How To Sign Form 8879 Electronically

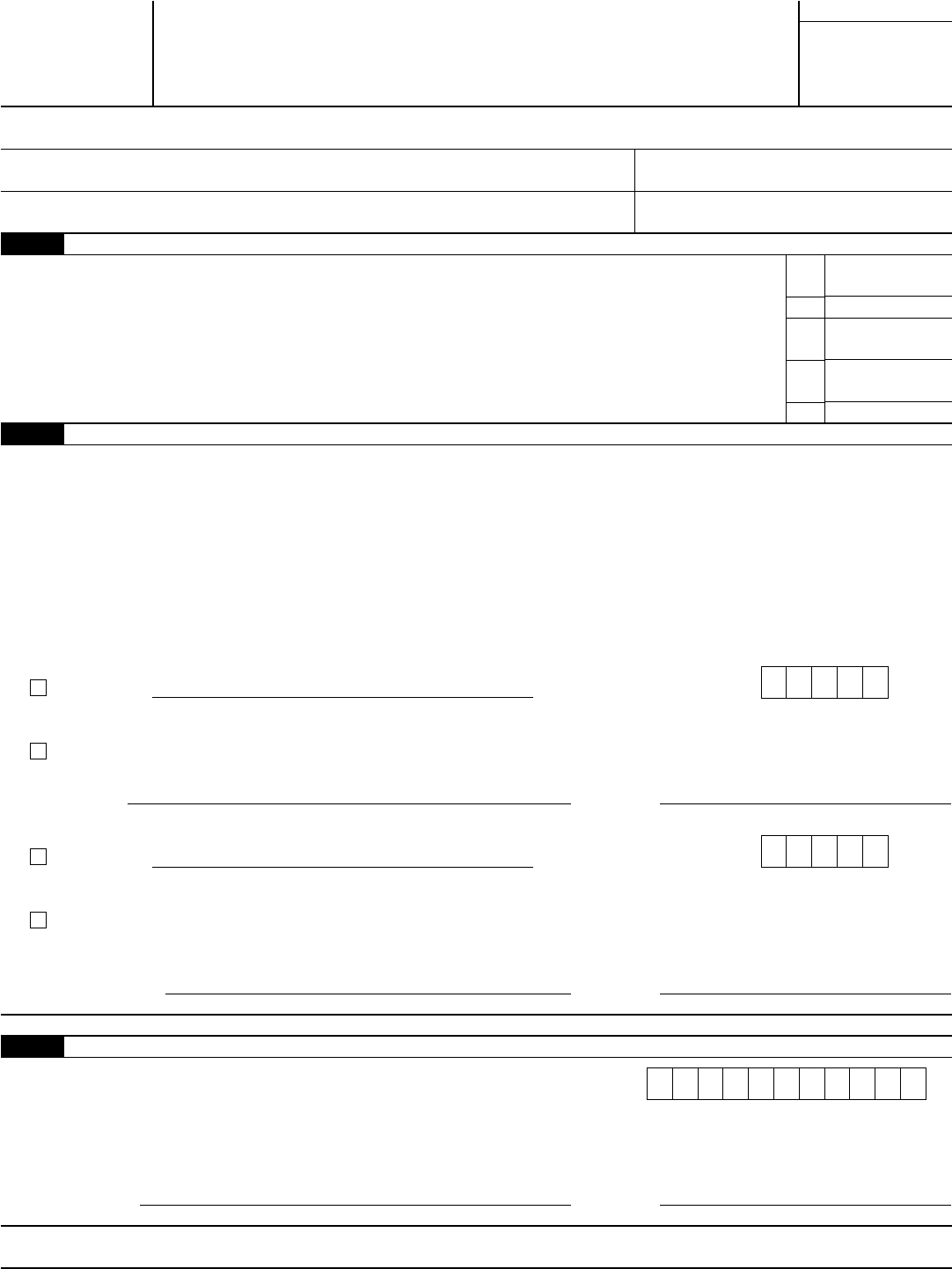

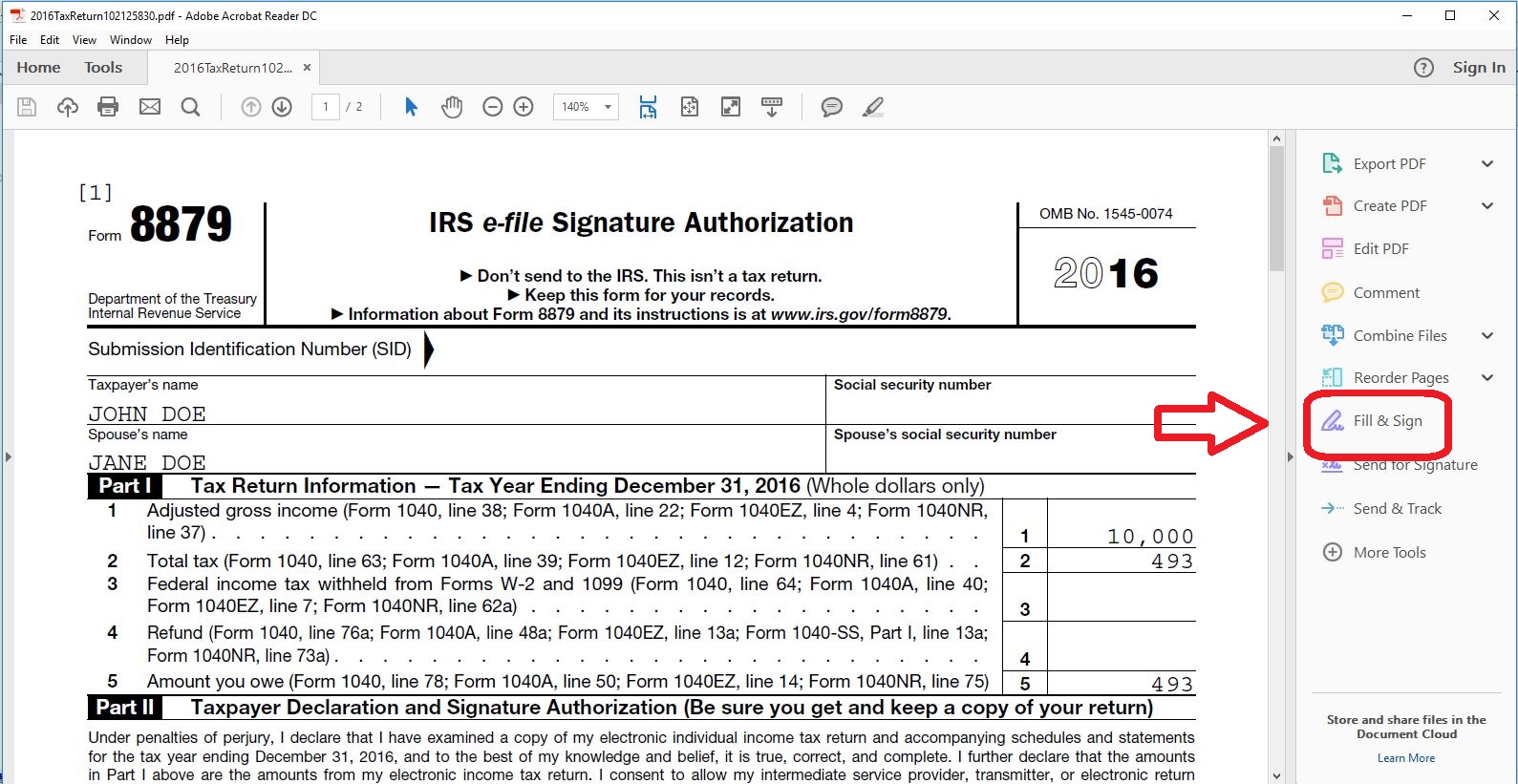

How To Sign Form 8879 Electronically - Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign irs form 8879. You can't send your returns to the irs yourself when using this form. For a partnership, it would. What irs form 8879 is why it is required with your tax return step by step instructions so you know what to expect And, here's how it works! They may send you a scanned copy of the signed page, such as using your encyro upload page. Web to electronically sign a pdf on windows, open adobe reader and click “fill & sign” to add your signature. Under this method, you authorize your tax practitioner to enter or generate your pin. Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. On a mac, open the pdf in preview and click “sign.” on android, iphone, or ipad, download adobe fill.

