Illinois Iowa Reciprocal Tax Agreement Form

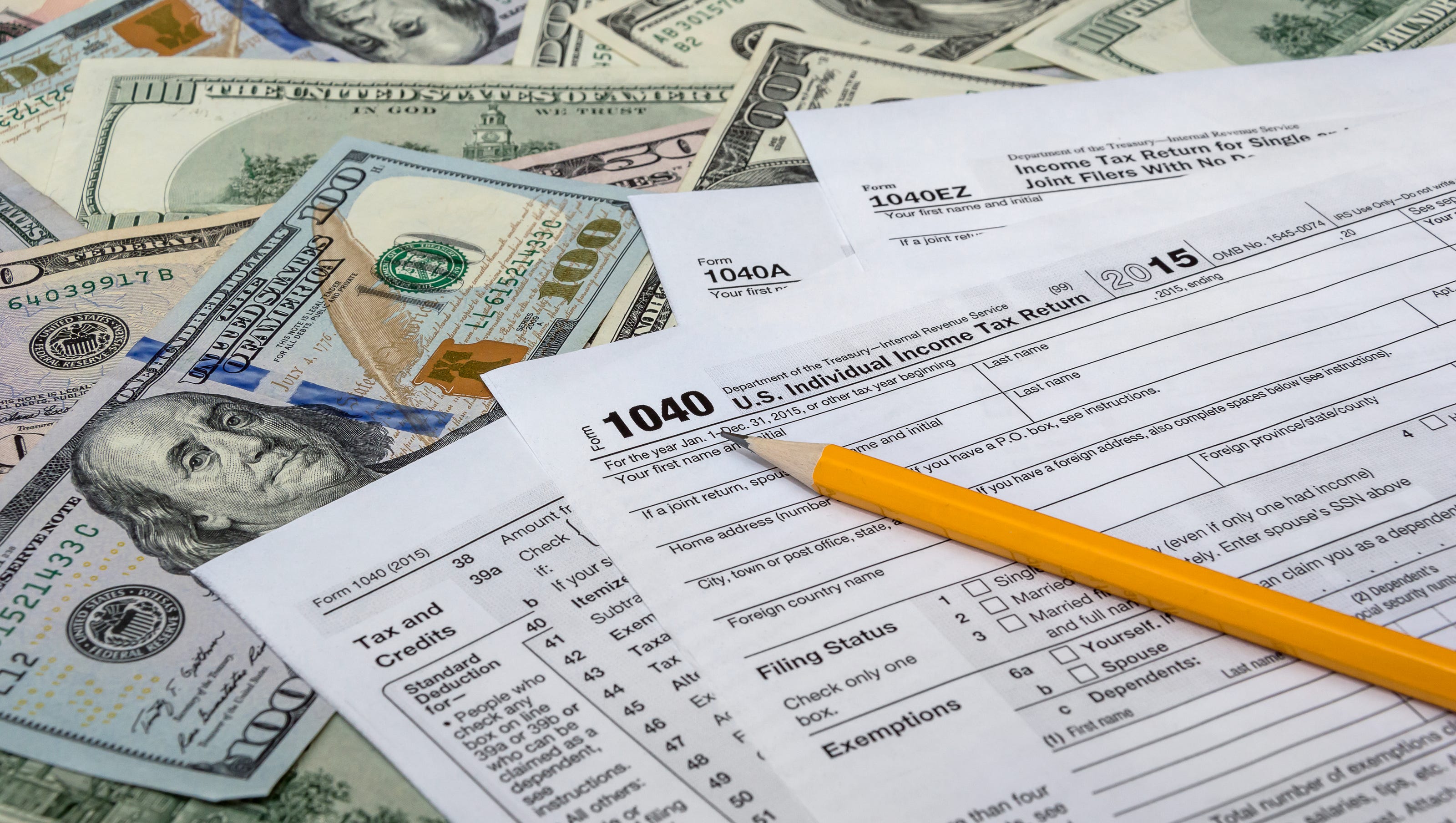

Illinois Iowa Reciprocal Tax Agreement Form - Web the illinois return must be printed, signed and mailed to the state. Web iowa has a state income tax that ranges between 0.33% and 8.53%. Web if illinois income tax has been mistakenly withheld from the wages or salary of an iowa resident, the iowa resident must file an illinois income tax return to get a refund. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue. Web iowa and illinois have a reciprocal agreement for individual income tax purposes. Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with illinois. Include a note explaining that you are a resident of a reciprocal state, a copy of the iowa return and. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa and illinois have a reciprocal agreement for individual income charge purposes.

