Lansing Mi City Tax Form

Lansing Mi City Tax Form - Handy tips for filling out l 1040. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Get ready for tax season deadlines by completing any required tax forms today. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. The city of east lansing will also accept the common form versions of these. Web here you can find all the different ways to submit your city of lansing income taxes. Refer to the outlined fillable fields. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web city income tax forms.

The remaining estimated tax is due in three. Web see options to pay tax and applicable tax rates. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Handy tips for filling out l 1040. Web find forms and resources for the city of lansing city assessor regarding personal property, property transfers and more. Web city tax information and assistance for city individual income tax and city business and fiduciary taxes. This is where to insert your data. All lansing income tax forms are available on the city’s website, www.lansingmi.gov. Refer to the outlined fillable fields. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to.

Web here you can find all the different ways to submit your city of lansing income taxes. Get ready for tax season deadlines by completing any required tax forms today. Refer to the outlined fillable fields. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information. Web see options to pay tax and applicable tax rates. Handy tips for filling out l 1040. Complete, edit or print tax forms instantly. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web this page is an attempt to give you all the information you may need about floodplain permit requirements in the city of lansing.

Lansing, Michigan (MI) map, earnings map, and wages data

Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Complete, edit or print tax forms instantly. Web filling out the.

City of East Lansing needs tax, including MSU employees

These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. The remaining estimated tax is due in three. The city of east lansing will also accept the common form versions of these. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local.

