Instructions For Oregon Form 40

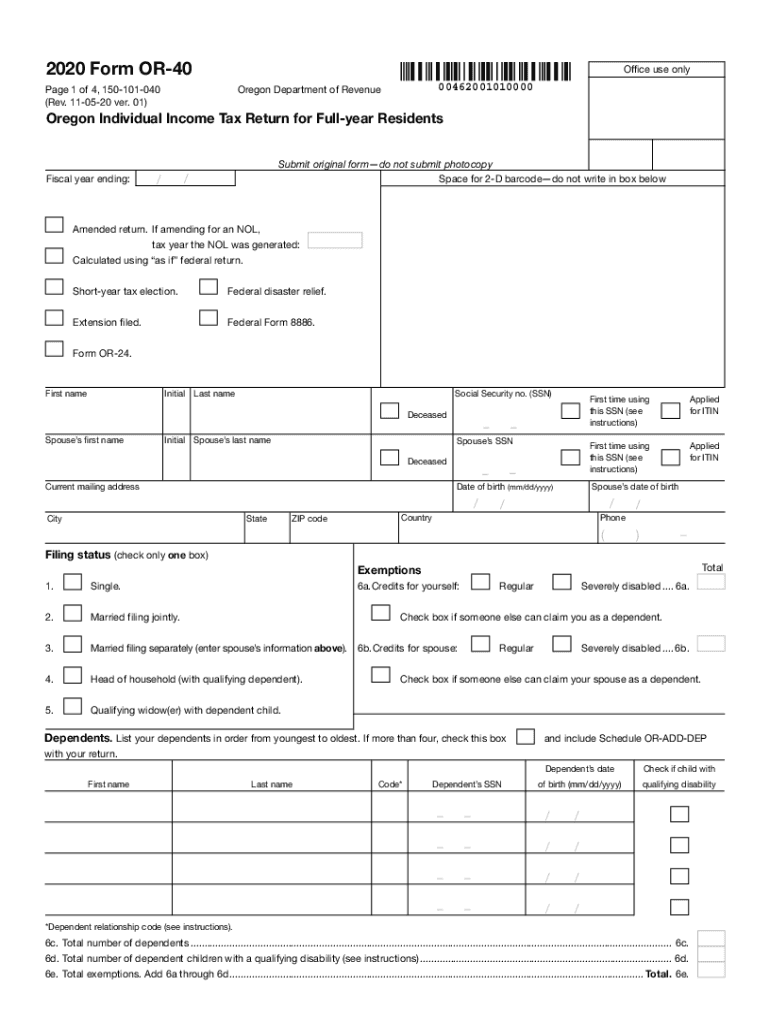

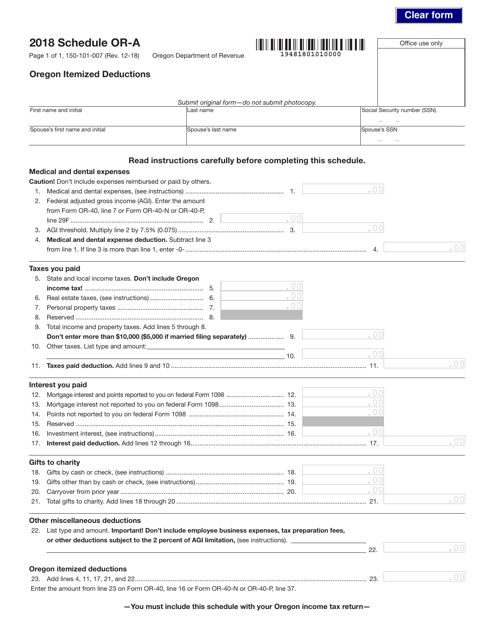

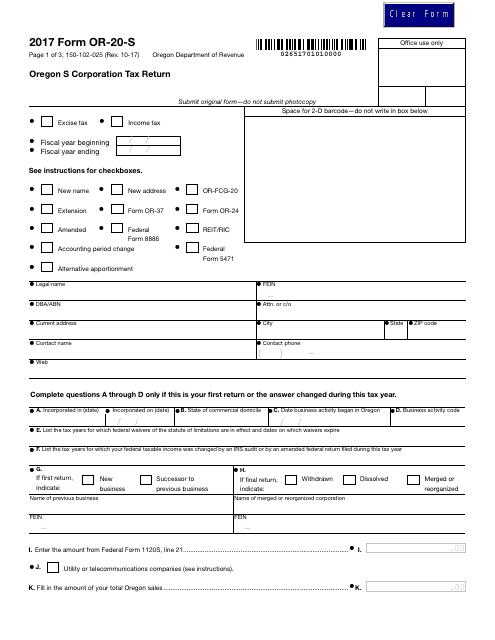

Instructions For Oregon Form 40 - Part b— prorate your total personal. Form 40 can be efiled, or a paper copy can be filed via mail. This percentage is determined and certified by oea. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Web federal form no longer calculates oregon withholding correctly. Web use form 40n or 40p instead. You can download or print. You need to file if your gross income is more than the.

Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Complete, edit or print tax forms instantly. If you do not receive an income. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Try it for free now! You need to file if your gross income is more than the. Web use form 40n or 40p instead. Include your payment with this return. Beginning next year, we will reduce the number of personalized income tax booklets we send to taxpayers in the mail. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Upload, modify or create forms. If you do not receive an income. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Include your payment with this return. You need to file if your gross income is more than the. Form 40 can be efiled, or a paper copy can be filed via mail. • file electronically—it’s fast, easy, and secure. Web any form or publication from the current or prior years can be found in this area. You can download or print.

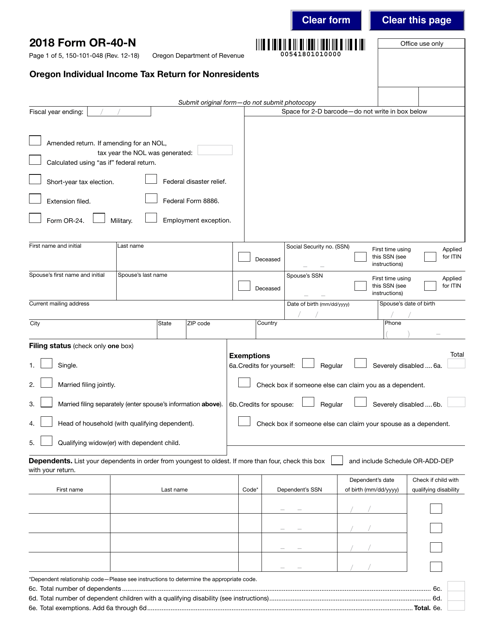

Oregon Form Tax Fill Out and Sign Printable PDF Template signNow

If you do not receive an income. You need to file if your gross income is more than the. If you include a payment with your return, don’t include form. Form 40 can be efiled, or a paper copy can be filed via mail. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue.

Oregon Form 40 Instructions 2017 slidesharedocs

Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Beginning next year, we will reduce the number of personalized income tax booklets we send to taxpayers in the mail. Web we last updated oregon form 40 in january 2023 from the.

Oregon Form 40 Instructions 2018 slidesharedocs

If you do not receive an income. You need to file if your gross income is more than the. If you include a payment with your return, don’t include form. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. This percentage is determined and certified by oea.

Oregon Form 40 Instructions 2018 slidesharedocs

Web use form 40n or 40p instead. Form 40 can be efiled, or a paper copy can be filed via mail. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you do not receive an income. If you include a payment with your return, don’t include form.

Oregon form 40 v Fill out & sign online DocHub

If you include a payment with your return, don’t include form. • file electronically—it’s fast, easy, and secure. This percentage is determined and certified by oea. Web use form 40n or 40p instead. You can download or print.

Oregon Form 40 Instructions 2017 slidesharedocs

Try it for free now! Part b— prorate your total personal. This form is for income earned in tax year 2022, with tax returns due in april 2023. This percentage is determined and certified by oea. • file electronically—it’s fast, easy, and secure.

Oregon Form 40 Instructions 2018 slidesharedocs

Web any form or publication from the current or prior years can be found in this area. If you do not receive an income. This percentage is determined and certified by oea. Beginning next year, we will reduce the number of personalized income tax booklets we send to taxpayers in the mail. You can download or print.

2014 Form OR DoR 40 Fill Online, Printable, Fillable, Blank PDFfiller

• filing an amended elderly rental assistance (era) return. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Web use form 40n or 40p instead. This percentage is determined and certified by oea. Try it for free now!

Oregon State Defense Council’s Official Air Raid Instructions, 2010.026

This percentage is determined and certified by oea. Form 40 can be efiled, or a paper copy can be filed via mail. • file electronically—it’s fast, easy, and secure. If you do not receive an income. Web use form 40n or 40p instead.

• Filing An Amended Elderly Rental Assistance (Era) Return.

Complete, edit or print tax forms instantly. If you include a payment with your return, don’t include form. Web any form or publication from the current or prior years can be found in this area. Web use form 40n or 40p instead.

Part B— Prorate Your Total Personal.

You can download or print. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Include your payment with this return. Form 40 can be efiled, or a paper copy can be filed via mail.

You Need To File If Your Gross Income Is More Than The.

This percentage is determined and certified by oea. • file electronically—it’s fast, easy, and secure. Try it for free now! Upload, modify or create forms.

Web Federal Form No Longer Calculates Oregon Withholding Correctly.

Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. If you do not receive an income. This form is for income earned in tax year 2022, with tax returns due in april 2023. Beginning next year, we will reduce the number of personalized income tax booklets we send to taxpayers in the mail.