Irs Form 8997

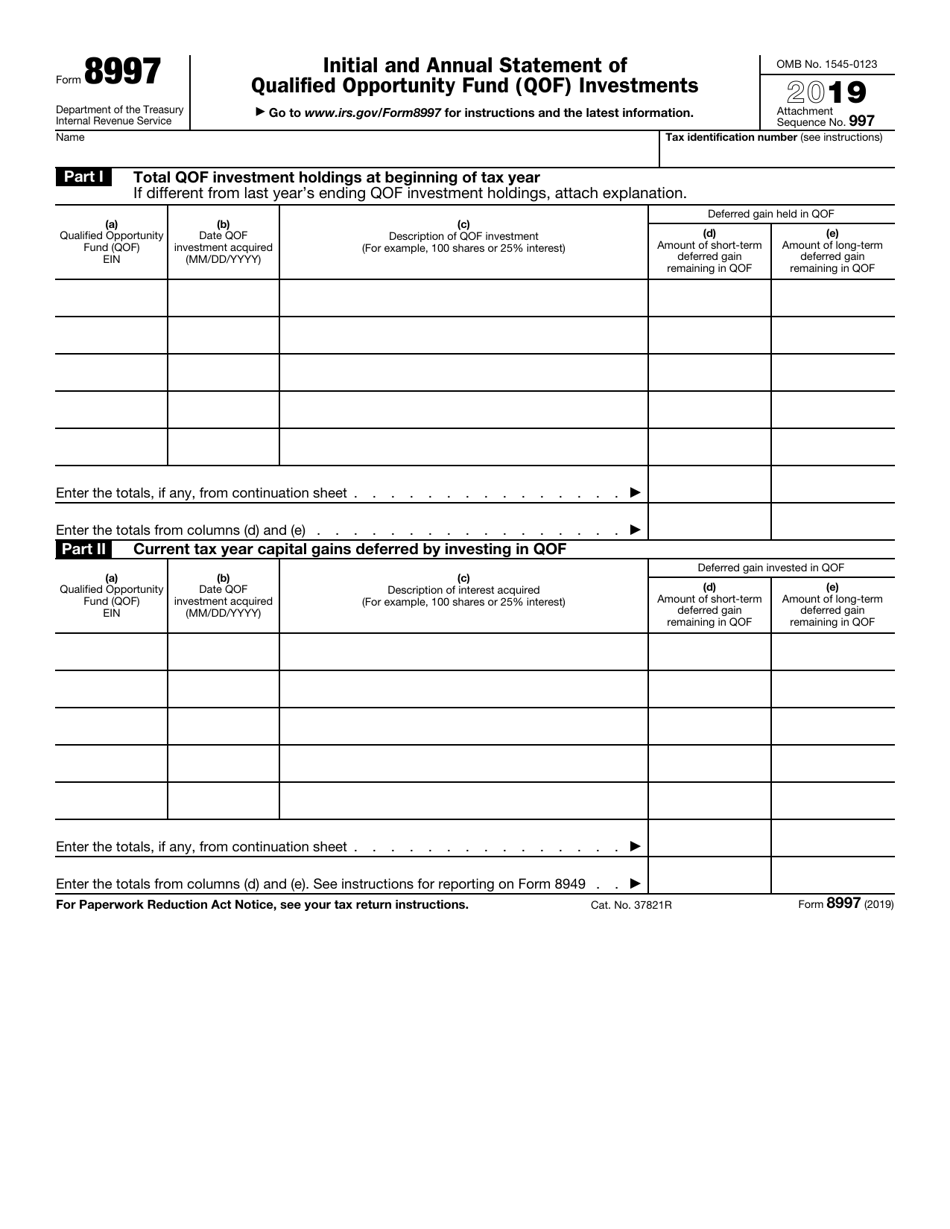

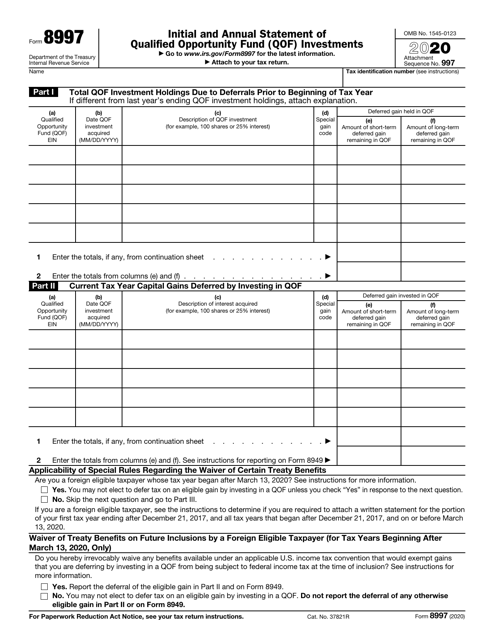

Irs Form 8997 - Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Qof investors sell a capital asset for a gain and drop that gain into a qof within 180 days, allowing them to defer taxes on the gain. Current year gain recognized from qof investments (through disposition or other inclusion event) 4. Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a qof and qof investments disposed of during the current tax year. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. This process starts with form 8949.

Current year gain recognized from qof investments (through disposition or other inclusion event) 4. Web the form 8997 consists of 4 parts: Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. This process starts with form 8949. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a qof and qof investments disposed of during the current tax year. You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Web form 8997, initial and annual statement of qualified opportunity fund (qof) investments any taxpayer who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Web what is form 8997? Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer?

