Ky Form 740-Es 2022

Ky Form 740-Es 2022 - Web • pay all of your estimated tax by january 18, 2022. Web estimated income tax return. At this time, dor accepts payments by credit card or electronic. Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income tax return for use by all taxpayers. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. Web download the taxpayer bill of rights. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser.

Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income tax return for use by all taxpayers. At this time, dor accepts payments by credit card or electronic. Check if estate or trust. The regular deadline to file a kentucky state income tax return is april. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. In this case, 2021 estimated tax. Web download the taxpayer bill of rights. Web • pay all of your estimated tax by january 18, 2022. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one.

At this time, dor accepts payments by credit card or electronic. Web form 740 is the kentucky income tax return for use by all taxpayers. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. In this case, 2021 estimated tax. The regular deadline to file a kentucky state income tax return is april. Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web • pay all of your estimated tax by january 18, 2022. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web estimated income tax return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

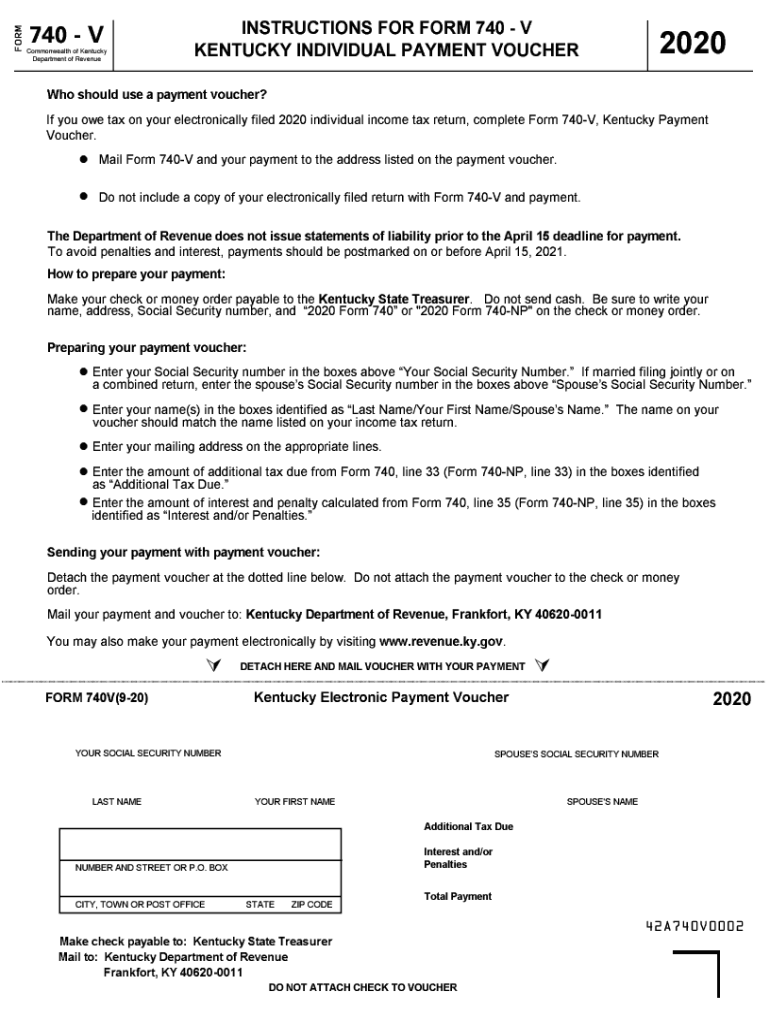

2020 Form KY 740V Fill Online, Printable, Fillable, Blank pdfFiller

If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. Web more about the kentucky form 740 individual income tax tax return ty 2022 form.

