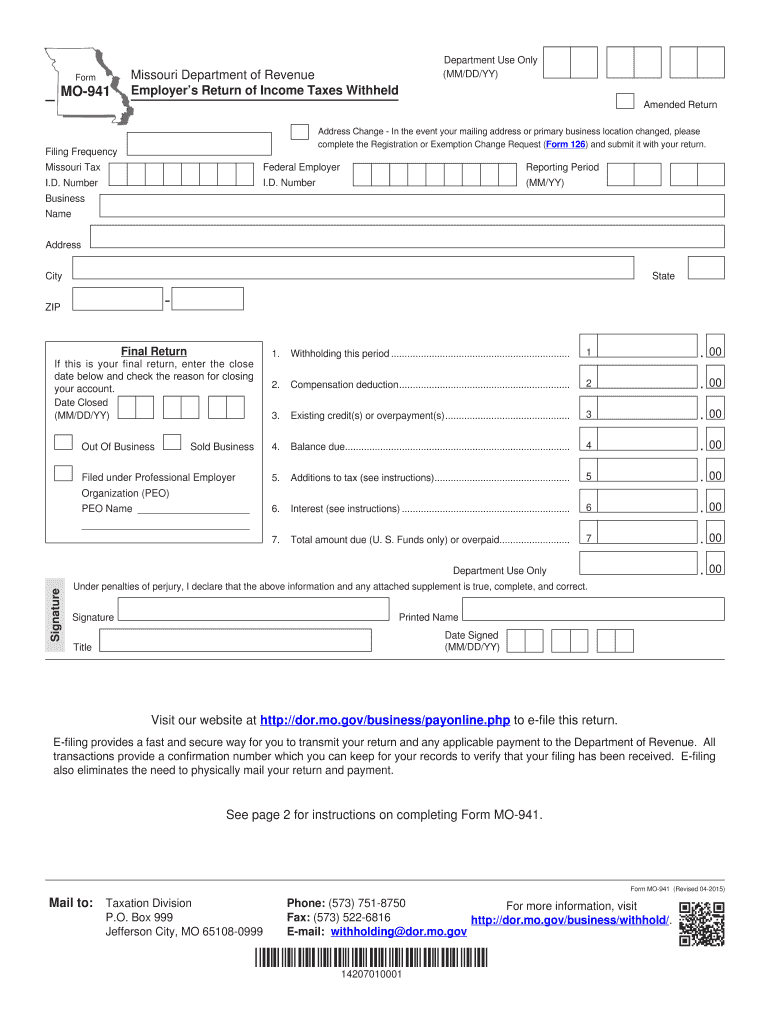

Missouri 941 Form

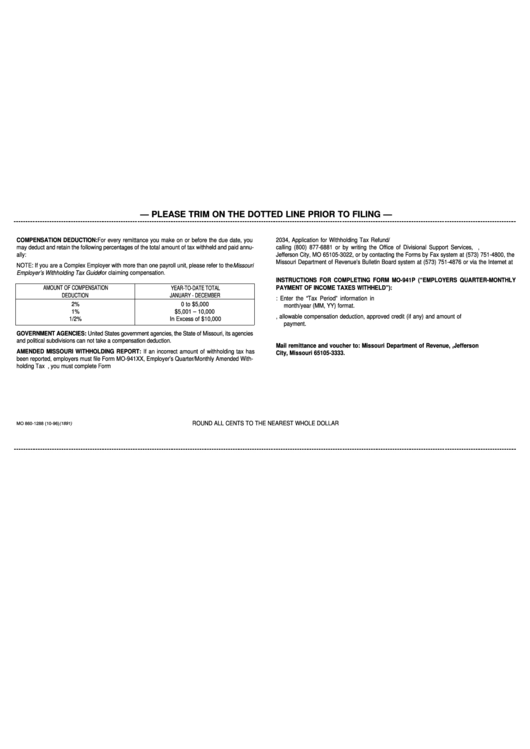

Missouri 941 Form - A separate filing is not required. Employer's withholding tax return correction: You can print other missouri tax forms here. Fill out and mail to: Employer's withholding tax final report: For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Employer's return of income taxes withheld (note: Missouri division of employment security, p.o. Withholding formula •updated withholding tax information is included in each voucher book.

