Irs Form 6765 Instructions

Irs Form 6765 Instructions - Neff recent legislation has doubled the potential value of the sec. Section b applies to the alternative simplified credit (asc). Elect and figure the payroll tax credit. Figure and claim the credit for increasing research activities. Web on january 12, 2023 the irs released a draft of revised instructions [1] for form 6765, credit for increasing research activities that now contains the guidance the irs announced previously regarding what must be submitted with an amended income tax return claiming a credit under irc §41 for increasing research activities. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Web the irs released a draft of the instructions for form 6765, credit for increasing research activities. Web eligible taxpayers file irs form 6765 to figure and claim the federal tax credit for increasing research activities, to elect a reduced tax credit under irc section 280c, and to elect to claim a certain amount of the credit as a payroll tax offset against the employer portion of payroll taxes. For paperwork reduction act notice, see separate instructions. Web on january 12, 2023, the irs released new draft instructions to the federal form 6765, the credit for increasing research activities.

For paperwork reduction act notice, see separate instructions. Elect the reduced credit under section 280c. Web the irs released a draft of the instructions for form 6765, credit for increasing research activities. Web irs provides instructions for using form 6765, these often make references to the relevant sections of the internal revenue code. Figure and claim the credit for increasing research activities. Web form 6765 instructions | gusto finances and taxes december 5, 2022 irs form 6765 for r&d tax credits: 2 section c—current year credit 35 enter the portion of the credit from form 8932, line 2, that is attributable to wages that were also Section a is used to claim the regular credit and has eight lines of required information (lines 1,2,3,7,8,10,11 and17). Instructions for form 6765(print versionpdf). Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765:

What it is, how to file, and more barbara c. The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar). Elect the reduced credit under section 280c. 41 research and development (r&d) federal tax credit. Section b applies to the alternative simplified credit (asc). Web irs provides instructions for using form 6765, these often make references to the relevant sections of the internal revenue code. Web on january 12, 2023 the irs released a draft of revised instructions [1] for form 6765, credit for increasing research activities that now contains the guidance the irs announced previously regarding what must be submitted with an amended income tax return claiming a credit under irc §41 for increasing research activities. As expected, the irs formalized the rules they outlined in faa20214101f. Figure and claim the credit for increasing research activities. Web form 6765 instructions | gusto finances and taxes december 5, 2022 irs form 6765 for r&d tax credits:

IRS Form 6765

Web on january 12, 2023 the irs released a draft of revised instructions [1] for form 6765, credit for increasing research activities that now contains the guidance the irs announced previously regarding what must be submitted with an amended income tax return claiming a credit under irc §41 for increasing research activities. So, unless you already know the technical ins.

Form 6765 Credit for Increasing Research Activities (2014) Free Download

2 section c—current year credit 35 enter the portion of the credit from form 8932, line 2, that is attributable to wages that were also Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a.

