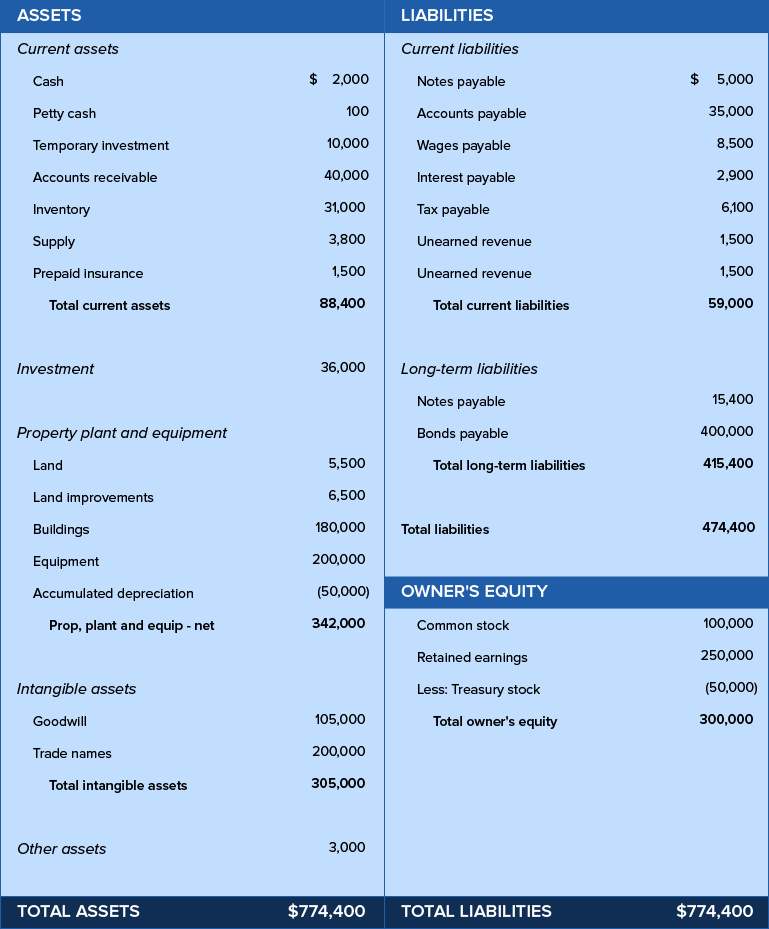

List Of Liabilities On A Balance Sheet

List Of Liabilities On A Balance Sheet - Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web t he assets and liabilities are separated into two categories: Web examples of these liabilities include: More liquid accounts, such as inventory, cash, and trades payables, are placed in. Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Web common current liabilities include: This is a list of what the company owes. Web current liabilities accounts might include: Interest payable is accumulated interest.

This is a list of what the company owes. Web examples of these liabilities include: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web t he assets and liabilities are separated into two categories: Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Interest payable is accumulated interest. Web current liabilities accounts might include: More liquid accounts, such as inventory, cash, and trades payables, are placed in. Web common current liabilities include:

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web examples of these liabilities include: This is a list of what the company owes. More liquid accounts, such as inventory, cash, and trades payables, are placed in. Interest payable is accumulated interest. Web current liabilities accounts might include: Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Web common current liabilities include: Web t he assets and liabilities are separated into two categories:

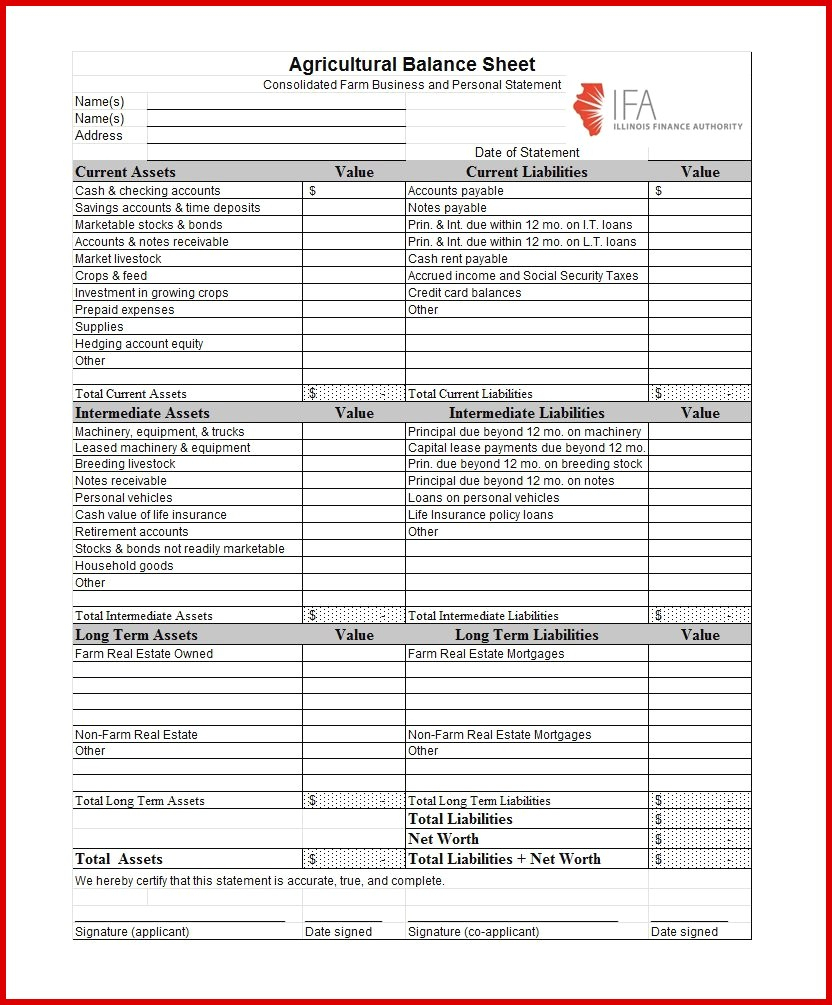

Balance Sheet Spreadsheet Template with regard to Lovely Account

Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Web t he assets and liabilities are separated into two categories: Web common current liabilities include: Interest payable is accumulated interest. Web current liabilities accounts might include:

Liabilities How to classify, Track and calculate liabilities?

Web examples of these liabilities include: Web current liabilities accounts might include: This is a list of what the company owes. Interest payable is accumulated interest. More liquid accounts, such as inventory, cash, and trades payables, are placed in.

How To Calculate Current Liabilities Haiper

Web examples of these liabilities include: Web current liabilities accounts might include: This is a list of what the company owes. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web t he assets and liabilities are separated into two categories:

un service soie Le propriétaire different types of balance sheet

Web t he assets and liabilities are separated into two categories: This is a list of what the company owes. Web current liabilities accounts might include: Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Web common current liabilities include:

The Importance of an Accurate Balance Sheet Basis 365 Accounting

Web examples of these liabilities include: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web current liabilities accounts might include: Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. More.

A Beginner's Guide to the Types of Liabilities on a Balance Sheet

Web t he assets and liabilities are separated into two categories: Interest payable is accumulated interest. This is a list of what the company owes. Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Web current liabilities accounts might include:

Assets vs. Liabilities Differences, Types & Examples

Web t he assets and liabilities are separated into two categories: Interest payable is accumulated interest. Web current liabilities accounts might include: Web examples of these liabilities include: This is a list of what the company owes.

Display of current liabilities in the Balance Sheet (Statement of

This is a list of what the company owes. Web t he assets and liabilities are separated into two categories: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web examples of these liabilities include: Web current liabilities accounts might include:

What Is a Balance Sheet?

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. More liquid accounts, such as inventory, cash, and trades payables, are placed in..

The Accounting Equation

Web current liabilities accounts might include: Web examples of these liabilities include: Web t he assets and liabilities are separated into two categories: Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. Interest payable is accumulated interest.

Web Examples Of These Liabilities Include:

Web common current liabilities include: This is a list of what the company owes. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Web current liabilities accounts might include:

Web T He Assets And Liabilities Are Separated Into Two Categories:

Loans that you take out on a car or house or for other personal purchases credit card payments mortgage payments student debt loans for other personal purchases. More liquid accounts, such as inventory, cash, and trades payables, are placed in. Interest payable is accumulated interest.

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)