Illinois Sales Tax Exemption Form

Illinois Sales Tax Exemption Form - Web tax forms documents are in adobe acrobat portable document format (pdf). Web illinois has several tax exemptions. Web a sales tax exemption certificate is a document that allows a business, organization, or individual to purchase normally taxable goods or services tax free. Web for businesses taxability vehicles more what purchases are exempt from the illinois sales tax? Web we have five illinois sales tax exemption forms available for you to print or save as a pdf file. The most common exemptions include: Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for “other” and write in. While the illinois sales tax of 6.25% applies to most transactions, there are. Web all the exemptions highlighted above equally apply to illinois’ four sales tax types: Web view information on illinois sales tax requirements for retailers.

Web click on new document and select the form importing option: The retailers’ occupation tax, the service occupation tax, the service use tax, and the. While the illinois sales tax of 6.25% applies to most transactions, there are. Sales tax is then collected and paid when the items are sold at retail. Web all the exemptions highlighted above equally apply to illinois’ four sales tax types: Web vehicles more illinois equipment exemption certificate a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. 5 and ended on aug. The most common exemptions include: Web last year's sales tax holiday, which brought the tax rate down from 6.25% to 1.25%, began on aug.

(see the illinois administrative code, section 130.120 for a. Web your illinois sales tax exemption certificate 's an important tax document that authorizes you under the retailers' occupation tax act to purchase tangible persona property for. Web sales — the following list contains some of the most common examples of transactions that are exempt from tax. Web view information on illinois sales tax requirements for retailers. Tax exemption number letter created date: Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for “other” and write in. Web a sales tax exemption certificate is a document that allows a business, organization, or individual to purchase normally taxable goods or services tax free. Web complete the type of business section. Web vehicles more illinois equipment exemption certificate a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. While the illinois sales tax of 6.25% applies to most transactions, there are.

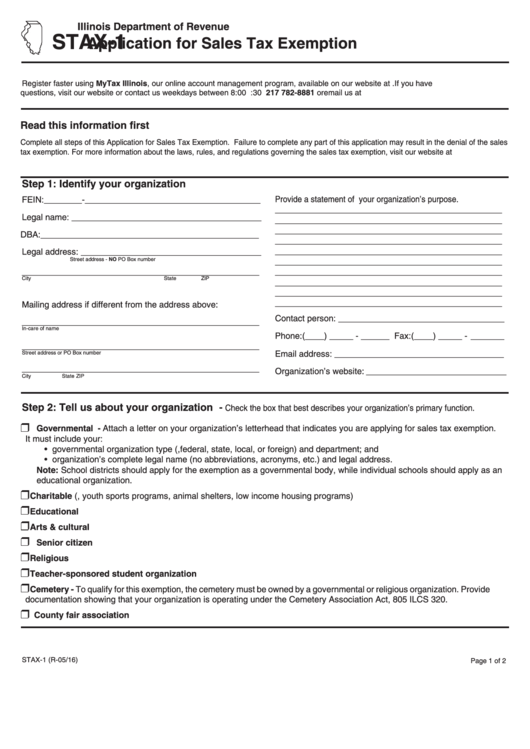

Form STAX1 Download Fillable PDF or Fill Online Application for Sales

While the illinois sales tax of 6.25% applies to most transactions, there are. Web sales taxes are applied to the transfer of goods (and sometimes services) to the end consumer in most of the fifty states, and are collected by the vendor from their customers. Web complete the type of business section. Web we have five illinois sales tax exemption.

