Is There A New 941 Form For 2022

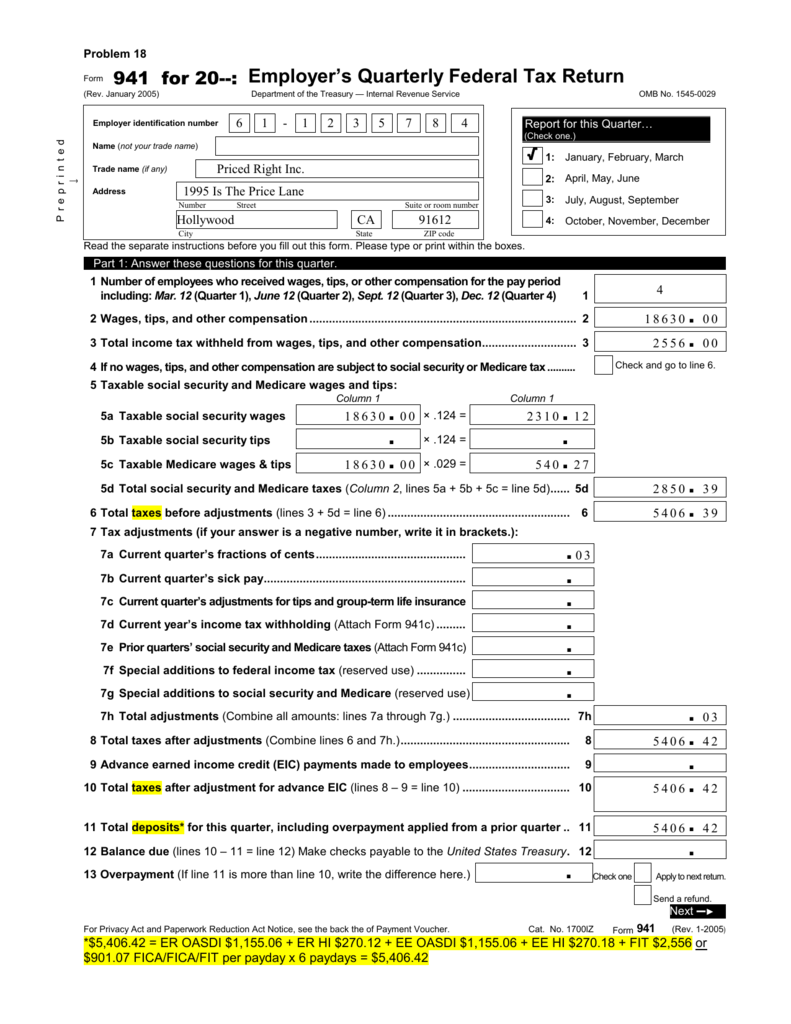

Is There A New 941 Form For 2022 - Web mar 08, 2022 form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. Web 2022 irs form 941 deposit rules and schedule dec 03, 2021 notice 931 sets the deposit rules and schedule for form 941 this information is also used for. If changes in law require additional changes to form 941, the. March 2022) employer’s quarterly federal tax return department of the treasury — internal. Web the irs expects the june 2022 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2022. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; March 2023) employer’s quarterly federal tax return department of the treasury — internal. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue. Web employer’s quarterly federal tax return form 941 for 2022:

If changes in law require additional changes to form 941, the. Form 941 is used by employers. Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. 26 by the internal revenue service. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Web employer’s quarterly federal tax return form 941 for 2023: Web mar 08, 2022 form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. Don't use an earlier revision to report taxes for 2023. Web employer’s quarterly federal tax return form 941 for 2022:

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue. Don't use an earlier revision to report taxes for 2023. Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. 26 by the internal revenue service. July 22, 2023 5:00 a.m. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The draft form 941, employer’s. How have the new form 941 fields been revised for q2 & q3 of 2022? Web an overview of the new form 941 for q2 & q3, 2022 ;

How to fill out IRS Form 941 2019 PDF Expert

Web the irs expects the june 2022 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2022. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service. March 2022) employer’s quarterly federal tax return department.

Form 941 for 20 Employer's Quarterly Federal Tax Return

Web the 2022 list will be used again in 2028, and the 2023 list was last used in 2017. If changes in law require additional. The draft form 941, employer’s. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Web use the march 2023 revision of form 941 to report taxes for.

Don’t Worksheet 1 When You File Your Form 941 this Quarter

In recent years several changes to the. When is the deadline to file form. If all of the names are exhausted — as happened in 2020, when there were 30. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web december 6, 2022 draft as of form 941 for 2023:

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Ad prepare your quarterly return from any device without installing with uslegalforms. Web employer’s quarterly federal tax return form 941 for 2022: When is the deadline to file form. This is the final week the social security administration is sending out payments for july. If changes in law require additional.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

If changes in law require additional. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. If changes in law require additional changes to form 941, the. Web mar 08, 2022 form.

Update on IRS Form 941 Changes Effective Immediately

March 2022) employer’s quarterly federal tax return department of the treasury — internal. If changes in law require additional. Web the 2022 list will be used again in 2028, and the 2023 list was last used in 2017. Web the irs expects the june 2022 revision of form 941 and these instructions to be used for the second, third, and.

How to Fill out IRS Form 941 Simple StepbyStep Instructions YouTube

If changes in law require additional changes to form 941, the. Web the irs expects the june 2022 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2022. Web irs issues form 941 for 1st quarter of 2022 jazlyn williams editor/writer a revised form 941 and instructions were released forms and.

Formulario 941 Instrucciones e información sobre el Formulario de

Web december 6, 2022 draft as of form 941 for 2023: Web mar 08, 2022 form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. July 22, 2023 5:00 a.m. 26 by the internal revenue service. Web information about form 941, employer's quarterly.

New 941 form for second quarter payroll reporting

July 22, 2023 5:00 a.m. Web employer’s quarterly federal tax return form 941 for 2022: The draft form 941, employer’s. When is the deadline to file form. At this time, the irs expects the march.

Form 941 Employer's Quarterly Federal Tax Return Definition

Complete, edit or print tax forms instantly. If all of the names are exhausted — as happened in 2020, when there were 30. The draft form 941, employer’s. Web 2022 irs form 941 deposit rules and schedule dec 03, 2021 notice 931 sets the deposit rules and schedule for form 941 this information is also used for. When is the.

July 22, 2023 5:00 A.m.

Web mar 08, 2022 form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. 26 by the internal revenue service. In recent years several changes to the. How have the new form 941 fields been revised for q2 & q3 of 2022?

Complete, Edit Or Print Tax Forms Instantly.

The draft form 941 ,. Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Ad prepare your quarterly return from any device without installing with uslegalforms. Web a draft version of form 941 for use in the second to fourth quarters of 2022 was issued april 14 by the internal revenue service.

Web 2022 Irs Form 941 Deposit Rules And Schedule Dec 03, 2021 Notice 931 Sets The Deposit Rules And Schedule For Form 941 This Information Is Also Used For.

If changes in law require additional. Web an overview of the new form 941 for q2 & q3, 2022 ; March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue. Web irs issues form 941 for 1st quarter of 2022 jazlyn williams editor/writer a revised form 941 and instructions were released forms and instructions also were.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Web form 941 is an essential form for all employers that pay employees and withhold federal and fica (social security and medicare) taxation. If changes in law require additional changes to form 941, the. The draft form 941, employer’s. Web employer’s quarterly federal tax return form 941 for 2023:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)