Indirect Rollover Tax Form

Indirect Rollover Tax Form - Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. The irs gives you 60 days to deposit the funds into an eligible retirement account before assessing your income tax and early withdrawal penalties. Web if jordan later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover, and $2,000 as taxes paid. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. Get start for free federal 1099 r form direct rollover To preview 1040 in turbotax online: If no earnings are distributed, enter 0 (zero) in box 2a and code j in box 7. If you requested a payment of cash from your retirement plan account and you deposited some or all of that money into another retirement plan or traditional ira within 60 days of receiving a check in the mail or an ach deposit into your bank account, you completed an indirect rollover. If the rollover is direct, the money is moved directly between. If married, the spouse must also have been a u.s.

Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. Web indirect rollovers more involved and have more tax implications. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. If married, the spouse must also have been a u.s. Get start for free federal 1099 r form direct rollover Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. If no earnings are distributed, enter 0 (zero) in box 2a and code j in box 7. Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. Jordan must also pay the 10% additional tax on early distributions on the $2,000 unless she qualifies for an exception. Just have the administrator cut a check and spend the money as needed.

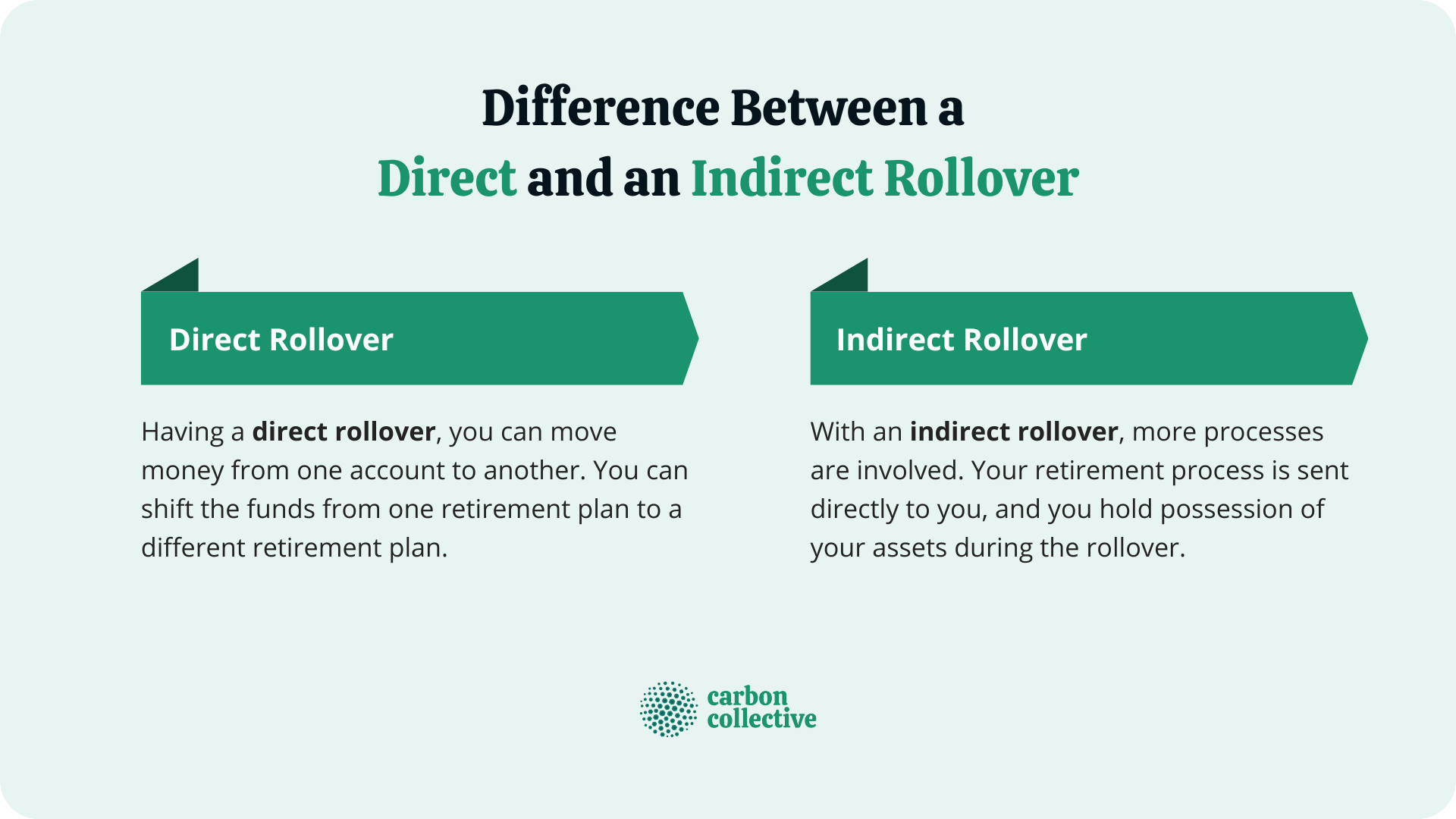

Web if jordan later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover, and $2,000 as taxes paid. Jordan must also pay the 10% additional tax on early distributions on the $2,000 unless she qualifies for an exception. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. Just have the administrator cut a check and spend the money as needed. Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your return as taxable on line 15 (b) (or 16 (b)). To preview 1040 in turbotax online: Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. If married, the spouse must also have been a u.s.

