Instructions For Irs Form 1310

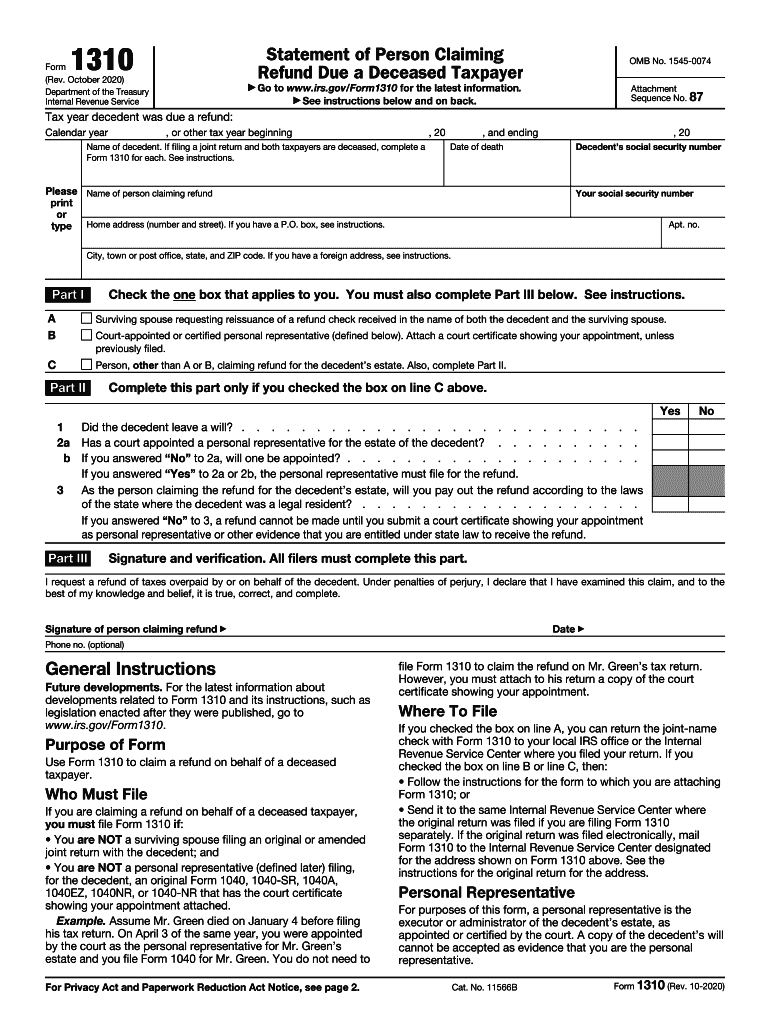

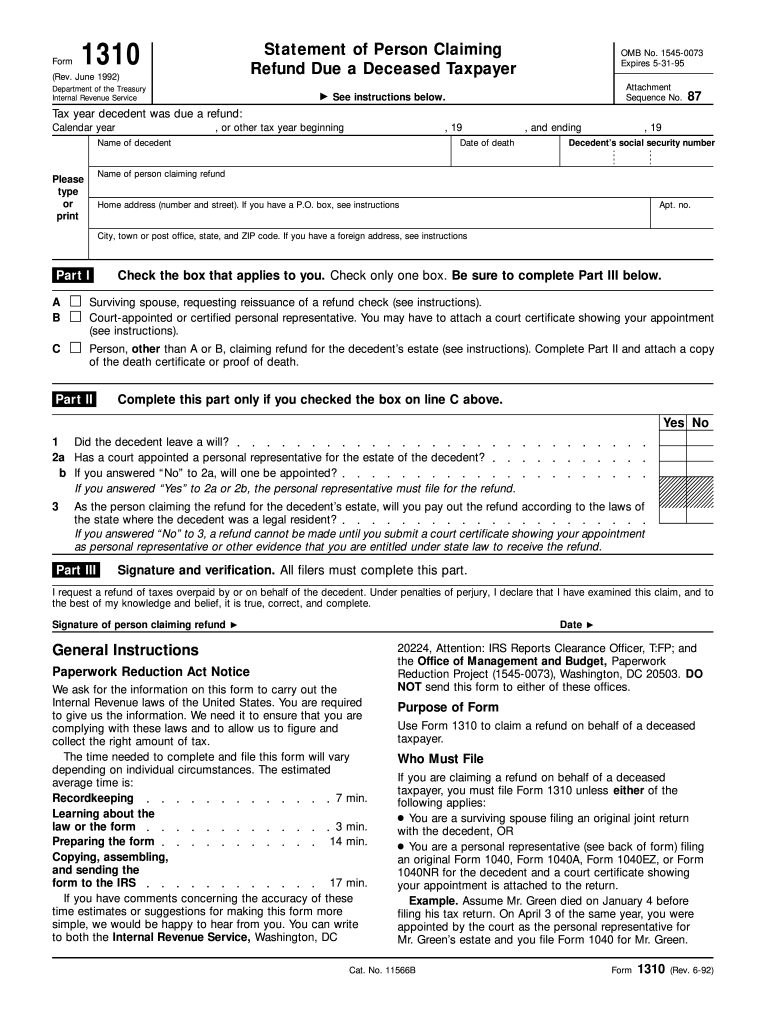

Instructions For Irs Form 1310 - Web the description and property data below may’ve been provided by a third party, the homeowner or public records. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the. Date of death decedent’s social security number name of person claiming refund your social security number home address (number. 1010 s 13th st, wilmington, nc is a single family home that contains 1,453 sq ft and was built in 1945. December 2021) department of the treasury internal revenue service go omb no. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. I was told not to use form 1310. Web irs form 1310 instructions. Web in all other circumstances, in order to claim a refund for a decedent, form 1310 must be completed and attached to the standard form 1040 tax return filed on behalf of any. In addition to completing this screen, the return must have the following in.

Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. Date of death decedent’s social security number name of person claiming refund your social security number home address (number. Web form 1310 for each. Web zestimate® home value: Complete, edit or print tax forms instantly. In addition to completing this screen, the return must have the following in. It contains 3 bedrooms and 2. 1010 s 13th st, wilmington, nc is a single family home that contains 1,453 sq ft and was built in 1945. The 750 square feet single family home is a 3 beds, 1 bath property. Web in all other circumstances, in order to claim a refund for a decedent, form 1310 must be completed and attached to the standard form 1040 tax return filed on behalf of any.

December 2021) department of the treasury internal revenue service go omb no. Web federal form 1310 instructions general instructions future developments. Date of death decedent’s social security number name of person claiming refund your social security number home address (number. Get ready for tax season deadlines by completing any required tax forms today. Irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that. I was told not to use form 1310. Web 1410 w 113th pl, chicago, il 60643 is currently not for sale. Web collect the right amount of tax. This home was built in 1925 and last sold on. Complete, edit or print tax forms instantly.

Download Instructions for IRS Form W2, W3 PDF, 2019 Templateroller

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. It must be in the same year as the tax. Web in all other circumstances, in order to claim a refund for a decedent, form 1310 must be completed and.

Irs Form 1310 Printable 2020 Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web collect the right amount of tax. The irs form 1310 instructions state if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the. You are a surviving spouse filing.

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1310 for each. Web the description and property data below may’ve been provided by a third party, the homeowner or public records. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. Web collect the right amount of tax. December 2021) department of the treasury internal revenue service go omb no.

IRS Instruction 2441 20202022 Fill out Tax Template Online US

Web collect the right amount of tax. It must be in the same year as the tax. Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer. Date of death decedent’s social security number name of person claiming refund your social security number home address (number. Web if a tax refund is.

Printable 1381 Form Printable Word Searches

Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: It contains 3 bedrooms and 2. The irs form 1310 instructions state if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the. Web use this.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Web collect the right amount of tax. It must be in the same year as the tax. Irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that. The irs form 1310 instructions state if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless.