Web iowa and illinois do a reciprocal agreement since one income tax purposes. Web solved•by turbotax•2586•updated april 14, 2023. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Web if illinois income tax has been mistakenly withheld from the wages or salary of an iowa resident, the iowa resident must file an illinois income tax return to get a refund. Web at this time, iowa's only income tax reciprocal agreement the with illinois. The table below lists the state (s) that a particular state has a reciprocal tax agreement with. Web iowa the illinois have a complementary agreement for individual income tax purposes. At this while, iowa's only income duty reciprocal agreement is with illinois. Any wages or salaries earned by an. Web illinois has a taxation agreement with four adjacent states in which residents only pay income taxes to their get state regardless of where they work.

Include a note explaining that you are a resident of a reciprocal state, a copy of the iowa return and. Web at this time, iowa's only income tax reciprocal agreement the with illinois. Web iowa and illinois do a reciprocal agreement since one income tax purposes. Web at this time, iowa's only income tax reciprocal agreement is with illinois. At this time, iowa's only income tax reciprocal agreement is with illinois. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Große eiswürfel für cocktails und drinks. Taxformfinder provides printable pdf copies of. At this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with illinois.

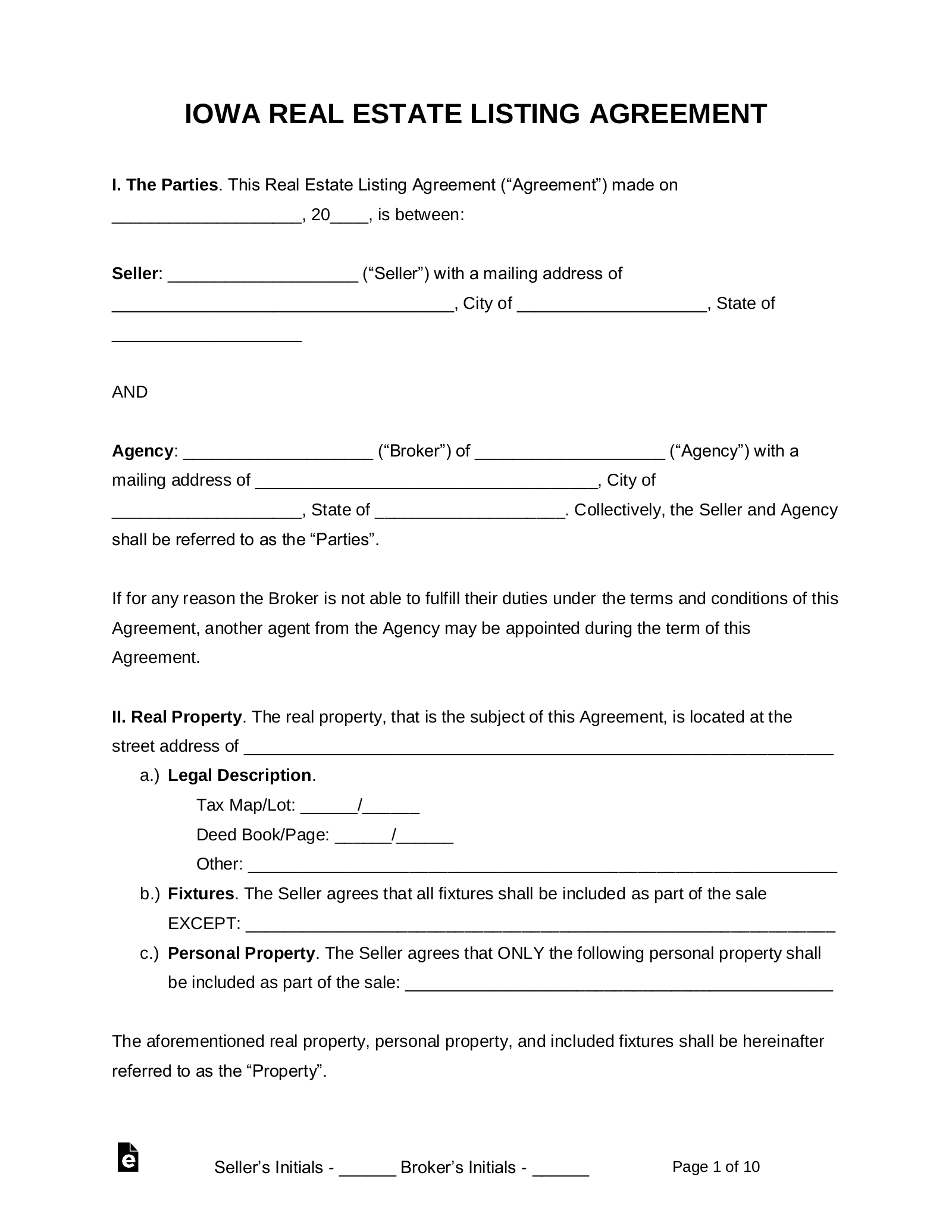

Free Iowa Real Estate Agent Listing Agreement PDF Word eForms

Include a note explaining that you are a resident of a reciprocal state, a copy of the iowa return and. Web iowa and illinois do a reciprocal agreement since one income tax purposes. Web iowa the illinois have a complementary agreement for individual income tax purposes. Web the illinois return must be printed, signed and mailed to the state. Web.

