Il 1040X Form

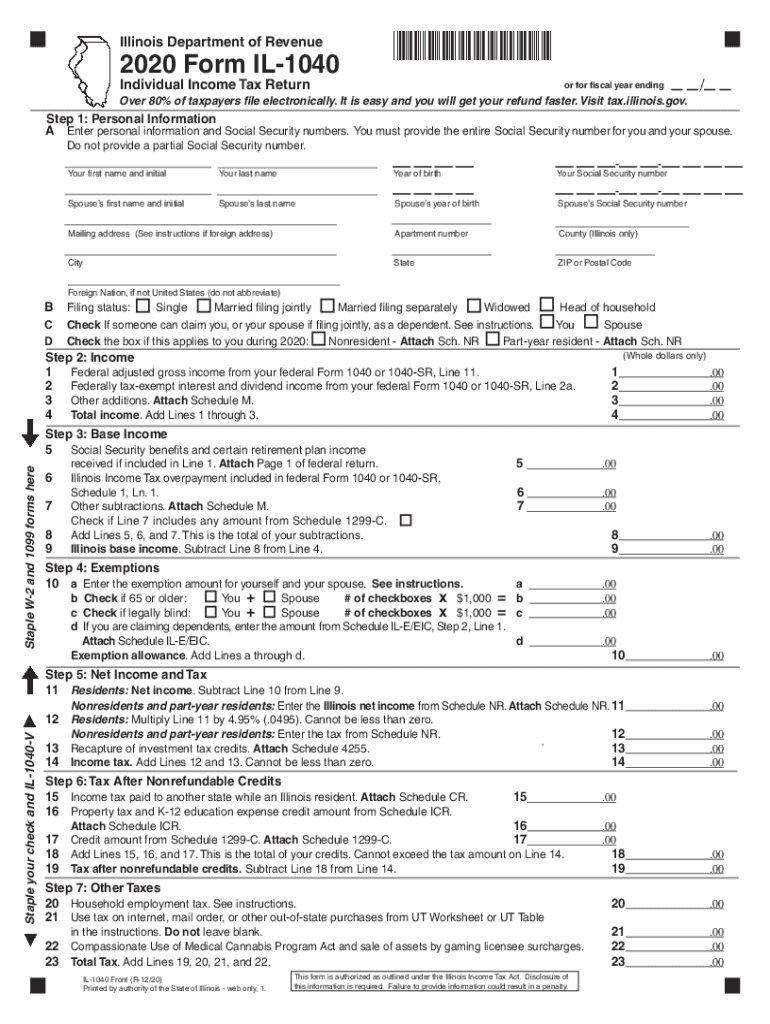

Il 1040X Form - Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Web proof of federal finalization for federal form 1040x or form 1045 overpayments and nol carryback deductions. Income tax rate the illinois income tax rate is 4.95 percent. Documents are in adobe acrobat portable document format (pdf). Personal information *61512211w* rev 12 step 2: This form is for income earned in tax year 2022, with tax. A copy of the notification you received from the irs that. Before viewing these documents you may need to download adobe acrobat reader. Web resident and nonresident aliens.