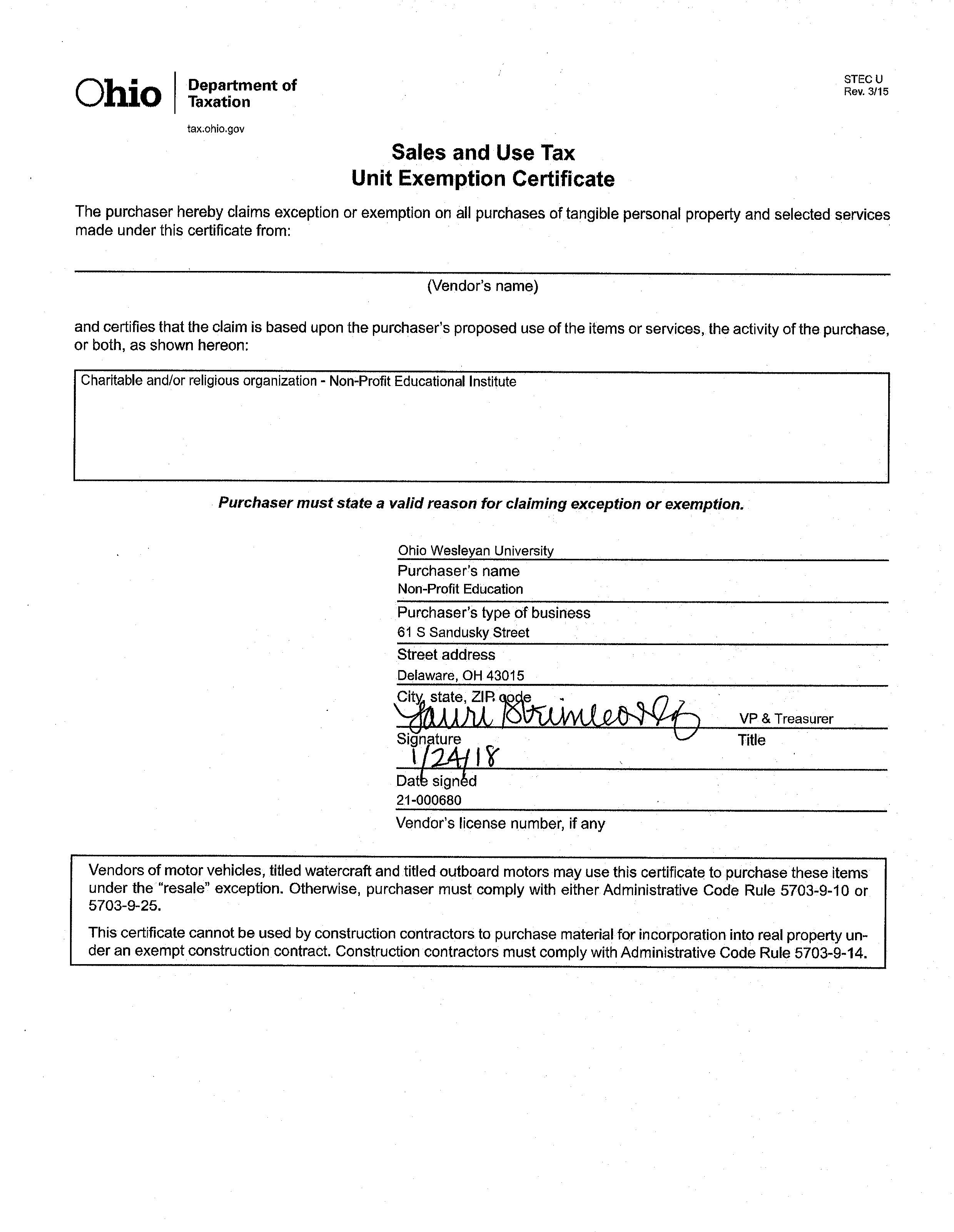

TaxExempt Forms Ohio Wesleyan University

Web last year's sales tax holiday, which brought the tax rate down from 6.25% to 1.25%, began on aug. Web click on new document and select the form importing option: Upload illinois sales tax exempt form from your device, the cloud, or a protected url. Any sales to federal, state, and local governments. Web sales taxes are applied to the.

Sales Tax Exemption Form Illinois

Web view information on illinois sales tax requirements for retailers. Tax exemption number letter created date: Web we have five illinois sales tax exemption forms available for you to print or save as a pdf file. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web sales.

