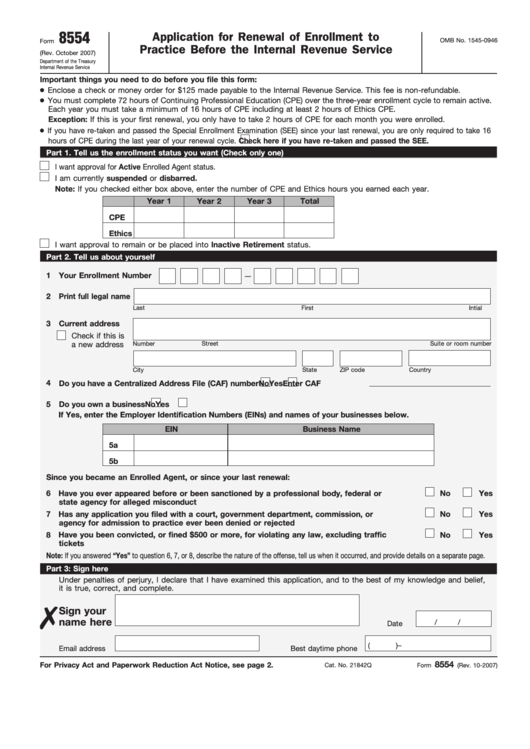

Irs Form 8554

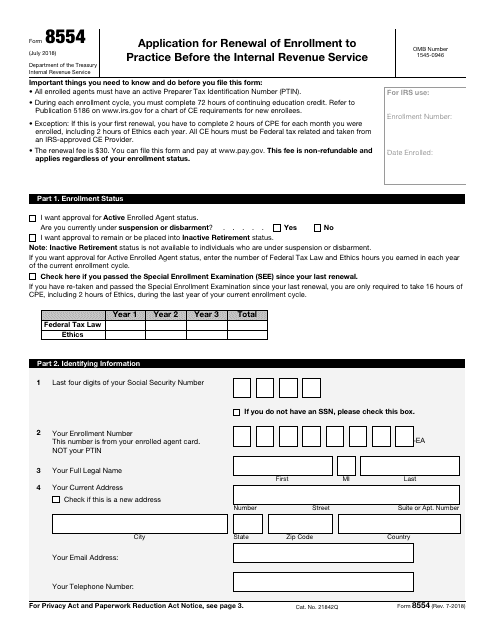

Irs Form 8554 - Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Use this form to pay and apply for. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not. It includes an enrollment status blank and. Web we last updated the application for renewal of enrollment to practice before the internal revenue service in december 2022, so this is the latest version of form 8554, fully. Application for renewal of enrollment to practice before the internal revenue service. Renew your enrollment every three (3) years. Complete this part only if your home was. You disposed of it in 2022. Web the irs is soliciting comments concerning form 8554, application for renewal of enrollment to practice before the internal revenue service and form 8554.

Form 8554 is used for making an application renewal of enrollment to practice before the internal revenue service. Part iii form 5405 gain or (loss) worksheet. March 2011) department of the treasury internal revenue service. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web enrolled agent renewal form 8554 description: Application for renewal of enrollment to practice before the internal revenue service. Web enrolled agent renewal form 8554 description: Web use form 5405 to do the following. Renew your enrollment every three (3) years. Web application for irs individual taxpayer identification number.

March 2011) department of the treasury internal revenue service. It includes an enrollment status blank and. Part iii form 5405 gain or (loss) worksheet. Use this form to pay and apply for. Did you timely file and pay all your individual and business. Web enrolled agent renewal form 8554 description: You have to enter “8554” in the search. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Form 8554 is used for making an application renewal of enrollment to practice before the internal revenue service. Web enrolled agent renewal form 8554 description:

Fill Free fillable IRS PDF forms

Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. March 2011) department of the treasury internal revenue service. Did you timely file and pay all your individual and business. Application for renewal of enrollment to practice before the internal revenue service. Notify the irs that the home you purchased in 2008 and for.