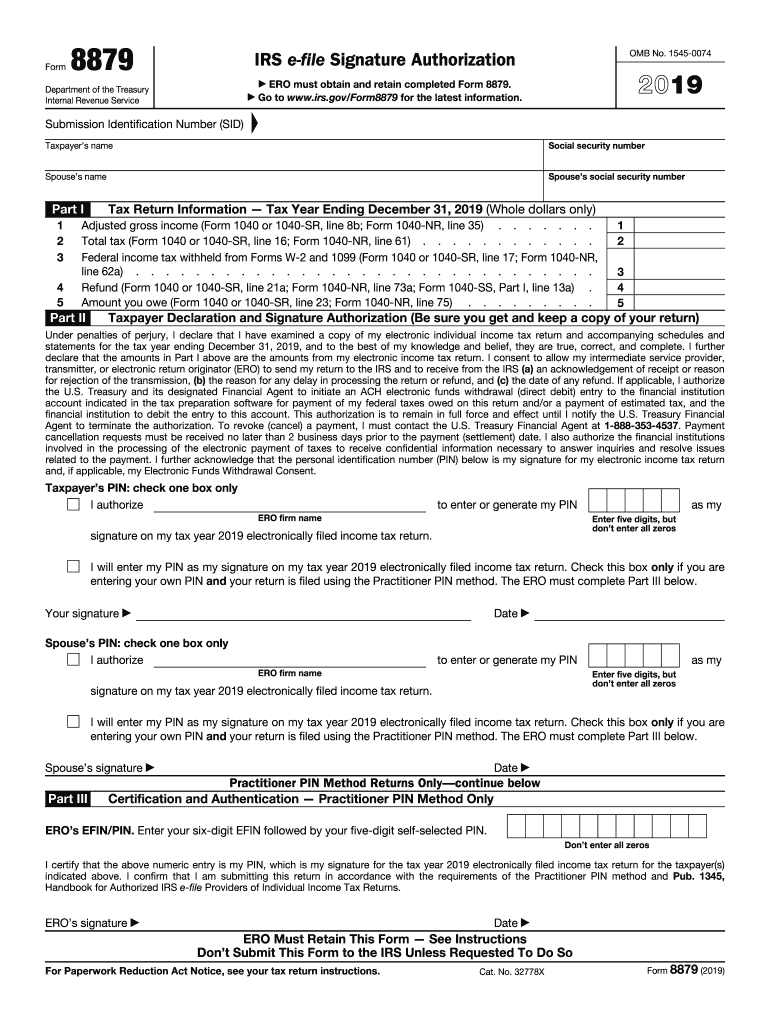

What irs form 8879 is why it is required with your tax return step by step instructions so you know what to expect And, here's how it works! Web an electronic return originator (ero) has two options to get forms 8879 or 8878 signed remotely by the client: Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign irs form 8879. For a corporation, that would be an officer of the company. They may send you a scanned copy of the signed page, such as using your encyro upload page. You can't send your returns to the irs yourself when using this form. Use this form 8879 (rev. Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. Web a reading of the instructions for form 8879 suggests that the irs allows taxpayers to sign the return electronically, by personally entering a pin.

Web an electronic return originator (ero) has two options to get forms 8879 or 8878 signed remotely by the client: What irs form 8879 is why it is required with your tax return step by step instructions so you know what to expect Web to electronically sign a pdf on windows, open adobe reader and click “fill & sign” to add your signature. You can't send your returns to the irs yourself when using this form. They may send you a scanned copy of the signed page, such as using your encyro upload page. Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign irs form 8879. And, here's how it works! This is not the same as authorizing the ero to enter or generate the pin. Under this method, you authorize your tax practitioner to enter or generate your pin. For a corporation, that would be an officer of the company.

