Income And Expense Declaration Form

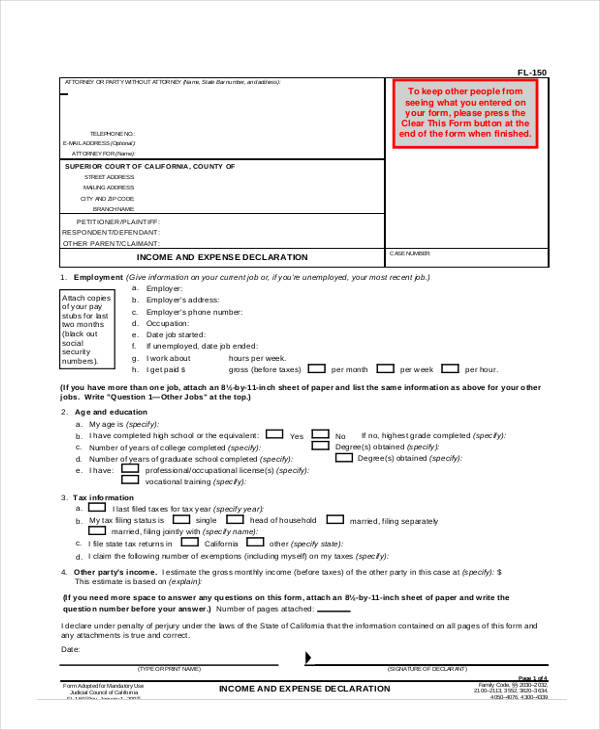

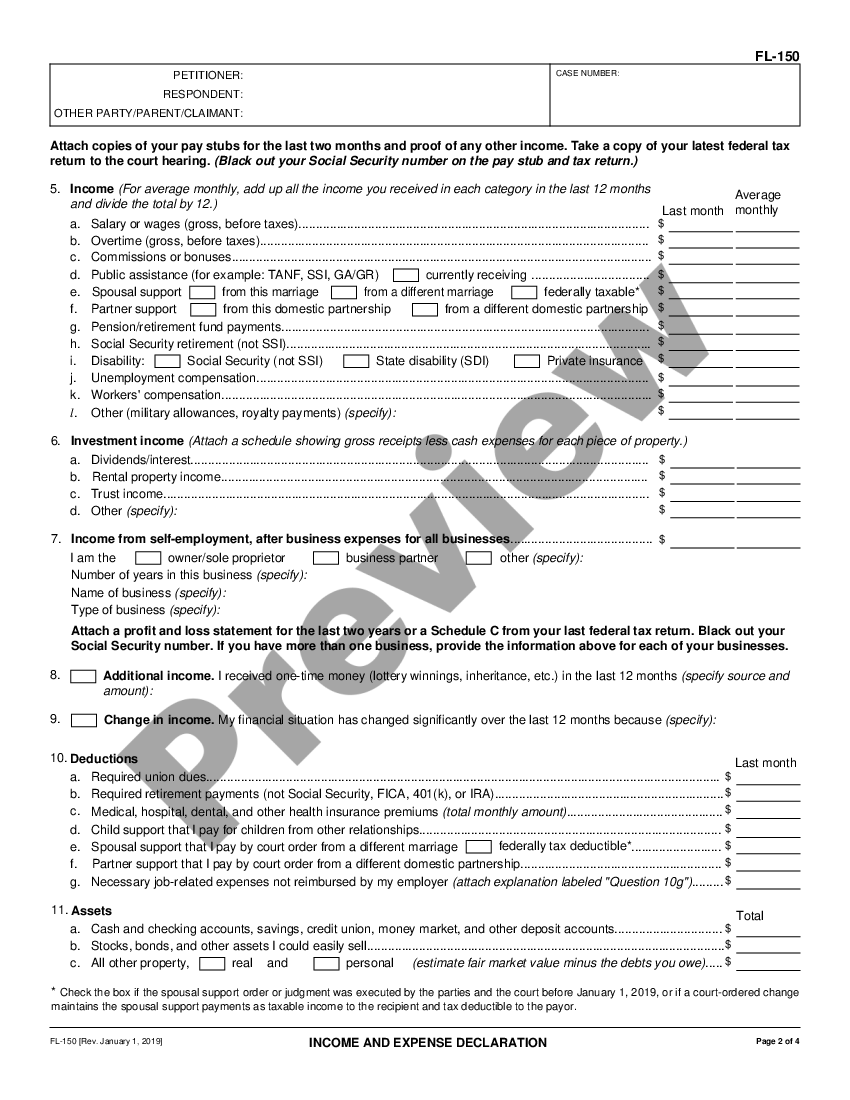

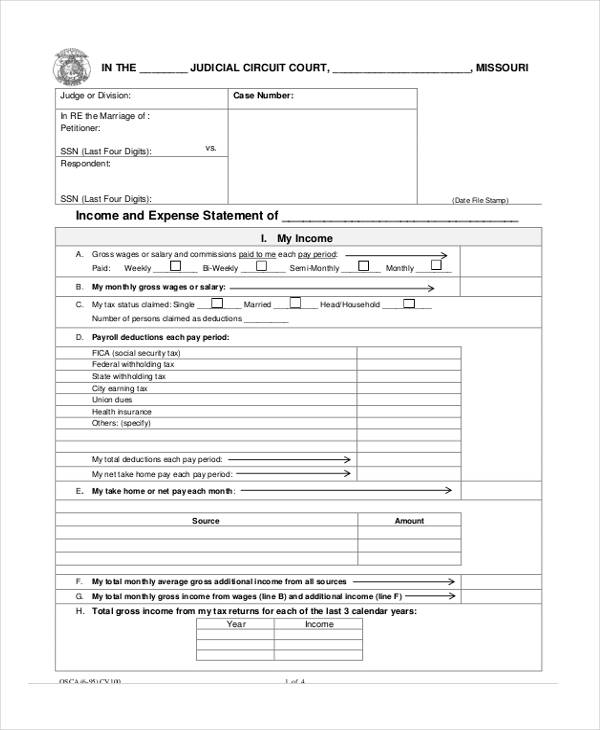

Income And Expense Declaration Form - Web declaration regarding service of declaration of disclosure and income and expense declaration. Web if you file form 2555, foreign earned income, to exclude any of your income or housing costs, report the full amount of your deductible moving expenses on form 3903 and on schedule 1 (form 1040), line 14. Adjunte copias de sus talones de sueldo de los últimos dos meses (tache los números de seguro social). If unemployed, date job ended: Número de teléfono del empleador: July 1, 2013] disclosure and income and expense declaration for your protection and privacy, please press the clear this form button after you have printed the form. Web declare under penalty of perjury under the laws of the state of california that the information contained on all pages of this form and any attachments is true and correct. Report the part of your moving expenses that is not allowed as a deduction because it is allocable to the excluded income on the appropriate. I work about hours per week. January 1, 2019] income and expense declaration.

If you are filing an income and expense declaration by itself, it must be served before. Web declare under penalty of perjury under the laws of the state of california that the information contained on all pages of this form and any attachments is true and correct. I work about hours per week. Income and expense declaration (packet #12. The court uses the information to make orders for support, attorneys fees, and other costs. Web you meet the difference between income and expenses. Do not attach a copy of your last year’s taxes. Make the same number of copies of this form as you make for any forms being filed with it. All forms are judicial council forms, unless otherwise indicated: January 1, 2019] income and expense declaration.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) July 1, 2013] disclosure and income and expense declaration for your protection and privacy, please press the clear this form button after you have printed the form. Be sure to blacken out. January 1, 2019] income and expense. Do not attach a copy of your last year’s taxes. (family law) page 1 of 1 All forms are judicial council forms, unless otherwise indicated: Web income and expense declaration is a legally required form submitted by a parent under oath stating his/her income, assets, expenses and liabilities. Web declare under penalty of perjury under the laws of the state of california that the information contained on all pages of this form and any attachments is true and correct. Web an income declaration form typically includes information such as the individual’s name, social security number, address, occupation, employer, income sources, and any deductions taken.

California and Expense Declaration Family Law Family Law

You need to attach proof of your income from the past 2 months to the form. Employment (give information on your current job or, if you're unemployed, your most recent job.) attach copies a. Web request for production of an income and expense declaration after judgment. All forms are judicial council forms, unless otherwise indicated: This form asks about how.

