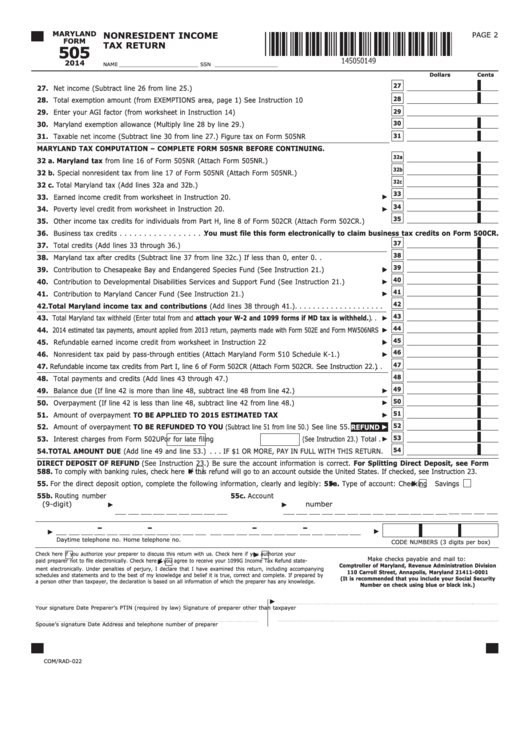

Maryland Tax Form 505

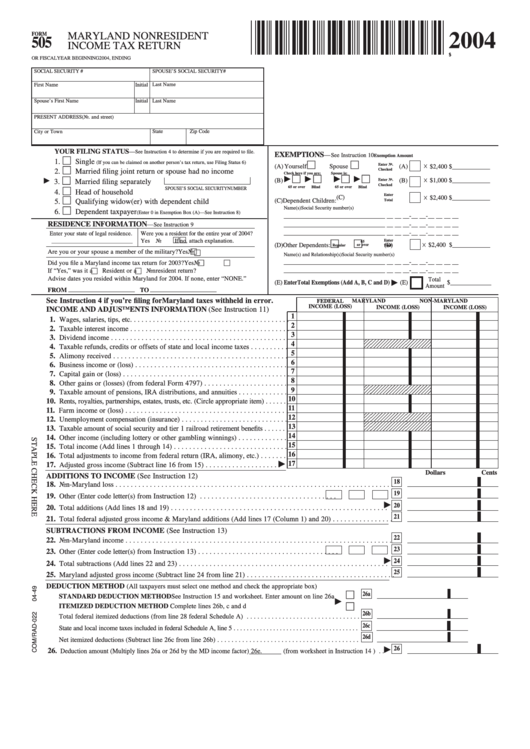

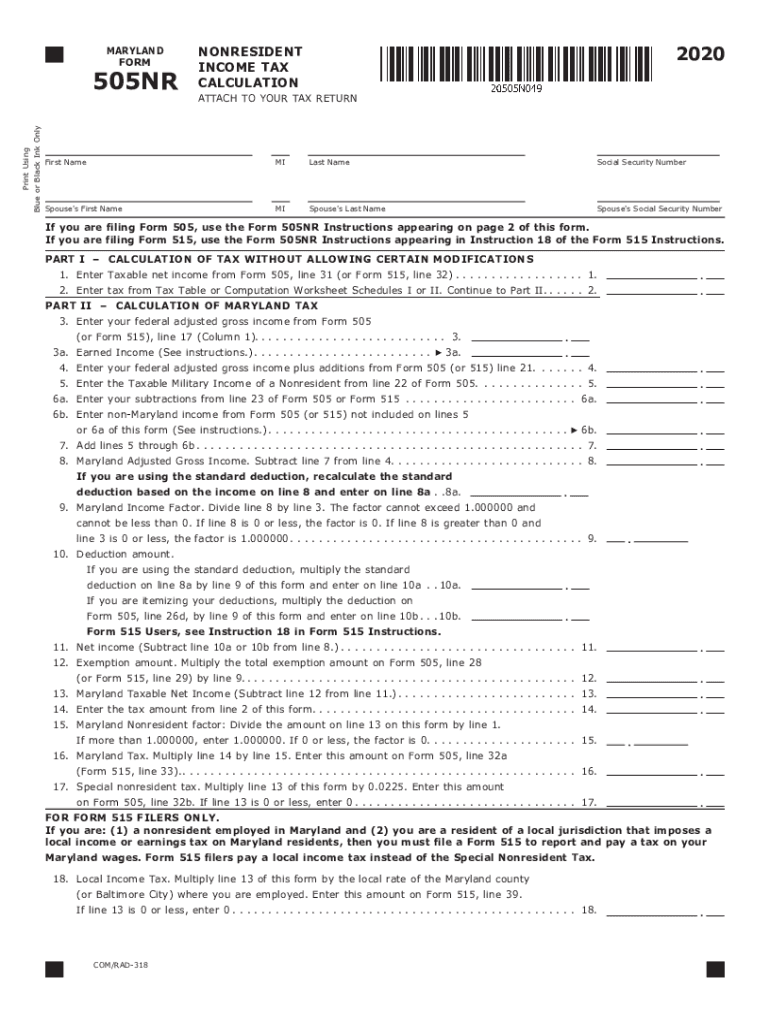

Maryland Tax Form 505 - Web form 505x requires you to list multiple forms of income, such as wages, interest, or alimony. Overpayment (if line 14 is less. Web multiply line 14 by line 15 to arrive at your maryland tax. Balance due (if line 14 is more than line 19, subtract line 19 from line 14. Web if both spouses have income subject to maryland tax and file a joint return. Enter this amount on line 16 and on form 505, line 32a. Download or email md 505nr & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web maryland tax, you must also file form 505.

Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income. Balance due (if line 14 is more than line 19, subtract line 19 from line 14. Web • 502x maryland amended tax form and instructions • 505 nonresident income tax return • 505x nonresident amended tax return all forms will be available at. Your signature date spouse’s signature date signature of preparer other than taxpayer. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. Enter this amount on line 16 and on form 505, line 32a. Web amended tax return maryland form 505x 2021 20.