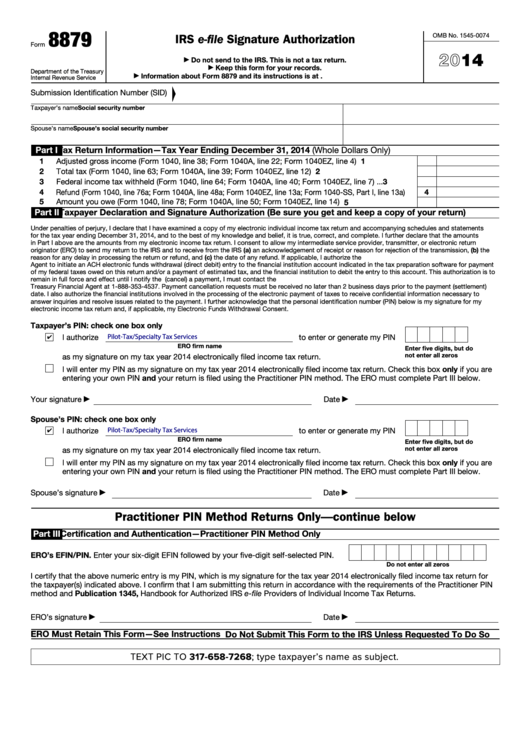

Fillable Form 8879 Irs EFile Signature Authorization 2014

Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign irs form 8879. They may send you a scanned copy of the signed page, such as using your encyro upload page. Web to electronically sign a pdf on windows, open adobe reader and click.

PA8879F 2014 PA EFile Signature Authorization Free Download

Web to electronically sign a pdf on windows, open adobe reader and click “fill & sign” to add your signature. On a mac, open the pdf in preview and click “sign.” on android, iphone, or ipad, download adobe fill. Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax.

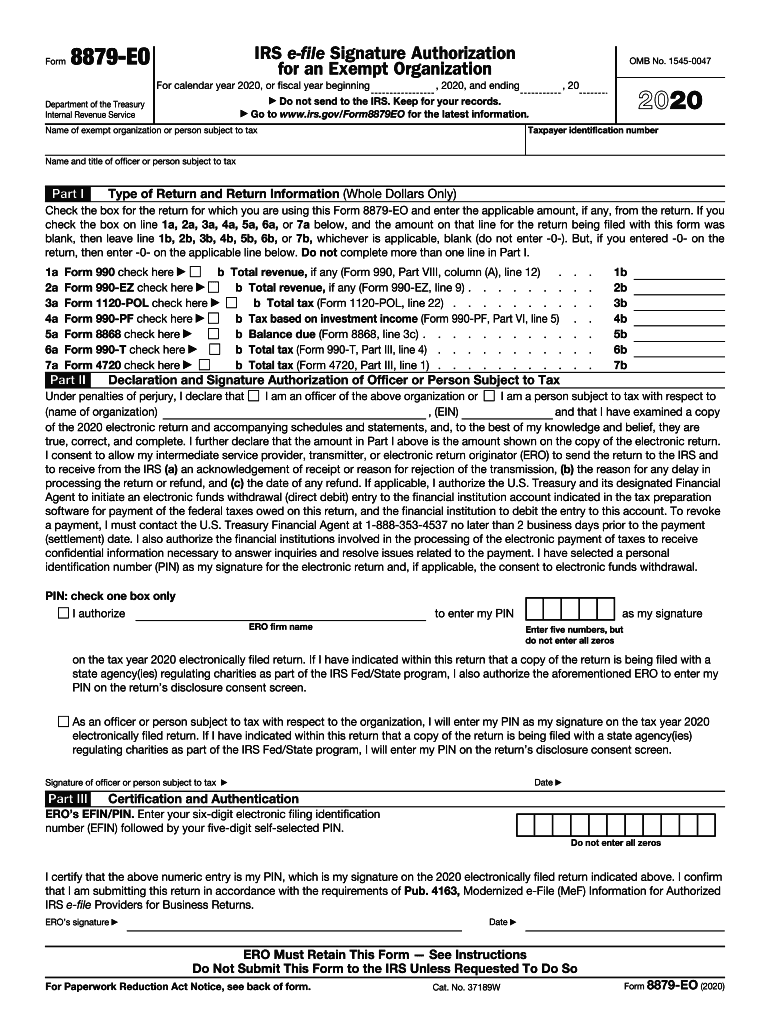

Form 8879 Eo Fill Out and Sign Printable PDF Template signNow

You can't send your returns to the irs yourself when using this form. Use this form 8879 (rev. For a corporation, that would be an officer of the company. What irs form 8879 is why it is required with your tax return step by step instructions so you know what to expect On a mac, open the pdf in preview.