Declaration of and Asset Proforma Expense Banks

January 1, 2019] income and expense. Web request for production of an income and expense declaration after judgment. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web you meet the difference between income and expenses. Employment (give information on your current job or, if you're unemployed, your most recent job.) attach copies a.

FREE 10+ and Expense Forms in PDF MS Word

Be sure to blacken out. January 1, 2019] income and expense. Individual income tax return pdf. Web the income and expense declaration is one of the most misunderstood forms required by the court when setting child and/or spousal support. The court uses the information to make orders for support, attorneys fees, and other costs.

California and Expense Declaration Family Law Family Law

You need to attach proof of your income from the past 2 months to the form. January 1, 2019] income and expense declaration. January 1, 2019] income and expense. Individual income tax return pdf. Be sure to blacken out.

EMANCIPATION OF MINOR AND EXPENSE DECLARATION Doc Template

Web income and expense declaration case number: Make the same number of copies of this form as you make for any forms being filed with it. Be sure to blacken out. January 1, 2019] income and expense declaration. January 1, 2019] income and expense declaration.

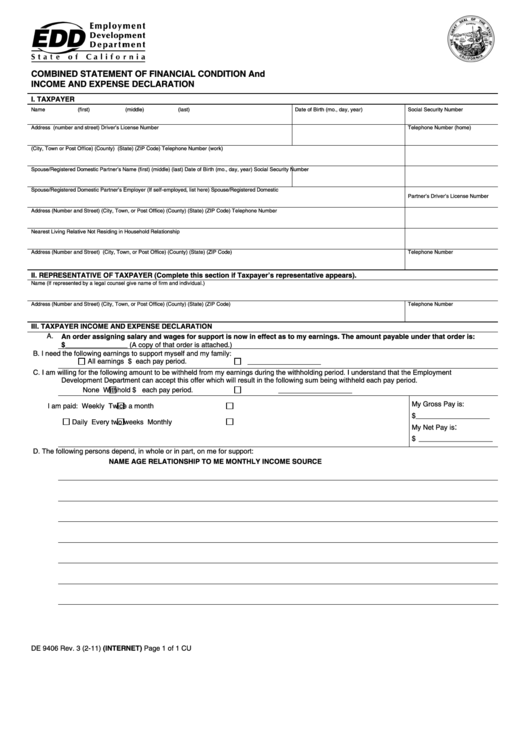

Fillable Form De 9406 Combined Statement Of Financial Condition And

Individual income tax return pdf. January 1, 2019] income and expense declaration. The court uses the information to make orders for support, attorneys fees, and other costs. Employment (give information on your current job or, if you're unemployed, your most recent job.) attach copies a. Web income and expense declaration is a legally required form submitted by a parent under.

FREE 10+ and Expense Forms in PDF MS Word

Web declare under penalty of perjury under the laws of the state of california that the information contained on all pages of this form and any attachments is true and correct. Employment (give information on your current job or, if you're unemployed, your most recent job.) attach copies a. Web income and expense declaration. Fecha en que empezó el trabajo:.

and expense declaration guide

Employment (give information on your current job or, if you're unemployed, your most recent job.) attach copies a. (family law) page 1 of 1 Web request for production of an income and expense declaration after judgment. Web income and expense declaration case number: I work about hours per week.

and Expense Declaration California Free Download

Bring a copy to your hearing. Web an income declaration form typically includes information such as the individual’s name, social security number, address, occupation, employer, income sources, and any deductions taken. You need to attach proof of your income from the past 2 months to the form. Web catch the top stories of the day on anc’s ‘top story’ (20.

and Expense Declaration California Free Download

Make the same number of copies of this form as you make for any forms being filed with it. An income and expense declaration must be submitted with copies of the two most recent months’ pay stubs. Do not attach a copy of your last year’s taxes. If unemployed, date job ended: Web catch the top stories of the day.

Be Sure To Blacken Out.

July 1, 2013] disclosure and income and expense declaration for your protection and privacy, please press the clear this form button after you have printed the form. You need to attach proof of your income from the past 2 months to the form. I work about hours per week. All forms are judicial council forms, unless otherwise indicated:

The Court Uses The Information To Make Orders For Support, Attorneys Fees, And Other Costs.