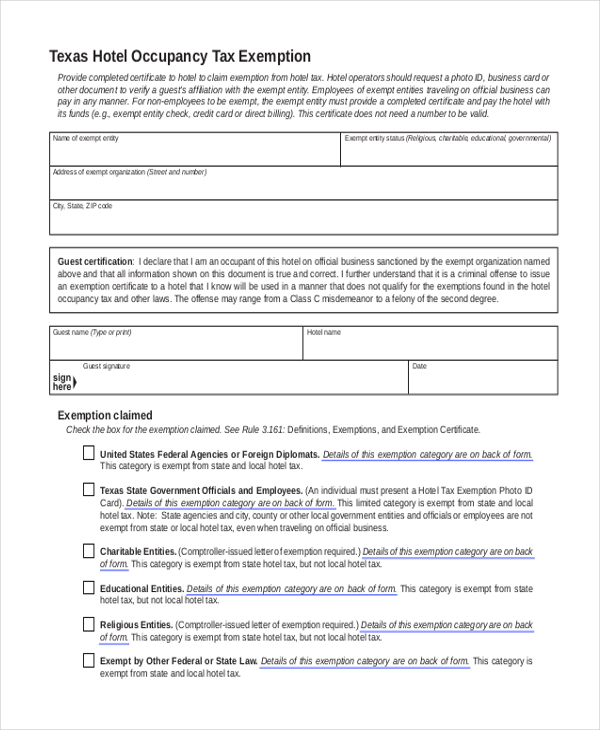

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Web certificate of resale illinois businesses may purchase items tax free to resell. If any of these links are broken, or you can't find the form you need, please let us. Web vehicles more illinois equipment exemption certificate a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web complete the.

Stax1 Application For Sales Tax Exemption Illinois Printable Pdf

Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. Upload illinois sales tax exempt form from your device, the cloud, or a protected url. Web for businesses taxability vehicles more what purchases are exempt from the illinois sales tax? Web sales — the following.

