Irs Form 3531 Missing Signature

Irs Form 3531 Missing Signature - Web irs 3531 form saying missing signature on the 1040 form. Can i send another copy of my tax return with original signature to irs? Web if the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. My wife received the 3531 form saying that no signature in the original 1040 form. Should we send to the same address that we originally sent to, or one of the submission. I did the same thing but i haven’t received the letter yet. You must resubmit the original completed form along with all applicable schedules, forms and attachments. We received the return with a form 3531, box 1 checked indicated lack of valid signature. Web we filed our 2019 return earlier this year and forgot to sign it. Web accidentally sent irs an unsigned copy of our 2016 form 1040 and later received a form 3531 requesting a valid original signature.

I do not understand how they. I filed electronically for 2019 and no signature pages were mailed in and not required by program. I don't know if i should sign over the photocopied signature, or if i should fill out a new 1040 and sign that. Web box 6 on form 3531 says: Web if the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. We received the return with a form 3531, box 1 checked indicated lack of valid signature. Should that returned signature be dated to the original submittal dat. Web may 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Together with the 3531 form, all the original 1040 form and attachments were sent to my wife and stapled together. My wife received the 3531 form saying that no signature in the original 1040 form.

Web accidentally sent irs an unsigned copy of our 2016 form 1040 and later received a form 3531 requesting a valid original signature. Can i send another copy of my tax return with original signature to irs? I did the same thing but i haven’t received the letter yet. A valid legal signature is an original signature written below the jurat statement in the sign here box on the return. Posted may 31, 2019 5:42 pm last updated may 31, 2019 5:42 pm 0 8 3,096 reply I don't know if i should sign over the photocopied signature, or if i should fill out a new 1040 and sign that. You must resubmit the original completed form along with all applicable schedules, forms and attachments. I do not understand how they. The copy i sent already has been stamped by the irs. Should we send to the same address that we originally sent to, or one of the submission.