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a qof and qof investments disposed of during the current tax year. You may not elect to defer tax on an eligible gain by investing in a qof unless you check “yes” in response to the next question. You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. See instructions for more information. Qof investors sell a capital asset for a gain and drop that gain into a qof within 180 days, allowing them to defer taxes on the gain. Web what is form 8997?

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Current year capital gains deferred through qof investment 3. Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Web what is form 8997? Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible.

IRS FORM 12257 PDF

Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). You may not elect to defer tax on an eligible gain by investing in a qof unless you check “yes” in response to the next question. 37821r form 8997 (2019) 2 part iii qof.

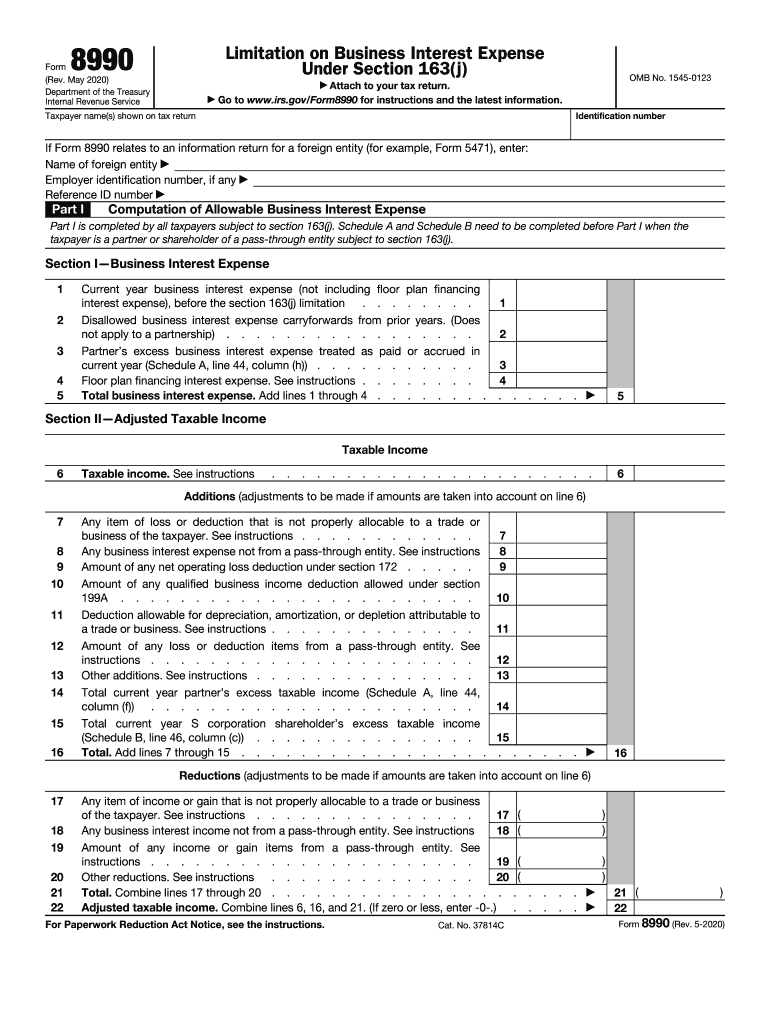

Irs Business 163 J Form Fill Out and Sign Printable PDF Template

Current year gain recognized from qof investments (through disposition or other inclusion event) 4. Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Current year capital gains deferred through qof investment 3. This process starts with form 8949. You can file.

IRS FORM 9297 SUMMARY OF CONTACT Get Tax Help

Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. Qof investors sell a capital asset for a gain and drop that gain into a qof within 180.

Irs Form 1090 T Universal Network

Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). Web what is form 8997? Web on september 25, 2019, the irs released draft form 8997, initial and.

IRS Form 1040es Estimated Tax for Individuals Lies on Flat Lay Office

Web what is form 8997? Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. Skip the next question and go to part iii. Current year capital gains.

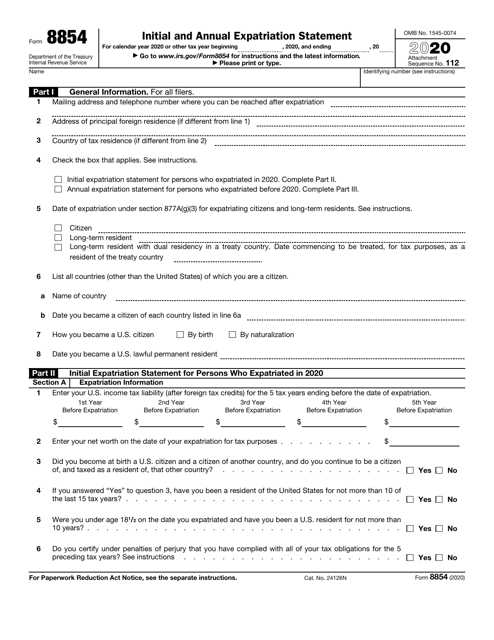

IRS Form 8854 Download Fillable PDF or Fill Online Initial and Annual

This process starts with form 8949. Qof investments held at the beginning of the year 2. Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). Web the form 8997 consists of 4 parts: You may not elect to defer tax on an eligible.

Qualified Opportunity Zones Are They Really Effective? Western CPE

Web the form 8997 consists of 4 parts: You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Let’s first summarize how investors defer capital gains using a qof ( qualified.

Fill Free fillable IRS PDF forms

You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Web on september 25, 2019, the irs released draft form 8997, initial and annual statement of qualified opportunity fund (qof) investments, which investors in qualified opportunity zone funds (qofs) must file to report qof investments held at the beginning and end of the current tax year, current tax year capital gains deferred by investing in qofs,. Let’s first summarize how.

Current Year Gain Recognized From Qof Investments (Through Disposition Or Other Inclusion Event) 4.

Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). This process starts with form 8949. Web what is form 8997? Skip the next question and go to part iii.

Web Form 8997, Initial And Annual Statement Of Qualified Opportunity Fund Investments Is A New Form.

Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Qof investors sell a capital asset for a gain and drop that gain into a qof within 180 days, allowing them to defer taxes on the gain. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments.

Web On September 25, 2019, The Irs Released Draft Form 8997, Initial And Annual Statement Of Qualified Opportunity Fund (Qof) Investments, Which Investors In Qualified Opportunity Zone Funds (Qofs) Must File To Report Qof Investments Held At The Beginning And End Of The Current Tax Year, Current Tax Year Capital Gains Deferred By Investing In Qofs,.

Web the form 8997 consists of 4 parts: See instructions for more information. Current year capital gains deferred through qof investment 3. 37821r form 8997 (2019) 2 part iii qof investments disposed of during current tax year deferred gain included due to disposition of qof interest qualified opportunity fund (qof) ein (b) date qof sold or disposed (mm/dd/yyyy) (c) description of interest disposed (for example, 100 shares or 25% interest)

Qof Investments Held At The Beginning Of The Year 2.

Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? You may not elect to defer tax on an eligible gain by investing in a qof unless you check “yes” in response to the next question. Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments.

.jpg)