Irs Form 13873

Irs Form 13873 - Only list a spouse if their own transcripts will be requested and they will be signing the request. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web there are different versions of irs form 13873, including the: Forms with missing signatures will be rejected. Signatures are required for any taxpayer listed. What can i do to fix this? Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Web older tax years are provided on a form 13873 series. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Tax filers who have received an.

Forms with missing signatures will be rejected. Web older tax years are provided on a form 13873 series. Only list a spouse if their own transcripts will be requested and they will be signing the request. Web there are different versions of irs form 13873, including the: Signatures are required for any taxpayer listed. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Tax filers who have received an. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. What can i do to fix this?

Forms with missing signatures will be rejected. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Signatures are required for any taxpayer listed. Only list a spouse if their own transcripts will be requested and they will be signing the request. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Web older tax years are provided on a form 13873 series. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Web there are different versions of irs form 13873, including the: Tax filers who have received an. What can i do to fix this?

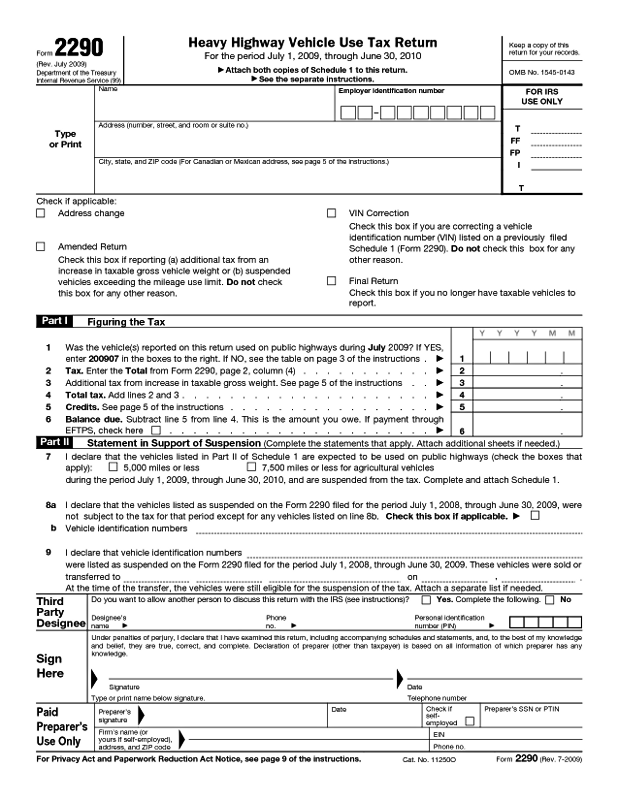

Irss forms tewspartners

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Forms with missing signatures will be rejected. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Only list a spouse.