Employer's withholding tax final report: Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. Missouri division of employment security, p.o. Withholding formula •updated withholding tax information is included in each voucher book. Employer's withholding tax return correction: • the information is presented in an “easy to follow” worksheet to calculate withholding tax. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: A separate filing is not required. Employer's return of income taxes withheld (note:

Missouri division of employment security, p.o. You can print other missouri tax forms here. Fill out and mail to: For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Employer's return of income taxes withheld (note: Employer's withholding tax final report: A separate filing is not required. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. • the information is presented in an “easy to follow” worksheet to calculate withholding tax. Withholding formula •updated withholding tax information is included in each voucher book.

18 Best Images of 2014 Tax Preparation Worksheet Sample W2 Completed

Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: Employer's return of income taxes withheld (note: For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. • the information is presented in.

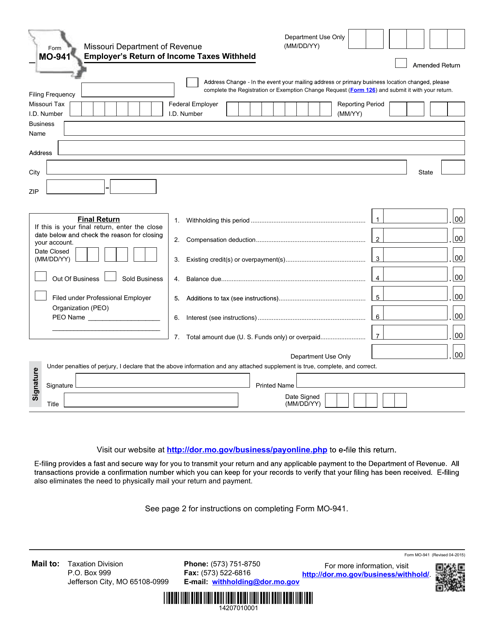

Missouri Department of Revenue Form Mo 941 Fill Out and Sign

Employer's withholding tax return correction: • the information is presented in an “easy to follow” worksheet to calculate withholding tax. You can print other missouri tax forms here. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: A separate filing is not required.

New 941 form for second quarter payroll reporting

Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. A separate filing is not required. • the information is presented in an “easy to follow” worksheet to calculate withholding tax. You can print other missouri tax forms here. Employer's withholding tax return correction:

Form MO941 Download Fillable PDF or Fill Online Employer's Return of

Employer's withholding tax final report: Missouri division of employment security, p.o. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. Fill out and mail to: A separate filing is not required.

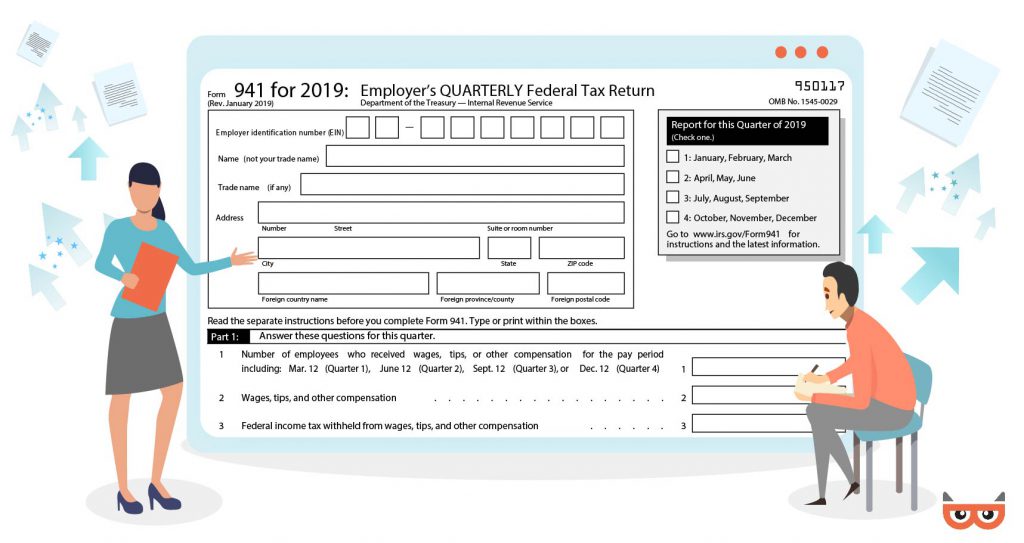

Your Ultimate Form 941 HowTo Guide Blog TaxBandits

A separate filing is not required. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. Fill out and mail to: Employer's withholding tax return correction: Withholding formula •updated withholding tax information is included in each voucher book.

