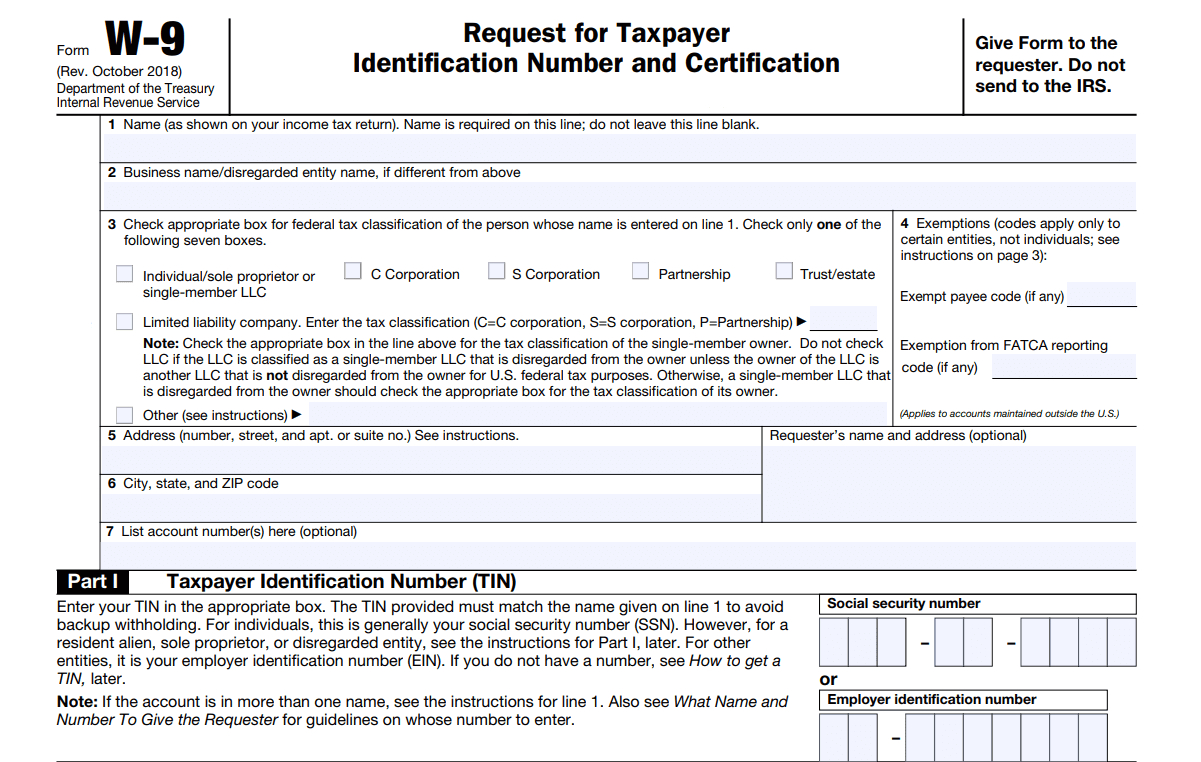

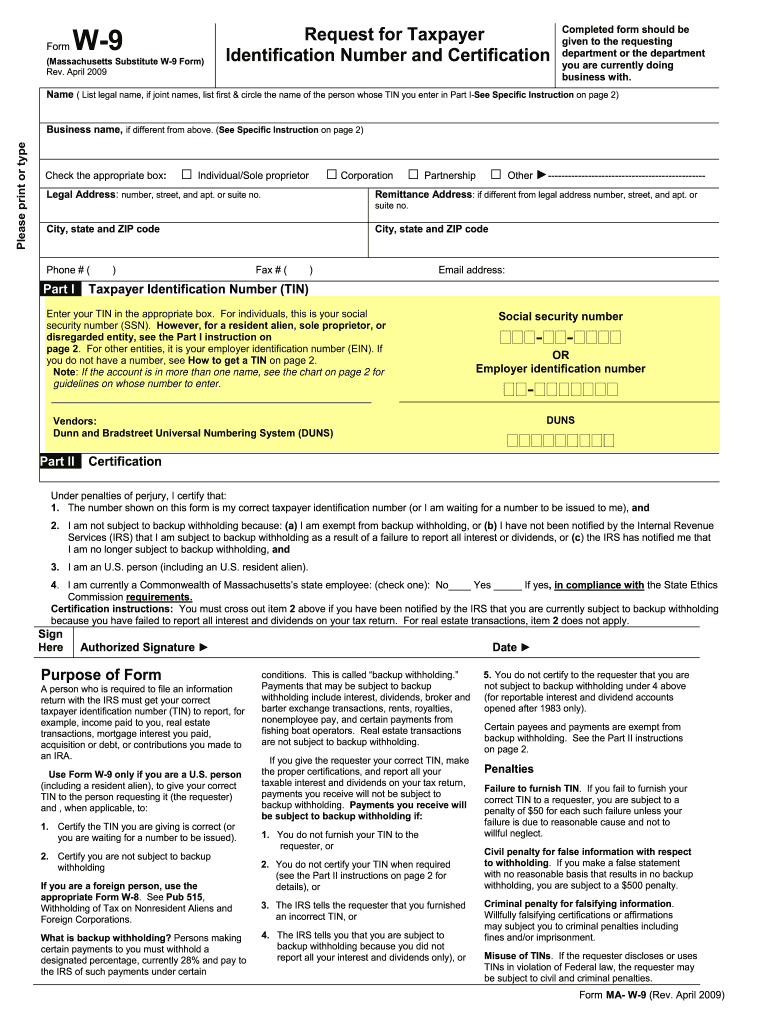

How to Fill Out and Sign Your W9 Form Online to Get Paid Faster

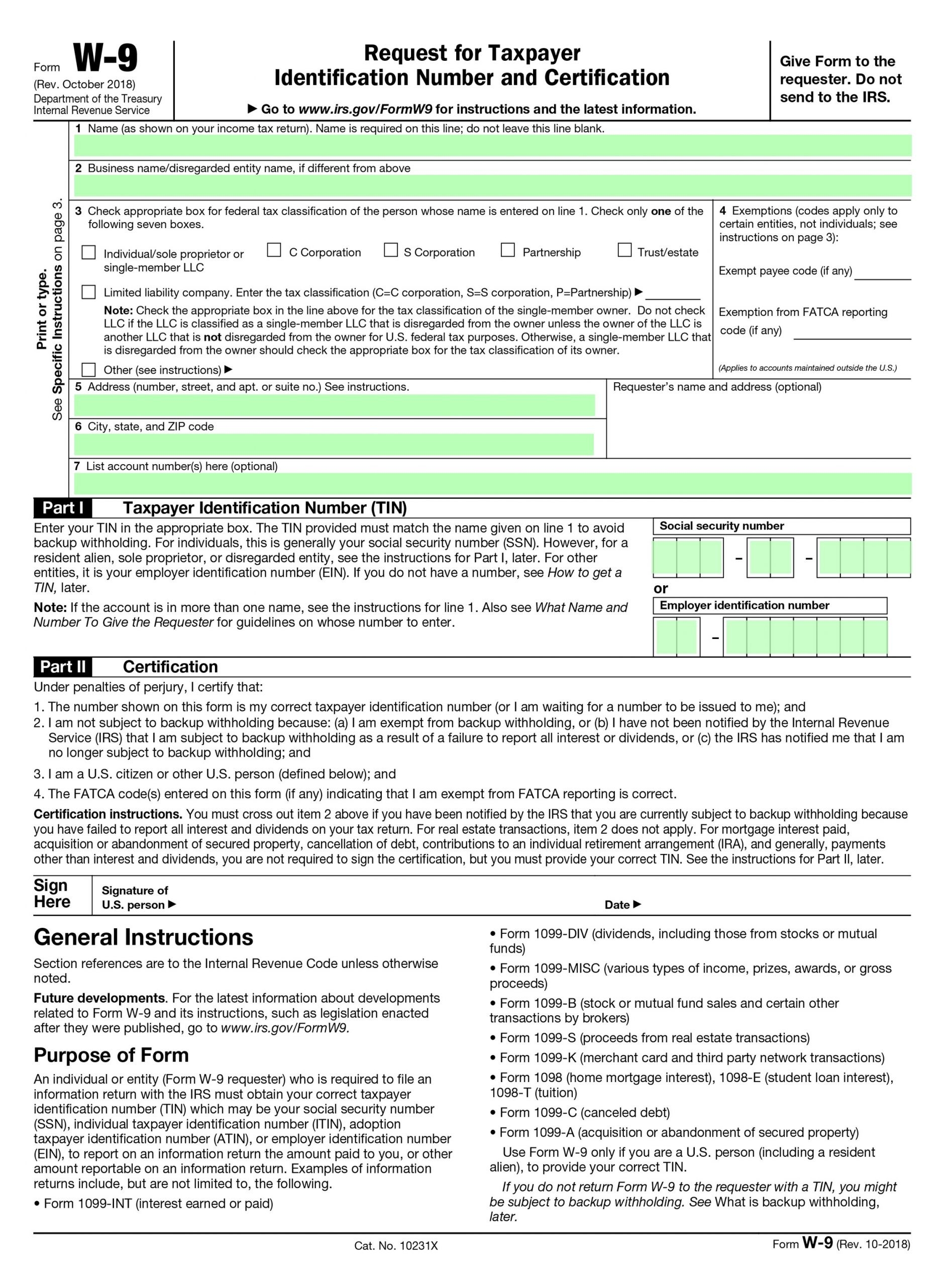

This includes their name, address, employer identification number (ein),. Web follow the instructions below to esign your form w9 with signnow: You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. Web how to complete this