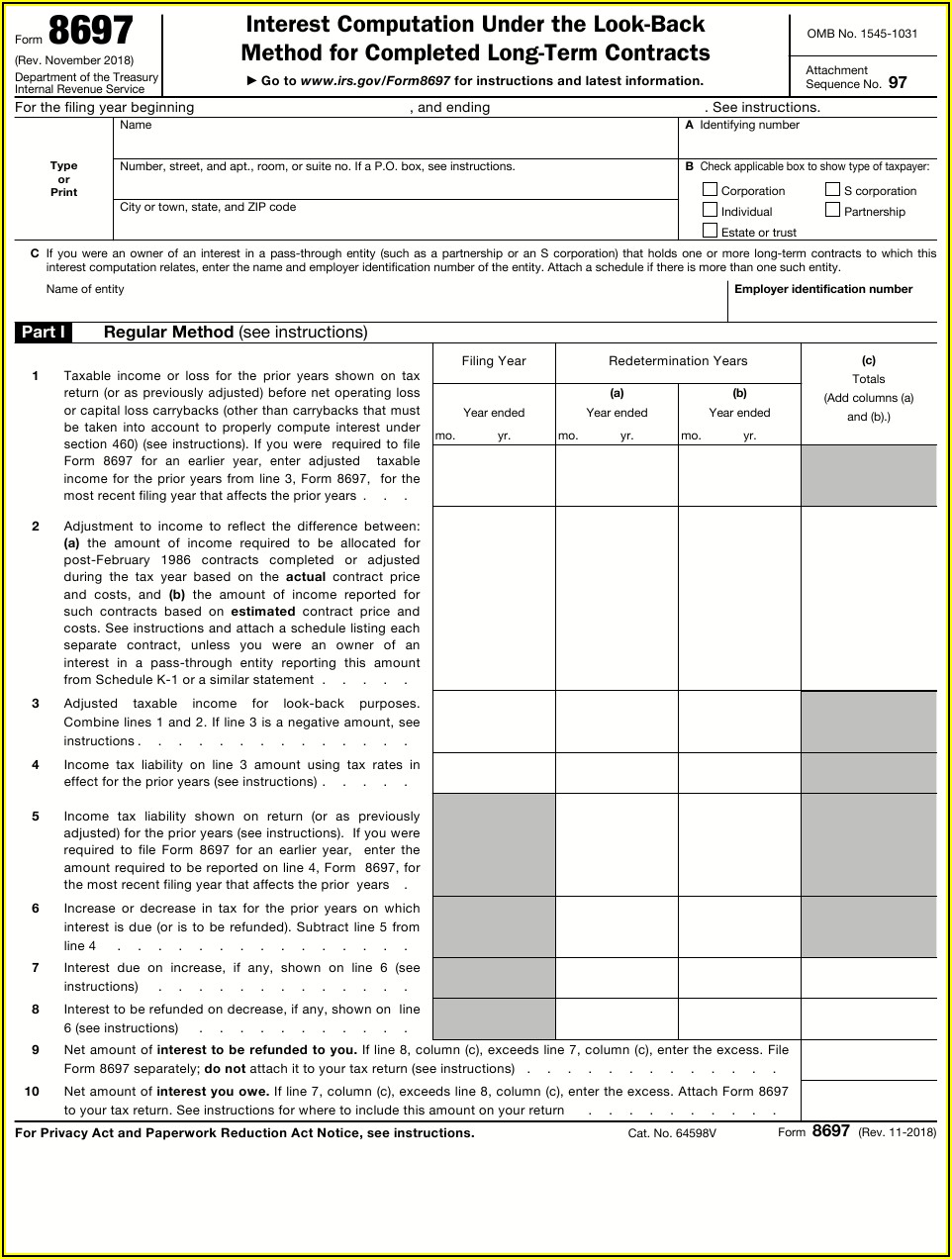

How to renew Enrolled Agent (EA) license by completing IRS Form 8554

Web use form 5405 to do the following. Use this form to pay and apply for renewal. Web we last updated the application for renewal of enrollment to practice before the internal revenue service in december 2022, so this is the latest version of form 8554, fully. Application for renewal of enrollment to practice before the internal revenue service. Enter.