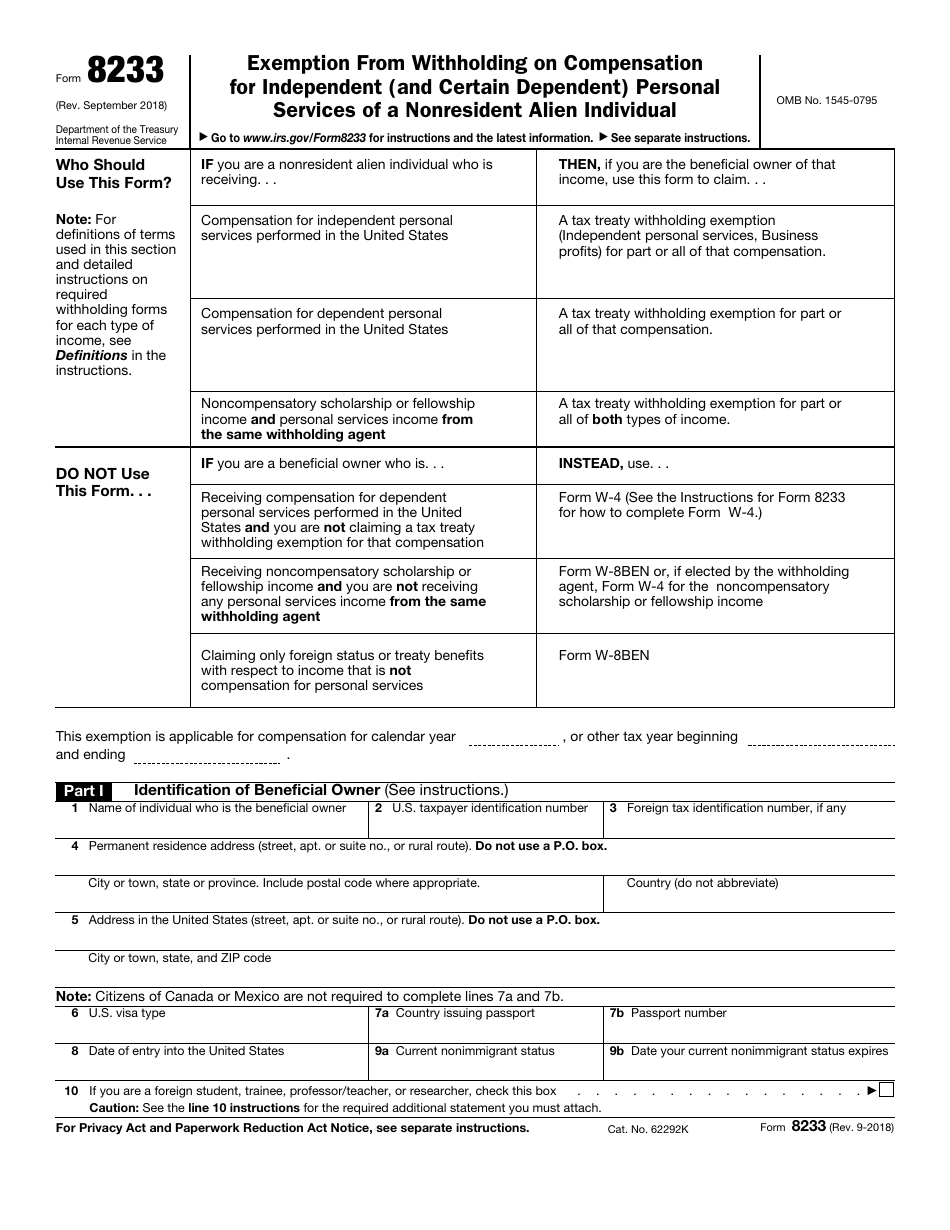

14 Form Irs Seven Signs You’re In Love With 14 Form Irs AH STUDIO Blog

Web older tax years are provided on a form 13873 series. Tax filers who have received an. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Only list a spouse if their own transcripts will be requested and they will be signing the request. Web there are different versions of irs form 13873,.

Formulario 433F del IRS Consejos, asignación e información de

Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Only list a spouse if their own transcripts will be requested and they will be signing the request. Tax filers who have received an. Only a form.

EDGAR Filing Documents for 000075068620000052

Web older tax years are provided on a form 13873 series. Tax filers who have received an. Forms with missing signatures will be rejected. Only a form 13873 that has a nonfiling or a no record found message is acceptable. Signatures are required for any taxpayer listed.

Irs Form 4506t Printable Printable Forms Free Online

Only a form 13873 that has a nonfiling or a no record found message is acceptable. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. What can i do.