form did you know? Web generally, payments other than interest and dividends, you are.

Form For W9 Fill Online, Printable, Fillable, Blank pdfFiller

Web login free trial homeguidew9 tax form w9 tax form what independent contractors and freelancers need to know? See the instructions on page 3. Go to billing > bills & payments > payment methods. Download a w9 form in pdf format from the irs website. For a joint account, only the person.

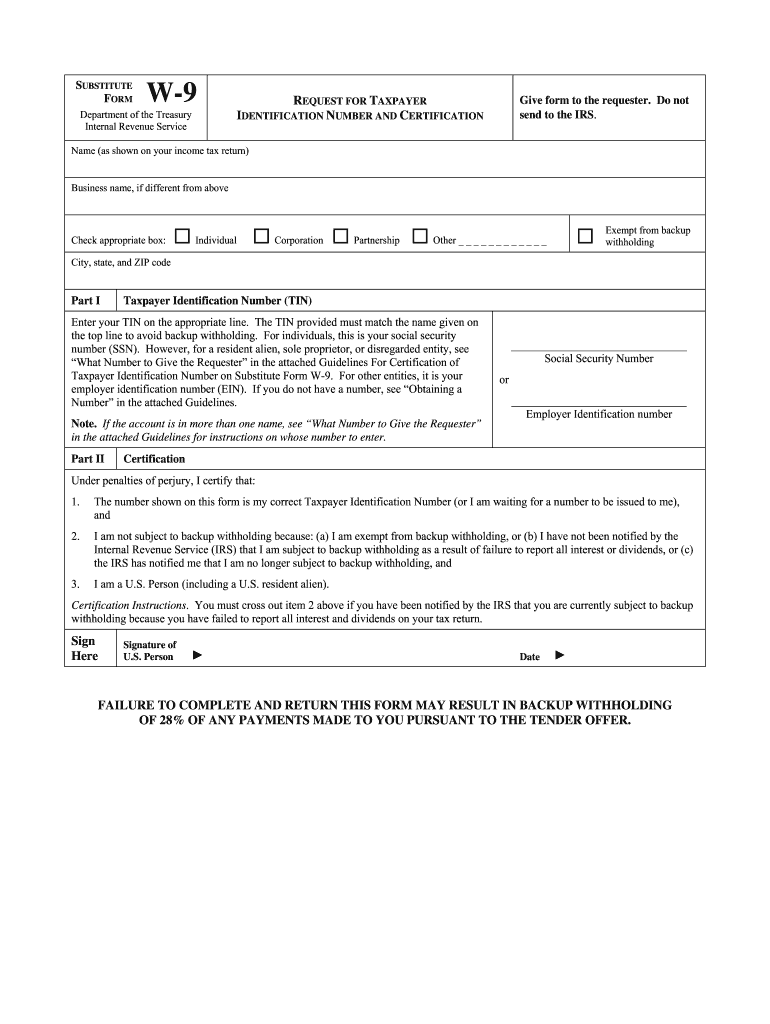

2020 W9 Blank Tax Form Calendar Template Printable

Make sure you save the form to your computer. While online, join the thousands of. Web add your esignature to a document in a few clicks. Alternatively, you can get a blank w9 template. Your quick guide on tax form by krisette lim it’s that time of year again when the dreaded tax forms surface.