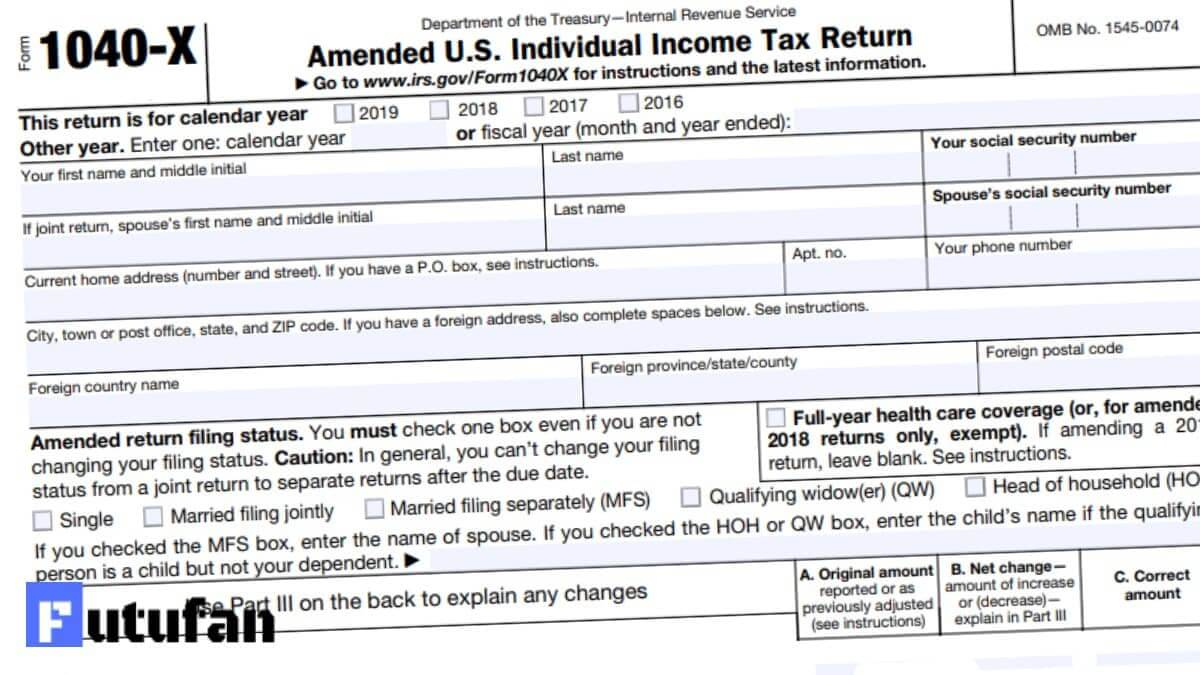

Department of the treasury—internal revenue service. This form is for income earned in tax year 2022, with tax. Income tax rate the illinois income tax rate is 4.95 percent. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. A copy of the notification you received from the irs that. Web filing online is quick and easy! Before viewing these documents you may need to download adobe acrobat reader. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Turbotax online posted february 11, 2022 6:08 pm last updated february 11, 2022 6:08 pm 0 7 1,519. Use this revision to amend 2019 or later tax.

Attach schedule m with amended figures. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web filing online is quick and easy! 2023 estimated income tax payments for individuals. 2022 estimated income tax payments for individuals. Income tax rate the illinois income tax rate is 4.95 percent. A copy of the notification you received from the irs that. Department of the treasury—internal revenue service. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Documents are in adobe acrobat portable document format (pdf).

