Irs Form 8918

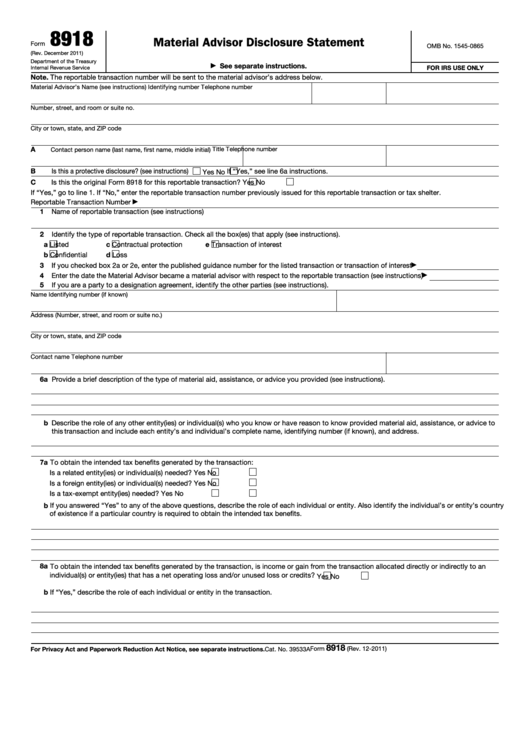

Irs Form 8918 - Material advisor disclosure statement 1121 06/19/2022 Web irs lets tax pros fax form 8918 for material advisor disclosures. The material advisor is someone that helps create and. The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. Material advisors to any reportable transaction file form 8918 to disclose certain information about the reportable transaction. After june 1, 2022, the irs will accept only the latest version of form 8918 (rev. Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the reportable transaction with the irs. Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: November 2021) department of the treasury internal revenue service. Material advisors who file a form 8918 will receive a reportable transaction number from the irs.

Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. After june 1, 2022, the irs will accept only the latest version of form 8918 (rev. Material advisors to any reportable transaction file form 8918 to disclose certain information about the reportable transaction. Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the reportable transaction with the irs. Web form 8918 available on irs.gov. Web irs lets tax pros fax form 8918 for material advisor disclosures. These are transactions that the irs has specifically identified as possible tax abuse areas. Web form 8918 replaces form 8264, application for registration of a tax shelter. Web this form is for reporting to the irs something called a reportable or listed transaction.

Web catalog number 39533a form. The irs will accept prior versions of. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. Material advisor disclosure statement 1121 06/19/2022 After june 1, 2022, the irs will accept only the latest version of form 8918 (rev. Web this form is for reporting to the irs something called a reportable or listed transaction.

Fill Free fillable IRS PDF forms

Web this form is for reporting to the irs something called a reportable or listed transaction. Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. Form 8918 replaces form 8264, application for registration of a tax shelter. Material advisors who file a form 8918 will receive a reportable transaction number.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

Web irs lets tax pros fax form 8918 for material advisor disclosures. Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or.