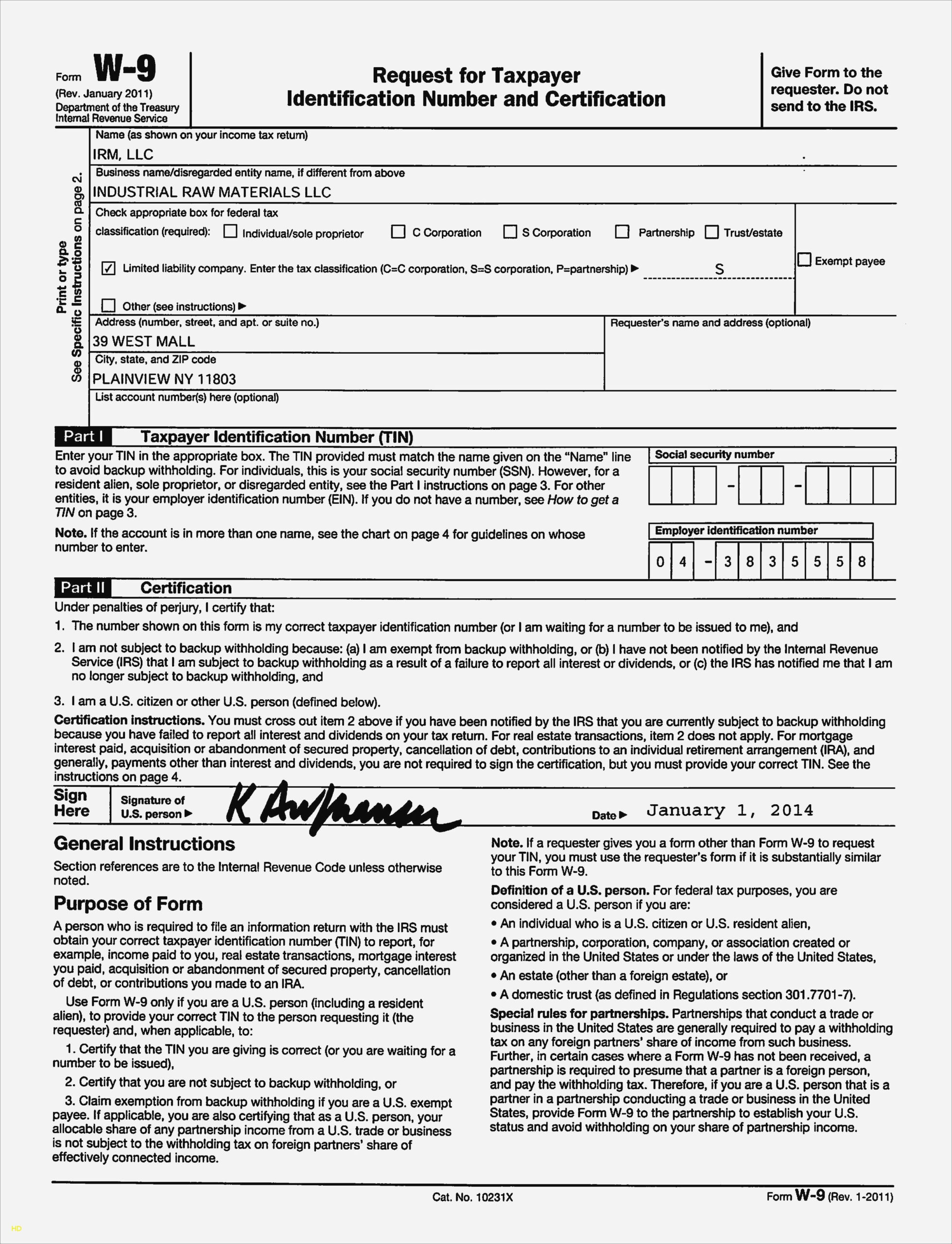

W9 Form Sign and Send IRS Form W9 by Barry Welch

We have successfully verify your tenant information and will send you copy of. Web i downloaded one from irs and filled in the info, but when i try to add a signature or digital id everything is grayed out under fill & sign. i've done this many. Web enter your ssn, ein or individual taxpayer identification as appropriate. Ad a.