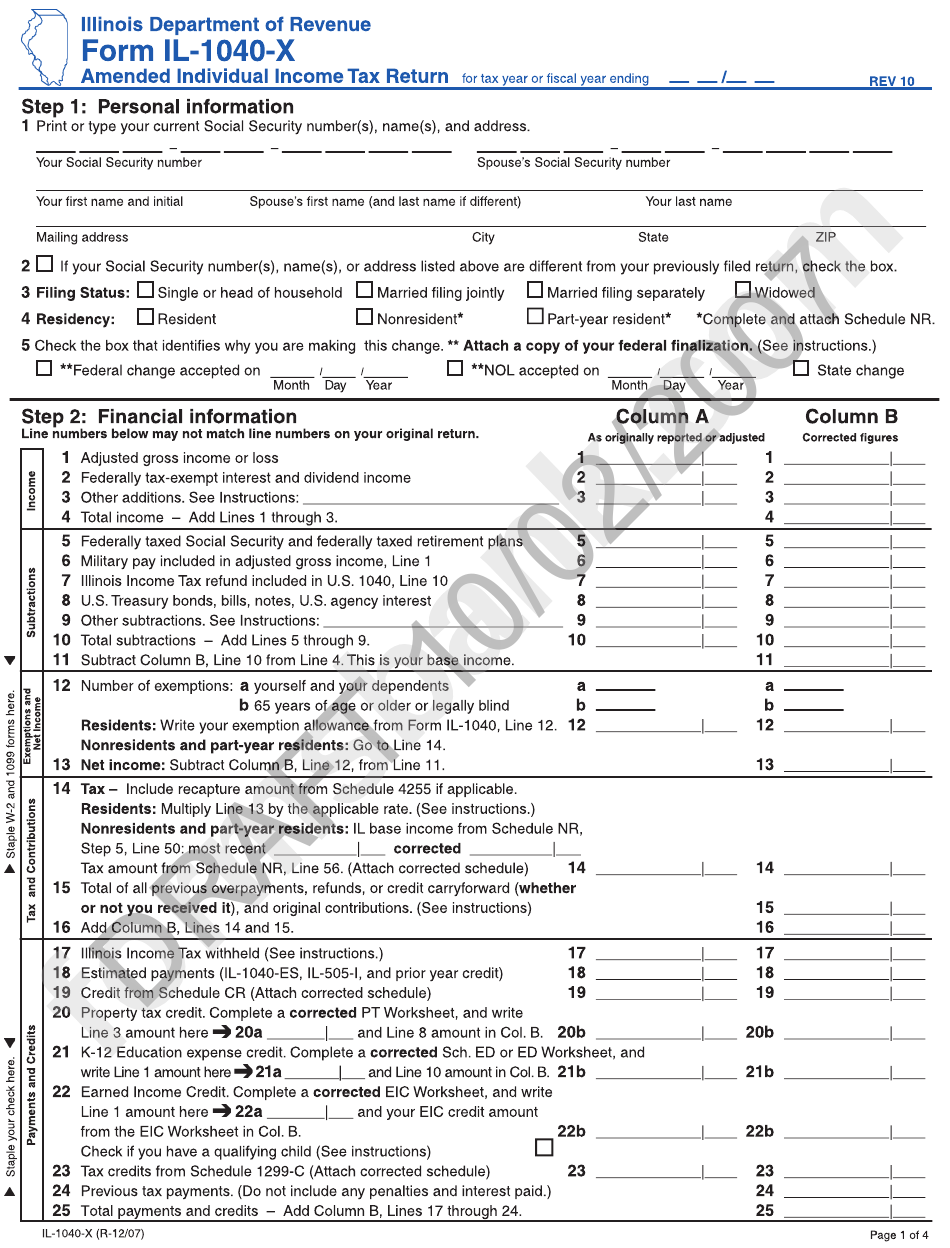

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

Documents are in adobe acrobat portable document format (pdf). Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. A copy of the notification you received from the irs that. Use this revision to amend 2019 or later tax. This form is for income earned in tax year 2022, with tax.