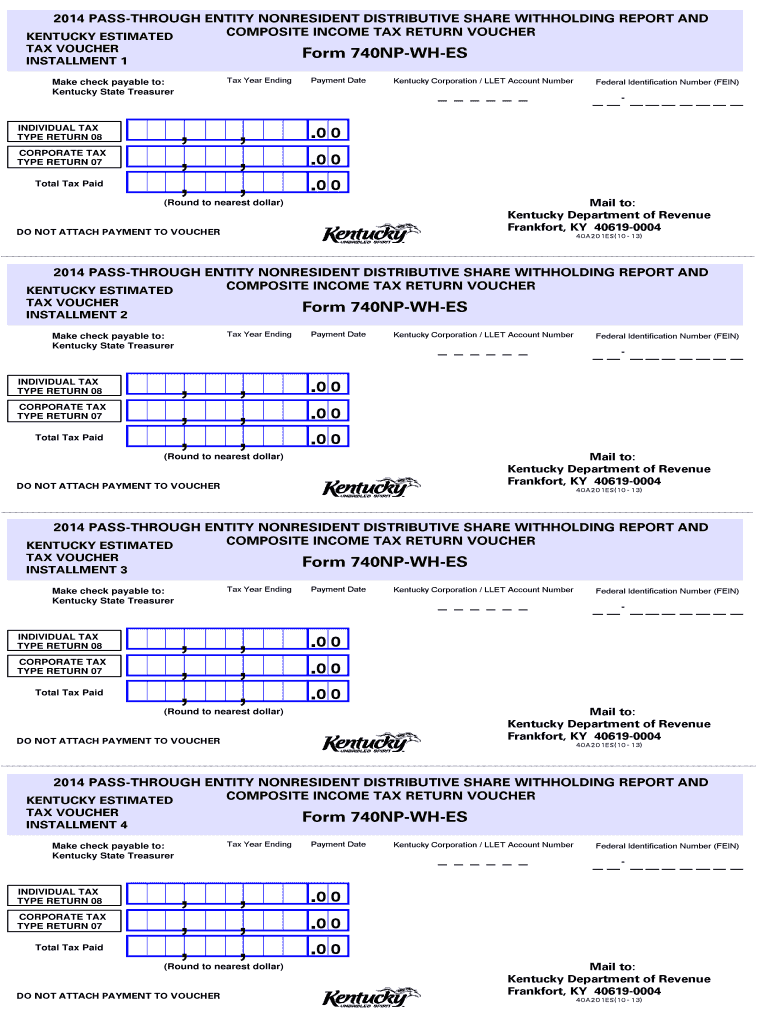

2013 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

At this time, dor accepts payments by credit card or electronic. Web • pay all of your estimated tax by january 18, 2022. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web most taxpayers are required.