9 Request Taxpayer Fill Online, Printable, Fillable, Blank pdfFiller

And • require as the. Web follow the instructions below to esign your form w9 with signnow: Web enter your ssn, ein or individual taxpayer identification as appropriate. You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. Web add your esignature to a document in a few clicks.

Free W 9 Form Printable Calendar Printables Free Blank

Whether you’re an individual or. Web add your esignature to a document in a few clicks. Go to billing > bills & payments > payment methods. Ad a reliable way to sign your documents quickly and effectively. Web add a payment method.

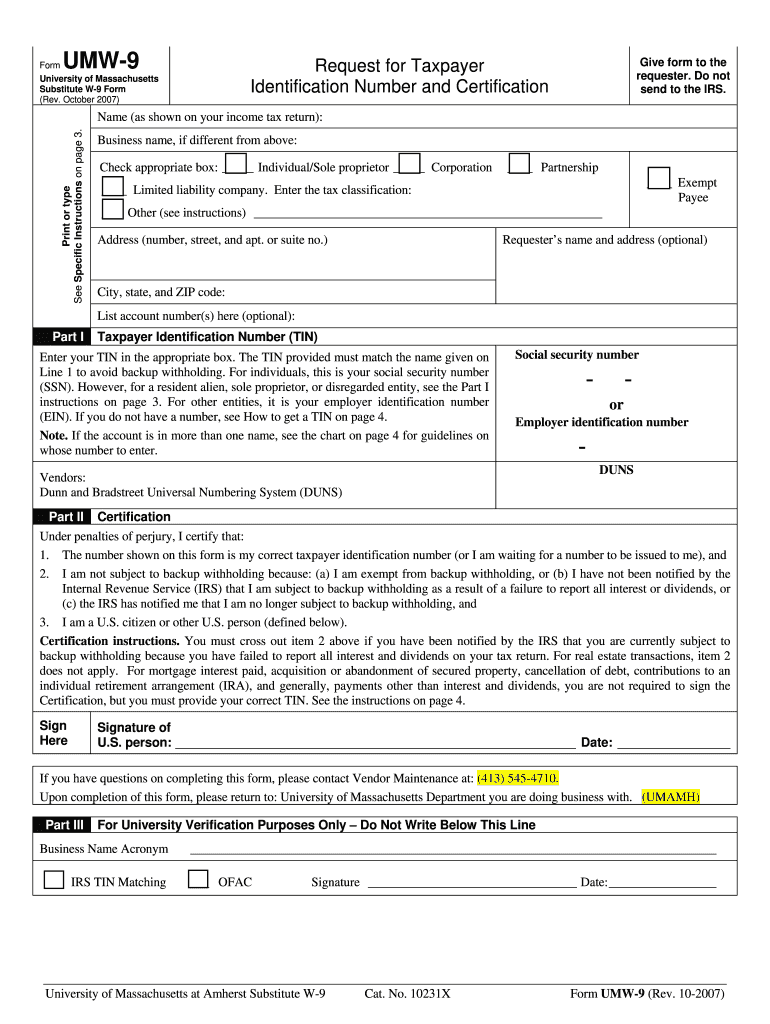

W9 2007 Fill Out and Sign Printable PDF Template signNow

Web login free trial homeguidew9 tax form w9 tax form what independent contractors and freelancers need to know? You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. Sign in to the microsoft 365 admin center with your admin credentials. Web how to sign w9 electronically on my computer? Many.

W9 Forms 2021 Printable Pdf Example Calendar Printable

Web how to sign w9 with esignature: For a joint account, only the person. Web add a payment method. You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. Locate your record in your folders or import a new one.

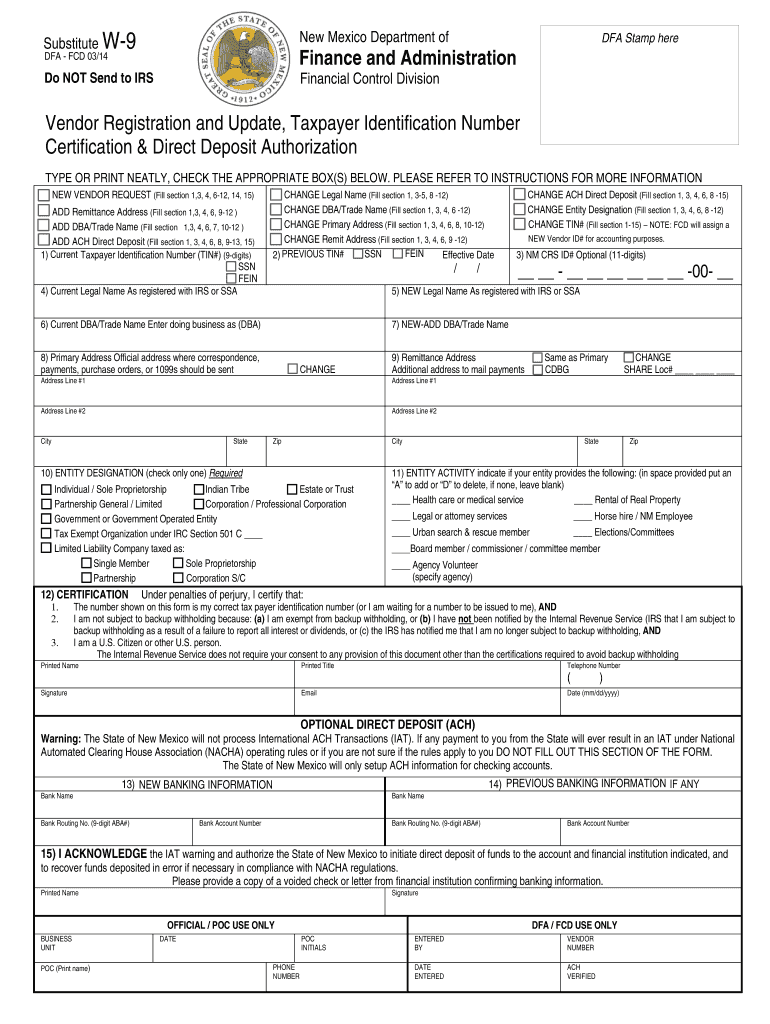

W9 Nm Fill Out and Sign Printable PDF Template signNow

Web how to sign w9 with esignature: Download a w9 form in pdf format from the irs website. Web i downloaded one from irs and filled in the info, but when i try to add a signature or digital id everything is grayed out under fill & sign. i've done this many. Of course, the second option is a simpler,.

W9 W Form Fill Out and Sign Printable PDF Template signNow

Register through your email address; Of course, the second option is a simpler, and therefore,. Your quick guide on tax form by krisette lim it’s that time of year again when the dreaded tax forms surface. Web follow the instructions below to esign your form w9 with signnow: This includes their name, address, employer identification number (ein),.

Web Generally, Payments Other Than Interest And Dividends, You Are Not Required To Sign The Certification, But You Must Provide Your Correct Tin.

While online, join the thousands of. Web i downloaded one from irs and filled in the info, but when i try to add a signature or digital id everything is grayed out under fill & sign. i've done this many. Ad a reliable way to sign your documents quickly and effectively. Web add your esignature to a document in a few clicks.

Web Follow The Instructions Below To Esign Your Form W9 With Signnow:

Whether you’re an individual or. Go to billing > bills & payments > payment methods. You can certify your account online by visiting us at the website on the reverse side of this form. Web how to sign w9 with esignature:

Alternatively, You Can Get A Blank W9 Template.

The irs accepts completed files in both paper and electronic forms. Register through your email address; You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise. Locate your record in your folders or import a new one.

Make Sure You Save The Form To Your Computer.

When the tax season approaches, you may be required. We have successfully verify your tenant information and will send you copy of. See the instructions on page 3. Web how to sign w9 electronically on my computer?