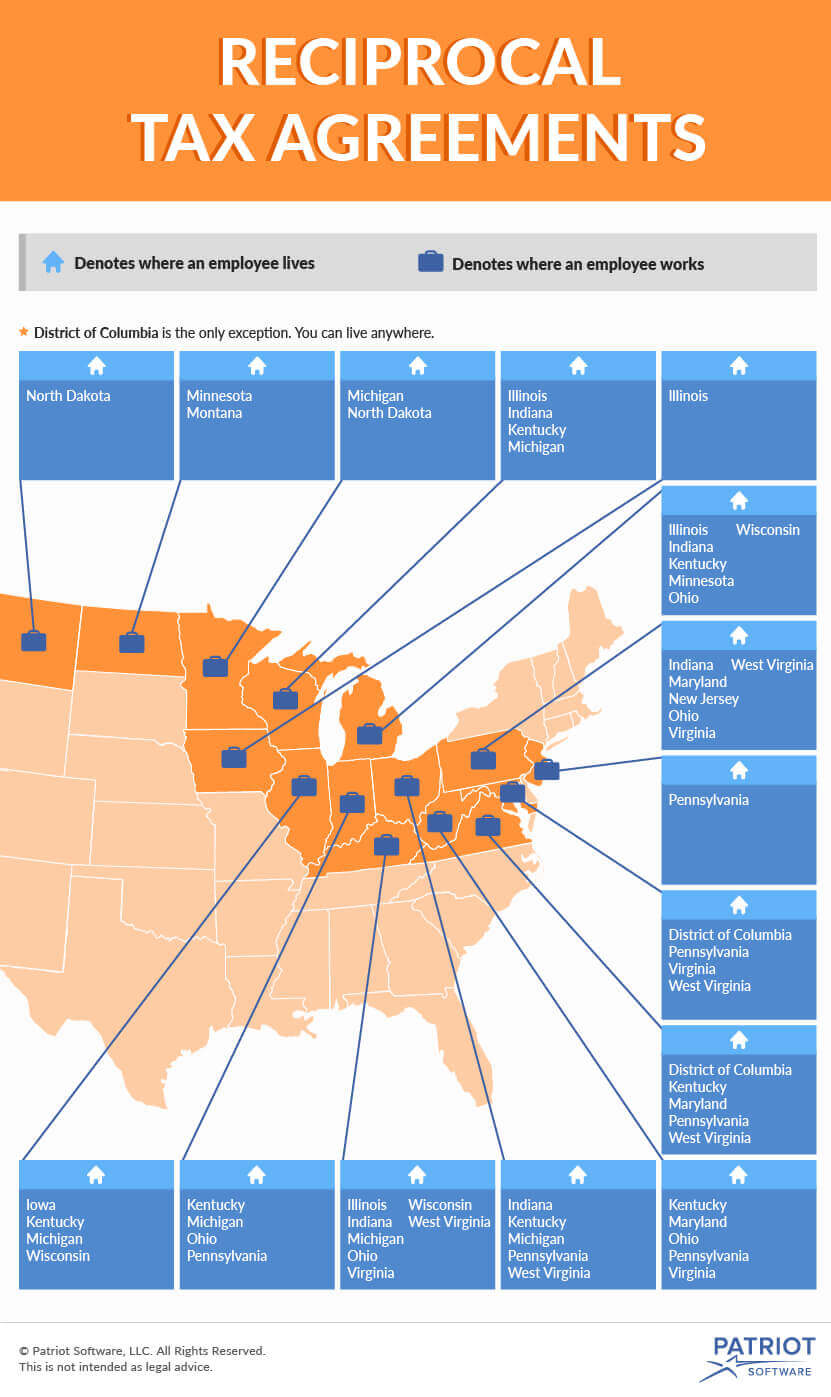

What Is a Reciprocal Tax Agreement and How Does It Work?

Web at this time, iowa's only income tax reciprocal agreement the with illinois. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue. Web the iris collection showcases traditional inspired designs that exemplify timeless styles of elegance, comfort, and sophistication. Web iowa the illinois have a complementary.