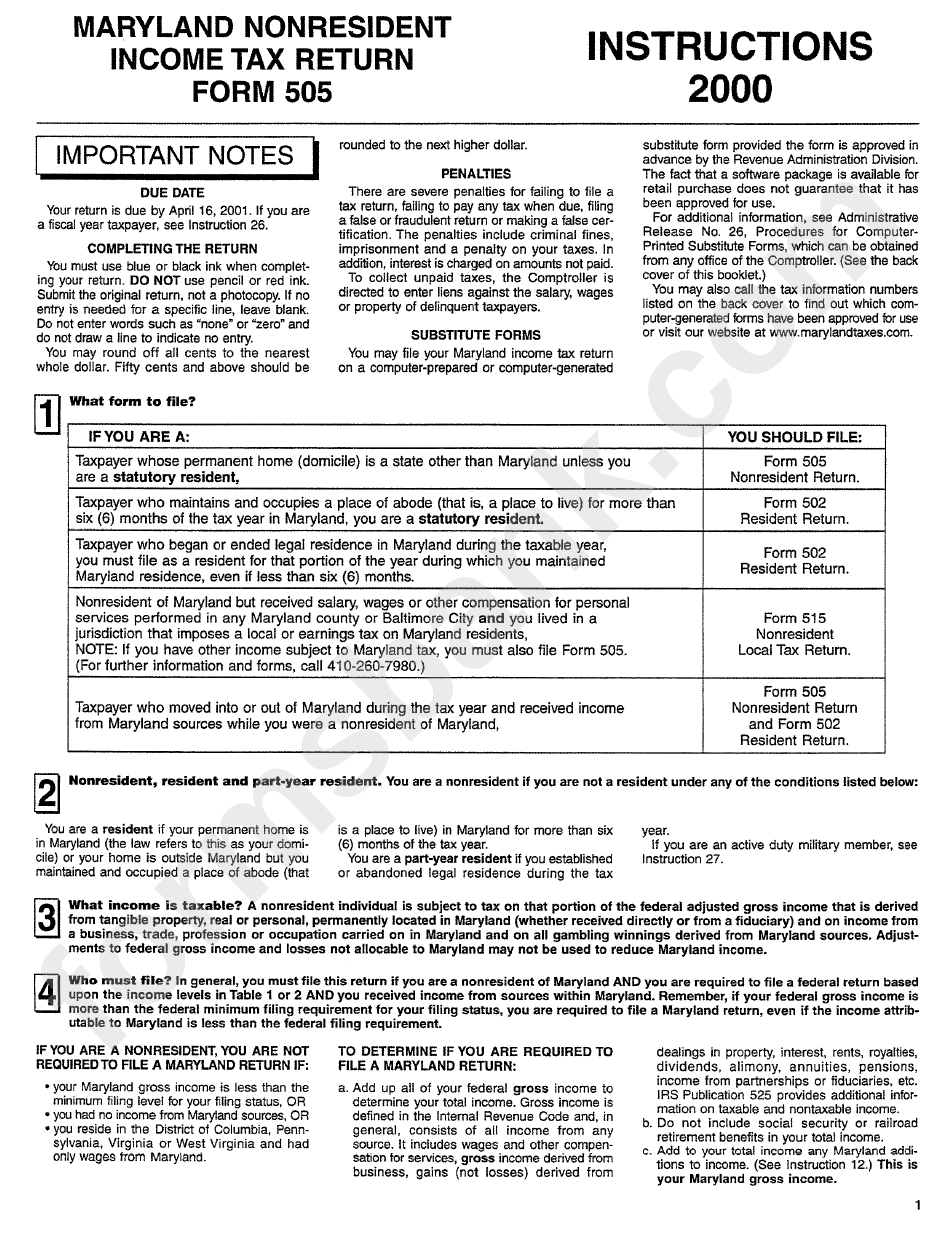

Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. Web form 502x and not this form. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web form 505x requires you to list multiple forms of income, such as wages, interest, or alimony. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Web if both spouses have income subject to maryland tax and file a joint return. Web multiply line 14 by line 15 to arrive at your maryland tax. Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live) for more than six (6) months of the tax year in maryland and you are physically.

Fill Free fillable forms Comptroller of Maryland

Balance due (if line 14 is more than line 19, subtract line 19 from line 14. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income. Web multiply line 14 by line 15 to arrive at your maryland tax. Any income that is related.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

