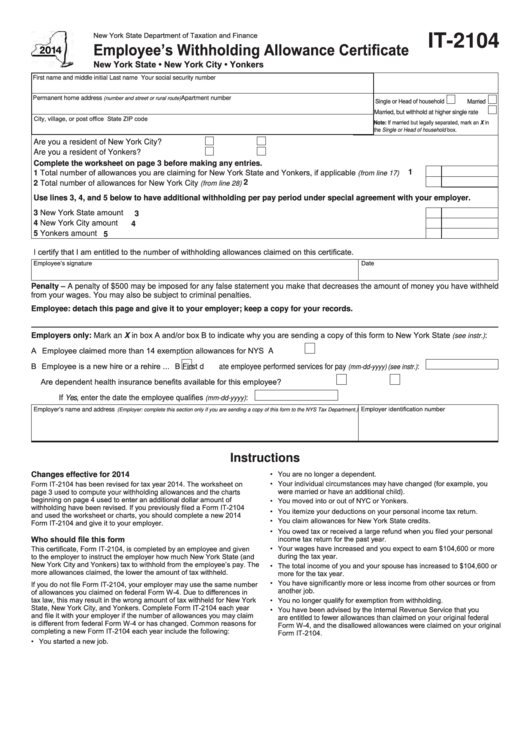

It-2104 Form 2022

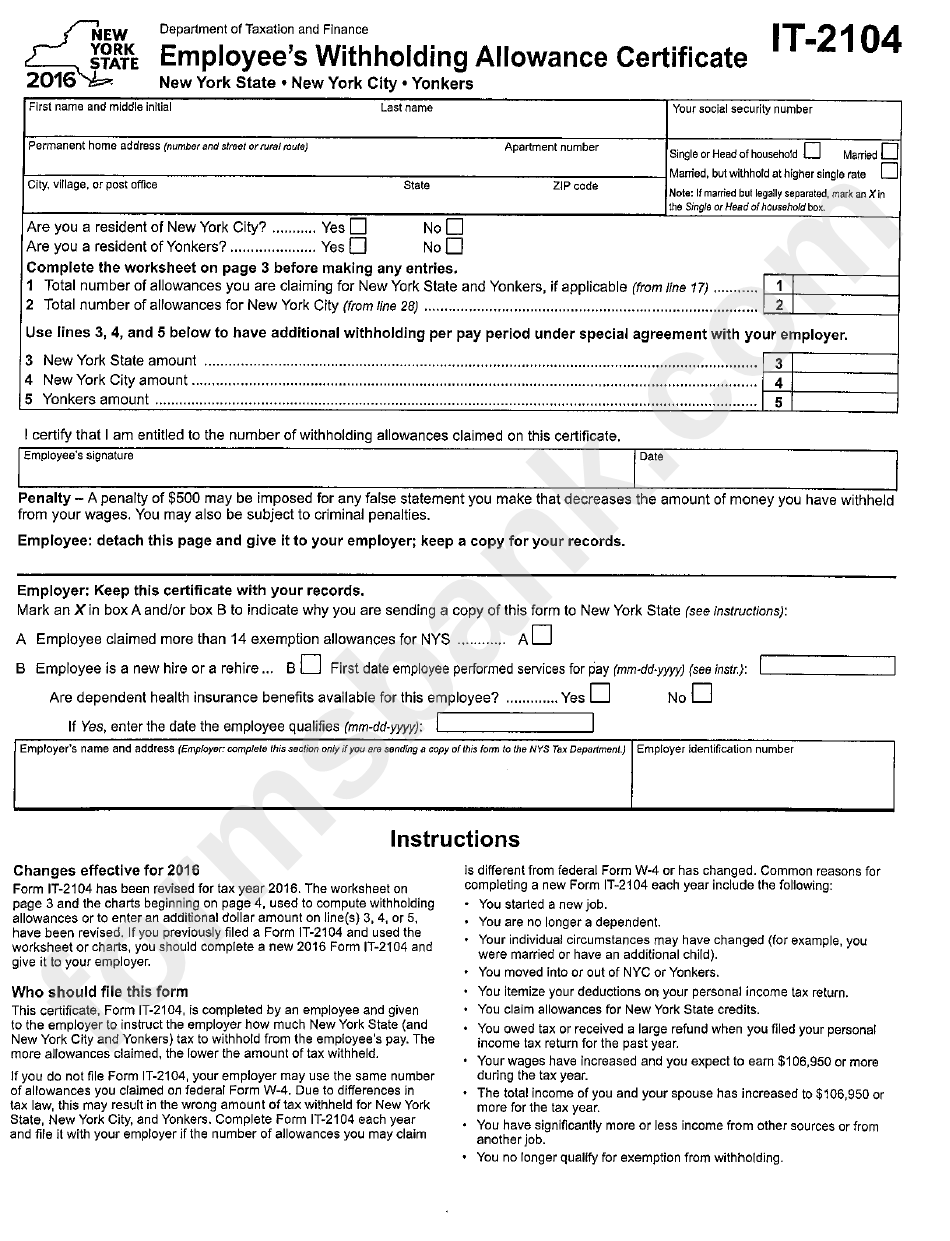

It-2104 Form 2022 - Make adobe acrobat the reader. If you become a new york state, new york city, or yonkers resident, or You must file a new certificate each year if you Web 8 rows employee's withholding allowance certificate. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. Complete the requested boxes that are colored in yellow. 12 by the state department of taxation and finance. The one you fill out depends on a variety of factors that may apply to you and your situation. • you started a new job. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances on line (s) 3, 4, or 5, have been revised.

Using firefox with pdf forms? Make adobe acrobat the reader. • you are no longer a dependent. Complete the requested boxes that are colored in yellow. Web employee's withholding allowance certificate. You must file a new certificate each year if you The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional dollar amount on line(s) 3, 4, or 5, have been revised. 12 by the state department of taxation and finance. Read through all pages of the document to find specific. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised.