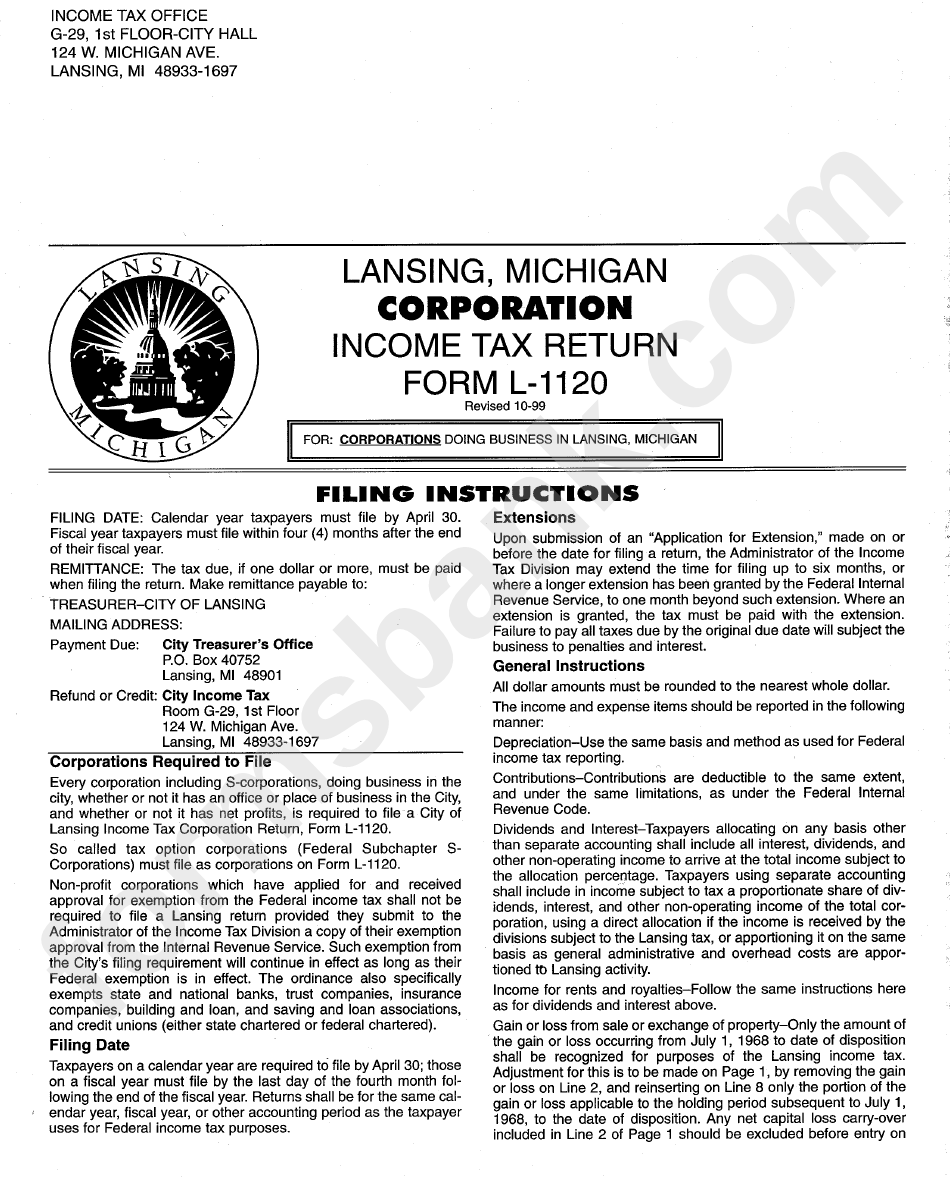

Form L1120 Lansing, Michigan Corporation Tax Return printable

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Web welcome to the city of lansing income tax online office,.

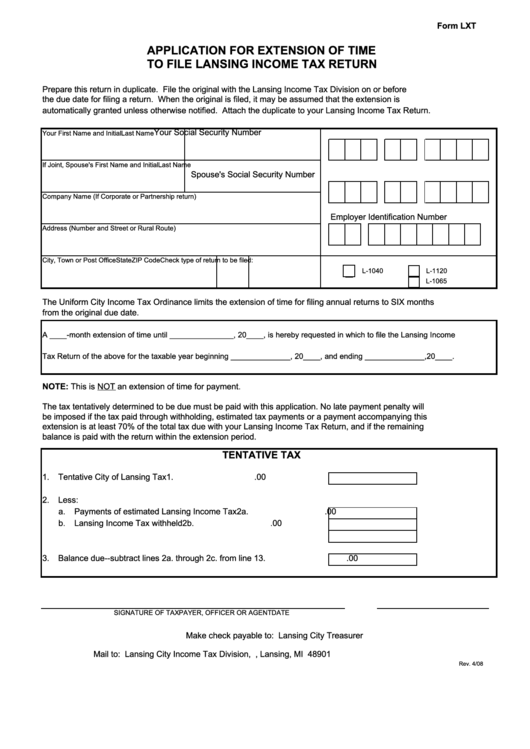

Fillable Form Lxt Application For Extension Of Time To File Lansing

Web follow the simple instructions below: The city of east lansing will also accept the common form versions of these. Web filling out the city of lansing tax forms 2021 with signnow will give better confidence that the output template will be legally binding and safeguarded. Handy tips for filling out l 1040. City estimated individual income tax voucher.

Lansing MI City Vector Road Map Blue Text Digital Art by Frank Ramspott

Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. The remaining estimated tax is due in three. The city of east lansing will also accept the common form versions of these. Tax at.

Pin on Ministry Connections

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. The city of east lansing will also accept the common form versions of these. Web tax at {tax rate} (multiply line 22 by lansing resident tax.

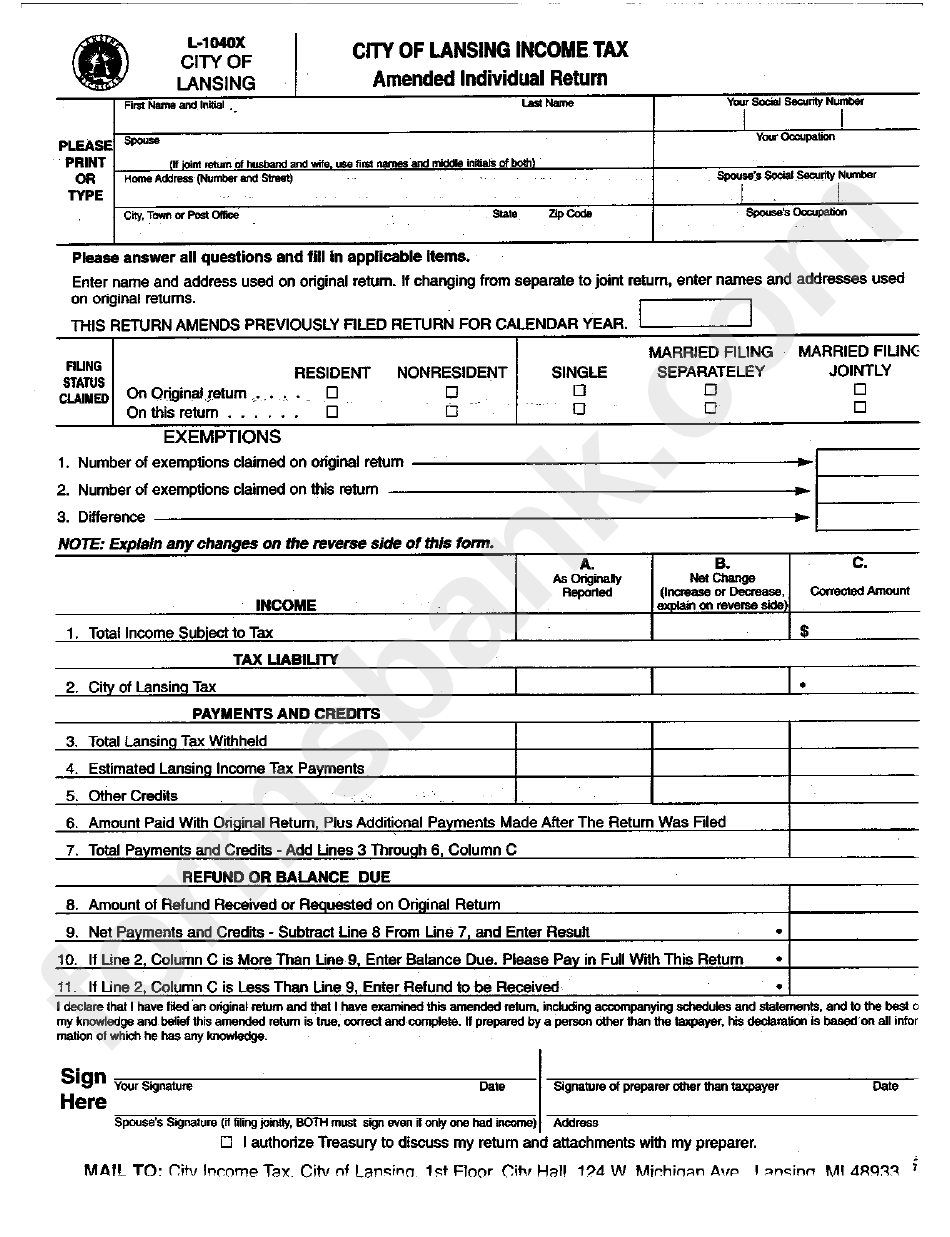

Form L1040x City Of Lansing Tax Amended Individual Return

Refer to the outlined fillable fields. Web filling out the city of lansing tax forms 2021 with signnow will give better confidence that the output template will be legally binding and safeguarded. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line.

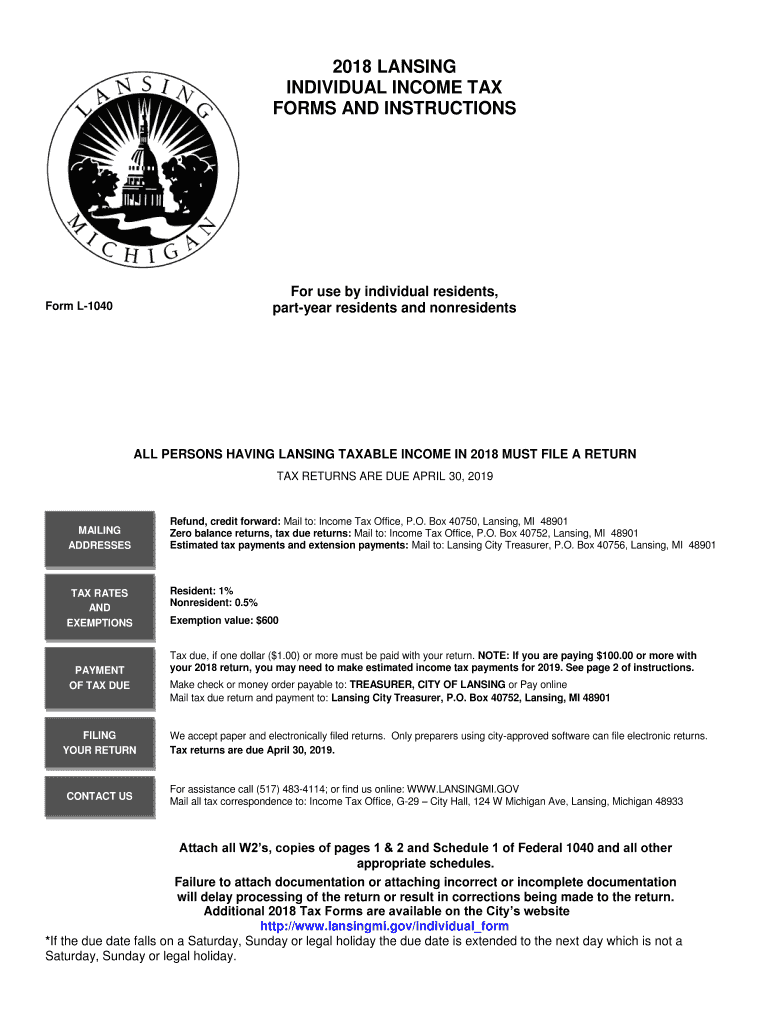

Lansing Tax Form Fill Out and Sign Printable PDF Template

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. Web this page is an attempt to give you.