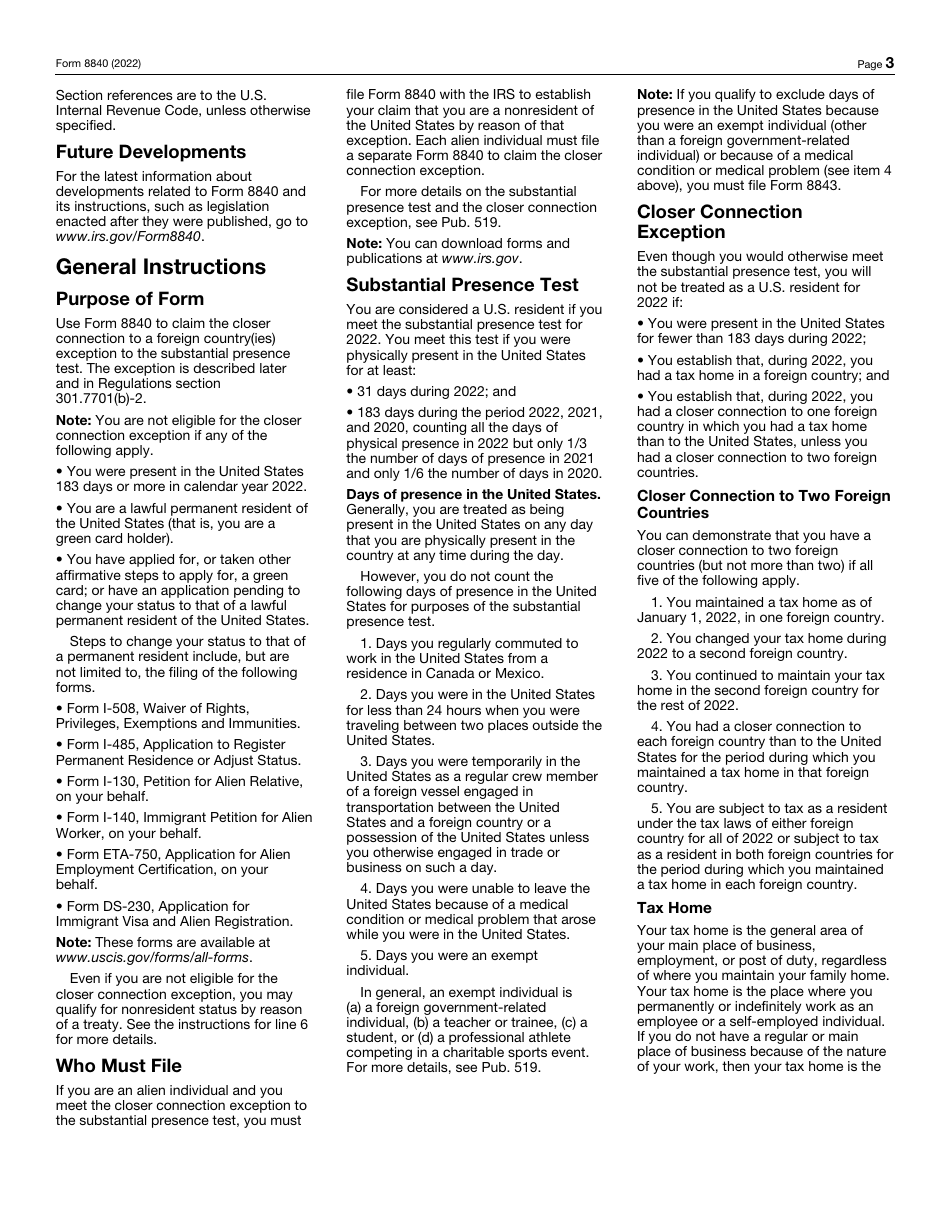

IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. Web form 8918 replaces form 8264, application for registration of a tax shelter. Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the.

Inst 8918Instructions for Form 8918, Material Advisor Disclosure Sta…

Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. Material advisors to any reportable transaction file form 8918 to disclose certain information about the reportable transaction. Web form 8918 is used by materials.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: Web irs lets tax pros fax form 8918 for material.

Inst 8918Instructions for Form 8918, Material Advisor Disclosure Sta…

Material advisors who file a form 8918 will receive a reportable transaction number from the irs. Material advisor disclosure statement 1121 06/19/2022 Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. Web irs lets tax pros fax form 8918 for material advisor disclosures. Instructions for.

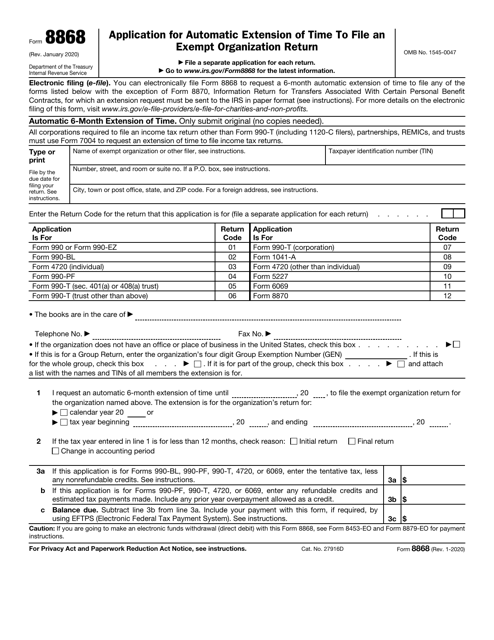

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Material advisor disclosure statement 1121 06/19/2022 Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: These are transactions that the irs has specifically identified as possible tax abuse areas. The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. Form 8918 replaces form.

IRS Fax Numbers Where You Can Send Your Tax Forms iFax

These are transactions that the irs has specifically identified as possible tax abuse areas. Web form 8918 replaces form 8264, application for registration of a tax shelter. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. Material advisors who file a form 8918 will. Web the.

Fillable Form 8918 Material Advisor Disclosure Statement printable

Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. Web until further notice, the irs is implementing the temporary procedure described below for.

Fill Free fillable Form 8918 2011 Material Advisor Disclosure

Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. These are transactions that the irs has specifically identified as possible tax abuse areas. Material advisors who file a form 8918 will.

Material Advisors Who File A Form 8918 Will Receive A Reportable Transaction Number From The Irs.

Material advisor disclosure statement 1121 06/19/2022 Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the reportable transaction with the irs. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. The reportable transaction number will be sent to the material advisor’s address below.

Web This Form Is For Reporting To The Irs Something Called A Reportable Or Listed Transaction.

General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. The material advisor is someone that helps create and. Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918:

November 2021) Department Of The Treasury Internal Revenue Service.

Web irs lets tax pros fax form 8918 for material advisor disclosures. Material advisors to any reportable transaction file form 8918 to disclose certain information about the reportable transaction. Web catalog number 39533a form. Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor.

Web A Material Advisor Required To File A Disclosure Statement Under This Section Must File A Completed Form 8918, “Material Advisor Disclosure Statement” (Or Successor Form) In Accordance With This Paragraph (D) And The Instructions To The Form.

After june 1, 2022, the irs will accept only the latest version of form 8918 (rev. The irs will accept prior versions of. Material advisors who file a form 8918 will. Web form 8918 replaces form 8264, application for registration of a tax shelter.