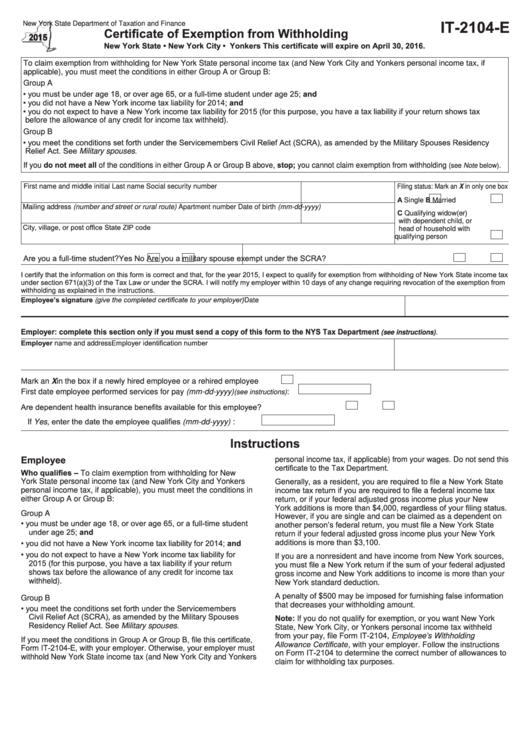

The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances on line (s) 3, 4, or 5, have been revised. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. Certificate of exemption from withholding. You must file a new certificate each year if you Using firefox with pdf forms? To claim exemption from income tax withholding, you must file Web 8 rows employee's withholding allowance certificate. Web new york’s 2022 withholding certificate was released jan. 12 by the state department of taxation and finance. • you started a new job.

Fillable Form It2104 Employee'S Withholding Allowance Certificate

You must file a new certificate each year if you The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional dollar amount on line(s) 3, 4, or 5, have been revised. How to make an signature for the nys form it 2104 2019 in chrome it 2104 for.

2022 Form NY DTF IT2104SNY Fill Online, Printable, Fillable, Blank

• you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Web 8 rows employee's withholding allowance certificate. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. • you are no longer a.

