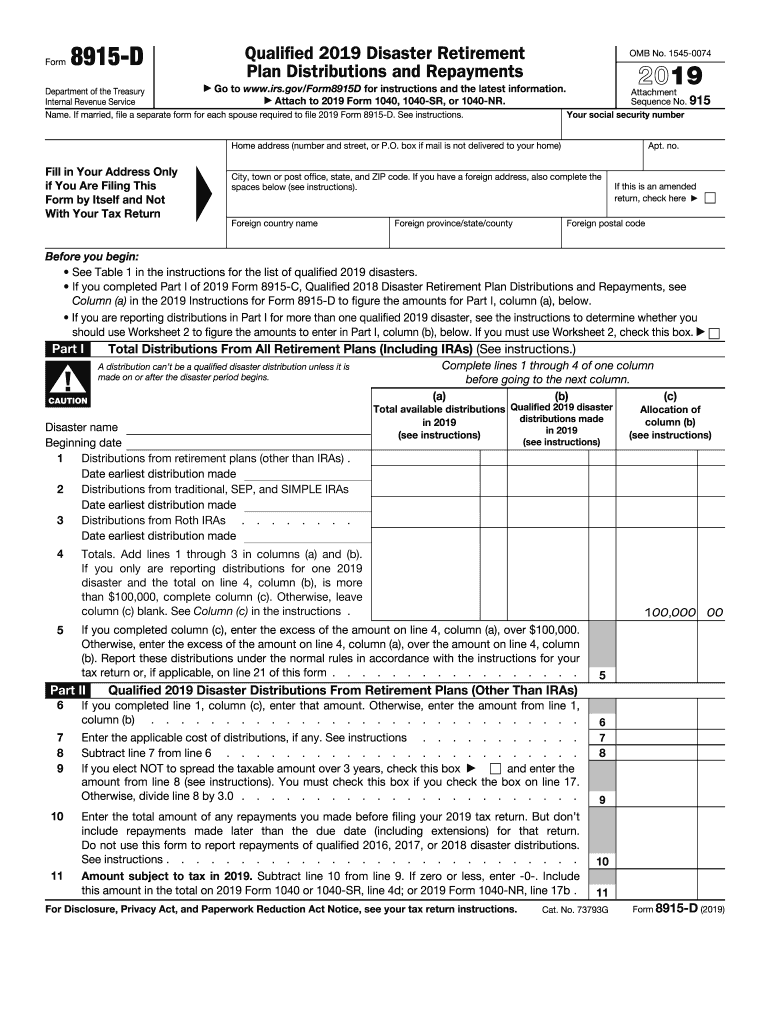

Irs Form 8915F

Irs Form 8915F - We are removing three examples and revising the worksheet 1b section. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. This could be any of the following: A qualified annuity plan the distribution must be to an eligible individual. Web instructions, and pubs is at irs.gov/forms. Sounds to me like someone is pulling someones leg. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. For example, the form 1040 page is at. The withdrawal must come from an eligible retirement plan. Qualified 2020 disaster retirement plan distributions and repayments.

Web instructions, and pubs is at irs.gov/forms. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments. Repayments of current and prior year qualified disaster distributions. (january 2022) qualified disaster retirement plan distributions and repayments. Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income about publication 976, disaster relief For instructions and the latest information. Almost every form and publication has a page on irs.gov with a friendly shortcut. The expectation is that it may be appended in the future years foregoing the need to establish a new.

Web instructions, and pubs is at irs.gov/forms. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. For instructions and the latest information. The expectation is that it may be appended in the future years foregoing the need to establish a new. A qualified annuity plan the distribution must be to an eligible individual. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Department of the treasury internal revenue service. For instructions and the latest information. The withdrawal must come from an eligible retirement plan. Repayments of current and prior year qualified disaster distributions.

The IRS 8822 Form To File or Not to File MissNowMrs

A qualified annuity plan the distribution must be to an eligible individual. For instructions and the latest information. Web instructions, and pubs is at irs.gov/forms. 501 page is at irs.gov/pub501; Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax.

8915e tax form instructions Somer Langley

How can that be when the irs has not released the form yet. Sounds to me like someone is pulling someones leg. Almost every form and publication has a page on irs.gov with a friendly shortcut. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments.

8915F LHR 32D Sargent Mortise Exit Devices SECLOCK

Sounds to me like someone is pulling someones leg. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Department of the treasury internal revenue service. This could be any of the following: Qualified 2020 disaster retirement plan distributions and repayments.