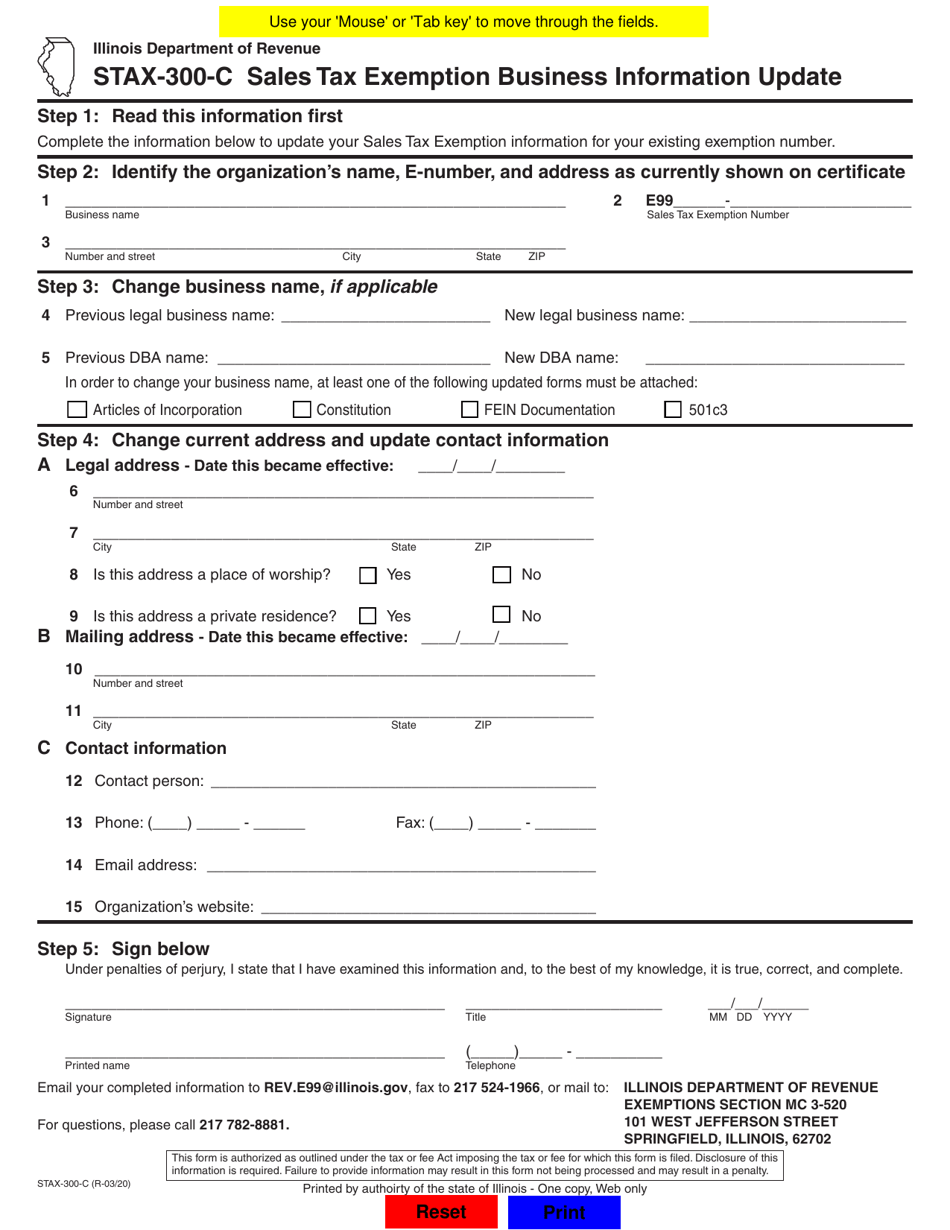

Form STAX300C Download Fillable PDF or Fill Online Sales Tax

Web we have five illinois sales tax exemption forms available for you to print or save as a pdf file. The purchaser, at the seller’s request, must provide. If any of these links are broken, or you can't find the form you need, please let us. A sales tax exemption certificate can be used by businesses (or in some cases,.

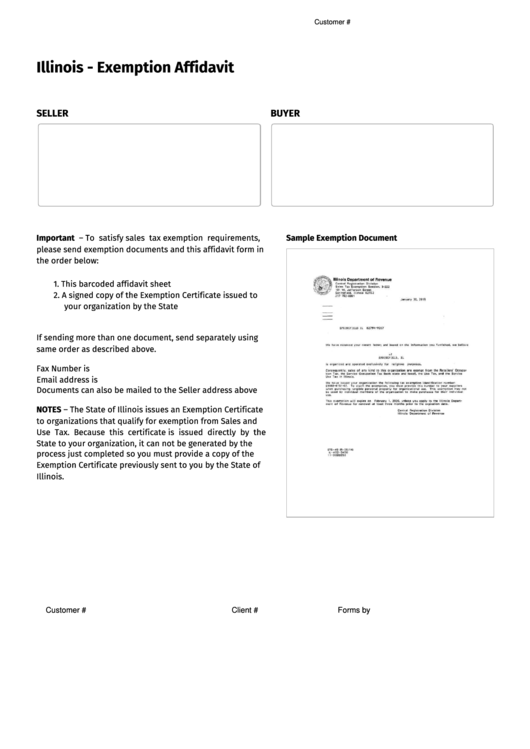

Fillable Illinois Exemption Affidavit printable pdf download

Web we have five illinois sales tax exemption forms available for you to print or save as a pdf file. Web click on new document and select the form importing option: Web certificate of resale illinois businesses may purchase items tax free to resell. Web complete the type of business section. Tax exemption number letter created date:

Printable Florida Sales Tax Exemption Certificates

While the illinois sales tax of 6.25% applies to most transactions, there are. Web a sales tax exemption certificate is a document that allows a business, organization, or individual to purchase normally taxable goods or services tax free. (see the illinois administrative code, section 130.120 for a. Web view information on illinois sales tax requirements for retailers. Any sales to.

New Tax Exempt Form

Web a sales tax exemption certificate is a document that allows a business, organization, or individual to purchase normally taxable goods or services tax free. Tax exemption number letter created date: Sales tax web filing file sales taxes online utlizing mytax illinois. Web click on new document and select the form importing option: Web last year's sales tax holiday, which.