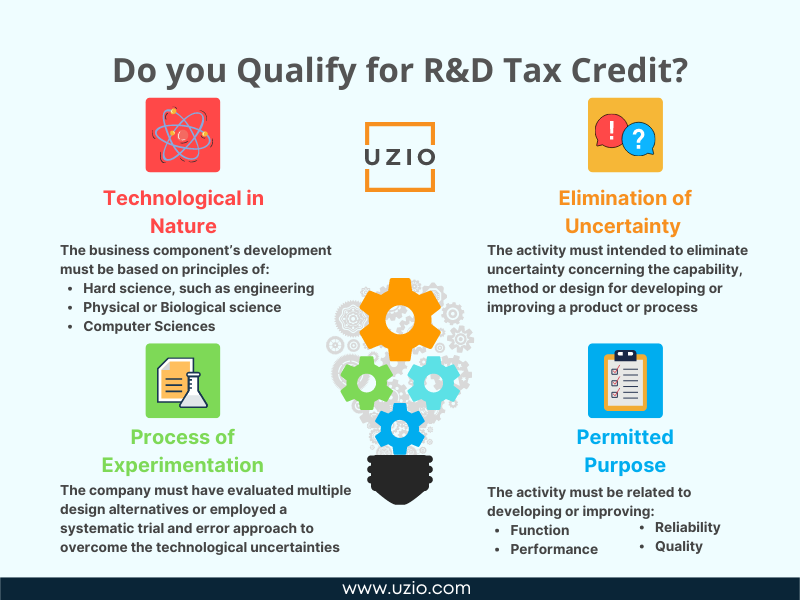

What is R&D Tax Credit and How Do I Claim it? UZIO Inc

Section b applies to the alternative simplified credit (asc). Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Web the irs released a draft of the instructions for form 6765, credit for increasing research activities. Neff recent legislation has doubled the potential value of the sec. Web use form 6765 to:

Irs Form 668 Wc) Instructions Form Resume Examples MoYolrmVZB

41 research and development (r&d) federal tax credit. Web use form 6765 to: For paperwork reduction act notice, see separate instructions. Neff recent legislation has doubled the potential value of the sec. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765:

9 Best Product Management Certifications Online 2023

The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar). What it is, how to file, and more barbara c. Web eligible taxpayers file irs form 6765 to figure and claim the federal tax credit for increasing research activities, to elect a reduced tax credit under.

Irs Form 990 Schedule N Instructions Form Resume Examples 7mk9wmm5GY

Web eligible taxpayers file irs form 6765 to figure and claim the federal tax credit for increasing research activities, to elect a reduced tax credit under irc section 280c, and to elect to claim a certain amount of the credit as a payroll tax offset against the employer portion of payroll taxes. 2 section c—current year credit 35 enter the.

Form 6765 Instructions Gusto

As expected, the irs formalized the rules they outlined in faa20214101f. The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar). Elect and figure the payroll tax credit. Web on january 12, 2023, the irs released new draft instructions to the federal form 6765, the credit.

Instructions For Form 6765 (Draft) Credit For Increasing Research

Elect and figure the payroll tax credit. As expected, the irs formalized the rules they outlined in faa20214101f. Web on january 12, 2023 the irs released a draft of revised instructions [1] for form 6765, credit for increasing research activities that now contains the guidance the irs announced previously regarding what must be submitted with an amended income tax return.

Instructions for IRS Form 6765 Credit for Increasing Research

Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes. 41 research and development (r&d) federal tax credit. Web irs provides instructions for using.

How to Fill Out Form 6765 (R&D Tax Credit) RD Tax Credit Software

Elect and figure the payroll tax credit. What it is, how to file, and more barbara c. Elect the reduced credit under section 280c. The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar). Web use form 6765 to figure and claim the credit for increasing.

41 Research And Development (R&D) Federal Tax Credit.

Web the irs released a draft of the instructions for form 6765, credit for increasing research activities. Elect and figure the payroll tax credit. Web form 6765 instructions | gusto finances and taxes december 5, 2022 irs form 6765 for r&d tax credits: Figure and claim the credit for increasing research activities.

As Expected, The Irs Formalized The Rules They Outlined In Faa20214101F.

Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes. Section a is used to claim the regular credit and has eight lines of required information (lines 1,2,3,7,8,10,11 and17). So, unless you already know the technical ins and outs of the tax code, the irs guidance can prove difficult and time consuming to follow. For paperwork reduction act notice, see separate instructions.

Web To Document Their Qualified R&D Expenses, Businesses Must Complete The Four Basic Sections Of Form 6765:

Web use form 6765 to: Web eligible taxpayers file irs form 6765 to figure and claim the federal tax credit for increasing research activities, to elect a reduced tax credit under irc section 280c, and to elect to claim a certain amount of the credit as a payroll tax offset against the employer portion of payroll taxes. Neff recent legislation has doubled the potential value of the sec. Elect the reduced credit under section 280c.

Instructions For Form 6765(Print Versionpdf).

Web on january 12, 2023 the irs released a draft of revised instructions [1] for form 6765, credit for increasing research activities that now contains the guidance the irs announced previously regarding what must be submitted with an amended income tax return claiming a credit under irc §41 for increasing research activities. Section b applies to the alternative simplified credit (asc). The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar). Web irs provides instructions for using form 6765, these often make references to the relevant sections of the internal revenue code.