Iowa Representative Certification Form

Iowa Representative Certification Form - Report fraud & identity larceny; See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). Stay informed, subscribe to receive updates. Get access to the largest online library of legal forms for any state. Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. This includes power of attorney, designated disclosure, and representative certification forms. Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department.

Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Stay informed, subscribe to receive updates. This includes power of attorney, designated disclosure, and representative certification forms. Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Get access to the largest online library of legal forms for any state. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6).

Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Get access to the largest online library of legal forms for any state. Report fraud & identity larceny; See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. This includes power of attorney, designated disclosure, and representative certification forms. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6).

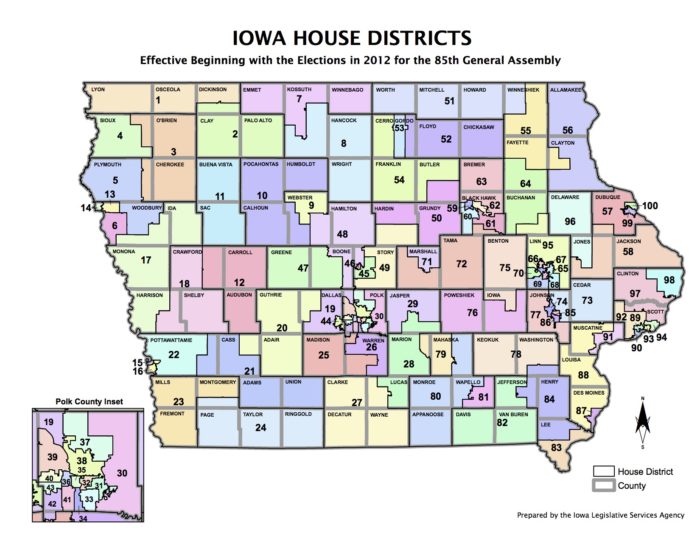

Bleeding Heartland

Report fraud & identity larceny; See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Stay informed, subscribe to receive updates. Web individuals in the.

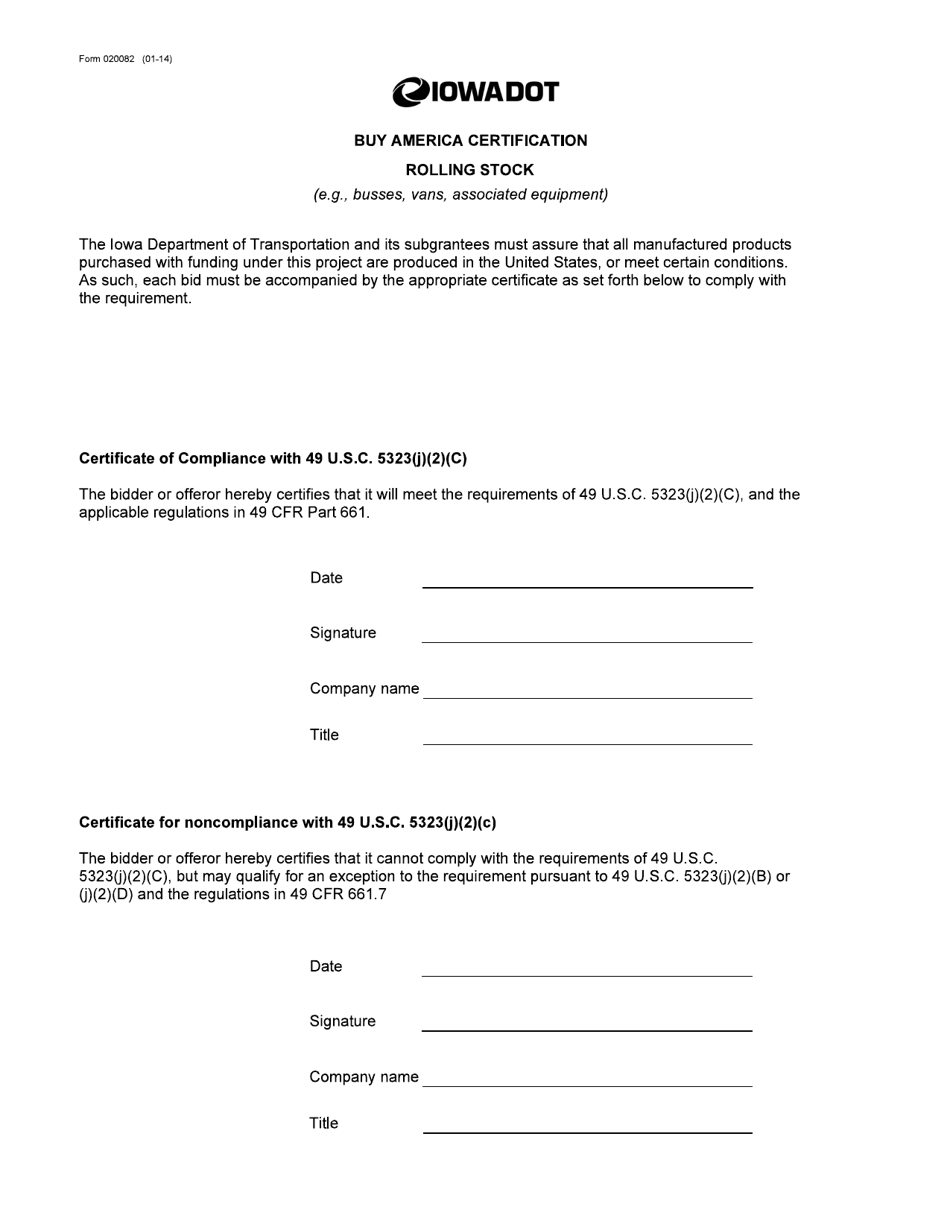

Form 020082 Download Fillable PDF or Fill Online Buy America

Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing.

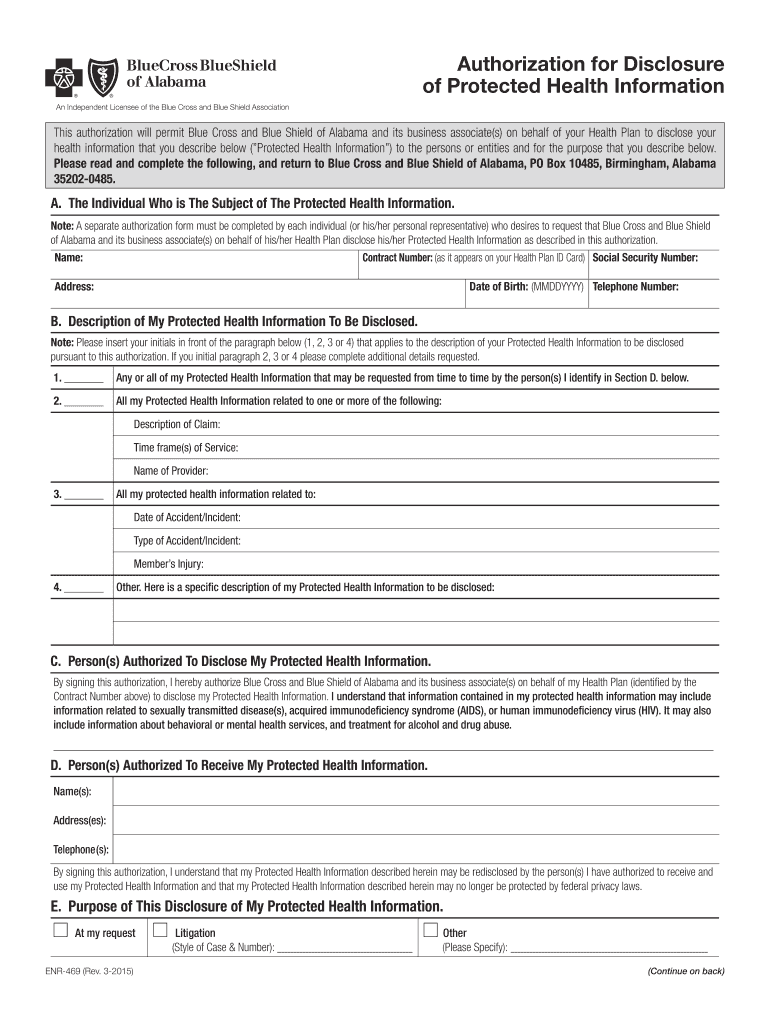

20152022 AL BCBS Form ENR469 Fill Online, Printable, Fillable, Blank

Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may.

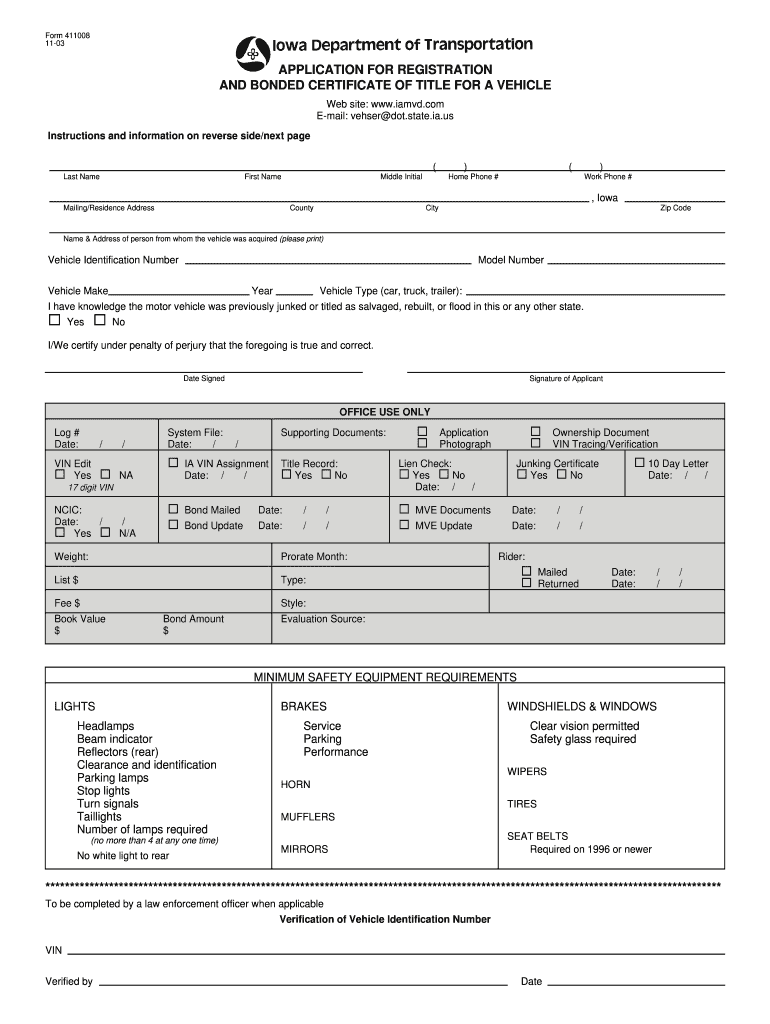

Iowa Form 411008 Fill Out and Sign Printable PDF Template signNow

Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department. Web managing and revoking access to accounts in govconnectiowa does not change or cancel any.

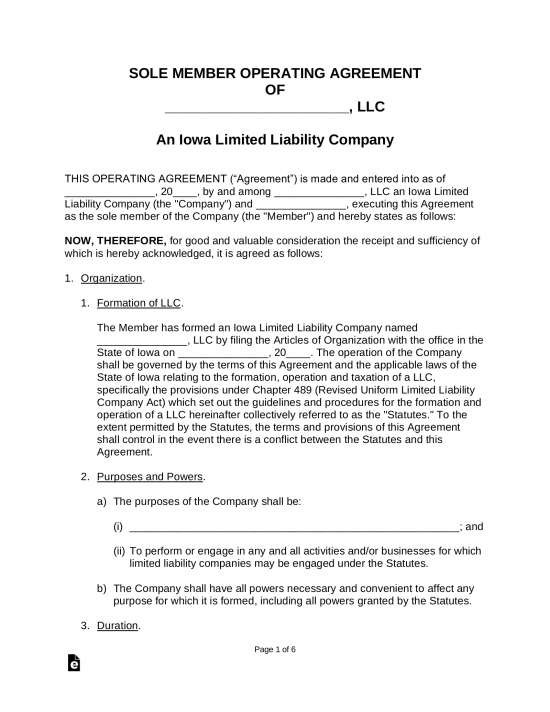

Iowa SingleMember LLC Operating Agreement Form eForms

Stay informed, subscribe to receive updates. Signature i, the undersigned, declare under penalties of perjury or false certificate, that i am the person listed as “taxpayer” above or. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. See subrule 7.6(6) since more.

Changes to the 2015 Iowa Probate Code Authority of Representative to

Stay informed, subscribe to receive updates. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Report fraud & identity larceny; Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: This includes power of attorney, designated disclosure, and representative certification forms.

Download Iowa Acceptance of Service, Waiver and Answer Form for Free

See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Report fraud & identity larceny; Stay informed, subscribe to receive updates. Once a representative has successfully notified the department of their authority.

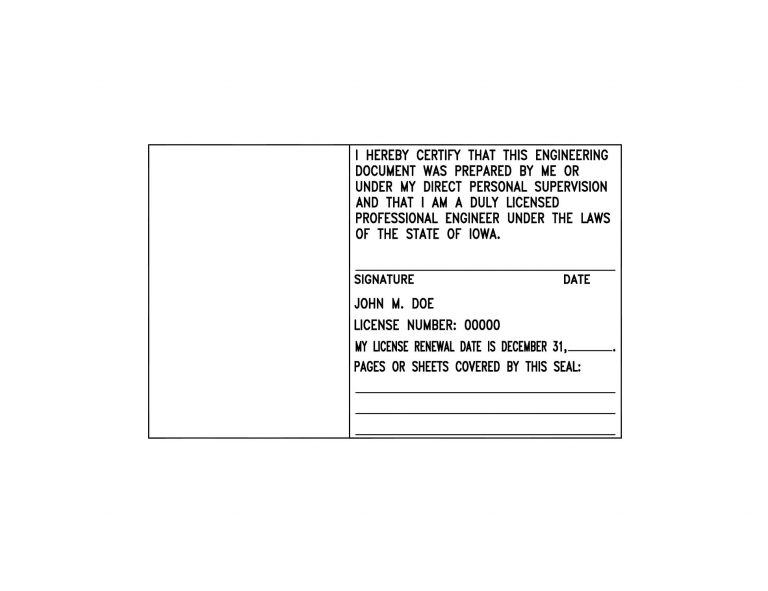

Iowa Professional Engineer Certification block PE Stamps

Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Web managing and revoking access to accounts in govconnectiowa does not change or cancel any third party authorization forms on file with the department. Get access to the largest online library of legal forms for any state. Report fraud & identity larceny;.

Download Iowa Affidavit of Correction Form for Free FormTemplate

Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: Stay informed, subscribe to receive updates. Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer.

Iowa Certificate of Authority Harbor Compliance

See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Once a representative has successfully notified the department of their authority using this form, the representative can receive information about the taxpayer and act for the taxpayer. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to.

Web Managing And Revoking Access To Accounts In Govconnectiowa Does Not Change Or Cancel Any Third Party Authorization Forms On File With The Department.

Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Get access to the largest online library of legal forms for any state. See subrule 7.6(6) since more information about humans who may qualify as authorized representatives and the information necessary. Stay informed, subscribe to receive updates.

Signature I, The Undersigned, Declare Under Penalties Of Perjury Or False Certificate, That I Am The Person Listed As “Taxpayer” Above Or.

Web the ia 2848 that you do not authorize the representative listed above to perform on your behalf: This includes power of attorney, designated disclosure, and representative certification forms. Web individuals in the authority to action on behalf of one taxpayer, including pursuant to iowa code section 421.59(2) or chapter 633b, must file a representative certification form for described in subrule 7.6(6). Report fraud & identity larceny;

Once A Representative Has Successfully Notified The Department Of Their Authority Using This Form, The Representative Can Receive Information About The Taxpayer And Act For The Taxpayer.

Web an authorized representative properly appointed by a representative certification or an idr power of attorney form may notify the department that an authorized representative no longer has authority to act on behalf of the taxpayer by filing a statement of revocation with the department.