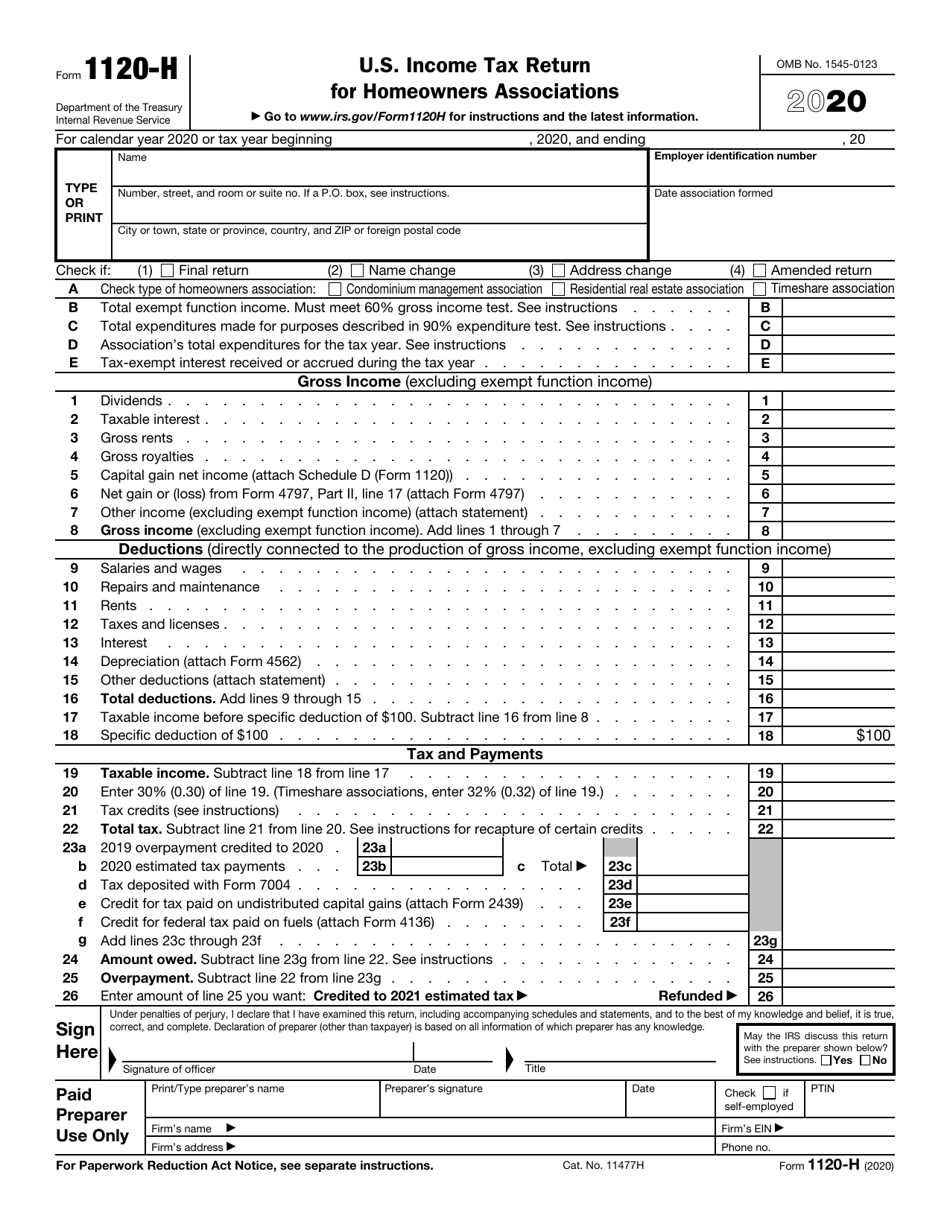

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

Only a form 13873 that has a nonfiling or a no record found message is acceptable. Only list a spouse if their own transcripts will be requested and they will be signing the request. Signatures are required for any taxpayer listed. Web there are different versions of irs form 13873, including the: Tax filers who have received an.

Compilation Error undeclared identifier trying to pass values from

Only a form 13873 that has a nonfiling or a no record found message is acceptable. Only list a spouse if their own transcripts will be requested and they will be signing the request. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower.

IRS FORM 147C PDF

Only list a spouse if their own transcripts will be requested and they will be signing the request. Web the income verification express service (ives) program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. Signatures are required for any taxpayer listed. Only a.

How to Obtain the NonFiling Letter from the IRS, Students Fill Online

Tax filers who have received an. Only list a spouse if their own transcripts will be requested and they will be signing the request. What can i do to fix this? Only a form 13873 that has a nonfiling or a no record found message is acceptable. Forms with missing signatures will be rejected.

Acceptable Documentation From Irs For Verification Of Nonfiling Status

Forms with missing signatures will be rejected. Tax filers who have received an. Signatures are required for any taxpayer listed. Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling..

Web The Income Verification Express Service (Ives) Program Is Used By Mortgage Lenders And Others Within The Financial Community To Confirm The Income Of A Borrower During The Processing Of A Loan Application.

Web there are different versions of irs form 13873, including the: Forms with missing signatures will be rejected. Web older tax years are provided on a form 13873 series. What can i do to fix this?

Only A Form 13873 That Has A Nonfiling Or A No Record Found Message Is Acceptable.

Web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax return is acceptable documentation of nonfiling. Only list a spouse if their own transcripts will be requested and they will be signing the request. Tax filers who have received an. Signatures are required for any taxpayer listed.