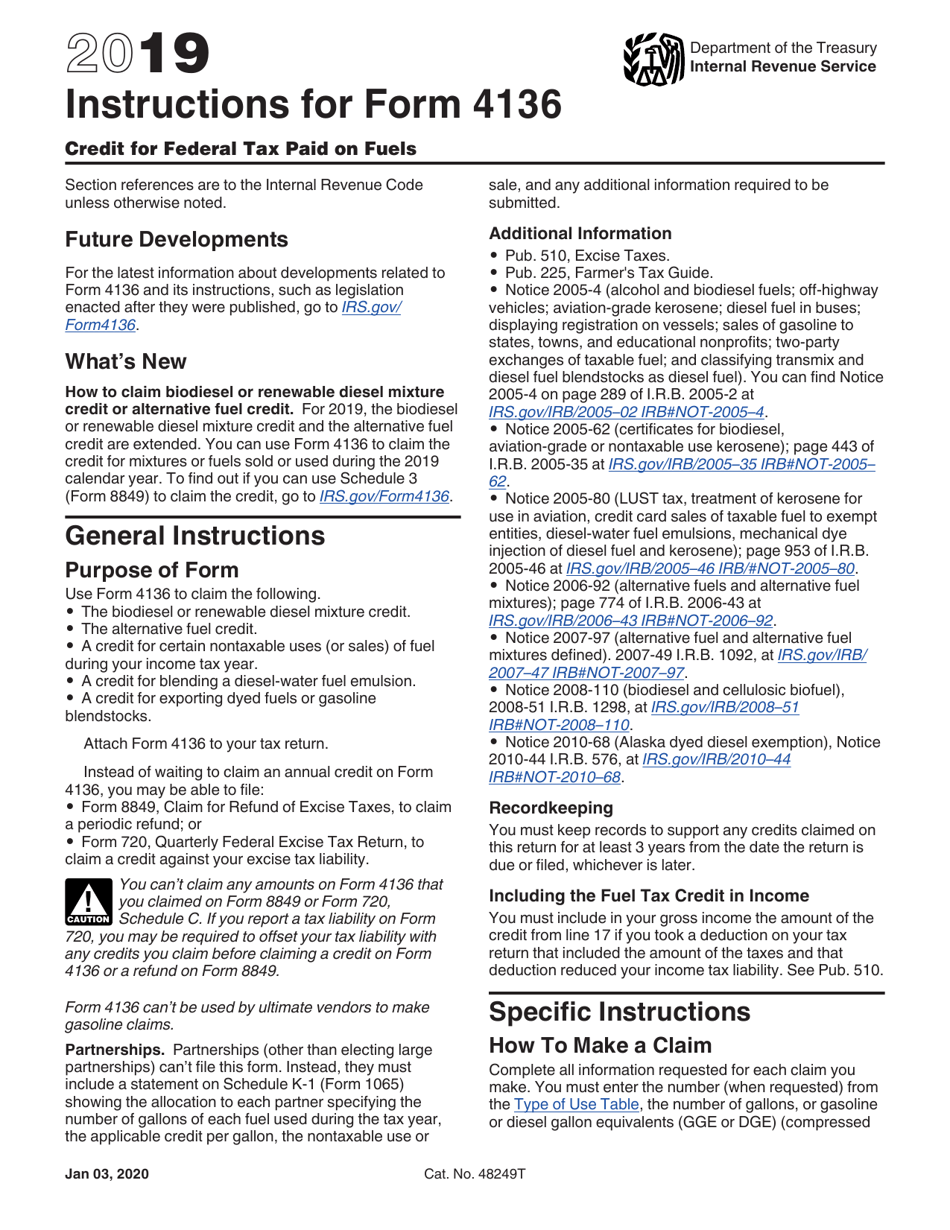

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Information about any future developments affecting form 1310 (such as legislation enacted after. It contains 3 bedrooms and 2. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. December 2021) department of the treasury internal revenue service go omb no. Complete, edit or print tax forms instantly.

IRS 2290 (SP) 2020 Fill and Sign Printable Template Online US Legal

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. The 750 square feet single family home is a 3 beds, 1 bath property. It must be.