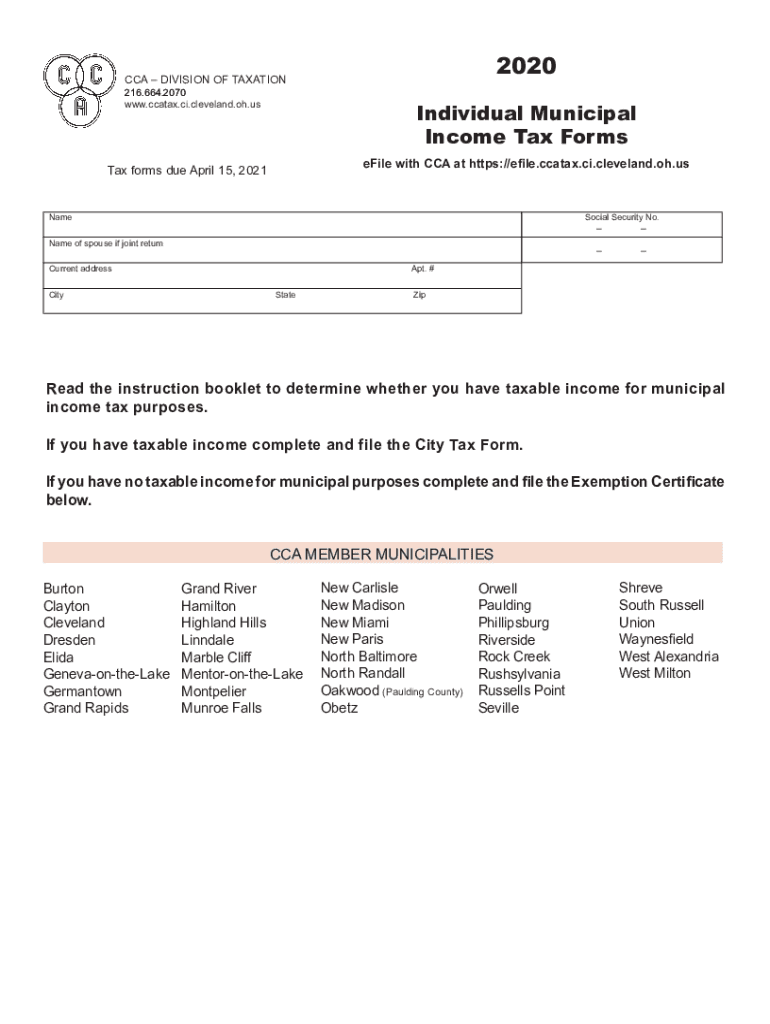

Cca Form Tax Fill Out and Sign Printable PDF Template signNow

These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. All lansing income tax forms are available on the city’s website, www.lansingmi.gov. Web follow the simple instructions below: Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax.

Top 7 City Of Lansing Tax Forms And Templates free to download in PDF

Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute..

Web Learn About Property Tax, Income Tax, Employer Withholding, False Alarm System Registration And Invoice Payments As Well As Other Treasury Related Services.

All lansing income tax forms are available on the city’s website, www.lansingmi.gov. Web here you can find all the different ways to submit your city of lansing income taxes. These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. Web follow the simple instructions below:

Web This Page Is An Attempt To Give You All The Information You May Need About Floodplain Permit Requirements In The City Of Lansing.

Web city income tax forms. Click the city name to access the appropriate. This is where to insert your data. Web see options to pay tax and applicable tax rates.

Web Tax At {Tax Rate} (Multiply Line 22 By Lansing Resident Tax Rate Of 1.% (0.01) Or Nonresident Tax Rate Of 0.5% (0.005) And Enter Tax On Line 23B, Or If Using Schedule Tc To Compute.

Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Complete, edit or print tax forms instantly. The city of east lansing will also accept the common form versions of these.

Web City Income Tax Return Application For Extension Of Time To File.

Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. The remaining estimated tax is due in three. Handy tips for filling out l 1040. City estimated individual income tax voucher.