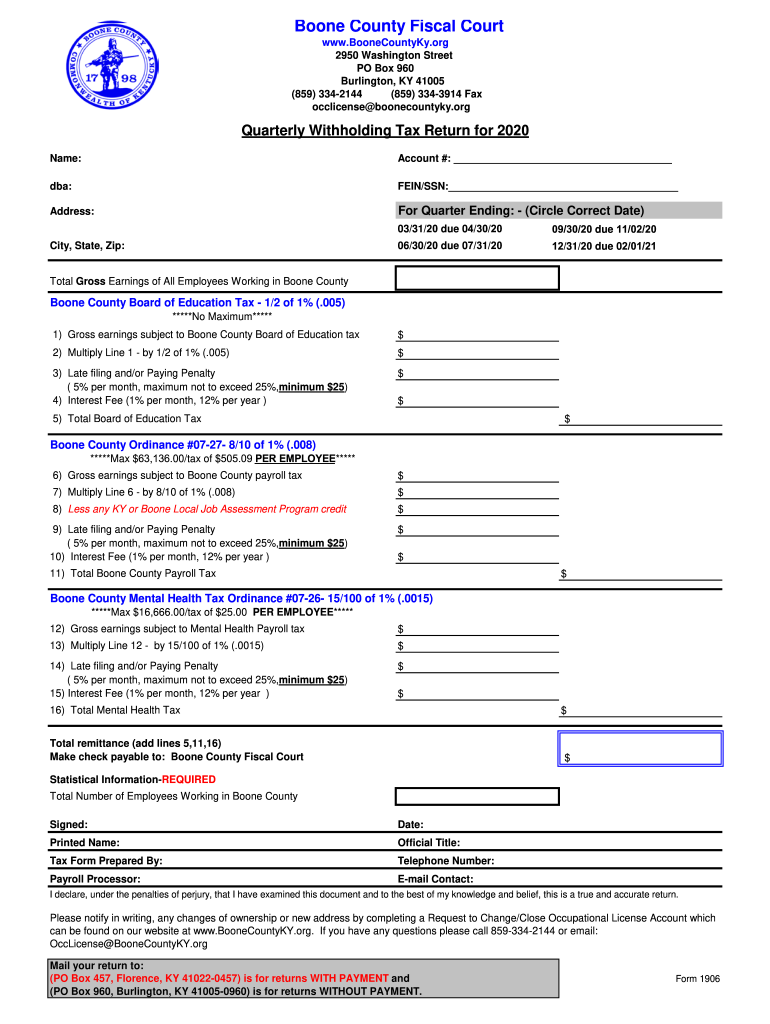

Ky Quarterly Tax Fill Out and Sign Printable PDF Template signNow

In this case, 2021 estimated tax. Web form 740 is the kentucky income tax return for use by all taxpayers. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. At this time, dor accepts payments by credit card or electronic. Web form 740 kentucky —.

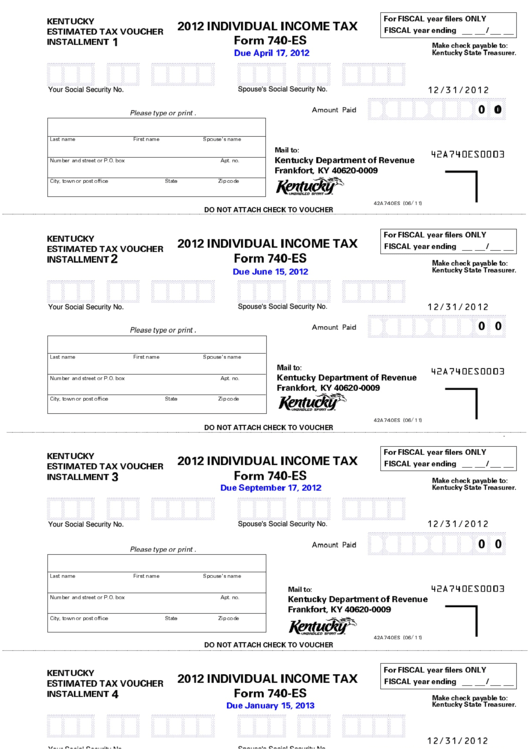

Fillable Form 740Es Individual Tax Estimated Tax Voucher

At this time, dor accepts payments by credit card or electronic. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income tax return for use by all taxpayers. Check if estate or trust. Web.

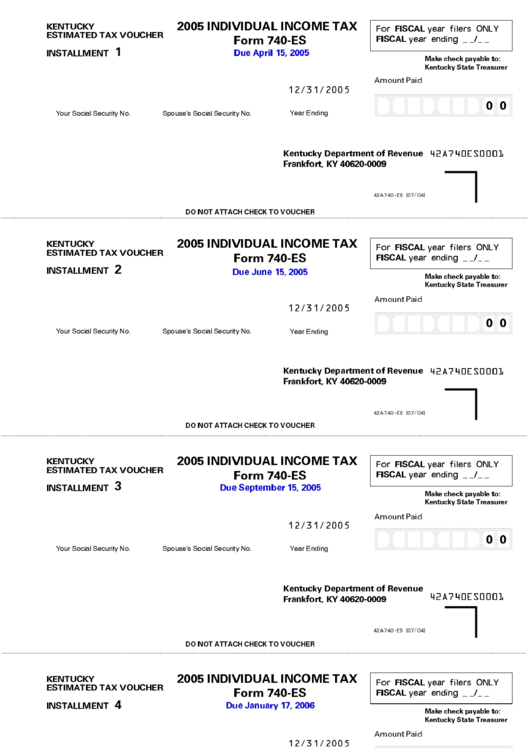

Form 740Es 2005 Individual Tax Kentucky Department Of

Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web estimated income tax return. In this case, 2021 estimated tax. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. This pdf packet includes form 740,.

