Irs Form 12661

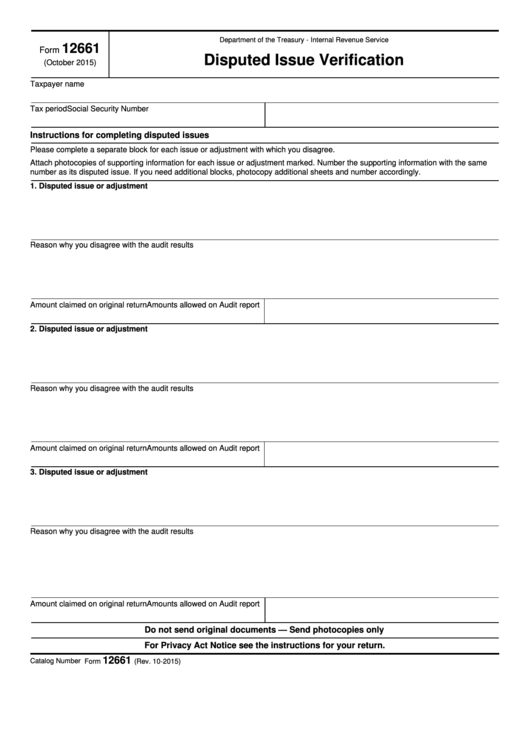

Irs Form 12661 - If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. Be sure to include paragraph and form 12661, disputed issue verification. Help with forms and instructions. Include a daytime and evening telephone number and the best time for the irs to call you Comment on tax forms and publications. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving results from an irs audit. Web the irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you disagree with. View more information about using irs forms, instructions, publications and other item files. The irs will review the taxpayer’s claim and the evidence provided by the taxpayer, and if it agrees, it will issue a letter of determination.

Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Help with forms and instructions. To complete the form, you’ll need to provide your name, the relevant tax period, your social security number, information from the original return and. The latest versions of irs forms, instructions, and publications. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Web how to fill out and sign irs audit reconsideration form 12661 online? Include a daytime and evening telephone number and the best time for the irs to call you Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Be sure to include paragraph and form 12661, disputed issue verification. Web the irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you disagree with.

If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web the irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Help with forms and instructions. Web how to fill out and sign irs audit reconsideration form 12661 online? The latest versions of irs forms, instructions, and publications. Follow the simple instructions below: Be sure to include paragraph and form 12661, disputed issue verification. Comment on tax forms and publications. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position.

Fillable Form 12661 Disputed Issue Verification printable pdf download

Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Through this process, you can disagree with the tax assessment of the. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Help with forms and instructions. To complete the.

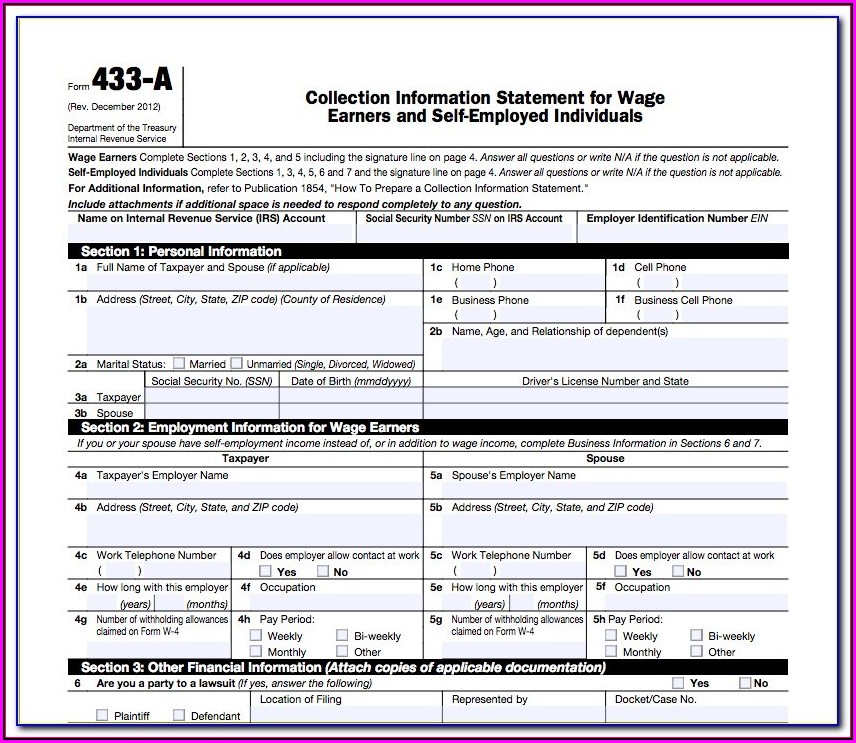

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Help with forms and instructions. View more information about using irs forms, instructions, publications and other item files. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. Be sure to include paragraph and form 12661, disputed issue verification. Get your online.