Understanding IRA Rollovers Learn more

Web if jordan later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover, and $2,000 as taxes paid. Just have the administrator cut a check and spend the money as needed. If the rollover is direct, the money is moved directly between. The irs gives you.

How To Report Rollovers On Your Tax Return » STRATA Trust Company

Get start for free federal 1099 r form direct rollover Web indirect rollovers more involved and have more tax implications. Just have the administrator cut a check and spend the money as needed. Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. To preview 1040 in turbotax.

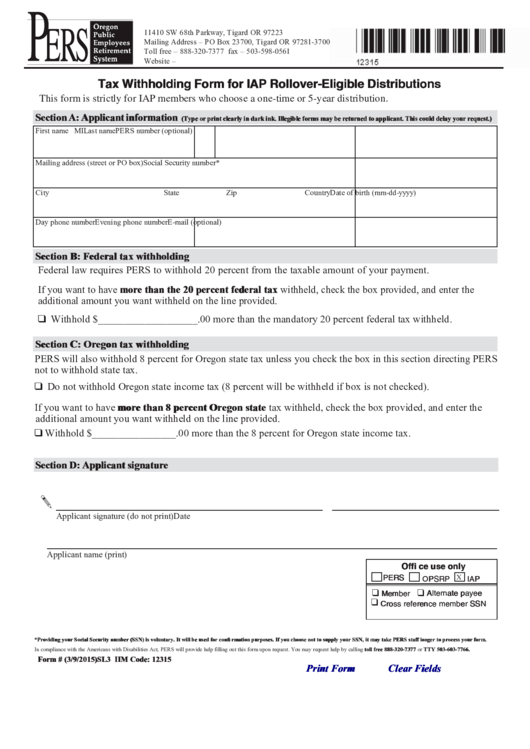

Fillable Tax Withholding Form For Iap RolloverEligible Distributions

Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your.

Ira Rollover Form 1040 Universal Network

To preview 1040 in turbotax online: And how the taxable amount reported on form 1099 r. Just have the administrator cut a check and spend the money as needed. Depending upon the manner in which the rollover occurs it can affect whether taxes withheld from the distribution. If no earnings are distributed, enter 0 (zero) in box 2a and code.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

If no earnings are distributed, enter 0 (zero) in box 2a and code j in box 7. Just have the administrator cut a check and spend the money as needed. Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. Web an indirect rollover occurs when the.

What do I do with my indirect rollover distribution check? Wickham

Citizen or resident alien for the entire tax year. Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. Just have the administrator cut a check and spend the.

Direct Rollover vs Indirect Rollover Differences and Rules

The irs gives you 60 days to deposit the funds into an eligible retirement account before assessing your income tax and early withdrawal penalties. Web indirect rollovers more involved and have more tax implications. Get start for free federal 1099 r form direct rollover If married, the spouse must also have been a u.s. And how the taxable amount reported.

How To Report Rollovers On Your Tax Return » STRATA Trust Company

Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. Web indirect rollovers more involved and have more tax implications. Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. Jordan must also pay the 10% additional tax on early distributions on.

What To Do With Your Old 401(k) Momentum Wealth

If you requested a payment of cash from your retirement plan account and you deposited some or all of that money into another retirement plan or traditional ira within 60 days of receiving a check in the mail or an ach deposit into your bank account, you completed an indirect rollover. If the rollover is direct, the money is moved.

Direct or Indirect Rollover? What is the difference? Unique Financial

Get start for free federal 1099 r form direct rollover Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself. Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16.

Depending Upon The Manner In Which The Rollover Occurs It Can Affect Whether Taxes Withheld From The Distribution.

Web regardless, the rollover rule is a great way to borrow distribution amounts on a normally untouchable ira. Web indirect rollovers more involved and have more tax implications. And how the taxable amount reported on form 1099 r. Web please note that all distributions will be reported on your tax return (whether or not they are taxable) on form 1040 on line 15 (a) (or 16 (a) but only the taxable portion will show on your return as taxable on line 15 (b) (or 16 (b)).

The Irs Gives You 60 Days To Deposit The Funds Into An Eligible Retirement Account Before Assessing Your Income Tax And Early Withdrawal Penalties.

Citizen or resident alien for the entire tax year. Web if jordan later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover, and $2,000 as taxes paid. Web the tool is designed for taxpayers who were u.s. Web an indirect rollover occurs when the plan’s administrator cuts you a check in your name, and you deposit the funds yourself.

If No Earnings Are Distributed, Enter 0 (Zero) In Box 2A And Code J In Box 7.

Redeposit it in 60 days to avoid having a taxable amount on taxes the following year. If the rollover is direct, the money is moved directly between. To preview 1040 in turbotax online: If you requested a payment of cash from your retirement plan account and you deposited some or all of that money into another retirement plan or traditional ira within 60 days of receiving a check in the mail or an ach deposit into your bank account, you completed an indirect rollover.

Just Have The Administrator Cut A Check And Spend The Money As Needed.

Key takeaways with indirect rollovers, you must deposit the payment into another retirement plan or ira within 60 days to avoid tax penalties. Jordan must also pay the 10% additional tax on early distributions on the $2,000 unless she qualifies for an exception. Get start for free federal 1099 r form direct rollover If married, the spouse must also have been a u.s.