Employment (give information on your current job or, if you're unemployed, your most recent job.) attach copies a. Número de teléfono del empleador: Fecha en que empezó el trabajo: Web if you file form 2555, foreign earned income, to exclude any of your income or housing costs, report the full amount of your deductible moving expenses on form 3903 and on schedule 1 (form 1040), line 14.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Web an income declaration form typically includes information such as the individual’s name, social security number, address, occupation, employer, income sources, and any deductions taken. Web income and expense declaration is a legally required form submitted by a parent under oath stating his/her income, assets, expenses and liabilities. Web income and expense declaration. If unemployed, date job ended:

Web Request For Production Of An Income And Expense Declaration After Judgment.

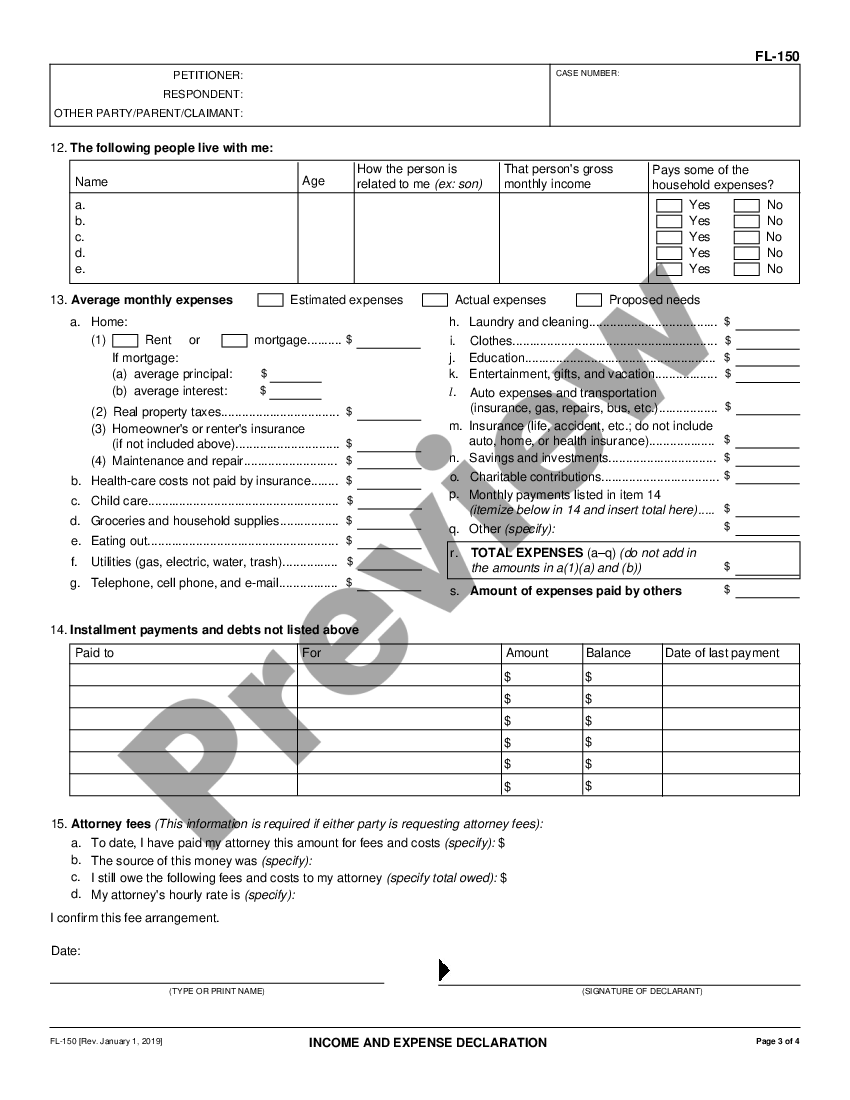

In my experience, it is due to page 3, the one where expenses are set forth. Adjunte copias de sus talones de sueldo de los últimos dos meses (tache los números de seguro social). January 1, 2019] income and expense declaration. Report the part of your moving expenses that is not allowed as a deduction because it is allocable to the excluded income on the appropriate.