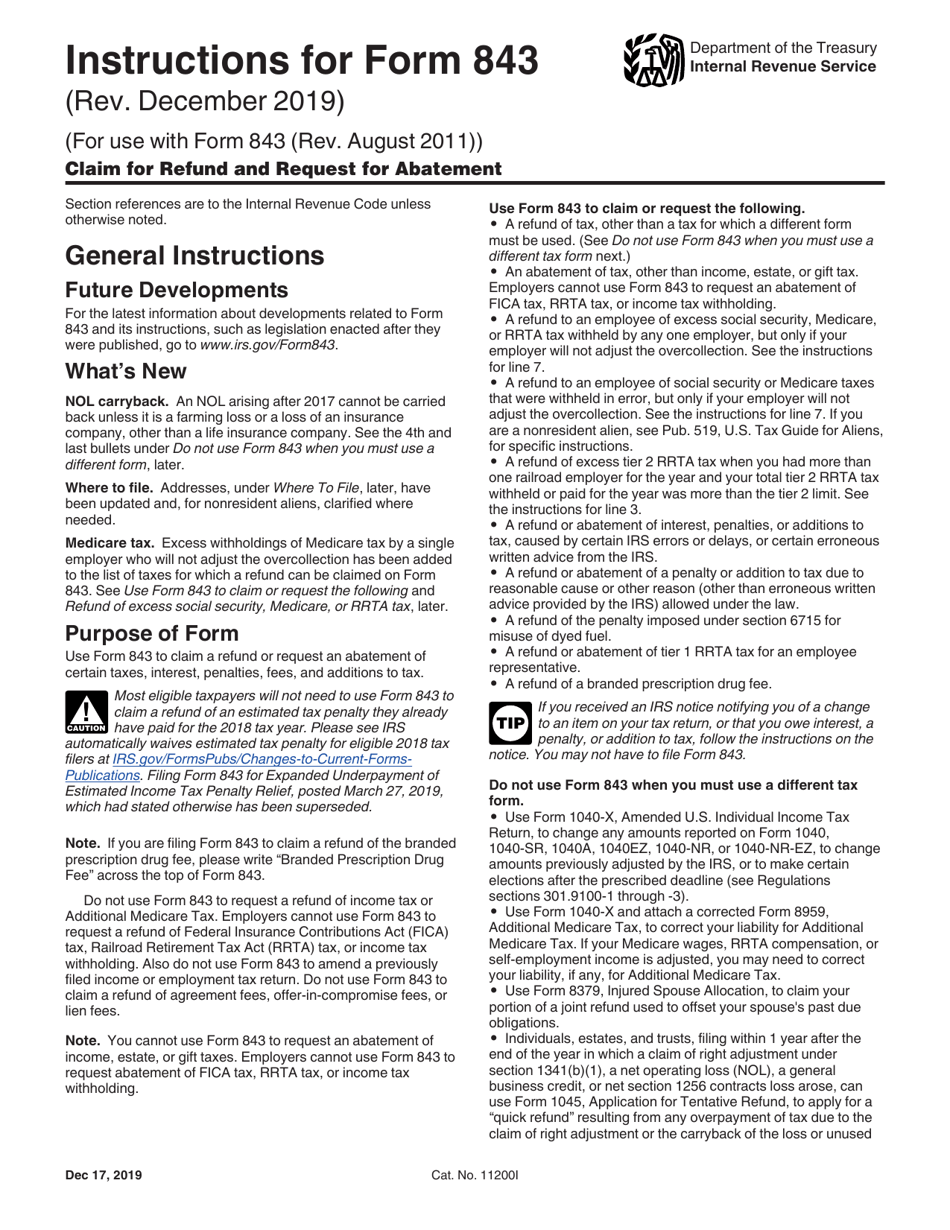

Download Instructions for IRS Form 843 Claim for Refund and Request for

Web zestimate® home value: You are a surviving spouse filing an original or. Information about any future developments affecting form 1310 (such as legislation enacted after. In addition to completing this screen, the return must have the following in. 1410 s 13th st, burlington, ia 52601 is a single.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

It must be in the same year as the tax. This home was built in 1925 and last sold on. Date of death decedent’s social security number name of person claiming refund your social security number home address (number. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of.

Web 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Form (Rev.

This home was built in 1925 and last sold on. Web form 1310 for each. I was told not to use form 1310. Web zestimate® home value:

The Irs Form 1310 Instructions State If You Are Claiming A Refund On Behalf Of A Deceased Taxpayer, You Must File Form 1310 Unless Either Of The.

Web the description and property data below may’ve been provided by a third party, the homeowner or public records. It contains 3 bedrooms and 2. Get ready for tax season deadlines by completing any required tax forms today. 1410 s 13th st, burlington, ia 52601 is a single.

You Are A Surviving Spouse Filing An Original Or.

Date of death decedent’s social security number name of person claiming refund your social security number home address (number. It must be in the same year as the tax. Web in all other circumstances, in order to claim a refund for a decedent, form 1310 must be completed and attached to the standard form 1040 tax return filed on behalf of any. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a.

1010 S 13Th St, Wilmington, Nc Is A Single Family Home That Contains 1,453 Sq Ft And Was Built In 1945.

Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Information about any future developments affecting form 1310 (such as legislation enacted after. Complete, edit or print tax forms instantly. In addition to completing this screen, the return must have the following in.