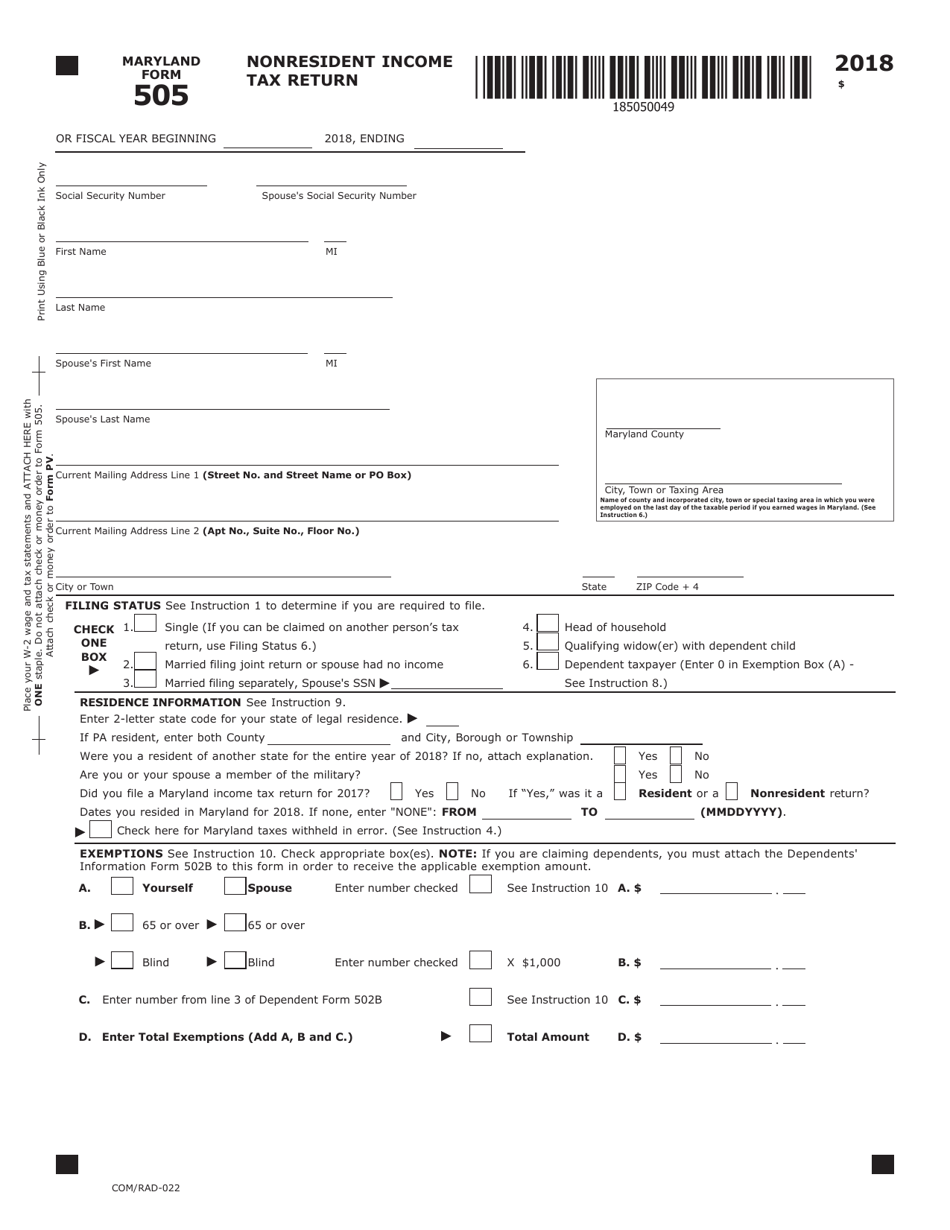

Maryland 505 Form

Maryland 505 Form - Web as a nonresident of maryland, you are required to file a nonresident income tax return form 505 and use form 505nr to calculate your nonresident tax, if you have income derived from: They are required to file a federal return based on the minimum filing requirements, and; All maryland court forms >>. (civil, expungement, landlord/tenant, protective orders, etc.) juvenile & family law forms >>. Form for nonresidents to file if: Maryland nonresident income tax return: Web subject to maryland corporation income tax. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. If you are requesting direct deposit of your refund, complete the following. For returns filed with payments, attach check or money order to form pv.