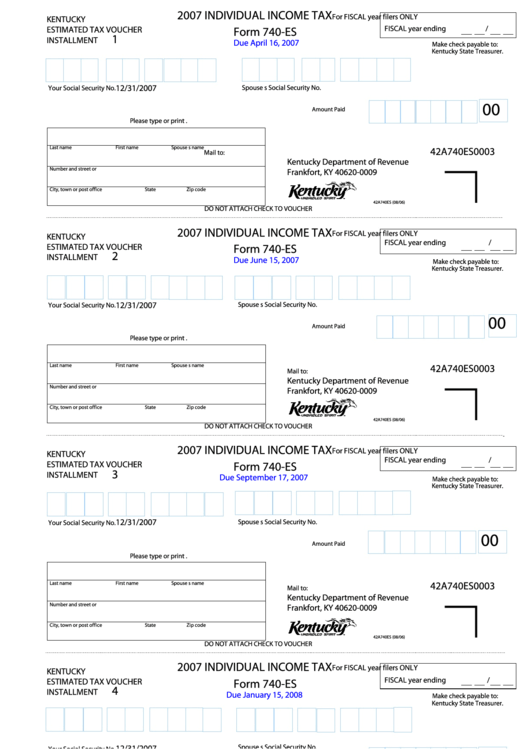

Fillable Form 740Es Individual Tax 2007 printable pdf download

At this time, dor accepts payments by credit card or electronic. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income tax return for use by all taxpayers. Web download the taxpayer bill of.

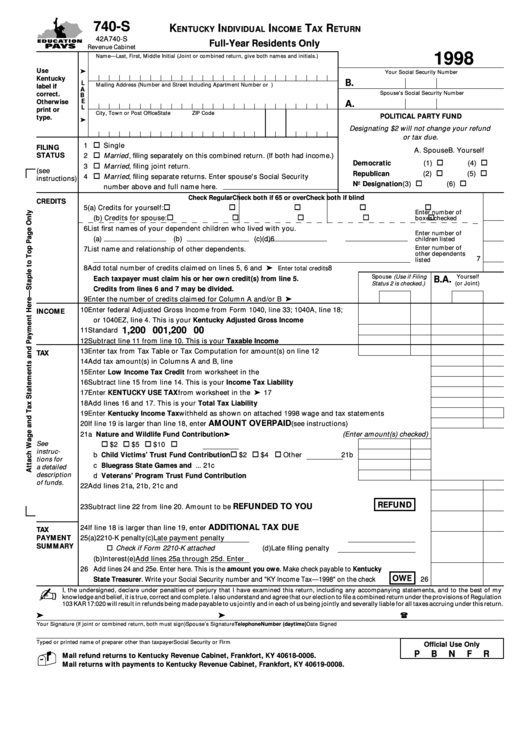

Printable Kentucky State Tax Forms Printable Form 2022

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web estimated income tax return. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Web form 740 kentucky — kentucky individual income tax return download this form print this.

740Np Wh Fill Out and Sign Printable PDF Template signNow

Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's.

Kentucky Yearly Vehicle Tax VEHICLE UOI

Check if estate or trust. The regular deadline to file a kentucky state income tax return is april. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. This pdf packet includes form 740, supplemental schedules, and tax.

