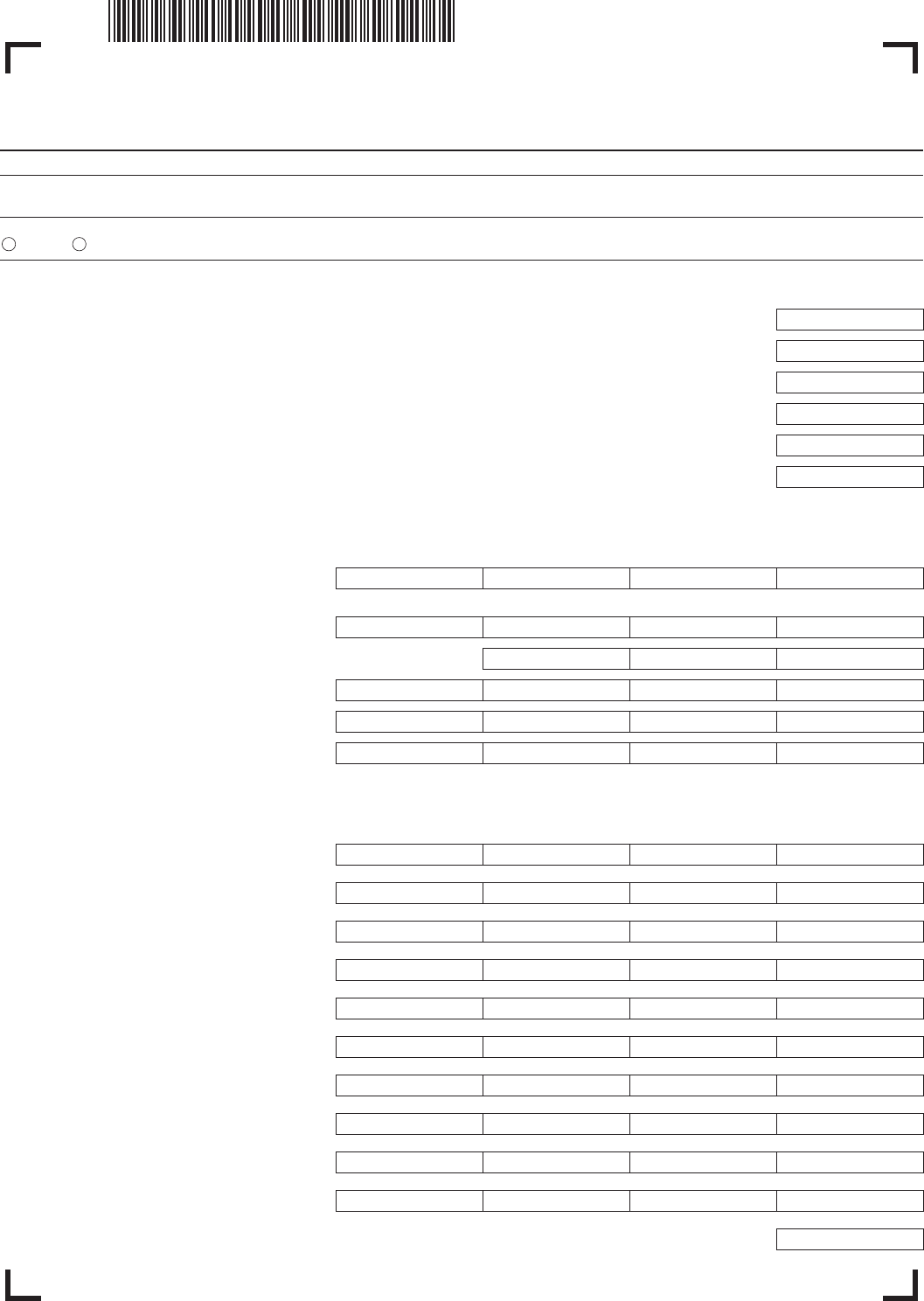

M-2210 Form

M-2210 Form - Web 1 4 executive office of the president office of management and budget washington, d.c. This form is for income earned in tax year 2022, with tax. Web what is form m 2210? Web mtfcy recipients can report changes: The irs will generally figure your penalty for you and you should not file form 2210. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Underpayment of mass estimated income tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. Web 2021 form efo:

Web mtfcy recipients can report changes: If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. It appears you don't have a pdf plugin for this browser. By visiting a local eligibility determination office (which will forward the change to cbs);. The irs will generally figure your penalty for you and you should not file form 2210. Web 2021 form efo: Underpayment of mass estimated income tax. This form is for income earned in tax year 2022, with tax.