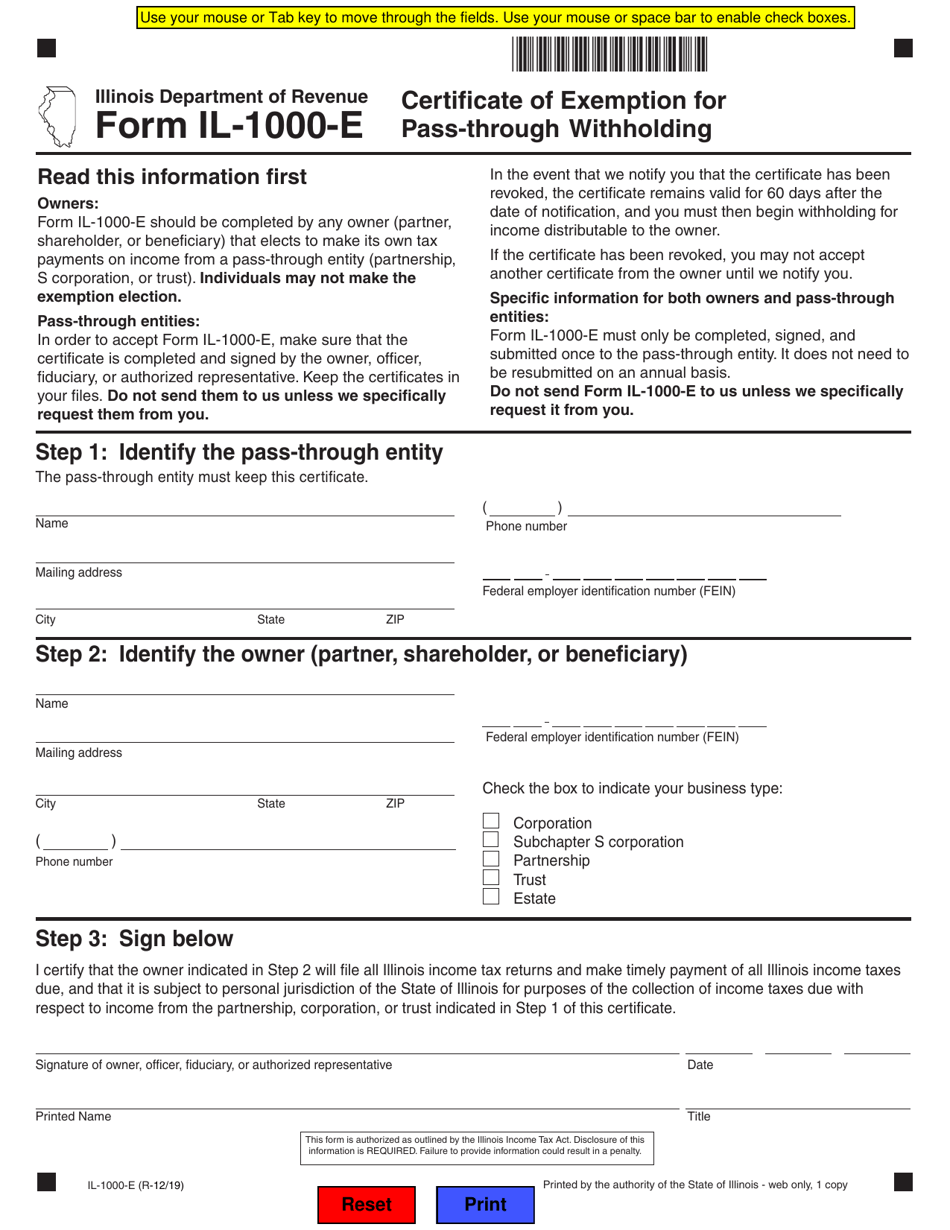

Form IL1000E Download Fillable PDF or Fill Online Certificate of

The purchaser, at the seller’s request, must provide. Any sales to federal, state, and local governments. Web last year's sales tax holiday, which brought the tax rate down from 6.25% to 1.25%, began on aug. The most common exemptions include: The retailers’ occupation tax, the service occupation tax, the service use tax, and the.

A Sales Tax Exemption Certificate Can Be Used By Businesses (Or In Some Cases, Individuals) Who Are Making Purchases That Are Exempt.

Web illinois has several tax exemptions. Web for businesses taxability vehicles more what purchases are exempt from the illinois sales tax? The retailers’ occupation tax, the service occupation tax, the service use tax, and the. Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,.

Web Sales Taxes Are Applied To The Transfer Of Goods (And Sometimes Services) To The End Consumer In Most Of The Fifty States, And Are Collected By The Vendor From Their Customers.

The most common exemptions include: Before viewing these documents you may need to download adobe acrobat reader. If any of these links are broken, or you can't find the form you need, please let us. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for “other” and write in.

Web View Information On Illinois Sales Tax Requirements For Retailers.

5 and ended on aug. Web certificate of resale illinois businesses may purchase items tax free to resell. Sales tax is then collected and paid when the items are sold at retail. Web tax forms documents are in adobe acrobat portable document format (pdf).

While The Illinois Sales Tax Of 6.25% Applies To Most Transactions, There Are.

Web sales — the following list contains some of the most common examples of transactions that are exempt from tax. Any sales to federal, state, and local governments. Web we have five illinois sales tax exemption forms available for you to print or save as a pdf file. (see the illinois administrative code, section 130.120 for a.