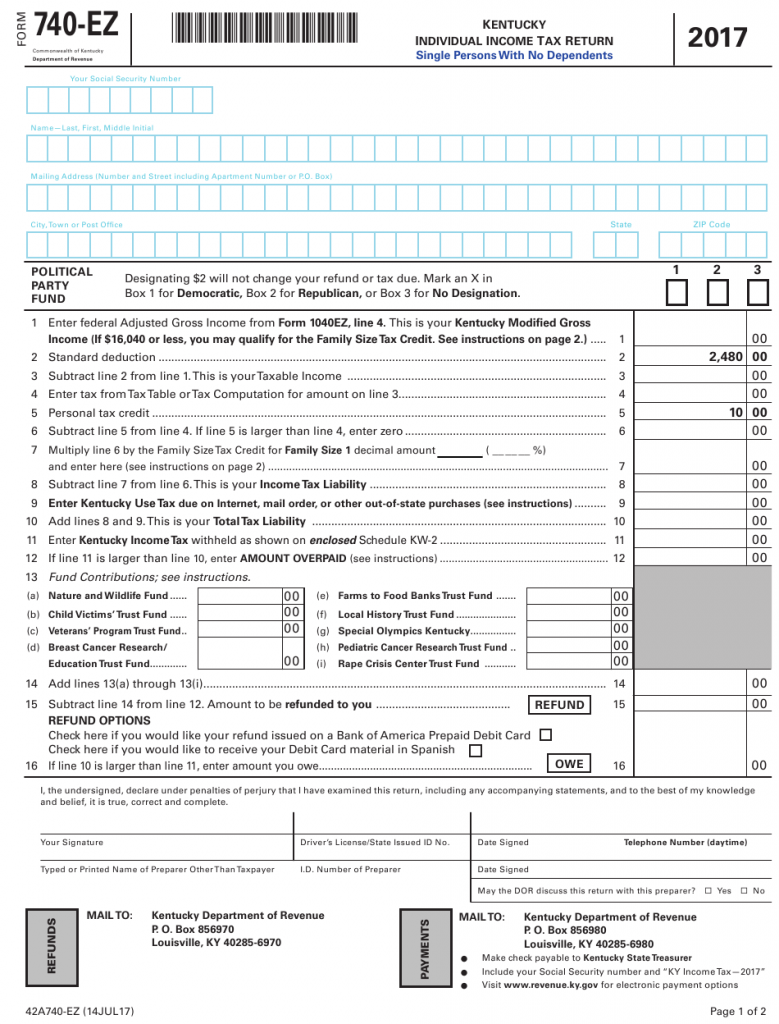

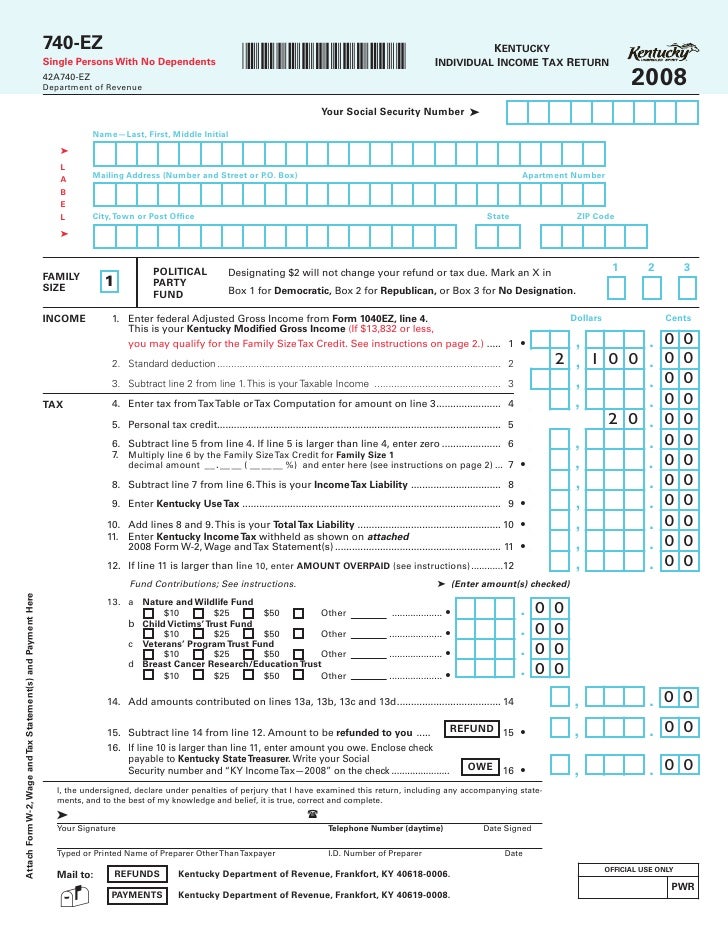

740EZ 2008 Kentucky Individual Tax Return Form 42A740EZ

Web • pay all of your estimated tax by january 18, 2022. Check if estate or trust. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. Web estimated income tax return. Web form 740 is the kentucky income tax return for use by all taxpayers.

Web Download The Taxpayer Bill Of Rights.

In this case, 2021 estimated tax. Check if estate or trust. The regular deadline to file a kentucky state income tax return is april. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

Web Estimated Income Tax Return.

Web • pay all of your estimated tax by january 18, 2022. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. At this time, dor accepts payments by credit card or electronic.

Web More About The Kentucky Form 740 Individual Income Tax Tax Return Ty 2022 Form 740 Is The Kentucky Income Tax Return For Use By All Taxpayers.

Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web form 740 is the kentucky income tax return for use by all taxpayers. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky.