Ira Transfer Form

Ira Transfer Form - Web transfer request the term ira will be used below to mean traditional ira and simple ira, unless otherwise specified. The rollover chart pdf summarizes allowable rollover transactions. You may also have to pay an additional tax of 10% or 25% on the amount you withdraw unless you are at least age 59½ or you qualify for another exception. Web ira/esa divorce transfer request form download: You can also have your financial institution or plan directly transfer the payment to another plan or ira. Use this for traditional ira to traditional ira or roth ira to roth ira transfers, only. Roth ira conversion form and account application Web open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary. Approved for use with investors. Use this form to roll over or transfer assets to a traditional or roth ira at john hancock investment management.

Just choose your ira custodian (ameriprise, merril lynch, edward jones, etc) and ira club will get to work. Web simple ira withdrawal and transfer rules withdrawals from simple iras generally, you have to pay income tax on any amount you withdraw from your simple ira. Inherited ira to inherited ira transfer form Use this form to roll over or transfer assets to a traditional or roth ira at john hancock investment management. Web request an ira to ira transfer today; Designated beneficiary distribution authorization form download: Web ira/esa divorce transfer request form download: The rollover chart pdf summarizes allowable rollover transactions. Web transfer request the term ira will be used below to mean traditional ira and simple ira, unless otherwise specified. Web are you ready to move your current ira into a fidelity ira?

Web request an ira to ira transfer today; Web are you ready to move your current ira into a fidelity ira? Just choose your ira custodian (ameriprise, merril lynch, edward jones, etc) and ira club will get to work. See all forms looking for tax forms? You may also have to pay an additional tax of 10% or 25% on the amount you withdraw unless you are at least age 59½ or you qualify for another exception. Roth ira conversion form and account application Web an ira transfer (which is not the same thing as an ira rollover, though the terms are sometimes used interchangeably) refers to transferring money from an individual retirement account (ira). Recipient name (first/mi/last) date of birth email address account number individual requesting the transfer phone suffix accepting account type traditional ira inherited traditional ira (select one). Web open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary. Inherited ira to inherited ira transfer form

Top Ira Transfer Forms And Templates free to download in PDF format

Web an ira transfer (which is not the same thing as an ira rollover, though the terms are sometimes used interchangeably) refers to transferring money from an individual retirement account (ira). The rollover chart pdf summarizes allowable rollover transactions. Use this form to roll over or transfer assets to a traditional or roth ira at john hancock investment management. Ira.

36 Ira Forms And Templates free to download in PDF

Web an ira transfer (which is not the same thing as an ira rollover, though the terms are sometimes used interchangeably) refers to transferring money from an individual retirement account (ira). Approved for use with investors. You may use this form to request a transfer from an existing ira account with another institution into your existing bpas ira account. Ira.

Bank of America IRA Beneficiary Change Fill and Sign Printable

We can help make the process as easy and seamless as possible. Designated beneficiary distribution authorization form download: Inherited ira to inherited ira transfer form Web are you ready to move your current ira into a fidelity ira? Approved for use with investors.

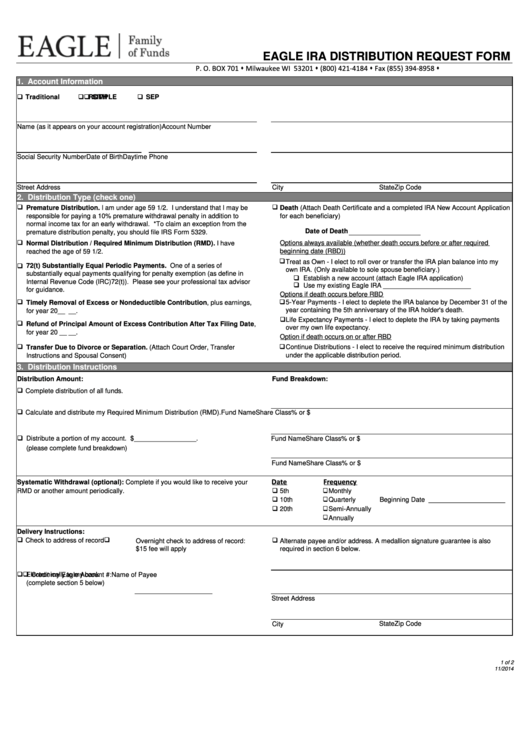

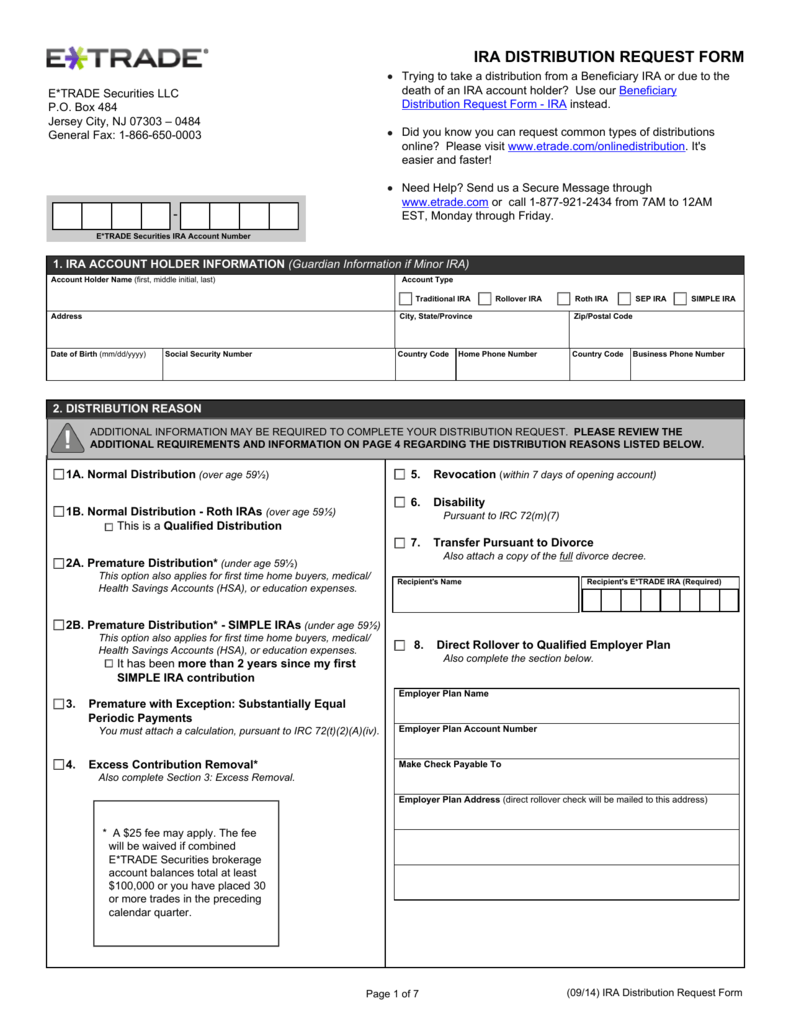

IRA Distribution Request form

You may use this form to request a transfer from an existing ira account with another institution into your existing bpas ira account. Use this for traditional ira to traditional ira or roth ira to roth ira transfers, only. You may also have to pay an additional tax of 10% or 25% on the amount you withdraw unless you are.

Ally Ira Transfer Form Fill Online, Printable, Fillable, Blank

Web open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary. The rollover chart pdf summarizes allowable rollover transactions. Just choose your ira custodian (ameriprise, merril lynch, edward jones, etc) and ira club will get to work. Web request an ira to ira transfer today; Web simple.

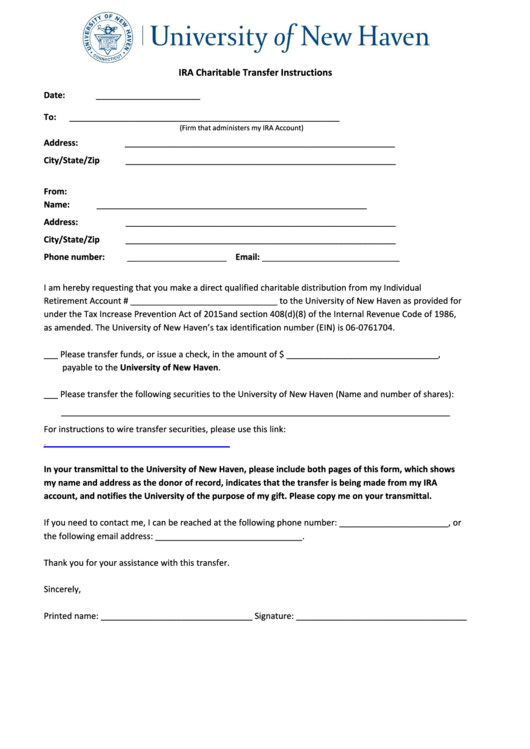

FREE 9+ Sample Transmittal Forms in PDF

Ira required minimum distribution (rmd) form download: See all forms looking for tax forms? Designated beneficiary distribution authorization form download: Use this form to roll over or transfer assets to a traditional or roth ira at john hancock investment management. Web are you ready to move your current ira into a fidelity ira?

Discover Bank Forms Fill Online, Printable, Fillable, Blank pdfFiller

Web simple ira withdrawal and transfer rules withdrawals from simple iras generally, you have to pay income tax on any amount you withdraw from your simple ira. You may also have to pay an additional tax of 10% or 25% on the amount you withdraw unless you are at least age 59½ or you qualify for another exception. Web ira/esa.

Ally Bank Ira Transfer Form ≡ Fill Out Printable PDF Forms Online

You may use this form to request a transfer from an existing ira account with another institution into your existing bpas ira account. Roth ira conversion form and account application Web request an ira to ira transfer today; Use this form to roll over or transfer assets to a traditional or roth ira at john hancock investment management. We can.

Capital One Ira Withdrawal Form Fill Online, Printable, Fillable

Web transfer request the term ira will be used below to mean traditional ira and simple ira, unless otherwise specified. You can also have your financial institution or plan directly transfer the payment to another plan or ira. You may also have to pay an additional tax of 10% or 25% on the amount you withdraw unless you are at.

IRA Transfer Information Form CDF Capital

Designated beneficiary distribution authorization form download: Just choose your ira custodian (ameriprise, merril lynch, edward jones, etc) and ira club will get to work. Web open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary. You may use this form to request a transfer from an existing.

Web Ira/Esa Divorce Transfer Request Form Download:

Web request an ira to ira transfer today; Web transfer request the term ira will be used below to mean traditional ira and simple ira, unless otherwise specified. Just choose your ira custodian (ameriprise, merril lynch, edward jones, etc) and ira club will get to work. Designated beneficiary distribution authorization form download:

Web Are You Ready To Move Your Current Ira Into A Fidelity Ira?

Web simple ira withdrawal and transfer rules withdrawals from simple iras generally, you have to pay income tax on any amount you withdraw from your simple ira. Web an ira transfer (which is not the same thing as an ira rollover, though the terms are sometimes used interchangeably) refers to transferring money from an individual retirement account (ira). Inherited ira to inherited ira transfer form Web open an inherited ira account to transfer funds from an ira owner who has named your entity, estate, or trust as their beneficiary.

Ira Required Minimum Distribution (Rmd) Form Download:

Roth ira conversion form and account application You may also have to pay an additional tax of 10% or 25% on the amount you withdraw unless you are at least age 59½ or you qualify for another exception. Use this form to roll over or transfer assets to a traditional or roth ira at john hancock investment management. You can also have your financial institution or plan directly transfer the payment to another plan or ira.

We Can Help Make The Process As Easy And Seamless As Possible.

The rollover chart pdf summarizes allowable rollover transactions. Recipient name (first/mi/last) date of birth email address account number individual requesting the transfer phone suffix accepting account type traditional ira inherited traditional ira (select one). Use this for traditional ira to traditional ira or roth ira to roth ira transfers, only. Approved for use with investors.