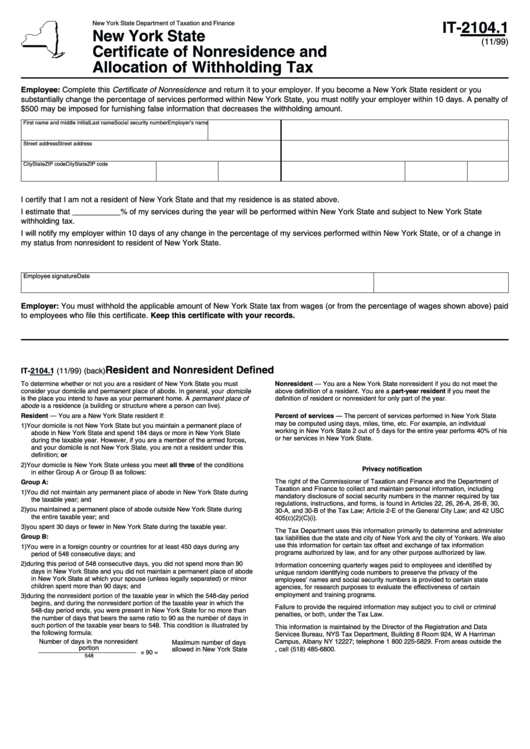

NY DTF IT2104.2 2000 Fill out Tax Template Online US Legal Forms

Using firefox with pdf forms? • you are no longer a dependent. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. Press the green arrow with the inscription next to move on from box to box. If you become a new york.

Fillable Form It2104.1 Certificate Of Nonresidence And Allocation Of

You must file a new certificate each year if you Make adobe acrobat the reader. Complete this form and return it to your employer. How to make an signature for the nys form it 2104 2019 in chrome it 2104 for 2019browser has gained its worldwide popularity due to its number of useful features, extensions and. Complete the requested boxes.

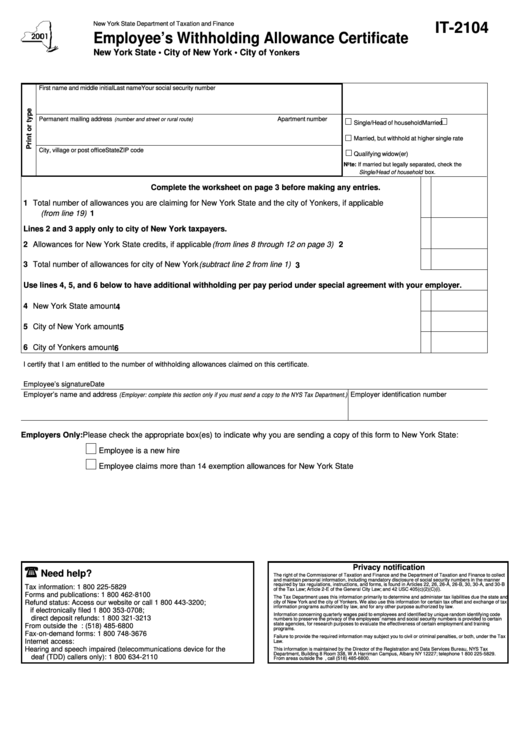

Employee's Withholding Allowance Certificate Form 2022 2023

• you are no longer a dependent. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. Web 8 rows employee's withholding allowance certificate. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on.

Form It2104 Employee'S Withholding Allowance Certificate printable

The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. Read through all pages of the document to find specific. Certificate of exemption from withholding. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances on.

