Michigan Form 5081 Instructions

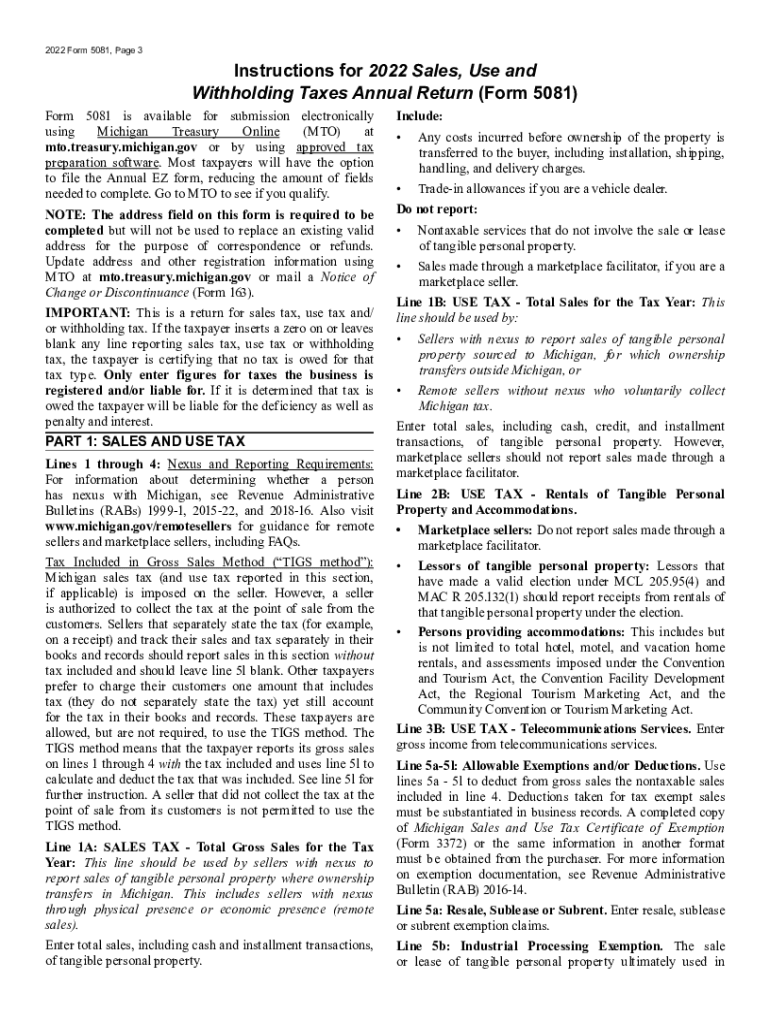

Michigan Form 5081 Instructions - Web instructions for 2023 sales, use and withholding taxes annual return (form 5081) form 5081 is available for submission electronically using michigan treasury online (mto) at. Subtract line 10 from line 9. Fill in the blank fields; Enter your gross michigan payroll, pension, and other taxable compensation. Instructions for 2023 sales, use and withholding taxes monthly/quarterly return. Web here's how it works 02. Share your form with others send. Web instructions for 2022 sales, use and withholding taxes annual return form 5081 is available for submission electronically using michigan treasury online (mto) at. Web open the miform5081 and follow the instructions easily sign the michigan form 5081 with your finger send filled & signed michigan 5081 or save rate the mi form 5081 4.6. 2022 sales, use and withholding taxes monthly/quarterly return:

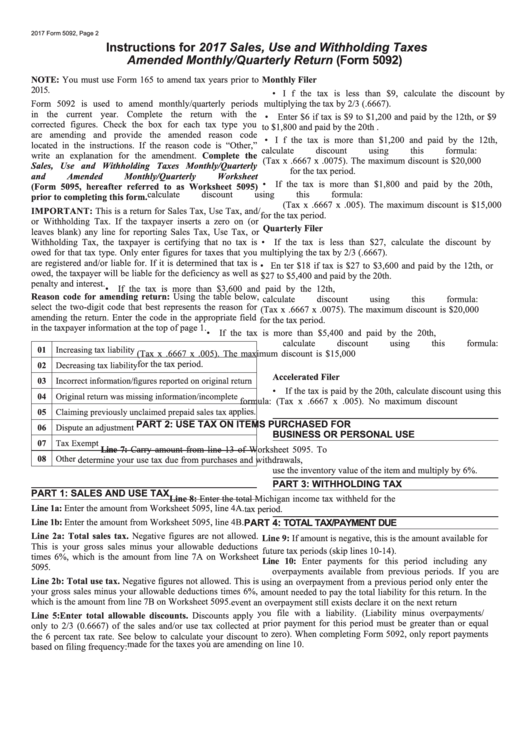

Instructions for 2023 sales, use and. The address field on this form is required to be line 5a: If you are an annual filer, you will need to use form 5081. Web open the miform5081 and follow the instructions easily sign the michigan form 5081 with your finger send filled & signed michigan 5081 or save rate the mi form 5081 4.6. Web this form is used to file sales, use and withholding taxes for monthly and quarterly filers. Complete, edit or print tax forms instantly. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. Updated 7 months ago by greg hatfield. Instructions for 2022 sales, use and withholding taxes annual. Enter your gross michigan payroll, pension, and other taxable compensation.