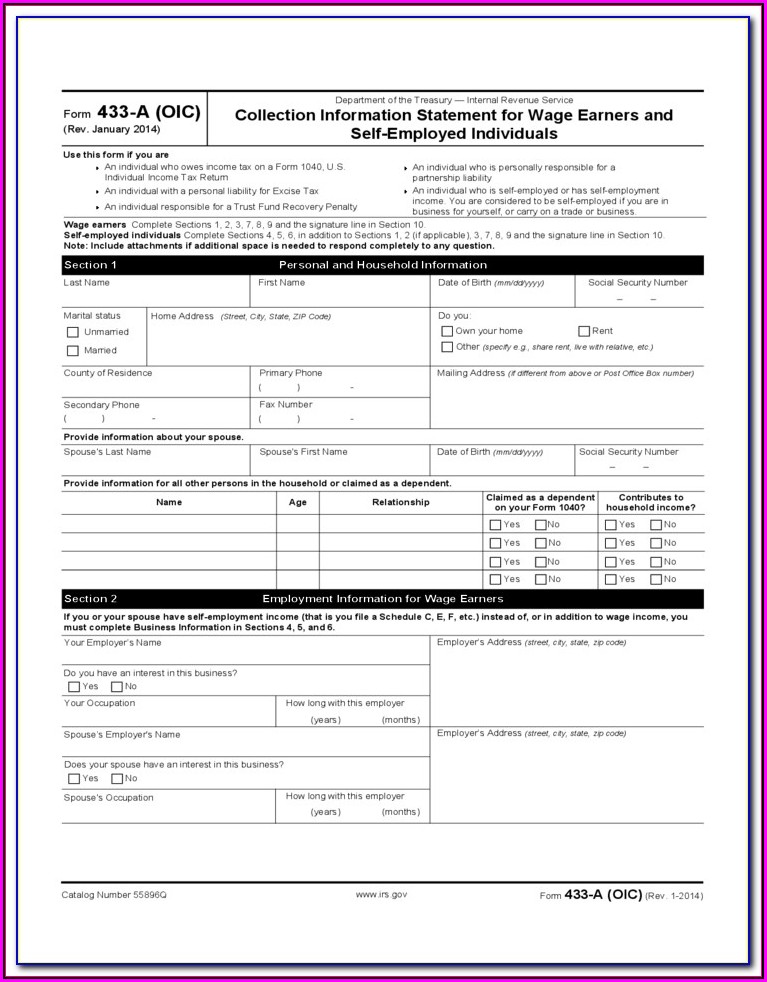

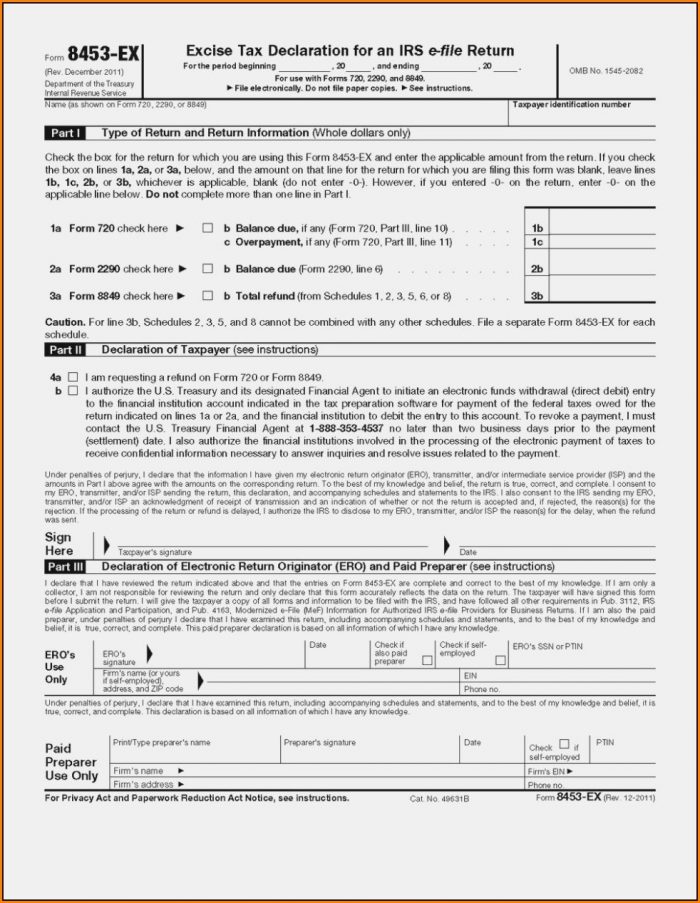

8+ IRS Forms Free Download

Web how to fill out and sign irs audit reconsideration form 12661 online? Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving results from an irs audit. If available, attach a copy of your examination report, form 4549, along with the new documentation that.