Web what is form m 2210? Underpayment of massachusetts estimated income. This form is for income earned in tax year 2022, with tax. Once i put the rmd withholding in the april. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. Web mtfcy recipients can report changes: Web 1 4 executive office of the president office of management and budget washington, d.c. If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. It appears you don't have a pdf plugin for this browser. Underpayment of mass estimated income tax.

Form M2210 Edit, Fill, Sign Online Handypdf

Underpayment of massachusetts estimated income. Web 1 4 executive office of the president office of management and budget washington, d.c. Once i put the rmd withholding in the april. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. Web what is form m 2210?

Form M2210 Edit, Fill, Sign Online Handypdf

Underpayment of massachusetts estimated income. Once i put the rmd withholding in the april. It appears you don't have a pdf plugin for this browser. Web mtfcy recipients can report changes: The irs will generally figure your penalty for you and you should not file form 2210.

Fill Free fillable Form 2210F Underpayment of Estimated Tax Farmers

The irs will generally figure your penalty for you and you should not file form 2210. By visiting a local eligibility determination office (which will forward the change to cbs);. Underpayment of mass estimated income tax. Once i put the rmd withholding in the april. Underpayment of massachusetts estimated income.

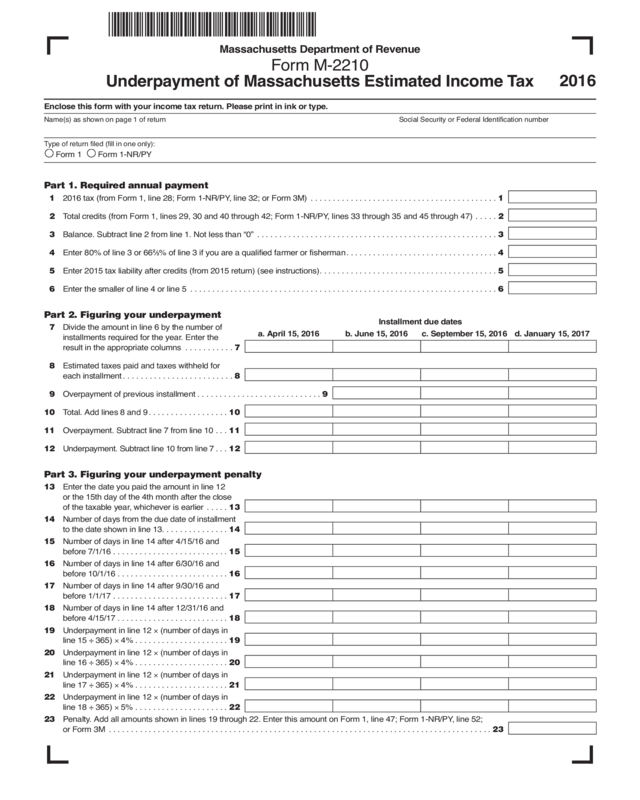

Form DCF2210 B Download Printable PDF or Fill Online Request for

Underpayment of massachusetts estimated income. Web mtfcy recipients can report changes: Underpayment of mass estimated income tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web 2021 form efo:

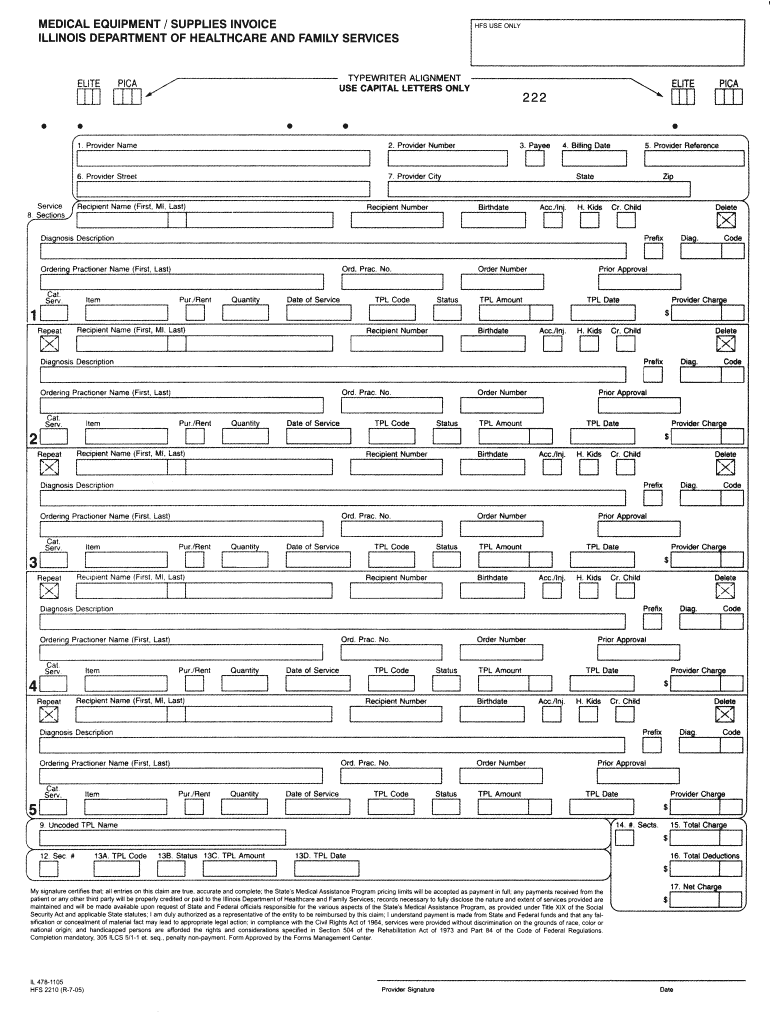

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

The irs will generally figure your penalty for you and you should not file form 2210. Web what is form m 2210? Web 2021 form efo: Once i put the rmd withholding in the april. If the amount on line 10 was paid on or after 04/15/12 enter 0 zero.

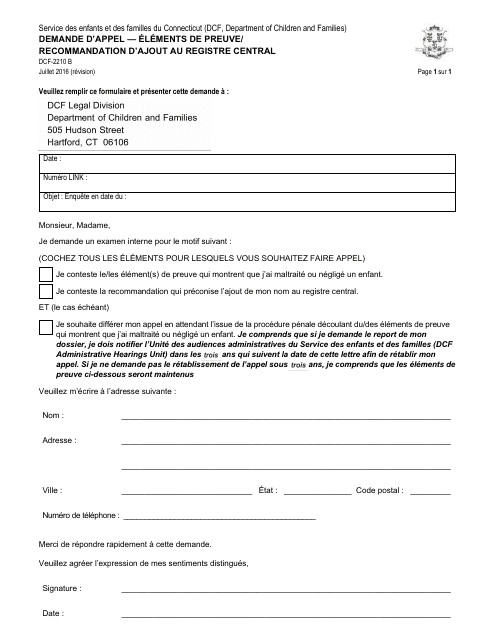

Hfs 2210 Fill Fill Online, Printable, Fillable, Blank pdfFiller

The irs will generally figure your penalty for you and you should not file form 2210. Once i put the rmd withholding in the april. This form is for income earned in tax year 2022, with tax. Web 2021 form efo: By visiting a local eligibility determination office (which will forward the change to cbs);.

Form 2210 Edit, Fill, Sign Online Handypdf

Underpayment of massachusetts estimated income. Web 1 4 executive office of the president office of management and budget washington, d.c. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. The irs will generally figure your penalty for you and you should not file form 2210. Web what is form m 2210?