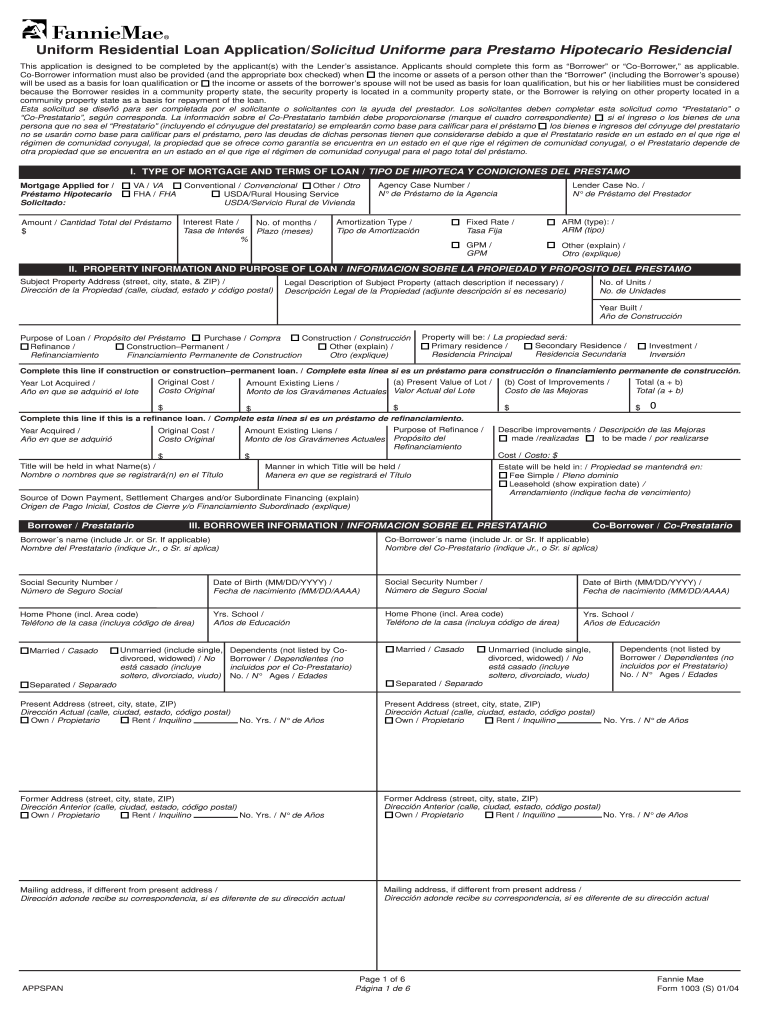

Form 1003 in spanish Fill out & sign online DocHub

The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. If you become a new york state, new york city, or yonkers resident, or The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on.

Fillable Form It2104E Certificate Of Exemption From Withholding

Certificate of exemption from withholding. You must file a new certificate each year if you The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances or to enter an additional dollar amount on line(s) 3, 4, or 5, have been revised. The worksheet and the charts below, used to compute withholding allowances or.

84 TAX FORM IT2104, FORM IT2104 TAX Form

• you started a new job. Web 8 rows employee's withholding allowance certificate. The one you fill out depends on a variety of factors that may apply to you and your situation. Web new york’s 2022 withholding certificate was released jan. The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances on line.

Form It2104 Employee'S Withholding Allowance Certificate 2016

The one you fill out depends on a variety of factors that may apply to you and your situation. Web employee's withholding allowance certificate. Press the green arrow with the inscription next to move on from box to box. If you become a new york state, new york city, or yonkers resident, or How to make an signature for the.

Web Employee's Withholding Allowance Certificate.

The one you fill out depends on a variety of factors that may apply to you and your situation. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised. 12 by the state department of taxation and finance. The worksheet and the charts below, used to compute withholding allowances or to enter an additional dollar amount on line 3, 4, or 5, have been revised.

Press The Green Arrow With The Inscription Next To Move On From Box To Box.

• you started a new job. Web 8 rows employee's withholding allowance certificate. Read through all pages of the document to find specific. Web new york’s 2022 withholding certificate was released jan.

How To Make An Signature For The Nys Form It 2104 2019 In Chrome It 2104 For 2019Browser Has Gained Its Worldwide Popularity Due To Its Number Of Useful Features, Extensions And.

The worksheet on page 4 and the charts beginning on page 5, used to compute withholding allowances on line (s) 3, 4, or 5, have been revised. Make adobe acrobat the reader. Complete the requested boxes that are colored in yellow. If you become a new york state, new york city, or yonkers resident, or

Complete This Form And Return It To Your Employer.

To claim exemption from income tax withholding, you must file • you are no longer a dependent. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Certificate of exemption from withholding.