Audit Reconsideration Letter Template Examples Letter Template

If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Help with forms and instructions. Enjoy smart fillable fields and interactivity. The latest versions of irs forms, instructions, and publications.

Fill Free fillable IRS PDF forms

Through this process, you can disagree with the tax assessment of the. The irs will review the taxpayer’s claim and the evidence provided by the taxpayer, and if it agrees, it will issue a letter of determination. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. To complete the form, you’ll need to provide.

IRS Audit Penalties Everything to Know About IRS Audit Tax Penalties

Through this process, you can disagree with the tax assessment of the. Web issue letter 3338c. Follow the simple instructions below: Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving results from an irs audit. Web the irs audit reconsideration is an option you.

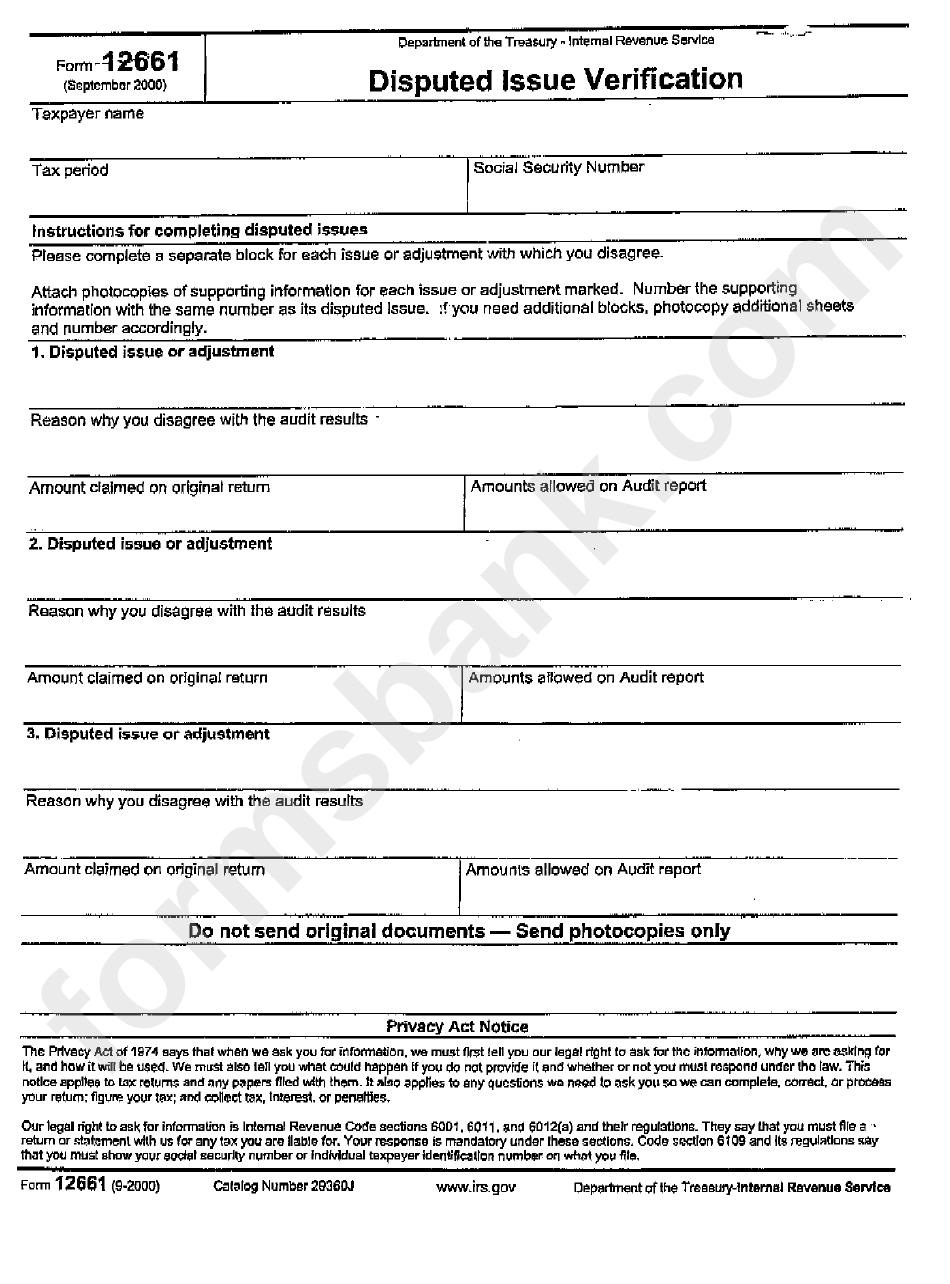

Form 12661 Disputed Issue Verification 2000 printable pdf download

Comment on tax forms and publications. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Get your online template and fill it in using progressive features. Follow the simple instructions below:

Irs Form 668 Wc) Instructions Form Resume Examples MoYolrmVZB

Get your online template and fill it in using progressive features. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving results from an irs audit. Web issue letter 3338c. The irs will review the taxpayer’s claim and the evidence provided by the taxpayer, and.