Share your form with others send. Updated 7 months ago by greg hatfield. Web instructions for 2022 sales, use and withholding taxes annual return form 5081 is available for submission electronically using michigan treasury online (mto) at. Ad download or email mi 5081 & more fillable forms, register and subscribe now! Reset form michigan department of treasury 5081. Web open the miform5081 and follow the instructions easily sign the michigan form 5081 with your finger send filled & signed michigan 5081 or save rate the mi form 5081 4.6. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. 2022 sales, use and withholding. Web michigan department of treasury sales, use and withholding lansing, mi 48930. Subtract line 10 from line 9.

2020 Michigan Form 5081 Fill Out and Sign Printable PDF Template

Web michigan department of treasury sales, use and withholding lansing, mi 48930. Complete, edit or print tax forms instantly. 2022 sales, use and withholding taxes monthly/quarterly return: Web form number form name; 2015 form 5081 page 2 11.

Gallery of Form 5081 Michigan 2017 Fresh the Ï Subunit Governs Rna

2022 sales, use and withholding taxes annual. Web instructions for 2022 sales, use and withholding taxes annual return form 5081 is available for submission electronically using michigan treasury online (mto) at. Share your form with others send. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad..

Form 5081 Fill out & sign online DocHub

Share your form with others send. 2015 68 01 27 7 continue on page 2. 2022 sales, use and withholding taxes annual. Enter your gross michigan payroll, pension, and other taxable compensation. Web instructions for 2022 sales, use and withholding taxes annual return form 5081 is available for submission electronically using michigan treasury online (mto) at.

Michigan Sales Tax Form 5081 2019 Fill Online, Printable, Fillable

Web up to $40 cash back 10. Web instructions for 2023 sales, use and withholding taxes annual return (form 5081) form 5081 is available for submission electronically using michigan treasury online (mto) at. Web 2023 mto form instructions. Web this form is used to file sales, use and withholding taxes for monthly and quarterly filers. 2015 form 5081 page 2.

Fill Michigan

Web this form is used to file sales, use and withholding taxes for monthly and quarterly filers. Share your form with others send. Web open the miform5081 and follow the instructions easily sign the michigan form 5081 with your finger send filled & signed michigan 5081 or save rate the mi form 5081 4.6. Web here's how it works 02..

Gallery of Form 5081 Michigan 2017 Awesome Us A1 O Linked Glycosylation

If you are an annual filer, you will need to use form 5081. Share your form with others send. The address field on this form is required to be line 5a: Instructions for 2023 sales, use and withholding taxes monthly/quarterly return. Web here's how it works 02.

Michigan Sales Tax form 5081 Best Of 2y2s Syllabus Pilation Gross In E

Web open the miform5081 and follow the instructions easily sign the michigan form 5081 with your finger send filled & signed michigan 5081 or save rate the mi form 5081 4.6. 2015 68 01 27 7 continue on page 2. Instructions for 2022 sales, use and withholding taxes annual. Enter your gross michigan payroll, pension, and other taxable compensation. This.

Gallery of Form 5081 Michigan 2017 Fresh the Ï Subunit Governs Rna

2022 sales, use and withholding taxes annual. The address field on this form is required to be line 5a: Web instructions for 2023 sales, use and withholding taxes annual return (form 5081) form 5081 is available for submission electronically using michigan treasury online (mto) at. Instructions for 2023 sales, use and withholding taxes monthly/quarterly return. Web form number form name;

Gallery of Form 5081 Michigan 2017 Fresh the Ï Subunit Governs Rna

Updated 7 months ago by greg hatfield. 2015 form 5081 page 2 11. Ad download or email mi 5081 & more fillable forms, register and subscribe now! Web up to $40 cash back 10. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return.

Top 40 Michigan Form 3372 Templates free to download in PDF format

2022 sales, use and withholding taxes annual. Web open the miform5081 and follow the instructions easily sign the michigan form 5081 with your finger send filled & signed michigan 5081 or save rate the mi form 5081 4.6. Fill in the blank fields; Enter your gross michigan payroll, pension, and other taxable compensation. Web 2023 mto form instructions.

Updated 7 Months Ago By Greg Hatfield.

Subtract line 10 from line 9. Share your form with others send. Complete, edit or print tax forms instantly. Web form number form name;

Ad Download Or Email Mi 5081 & More Fillable Forms, Register And Subscribe Now!

Web instructions for 2022 sales, use and withholding taxes annual return form 5081 is available for submission electronically using michigan treasury online (mto) at. Web here's how it works 02. Web up to $40 cash back 10. If you are an annual filer, you will need to use form 5081.

Instructions For 2023 Sales, Use And.

Web michigan department of treasury sales, use and withholding lansing, mi 48930. 2015 form 5081 page 2 11. Fill in the blank fields; Web this form cannot be used as an 5081 (rev.

Reset Form Michigan Department Of Treasury 5081.

2022 sales, use and withholding taxes annual. Web instructions for 2019 sales, use and withholding taxes annual return (form 5081) note: Instructions for 2023 sales, use and withholding taxes monthly/quarterly return. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return.