Overpayment (if line 14 is less. Get the most out of. Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live) for more than six (6) months of the tax year in maryland and you are physically. Web form 505x requires you to list multiple forms of income, such as wages, interest,.

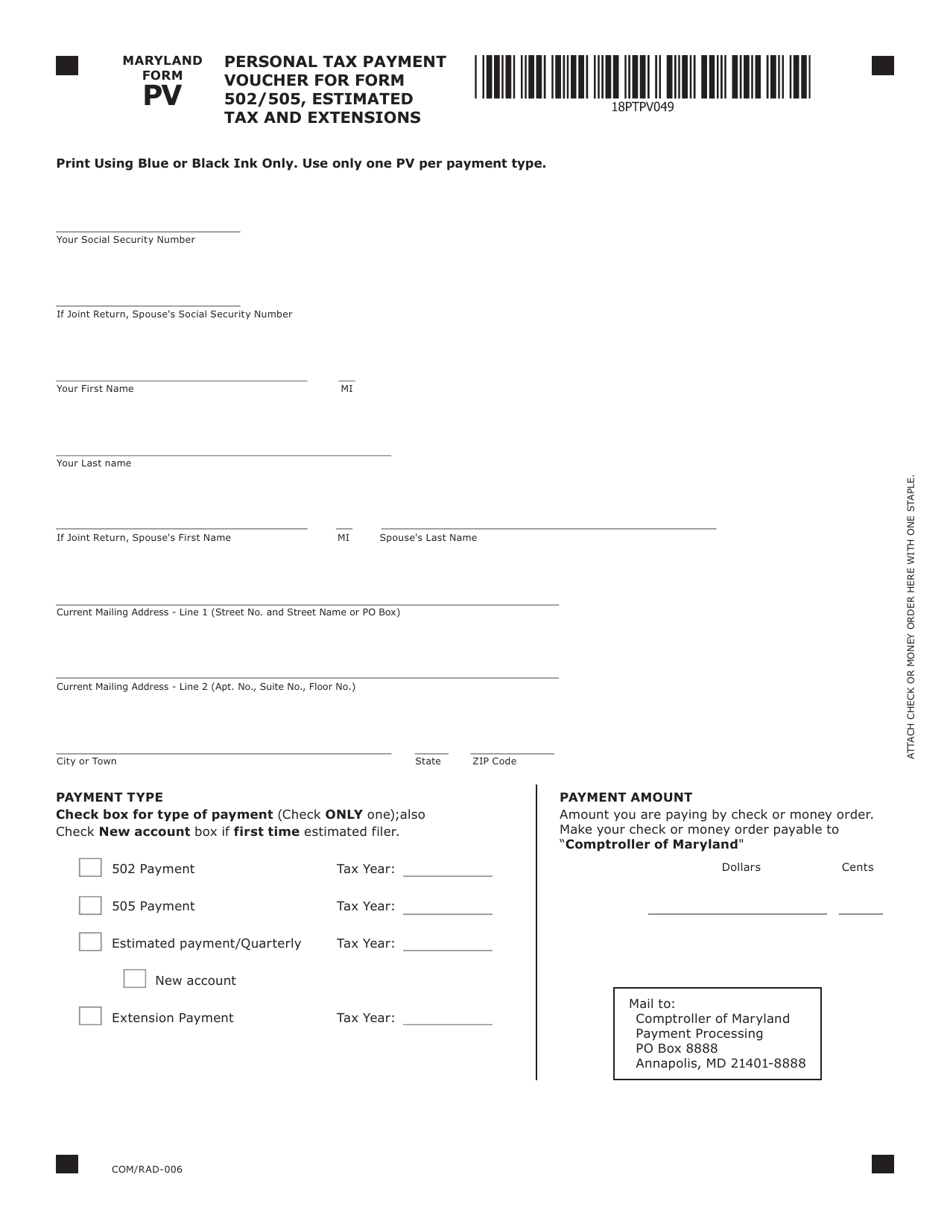

Maryland Form PV Download Fillable PDF or Fill Online

This form is for income earned in tax year 2022, with tax returns due in april. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income. Enter this amount on line. You can download or print. Enter this amount on line 16 and on.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web multiply line 14 by line 15 to arrive at your maryland tax. Enter this amount on line. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web if.