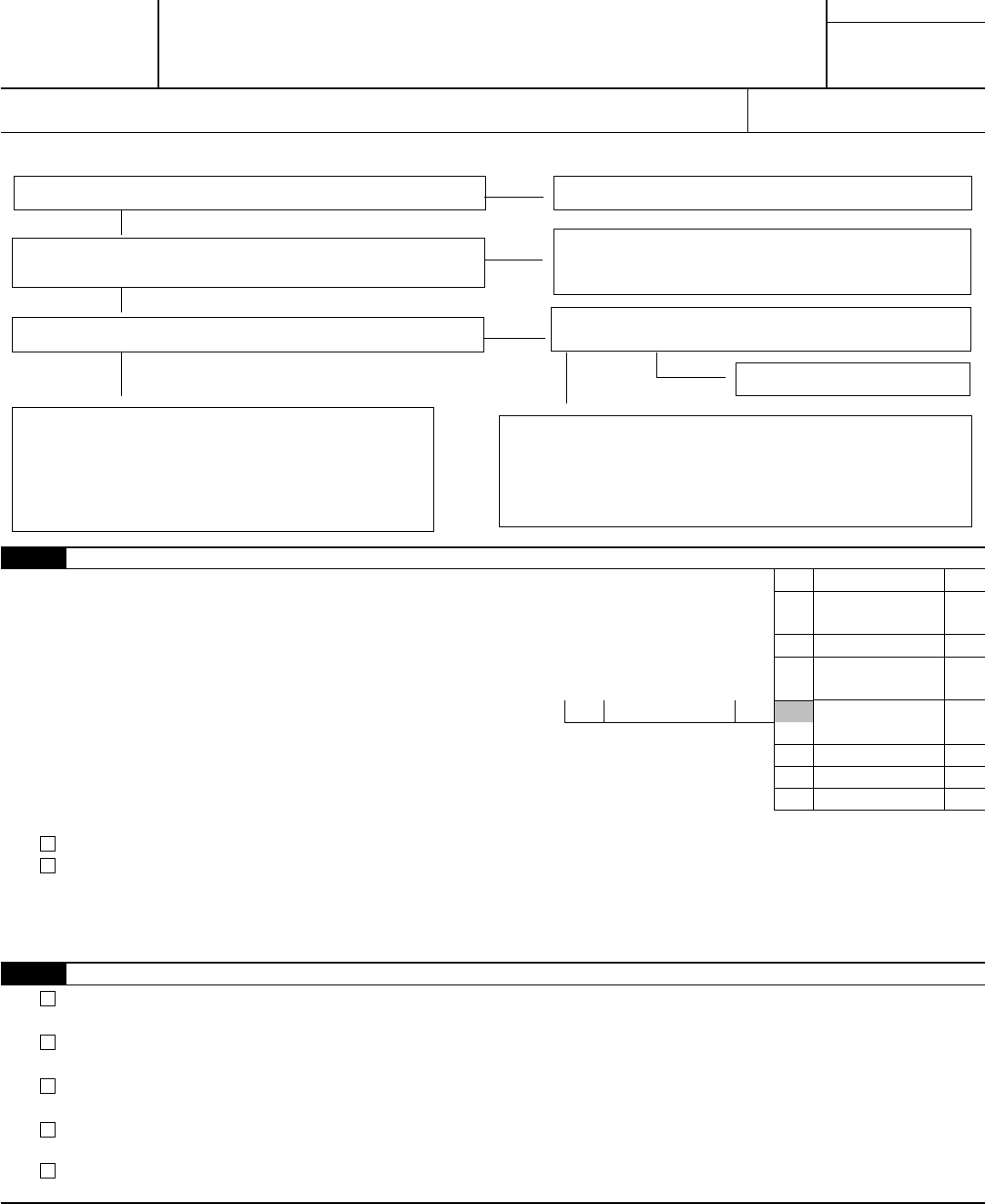

Form D2210 Underpayment Of Estimated Tax By Individuals

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. By visiting a local eligibility determination office (which will forward the change to cbs);. Web mtfcy recipients can report changes: Underpayment of mass estimated income tax. If the amount on line 10 was paid on or after 04/15/12 enter 0 zero.