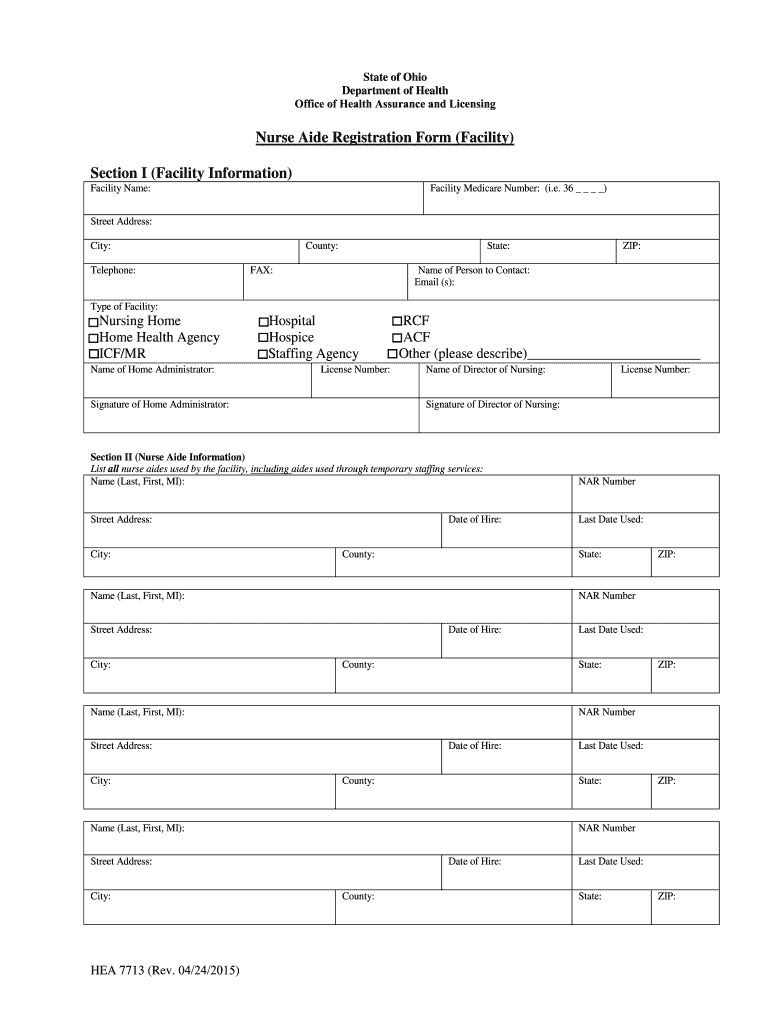

Ohio Nurse Aide Registration Form Fill Out and Sign Printable PDF

Web issue letter 3338c. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Select appropriate paragraphs based on disputed issues and include paragraph to enclose pub 3598 and form 12661. Be sure to include paragraph and form 12661, disputed issue verification. Web form 12661, disputed issue verification, is recommended.

Medicare Form 1490s Instructions Form Resume Examples Wk9yGWvV3D

Web the irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you disagree with. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. If available, attach a copy of your examination report, form 4549, along with the.

The Latest Versions Of Irs Forms, Instructions, And Publications.

Web post release changes to forms. The irs will review the taxpayer’s claim and the evidence provided by the taxpayer, and if it agrees, it will issue a letter of determination. Web how to fill out and sign irs audit reconsideration form 12661 online? Be sure to include paragraph and form 12661, disputed issue verification.

If Available, Attach A Copy Of Your Examination Report, Form 4549, Along With The New Documentation That Supports Your Position.

Enjoy smart fillable fields and interactivity. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. Through this process, you can disagree with the tax assessment of the. View more information about using irs forms, instructions, publications and other item files.

Advise The Taxpayer To Fully Explain The Reason For Disagreement With The Audit Adjustment On Form 12661.

Comment on tax forms and publications. Help with forms and instructions. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Include a daytime and evening telephone number and the best time for the irs to call you

Web Issue Letter 3338C.

Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving results from an irs audit. Web the irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you disagree with. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with.