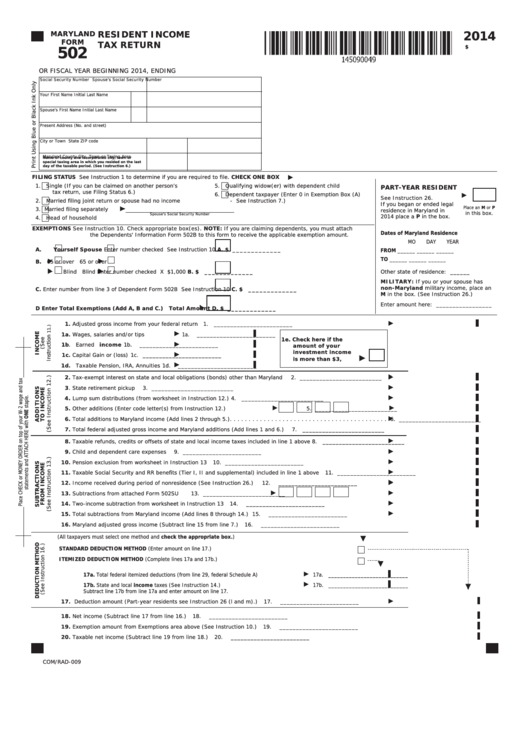

Fillable Form 502 Maryland Resident Tax Return 2014

Multiply line 13 by.0125 (1.25%). Any income that is related to tangible or intangible property that was seized, misappropriated. Get the most out of. Enter this amount on line. Form to be used when claiming dependents.

Fill Free fillable forms Comptroller of Maryland

Web form 505x requires you to list multiple forms of income, such as wages, interest, or alimony. Complete, edit or print tax forms instantly. Web amended tax return maryland form 505x 2021 20. Multiply line 13 by.0125 (1.25%). Complete, edit or print tax forms instantly.

Form 505 Maryland Nonresident Tax Return 2000 printable pdf

Complete, edit or print tax forms instantly. Web maryland resident income tax return: Overpayment (if line 14 is less. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. This form is for income earned in tax year 2022, with tax returns due in april.

Fillable Form 505 Maryland Nonresident Tax Return 2004

Enter this amount on line 16 and on form 505, line 32a. Any income that is related to tangible or intangible property that was seized, misappropriated. Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. Get the most out of. Web maryland resident income tax return:

Fillable Maryland Form 505 Nonresident Tax Return 2014

Balance due (if line 14 is more than line 19, subtract line 19 from line 14. If you must amend a tax year prior to 01/01/2011, you should obtain a form 505x and a nonresident tax booklet for the year you wish to amend so. Web if you are a nonresident of maryland, you are required to file form 505.

Maryland Form 505 Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april. Web maryland 2021 form 505 nonresident income tax return or fiscal year beginning 2021, ending social security number spouse's social security number. This year i do not expect to owe any maryland income tax. Web use this.

Web We Last Updated The Maryland Nonresident Income Tax Return In January 2023, So This Is The Latest Version Of Form 505, Fully Updated For Tax Year 2022.

If you must amend a tax year prior to 01/01/2011, you should obtain a form 505x and a nonresident tax booklet for the year you wish to amend so. Web form 505 nonresident return taxpayer who maintains a place of abode (that is, a place to live) for more than six (6) months of the tax year in maryland and you are physically. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. This year i do not expect to owe any maryland income tax.

Form To Be Used When Claiming Dependents.

Overpayment (if line 14 is less. For returns filed without payments, mail your completed return to: Enter this amount on line. Web form 502x and not this form.

Web If You Are A Nonresident Of Maryland, You Are Required To File Form 505 (Maryland Nonresident Income Tax Return) And Form 505Nr (Maryland Nonresident Income.

Complete, edit or print tax forms instantly. Download or email md 505nr & more fillable forms, register and subscribe now! Web multiply line 14 by line 15 to arrive at your maryland tax. Return taxpayer who moved into or out.

Download Or Email Md 505Nr & More Fillable Forms, Register And Subscribe Now!

Enter this amount on line 16 and on form 505, line 32a. Web • 502x maryland amended tax form and instructions • 505 nonresident income tax return • 505x nonresident amended tax return all forms will be available at. This form is for income earned in tax year 2022, with tax returns due in april. Multiply line 13 by.0125 (1.25%).