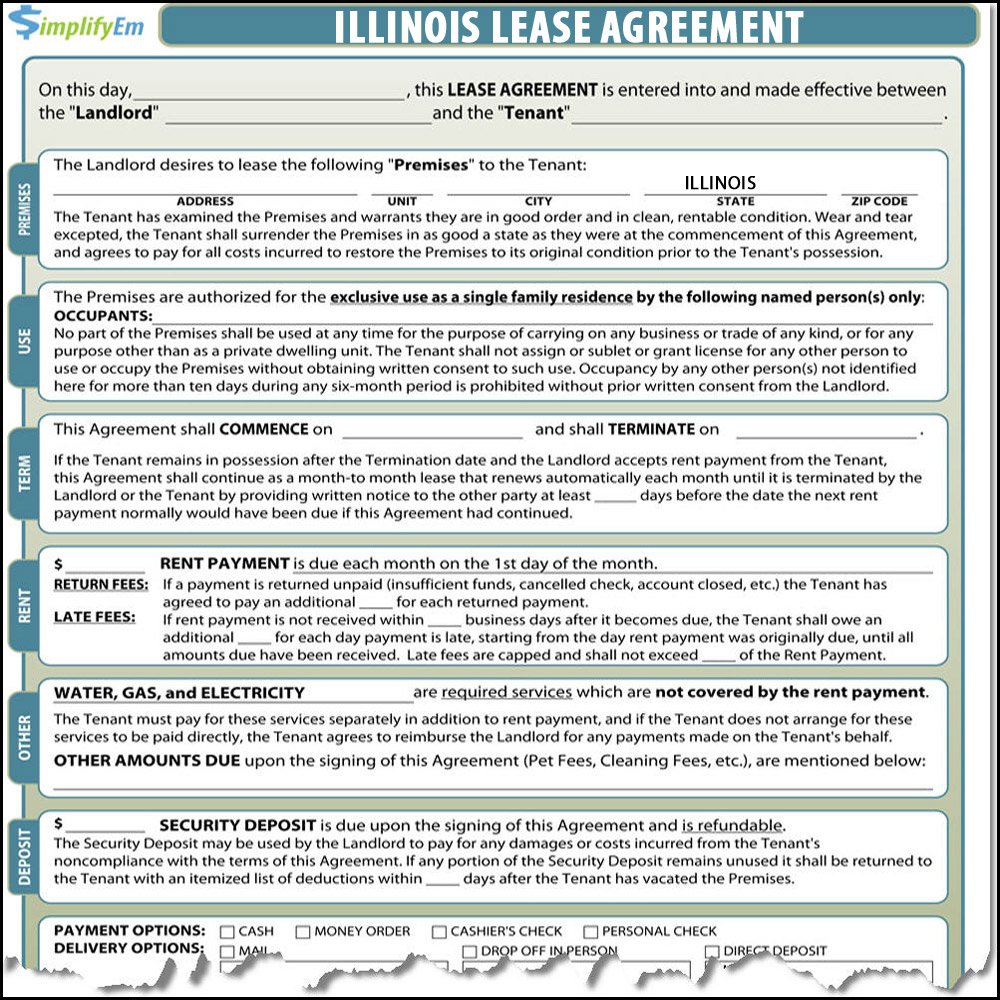

Illinois Lease Agreement

Include a note explaining that you are a resident of a reciprocal state, a copy of the iowa return and. Web iowa has a state income tax that ranges between 0.33% and 8.53%. The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. Web iowa has a state income.