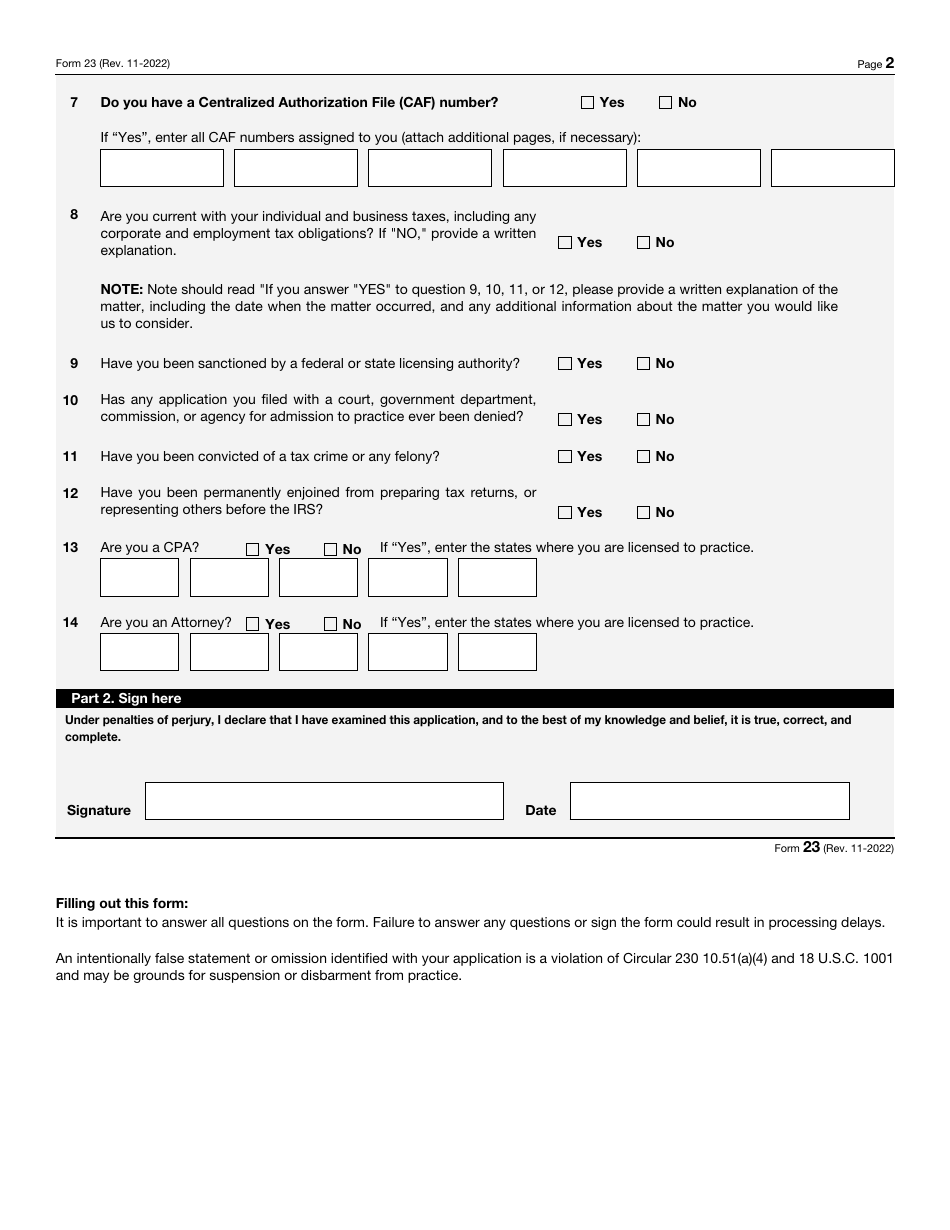

IRS Form 23 Download Fillable PDF or Fill Online Application for

Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be. Did you timely file and pay all your individual and business. Use this form to pay and apply for. It includes an enrollment status blank and. Application for renewal of enrollment to practice before the internal.

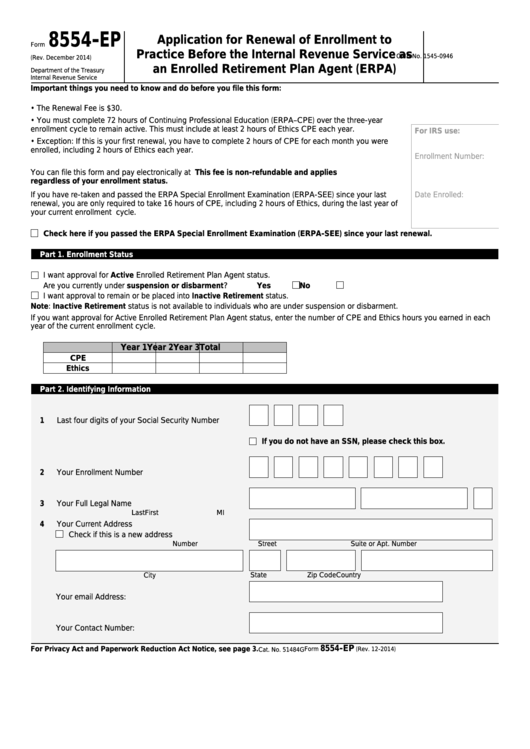

Form 8554 Ep ≡ Fill Out Printable PDF Forms Online

Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Application for renewal of enrollment to practice before the internal revenue service as. Web enrolled agent renewal form 8554 description: Complete this part only if your home was. Web the irs is soliciting comments concerning form 8554, application for renewal of enrollment to practice.