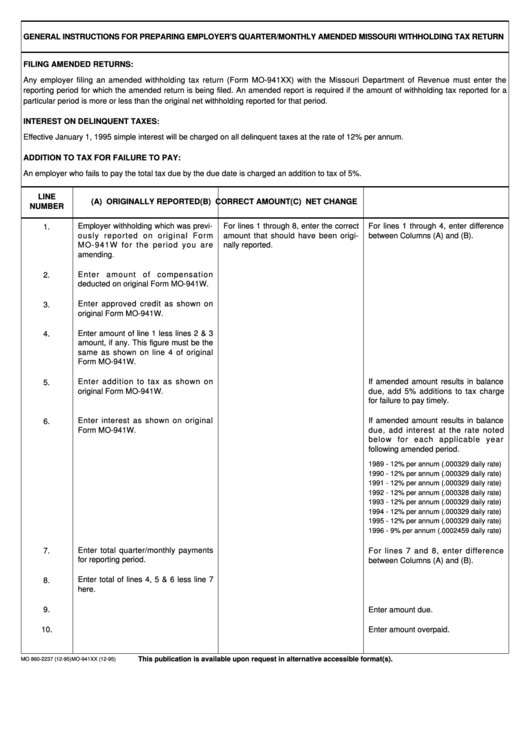

Top Mo941 X Form Templates free to download in PDF format

For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022: You can print other missouri tax forms here. Employer's withholding tax final report: Withholding formula •updated withholding tax information is included in each voucher book.

Form 941 X 2023 Fill online, Printable, Fillable Blank

For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Withholding formula •updated withholding tax information is included in each voucher book. A separate filing is not required. Your filing frequency is determined by the amount of income tax.

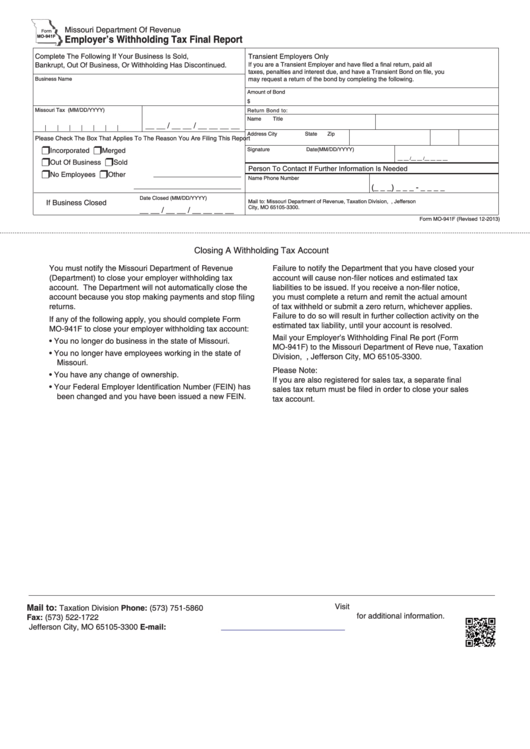

Fillable Form Mo941f Employer'S Withholding Tax Final Report 2013

• the information is presented in an “easy to follow” worksheet to calculate withholding tax. Fill out and mail to: Missouri division of employment security, p.o. Withholding formula •updated withholding tax information is included in each voucher book. A separate filing is not required.

9 Missouri Mo941 Forms And Templates free to download in PDF

Employer's return of income taxes withheld (note: Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Employer's withholding tax return correction: You can print other missouri tax forms here. • the information is presented in an “easy to follow” worksheet to calculate withholding tax.