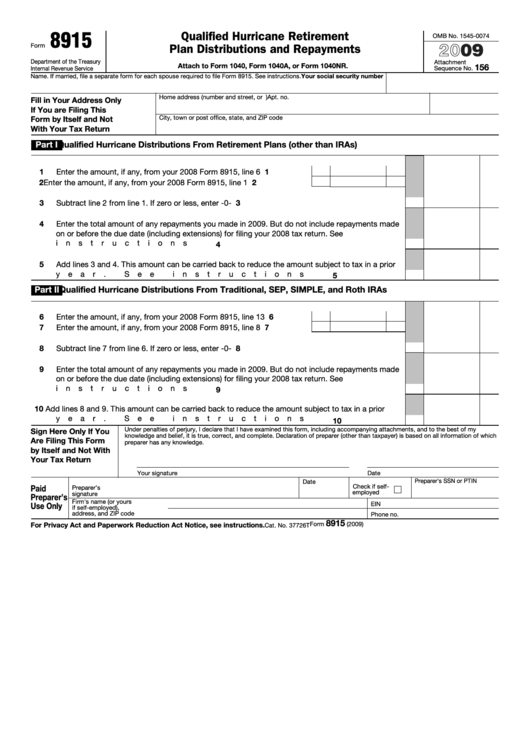

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Department of the treasury internal revenue service. Almost every form and publication has a page on irs.gov with a friendly shortcut. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Qualified 2020 disaster retirement plan distributions and repayments. For instructions and the latest information.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

How can that be when the irs has not released the form yet. This could be any of the following: The withdrawal must come from an eligible retirement plan. Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income about publication 976, disaster relief For example, the form 1040 page is at.

form 8915 e instructions turbotax Renita Wimberly

Department of the treasury internal revenue service. A qualified annuity plan the distribution must be to an eligible individual. How can that be when the irs has not released the form yet. For instructions and the latest information. 501 page is at irs.gov/pub501;

Are You Ready? Big Changes to the 2020 Federal W4 Withholding Form

A qualified annuity plan the distribution must be to an eligible individual. We are removing three examples and revising the worksheet 1b section. Repayments of current and prior year qualified disaster distributions. How can that be when the irs has not released the form yet. 501 page is at irs.gov/pub501;

8915 D Form Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal revenue service. (january 2022) qualified disaster retirement plan distributions and repayments. Qualified 2020 disaster retirement plan distributions and repayments. For instructions and the latest information. Department of the treasury internal revenue service.

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

We are removing three examples and revising the worksheet 1b section. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. A qualified annuity plan the distribution must be to an eligible individual. 501 page is at irs.gov/pub501; Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income about publication 976, disaster relief

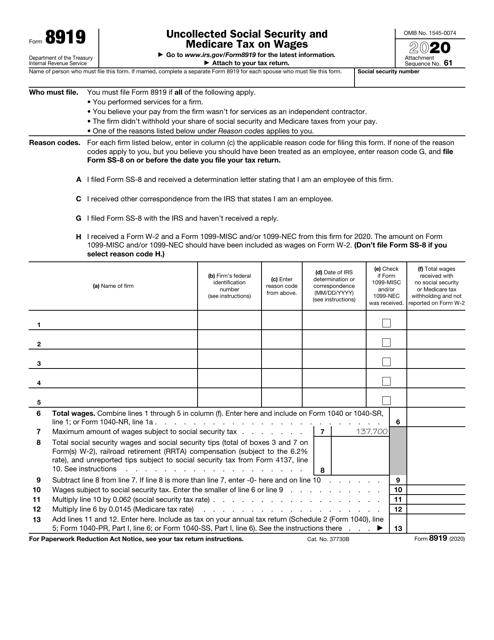

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

501 page is at irs.gov/pub501; For example, the form 1040 page is at. Sounds to me like someone is pulling someones leg. (january 2022) qualified disaster retirement plan distributions and repayments. Qualified 2020 disaster retirement plan distributions and repayments.

The Expectation Is That It May Be Appended In The Future Years Foregoing The Need To Establish A New.

Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income about publication 976, disaster relief And the schedule a (form 1040/sr) page is at irs.gov/schedulea. The withdrawal must come from an eligible retirement plan.

This Could Be Any Of The Following:

Sounds to me like someone is pulling someones leg. We are removing three examples and revising the worksheet 1b section. How can that be when the irs has not released the form yet. (january 2022) qualified disaster retirement plan distributions and repayments.

Repayments Of Current And Prior Year Qualified Disaster Distributions.

For example, the form 1040 page is at. Web instructions, and pubs is at irs.gov/forms. Department of the treasury internal revenue service. Almost every form and publication has a page on irs.gov with a friendly shortcut.

Department Of The Treasury Internal Revenue Service.

A qualified annuity plan the distribution must be to an eligible individual. For instructions and the latest information. Qualified 2020 disaster retirement plan distributions and repayments. For instructions and the latest information.