IRS Form 8554 Download Fillable PDF or Fill Online Application for

Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Application for renewal of enrollment to practice before the internal revenue service. Web the irs is soliciting comments concerning form 8554, application for renewal of enrollment to practice before the internal revenue service and form 8554. Part iii form 5405 gain or (loss) worksheet..

Irs.gov Form 1031 Form Resume Examples WjYD1gB0VK

Enter the amount from line 8 on your 2022 schedule 2 (form 1040), line 10. Web individuals who expatriated for immigration purposes after june 3, 2004, and before june 17, 2008, but who have not previously filed a form 8854, continue to be treated as u.s. Web application for irs individual taxpayer identification number. You disposed of it in 2022..

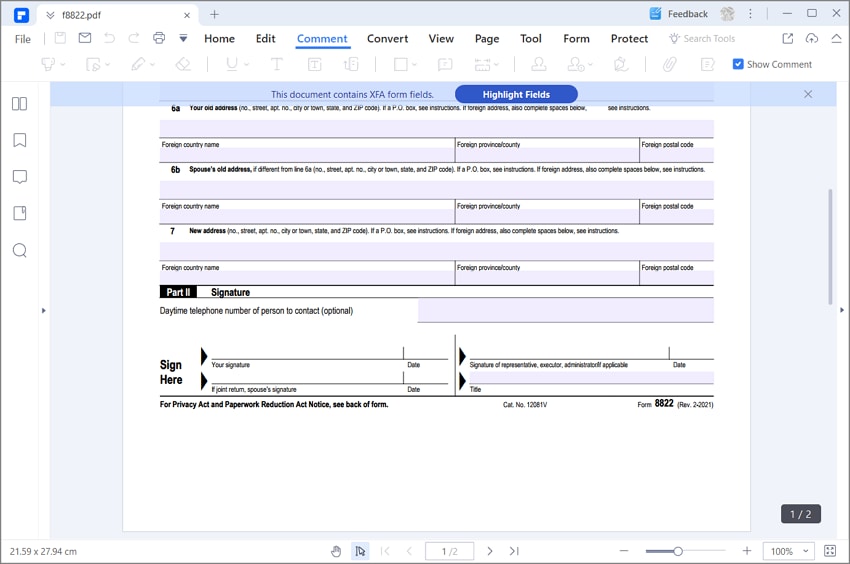

IRS Form 8822 The Best Way to Fill it

Form 8554 is used for making an application renewal of enrollment to practice before the internal revenue service. Use this form to pay and apply for renewal as an enrolled agent. You disposed of it in 2022. Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Web you must file form 5405 with.

Form 8554 Application for Renewal of Enrollment to Practice Before

Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not. Web application for irs individual taxpayer identification number. Application for renewal of enrollment to practice before the internal revenue service as. Web the irs is soliciting comments.

Fillable Form 8554 Application For Renewal Of Enrollment To Practice

Web individuals who expatriated for immigration purposes after june 3, 2004, and before june 17, 2008, but who have not previously filed a form 8854, continue to be treated as u.s. Use this form to pay and apply for. Web we last updated the application for renewal of enrollment to practice before the internal revenue service in december 2022, so.

Form 8554Ep Application For Renewal Of Enrollment To Practice Before

Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Web we last updated the application for renewal of enrollment to practice before the internal revenue service in december 2022, so this is the latest version of form 8554, fully. Enter the amount from line 8 on your 2022 schedule 2 (form 1040), line.

Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service.

Application for renewal of enrollment to practice before the internal revenue service as. Enter the amount from line 8 on your 2022 schedule 2 (form 1040), line 10. You disposed of it in 2022. Form 8554 is used for making an application renewal of enrollment to practice before the internal revenue service.

Web Application For Irs Individual Taxpayer Identification Number.

This form is used to renew your status as an enrolled agent. Use this form to pay and apply for renewal as an enrolled agent. Web use form 5405 to do the following. Application for renewal of enrollment to practice before the internal revenue service.

Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service.

Web enrolled agent renewal form 8554 description: Web the irs is soliciting comments concerning form 8554, application for renewal of enrollment to practice before the internal revenue service and form 8554. March 2011) department of the treasury internal revenue service. You have to enter “8554” in the search.

Web We Last Updated The Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service In December 2022, So This Is The Latest Version Of Form 8554, Fully.

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web the office of professional responsibility will consider any tax compliance issues in evaluating your renewal. Renew your enrollment every three (3) years. Web individuals who expatriated for immigration purposes after june 3, 2004, and before june 17, 2008, but who have not previously filed a form 8854, continue to be treated as u.s.