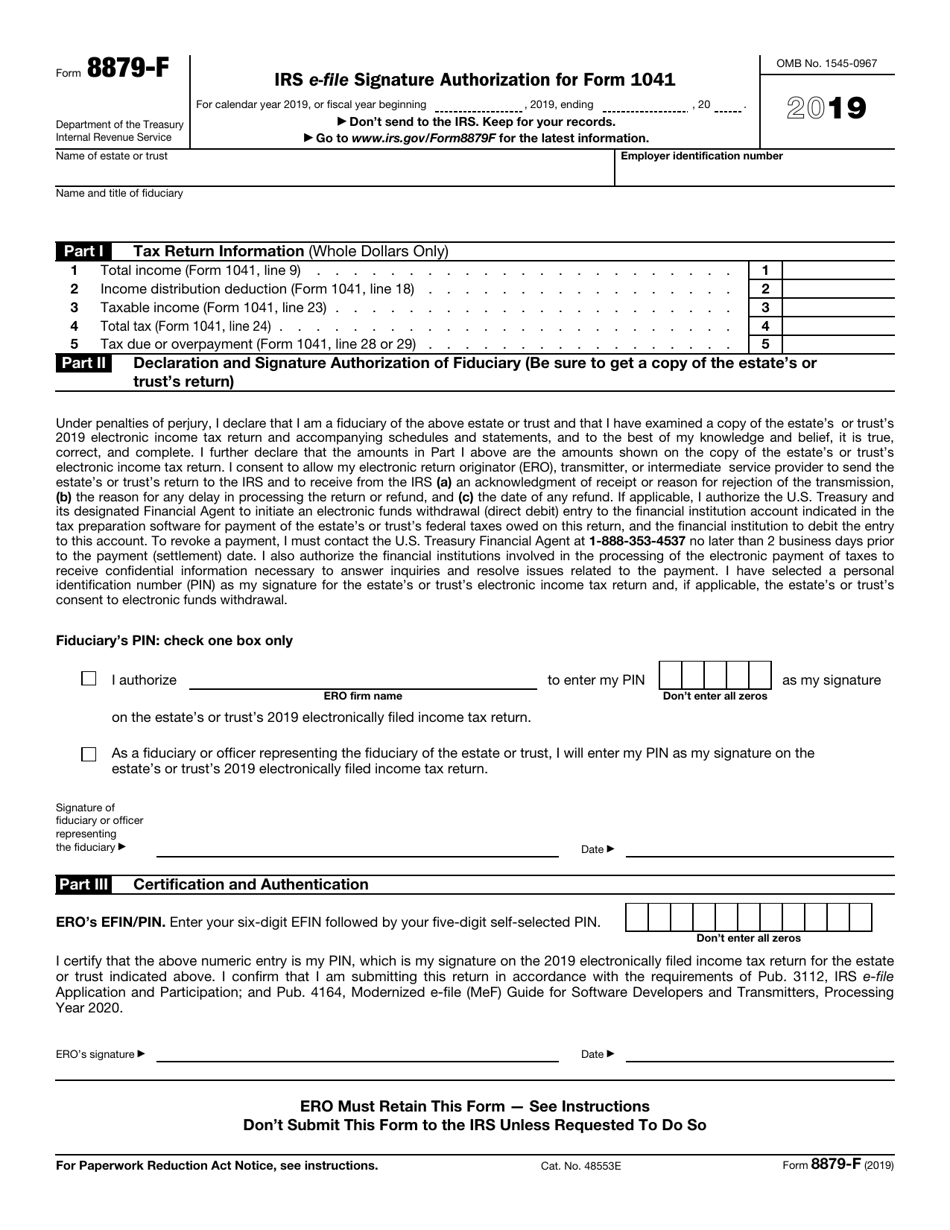

IRS Form 8879F Download Fillable PDF or Fill Online IRS EFile

Can i send another copy of my tax return with original signature to irs? I did the same thing but i haven’t received the letter yet. Web accidentally sent irs an unsigned copy of our 2016 form 1040 and later received a form 3531 requesting a valid original signature. Web we filed our 2019 return earlier this year and forgot.

Form 8879EX IRS efile Signature Authorization for Forms 720, 2290

Should that returned signature be dated to the original submittal dat. Web where do i send a missing signature form 3531? Web irs 3531 form saying missing signature on the 1040 form. A valid legal signature is an original signature written below the jurat statement in the sign here box on the return. Web we filed our 2019 return earlier.

IRS Audit Letter 3531 Sample 1

Should we send to the same address that we originally sent to, or one of the submission. We do not have the envelope that we received it in, so not sure what the return address was. A valid legal signature is an original signature written below the jurat statement in the sign here box on the return. Web may 3,.

Fill Free fillable IRS efile Signature Authorization for Form 1120F

We are returning your tax return because we need more information toprocess it. Web if the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. Web box 6 on form 3531 says: Web accidentally sent irs an unsigned copy of our 2016 form 1040 and later received.

Irs Form W4V Printable Irs Form 1036 2020 Form Fill Online

We received the return with a form 3531, box 1 checked indicated lack of valid signature. Web my friend received form 3531 from irs due to missing original signature because she sent photocopied signature 1040. Web irs 3531 form saying missing signature on the 1040 form. Web we filed our 2019 return earlier this year and forgot to sign it..

IRS Audit Letter 3531 Sample 1

I used turbo tax for the 1st time this year to file. We received the return with a form 3531, box 1 checked indicated lack of valid signature. I do not understand how they. The copy i sent already has been stamped by the irs. Web my friend received form 3531 from irs due to missing original signature because she.

3.11.3 Individual Tax Returns Internal Revenue Service

Web accidentally sent irs an unsigned copy of our 2016 form 1040 and later received a form 3531 requesting a valid original signature. Web we filed our 2019 return earlier this year and forgot to sign it. We do not have the envelope that we received it in, so not sure what the return address was. You must resubmit the.

New IRS Snail Mail SCAM

A valid legal signature is an original signature written below the jurat statement in the sign here box on the return. Web box 6 on form 3531 says: Should we send to the same address that we originally sent to, or one of the submission. I used turbo tax for the 1st time this year to file. We do not.

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

I used turbo tax for the 1st time this year to file. Web the 3531 asks to sign in the sign here box, but the form i sent has my (photocopied) signature there. I filed electronically for 2019 and no signature pages were mailed in and not required by program. My wife received the 3531 form saying that no signature.

3.11.3 Individual Tax Returns Internal Revenue Service

Web may 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Together with the 3531 form, all the original 1040 form and attachments were sent to my wife and stapled together. I do not understand how they. We are returning your tax return because we need more information toprocess it. I did.

Your Form 1040/A/Ez/Sr Is Blank, Illegible, Missing Or Damaged And We Can't Process It.

A valid legal signature is an original signature written below the jurat statement in the sign here box on the return. We are returning your tax return because we need more information toprocess it. Web my friend received form 3531 from irs due to missing original signature because she sent photocopied signature 1040. I did the same thing but i haven’t received the letter yet.

Web The 3531 Asks To Sign In The Sign Here Box, But The Form I Sent Has My (Photocopied) Signature There.

The copy i sent already has been stamped by the irs. I do not understand how they. I don't know if i should sign over the photocopied signature, or if i should fill out a new 1040 and sign that. Web where do i send a missing signature form 3531?

We Do Not Have The Envelope That We Received It In, So Not Sure What The Return Address Was.

Can i send another copy of my tax return with original signature to irs? Should we send to the same address that we originally sent to, or one of the submission. Web accidentally sent irs an unsigned copy of our 2016 form 1040 and later received a form 3531 requesting a valid original signature. I filed electronically for 2019 and no signature pages were mailed in and not required by program.

We Received The Return With A Form 3531, Box 1 Checked Indicated Lack Of Valid Signature.

Posted may 31, 2019 5:42 pm last updated may 31, 2019 5:42 pm 0 8 3,096 reply I used turbo tax for the 1st time this year to file. Web if the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. Your original signature is required.