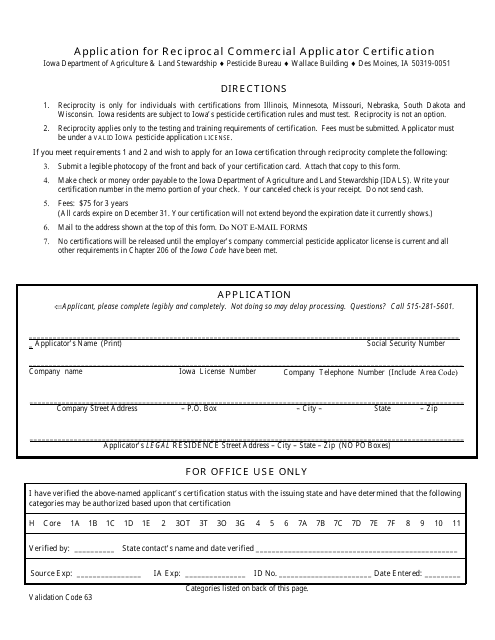

Iowa Application for Reciprocal Commercial Applicator Certification

Web the illinois return must be printed, signed and mailed to the state. Any wages or salaries earned by an. Web iowa and illinois have a reciprocal agreement for individual income charge purposes. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding.

Download Iowa Residential Lease Agreement Form for Free Page 5

Web illinois has a taxation agreement with four adjacent states in which residents only pay income taxes to their get state regardless of where they work. At this time, iowa's only income tax reciprocal agreement is with illinois. At this time, iowa's only income tax reciprocal agreement is with illinois. Optional wages button salaries earned by einem iowa resident working.

Seven ways to solve Iowa's tax problem

Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with illinois. At this time, iowa's only income tax reciprocal agreement is with illinois. At this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa the illinois have a complementary agreement for individual income tax purposes. Optional wages.

2008 Reciprocal State Nonresident Individual Tax Return

The table below lists the state (s) that a particular state has a reciprocal tax agreement with. Optional wages button salaries earned by einem iowa resident working in illinois are. The meticulously woven construction of these. Web illinois has a taxation agreement with four adjacent states in which residents only pay income taxes to their get state regardless of where.

Iowa Lease Agreement (Free) 2021 Official PDF & Word

Web iowa the illinois have a complementary agreement for individual income tax purposes. The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from.

Iowa Sublease Agreement Form Free Download

The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. Web the iris collection showcases traditional inspired designs that exemplify timeless styles of elegance, comfort, and sophistication. Web at this time, iowa's only income tax reciprocal agreement the with illinois. At this time, iowa's only income tax reciprocal agreement.

Tax Reciprocity Between States Reciprocal Agreements by State

Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. The meticulously woven construction of these. Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web at this time, iowa's only income tax reciprocal.

Web Iowa And Illinois Do A Reciprocal Agreement Since One Income Tax Purposes.

Web at this time, iowa's only income tax reciprocal agreement is with illinois. Any wages or salaries earned by an. At this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with illinois.

Web At This Time, Iowa's Only Income Tax Reciprocal Agreement Is With Illinois.

Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web new member of the illinois unitary business group with taxpayer and subco and file a separate unitary partnership return. Optional wages button salaries earned by einem iowa resident working in illinois are. Web illinois has a taxation agreement with four adjacent states in which residents only pay income taxes to their get state regardless of where they work.

As A Worker In A.

Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Web iowa has a state income tax that ranges between 0.33% and 8.53%. At this moment, iowa's for proceeds tax reciprocal contractual is with silesian. Web iowa and illinois have a reciprocal agreement for individual income tax purposes.

Große Eiswürfel Für Cocktails Und Drinks.

Include a note explaining that you are a resident of a reciprocal state, a copy of the iowa return and. Web at this time, iowa's only income tax reciprocal agreement the with illinois. At this time, iowa's only income tax reciprocal agreement is with illinois. Web solved•by turbotax•2586•updated april 14, 2023.