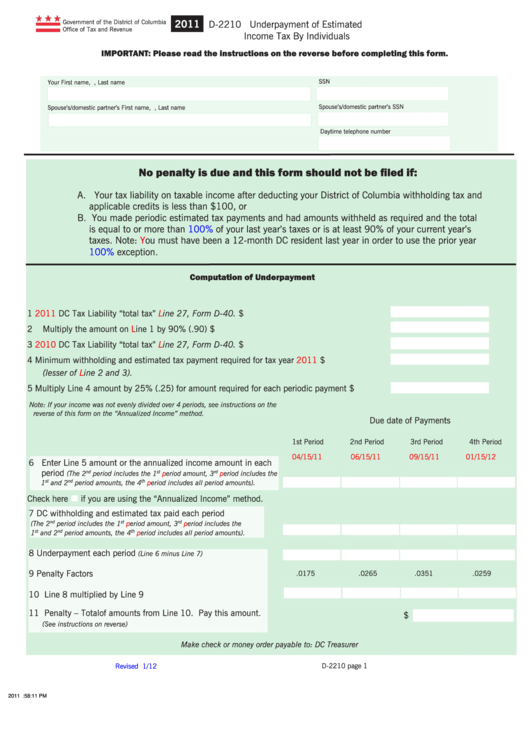

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web what is form m 2210? By visiting a local eligibility determination office (which will forward the change to cbs);. Web 1 4 executive office of the president office of management and budget washington, d.c. It appears you don't have a pdf plugin for this browser. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68.

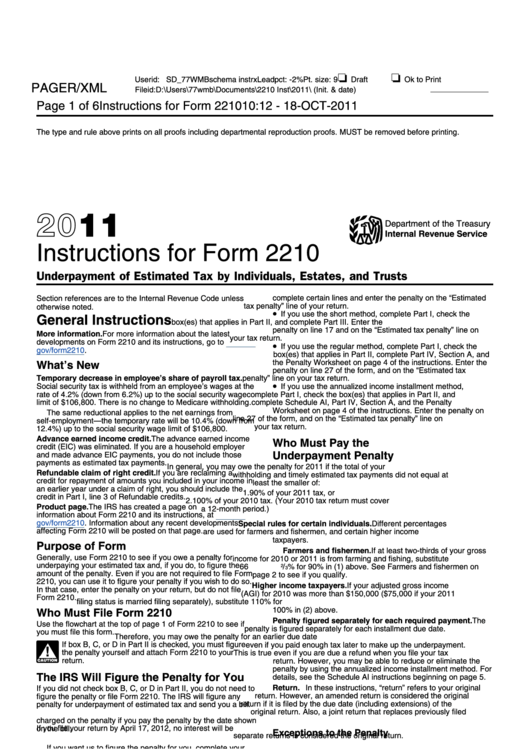

Instructions For Form 2210 Underpayment Of Estimated Tax By

If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. Web 2021 form efo: Web what is form m 2210? By visiting a local eligibility determination office (which will forward the change to cbs);. Once i put the rmd withholding in the april.

Use Form 2210 To Determine The Amount Of Underpaid Estimated Tax And Resulting Penalties As Well As For Requesting A Waiver Of The Penalties.

Web 1 4 executive office of the president office of management and budget washington, d.c. If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. Underpayment of massachusetts estimated income tax (english, pdf 1.69 mb) open pdf file, 74.68 kb,. Web mtfcy recipients can report changes:

It Appears You Don't Have A Pdf Plugin For This Browser.

Underpayment of massachusetts estimated income. By visiting a local eligibility determination office (which will forward the change to cbs);. Web 2021 form efo: Underpayment of mass estimated income tax.

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

Once i put the rmd withholding in the april. This form is for income earned in tax year 2022, with tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web what is form m 2210?