Did you know that Canopy's eSign is KBA compliant? Conveniently esign

Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. You can't send your returns to the irs yourself when using this form. Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will.

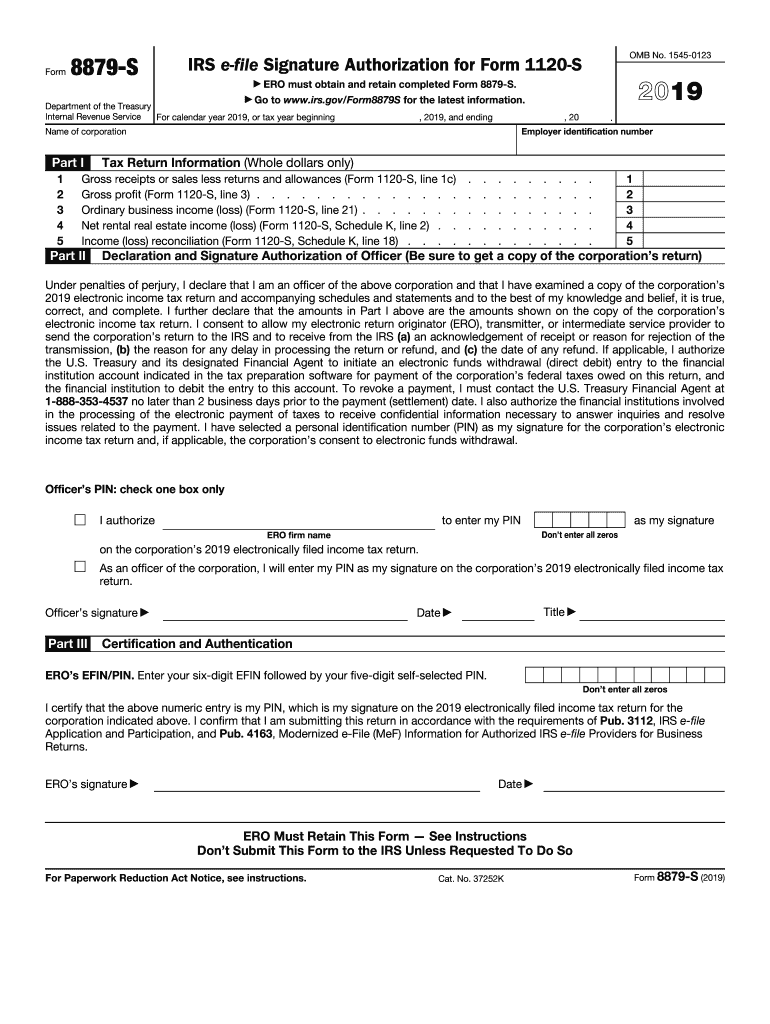

2019 Form IRS 8879S Fill Online, Printable, Fillable, Blank pdfFiller

Use this form 8879 (rev. Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. For a partnership, it would. What irs form 8879 is why it is required with your tax return step by step instructions so you know what to expect They may.

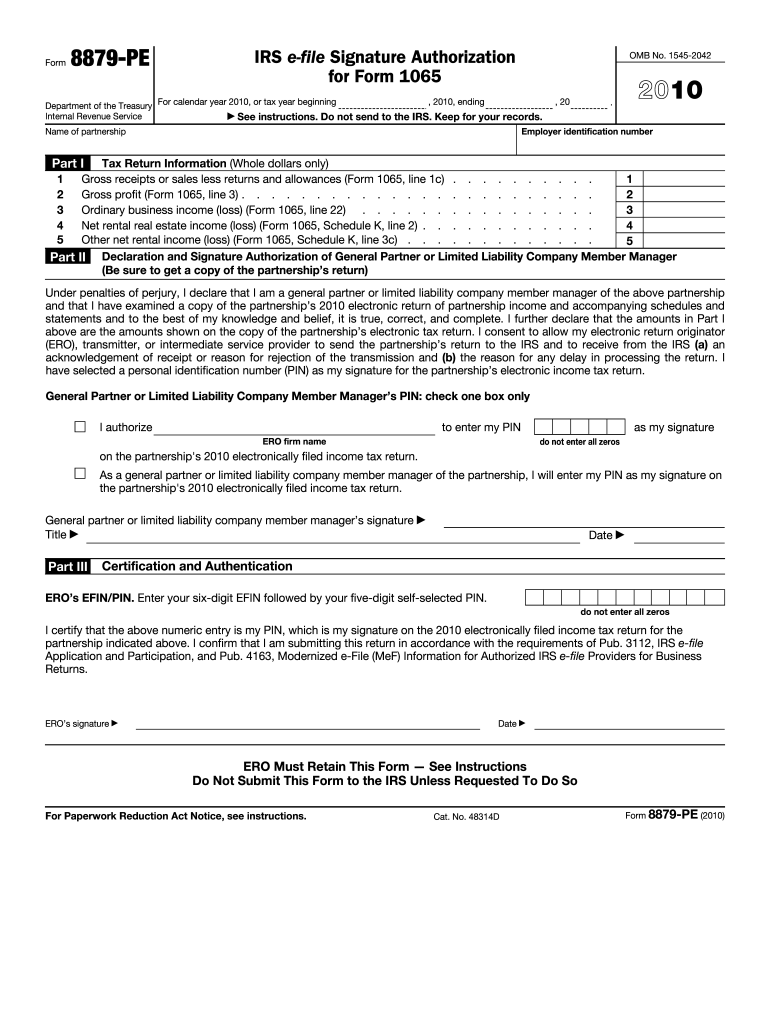

8879 Pe Instructions Form Fill Out and Sign Printable PDF Template

They may send you a scanned copy of the signed page, such as using your encyro upload page. For a corporation, that would be an officer of the company. You can't send your returns to the irs yourself when using this form. Web to electronically sign a pdf on windows, open adobe reader and click “fill & sign” to add.

Form 8879 Fill Out and Sign Printable PDF Template signNow

Under this method, you authorize your tax practitioner to enter or generate your pin. Web a reading of the instructions for form 8879 suggests that the irs allows taxpayers to sign the return electronically, by personally entering a pin. This is not the same as authorizing the ero to enter or generate the pin. They may send you a scanned.

Form 8879 Edit, Fill, Sign Online Handypdf

Under this method, you authorize your tax practitioner to enter or generate your pin. Use this form 8879 (rev. Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. Web an electronic return originator (ero) has two options to get forms 8879 or 8878 signed.

Blog Taxware Systems

Web a reading of the instructions for form 8879 suggests that the irs allows taxpayers to sign the return electronically, by personally entering a pin. Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign irs form 8879. This is not the same as.

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

Web the taxpayer declaration on the form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. Under this method, you authorize your tax practitioner to enter or generate your pin. You can't send your returns to the irs yourself when using this form. For a partnership, it would. Use this form.

On A Mac, Open The Pdf In Preview And Click “Sign.” On Android, Iphone, Or Ipad, Download Adobe Fill.

Web a reading of the instructions for form 8879 suggests that the irs allows taxpayers to sign the return electronically, by personally entering a pin. And, here's how it works! Web to electronically sign a pdf on windows, open adobe reader and click “fill & sign” to add your signature. Web if you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign irs form 8879.

They May Send You A Scanned Copy Of The Signed Page, Such As Using Your Encyro Upload Page.

For a corporation, that would be an officer of the company. What irs form 8879 is why it is required with your tax return step by step instructions so you know what to expect Web an electronic return originator (ero) has two options to get forms 8879 or 8878 signed remotely by the client: For a partnership, it would.

Web The Taxpayer Declaration On The Form 8879 Series Of Forms Must Be Signed By A Person Authorized To Sign Tax Returns For The Taxpayer.

Use this form 8879 (rev. You can't send your returns to the irs yourself when using this form. Under this method, you authorize your tax practitioner to enter or generate your pin. This is not the same as authorizing the ero to enter or generate the pin.