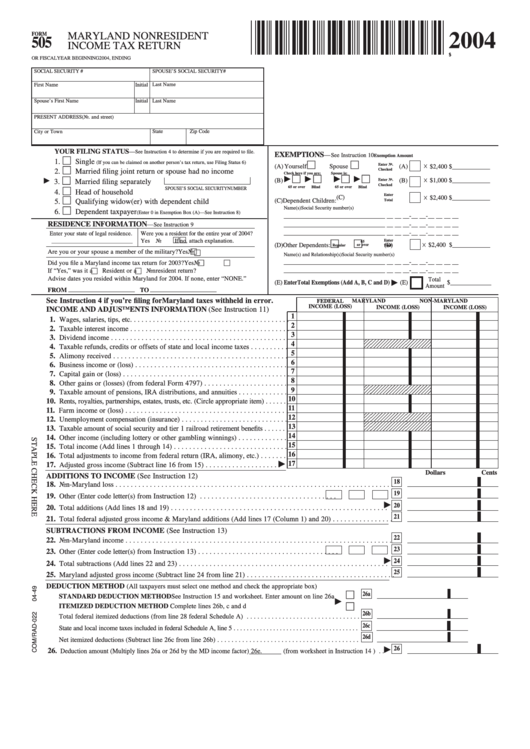

Maryland nonresident income tax return: If you lived in maryland only part of the year, you must file form 502. For returns filed without payments, mail your completed return to: (2) enter the total taxable income on line 1, check the applicable box labeled “other” and enter “1120s”; (child custody, child support, divorce. If you are a nonresident, you must file form 505 and form 505nr. Web as a nonresident of maryland, you are required to file a nonresident income tax return form 505 and use form 505nr to calculate your nonresident tax, if you have income derived from: (a searchable index of all court forms) district court forms >>. Go directly to a specific forms index. Use form 500 to calculate the amount of maryland corporation income tax.

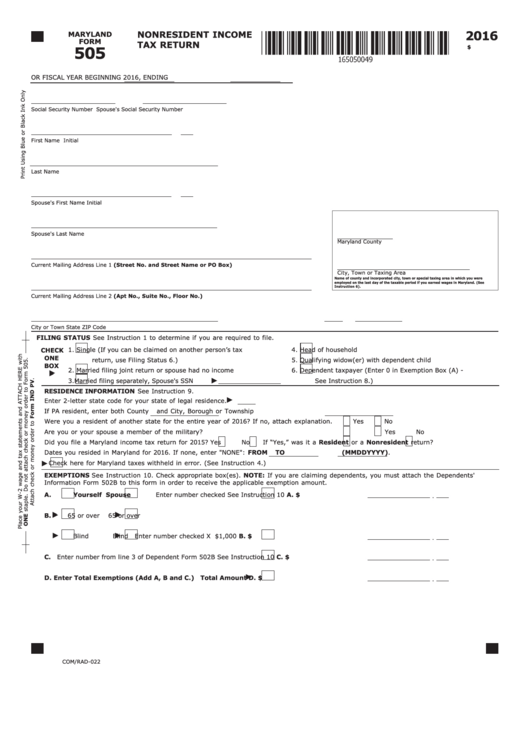

Web initial last name spouse's first name initial spouse's last name maryland county city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on the last day of the taxable period if you earned wages in maryland. Maryland nonresident income tax return: They are required to file a federal return based on the minimum filing requirements, and; Web as a nonresident of maryland, you are required to file a nonresident income tax return form 505 and use form 505nr to calculate your nonresident tax, if you have income derived from: (a searchable index of all court forms) district court forms >>. For splitting direct deposit, use form 588. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. They received income from sources in maryland Form for nonresidents to file if: If you are a nonresident, you must file form 505 and form 505nr.

Aoc E 505 Form Print 20202021 Fill and Sign Printable Template

For returns filed without payments, mail your completed return to: Web maryland form 505nr nonresident income tax calculation attach to your tax return 2022 first name mi last name social security number spouse's first name mi spouse's last name spouse's social security number if you are filing form 505, use the form 505nr instructions appearing on page 2 of this.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

(a searchable index of all court forms) district court forms >>. Form for nonresidents to file if: (2) enter the total taxable income on line 1, check the applicable box labeled “other” and enter “1120s”; Web maryland form 505nr nonresident income tax calculation attach to your tax return 2022 first name mi last name social security number spouse's first name.

Changes to Form 505 Companion Form to SCR 504 YouTube

Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Maryland nonresident income tax return: If you are a nonresident, you must file form 505 and form 505nr. Go directly to a specific forms index. If you are requesting direct deposit of your refund, complete.

ADEM Form 505 Download Fillable PDF or Fill Online Water and Wastewater

They received income from sources in maryland Use form 500 to calculate the amount of maryland corporation income tax. (child custody, child support, divorce. They are required to file a federal return based on the minimum filing requirements, and; Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

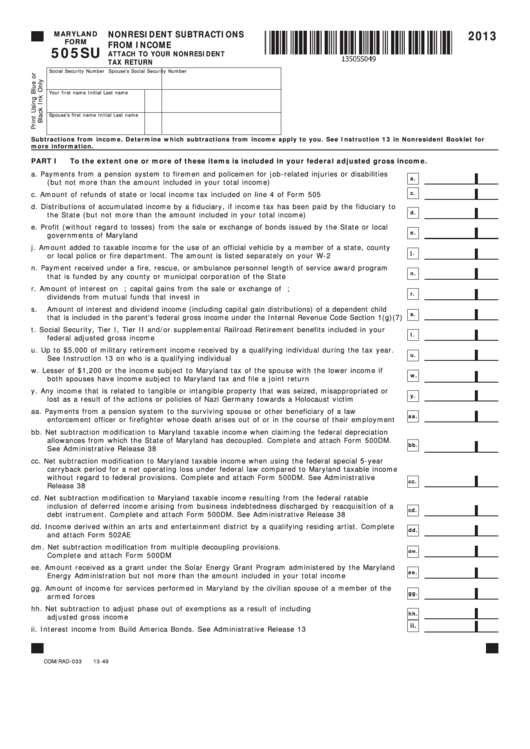

Use form 500 to calculate the amount of maryland corporation income tax. (child custody, child support, divorce. You can print other maryland tax forms here. Web initial last name spouse's first name initial spouse's last name maryland county city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on.

Fillable Maryland Form 505 Nonresident Tax Return 2016

All maryland court forms >>. (a searchable index of all court forms) district court forms >>. Tangible property, real or personal, permanently located in maryland; Web initial last name spouse's first name initial spouse's last name maryland county city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on.

Fillable Form 505 Maryland Nonresident Tax Return 2004

You can print other maryland tax forms here. (child custody, child support, divorce. They received income from sources in maryland If you are requesting direct deposit of your refund, complete the following. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000.

Fillable Maryland Form 505su Nonresident Subtractions From

Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. (child custody, child support, divorce. Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. For splitting direct deposit,.

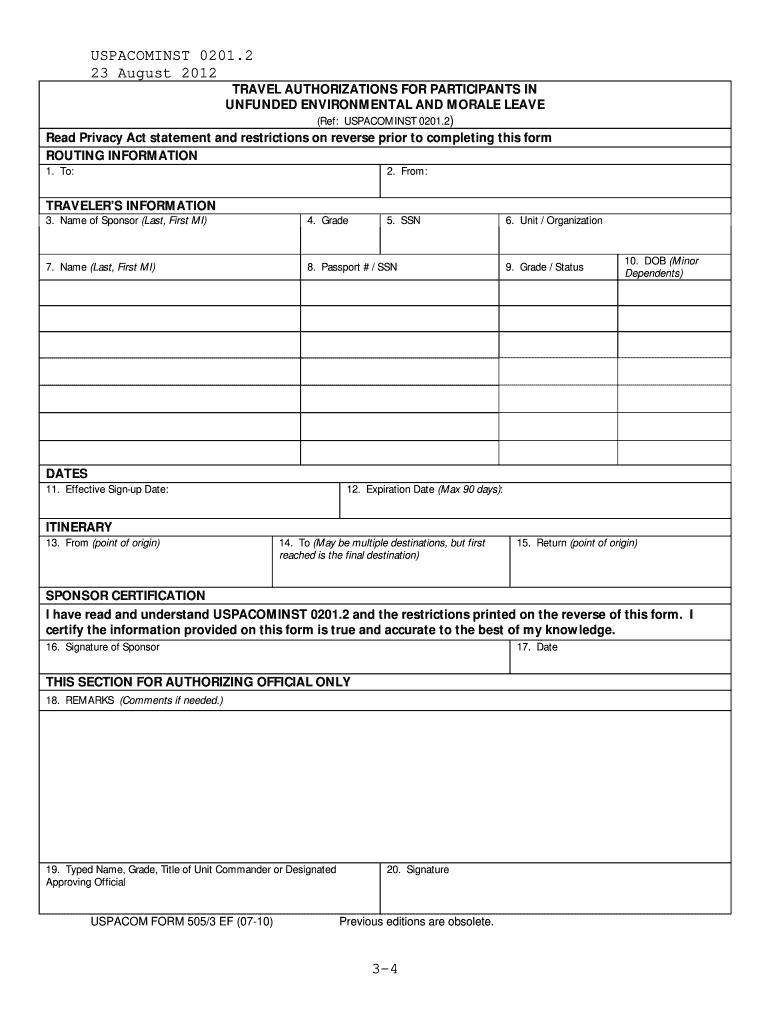

Form 505 3 Fill Out and Sign Printable PDF Template signNow

Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Form for nonresidents to file if: Use form 500 to calculate the amount of maryland corporation income tax. If you lived in maryland only part of the year, you must file form.

Form COM/RAD022 (Maryland Form 505) Download Fillable PDF or Fill

Web initial last name spouse's first name initial spouse's last name maryland county city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on the last day of the taxable period if you earned wages in maryland. You can print other maryland tax forms here. If you lived in.

They Are Required To File A Federal Return Based On The Minimum Filing Requirements, And;

All maryland court forms >>. For returns filed with payments, attach check or money order to form pv. (2) enter the total taxable income on line 1, check the applicable box labeled “other” and enter “1120s”; (a searchable index of all court forms) district court forms >>.

Web As A Nonresident Of Maryland, You Are Required To File A Nonresident Income Tax Return Form 505 And Use Form 505Nr To Calculate Your Nonresident Tax, If You Have Income Derived From:

You can print other maryland tax forms here. (child custody, child support, divorce. If you are a nonresident, you must file form 505 and form 505nr. For splitting direct deposit, use form 588.

For Returns Filed Without Payments, Mail Your Completed Return To:

Use form 500 to calculate the amount of maryland corporation income tax. Web initial last name spouse's first name initial spouse's last name maryland county city, town or taxing area name of county and incorporated city, town or special taxing area in which you were employed on the last day of the taxable period if you earned wages in maryland. Form for nonresidents to file if: (1) enter the corporation name, federal employer identification number and tax year;

Go Directly To A Specific Forms Index.

Maryland nonresident income tax return: Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and clearly legible. Web subject to maryland corporation income tax. If you lived in maryland only part of the year, you must file form 502.