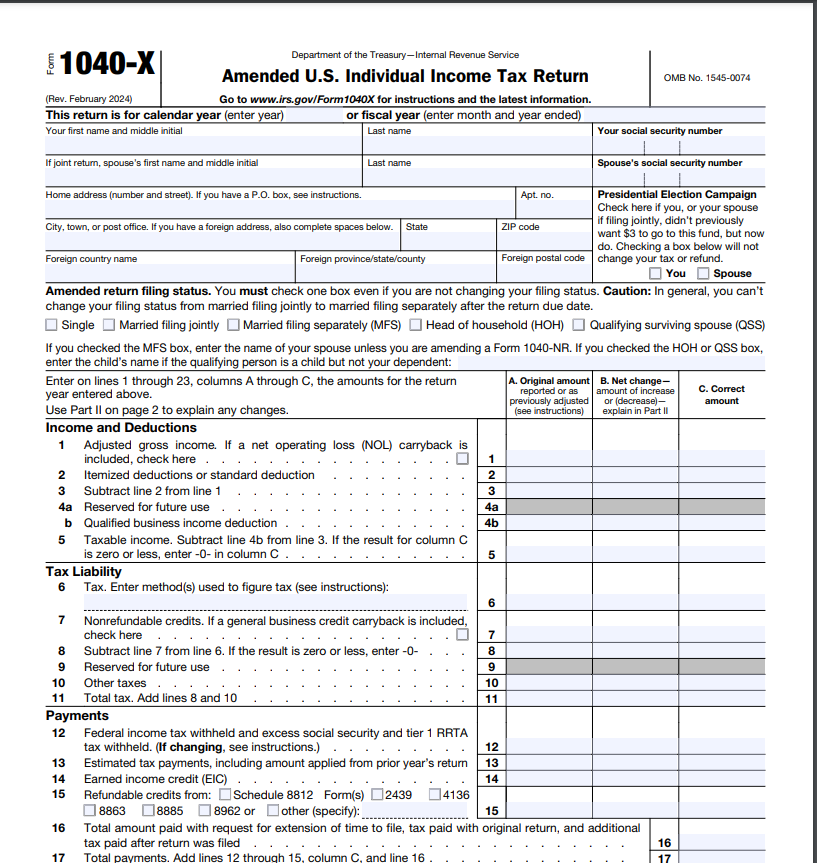

Form 1040X MJC

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web resident and nonresident aliens. Use this revision to amend 2019 or later tax. Department of the treasury—internal revenue service. Income tax rate the illinois income tax rate is 4.95 percent.

2018 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax. Use this revision to amend 2019 or later tax. Web resident and nonresident aliens. Income tax rate the illinois income tax rate is 4.95 percent. Documents are in adobe acrobat portable document format (pdf).

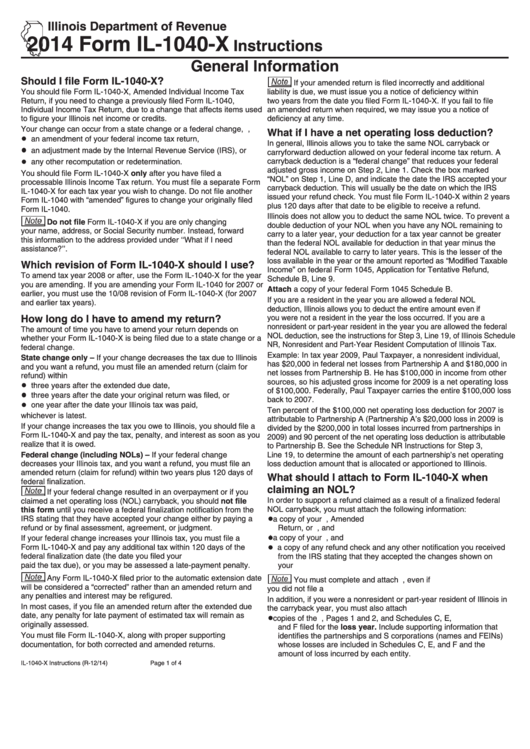

2014 Form Il1040X Instructions printable pdf download

Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. A copy of the notification you received from the irs that. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2023 estimated income tax payments for individuals. Income tax rate the illinois income tax.

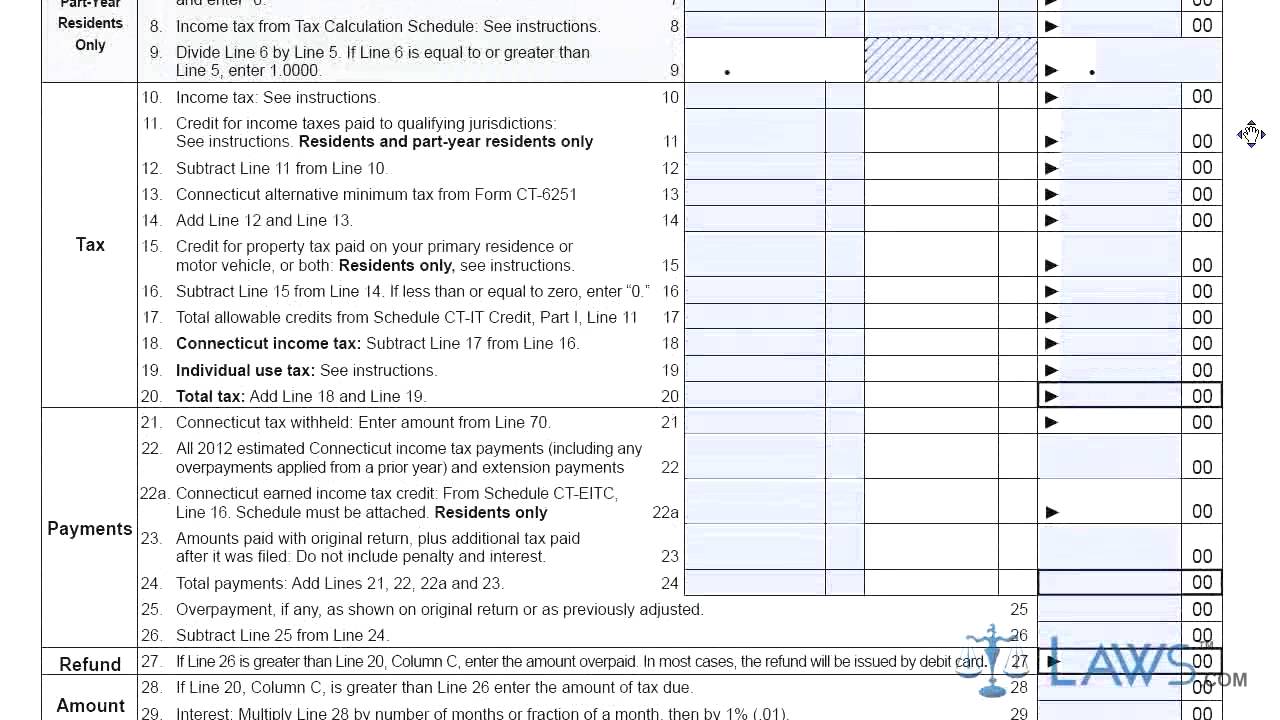

Form CT 1040X Amended Connecticut Tax Return for Individuals

Web resident and nonresident aliens. Web filing online is quick and easy! A copy of the notification you received from the irs that. Web proof of federal finalization for federal form 1040x or form 1045 overpayments and nol carryback deductions. Income tax rate the illinois income tax rate is 4.95 percent.

Form Il1040X Draft Amended Individual Tax Return printable

Web resident and nonresident aliens. A copy of the notification you received from the irs that. Web filing online is quick and easy! Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address.

1040 Document 2021 Example Calendar Printable

2023 estimated income tax payments for individuals. This form is for income earned in tax year 2022, with tax. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. A copy of the notification you.

IRS Instruction 1040X Blank PDF Forms to Download

Income tax rate the illinois income tax rate is 4.95 percent. Web resident and nonresident aliens. Use this revision to amend 2019 or later tax. Web filing online is quick and easy! Documents are in adobe acrobat portable document format (pdf).

Illinois Form IL 1040 X Amended Individual Tax Fill Out and

Personal information *61512211w* rev 12 step 2: Use this revision to amend 2019 or later tax. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Documents are in adobe acrobat portable document format (pdf). 2022 estimated income tax payments for individuals.

IRS 1040X 2020 Fill and Sign Printable Template Online US Legal Forms

Income tax rate the illinois income tax rate is 4.95 percent. Web resident and nonresident aliens. 2022 estimated income tax payments for individuals. Web proof of federal finalization for federal form 1040x or form 1045 overpayments and nol carryback deductions. This form is for income earned in tax year 2022, with tax.

Personal Information *61512201W* Rev 12 Print Or Type Your Current Social Security Number(S), Name(S), And Address.

Before viewing these documents you may need to download adobe acrobat reader. Department of the treasury—internal revenue service. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web resident and nonresident aliens.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Personal information *61512211w* rev 12 step 2: A copy of the notification you received from the irs that. 2023 estimated income tax payments for individuals. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically.

Income Tax Rate The Illinois Income Tax Rate Is 4.95 Percent.

Turbotax online posted february 11, 2022 6:08 pm last updated february 11, 2022 6:08 pm 0 7 1,519. Web filing online is quick and easy! Documents are in adobe acrobat portable document format (pdf). Web proof of federal finalization for federal form 1040x or form 1045 overpayments and nol carryback deductions.

Use This Form For Payments That Are Due On April 18, 2022, June 15, 2022, September 15, 2022, And.

2022 estimated income tax payments for individuals. Attach schedule m with amended figures. Use this revision to amend 2019 or later tax.