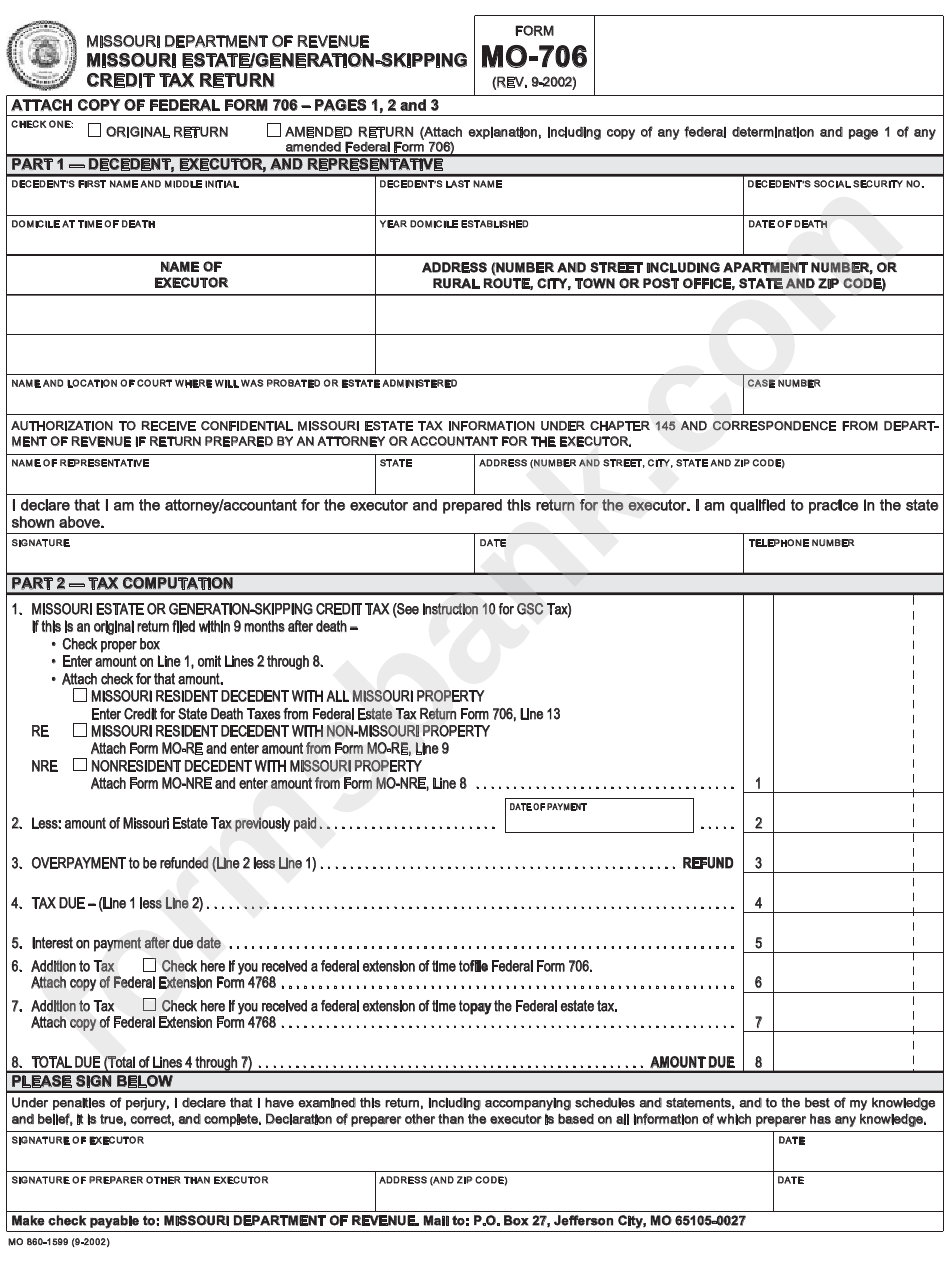

Form Mo706 Missouri Estate/generationSkipping Credit Tax Return

You can print other missouri tax forms here. Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. Withholding formula •updated withholding tax information is included in each voucher book. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. • the information is presented in an “easy to.

A Separate Filing Is Not Required.

Your filing frequency is determined by the amount of income tax that is withheld from the wages you pay. You can print other missouri tax forms here. Employer's withholding tax return correction: Fill out and mail to:

• The Information Is Presented In An “Easy To Follow” Worksheet To Calculate Withholding Tax.

Web the quarterly contribution and wage report and instructions are available at labor.mo.gov. For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2016. Withholding formula •updated withholding tax information is included in each voucher book. For optimal functionality, save the form to your computer before completing and utilize adobe reader.) 6/24/2022:

Employer's Withholding Tax Final Report:

Employer's return of income taxes withheld (note: Missouri division of employment security, p.o.