Missouri Fuel Tax Refund Form

Missouri Fuel Tax Refund Form - Web click here for the missouri fuel tax refund claim form. Claims must be postmarked between july 1 and. Web 9 rows highway use motor fuel refund claim for rate increases: On july 1, 2022, the gas tax will rise again to $0.22 per gallon. Web the refund form will be available on the missouri department of revenue website prior to july 1, 2022. 1, 2021, missouri increased its gas tax to $0.195 per gallon. Web find out how to get a refund. Web a refund claim form is expected be available on the department’s website prior to july 1. In addition to receipts, missouri drivers making a refund. Web a refund claim form will be available on the department of revenue’s website prior to july 1, 2022.

Web the refund form will be available on the missouri department of revenue website prior to july 1, 2022. “does missouri have a highway gasoline tax refund for the. On july 1, 2022, the gas tax will rise again to $0.22 per gallon. Web click here for the missouri fuel tax refund claim form. Web a refund claim form will be available on the department of revenue’s website prior to july 1, 2022. Web a refund claim form is expected be available on the department’s website prior to july 1. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. Business name or first name mi last. Web use this form to file a refund claim for the missouri motor fuel tax increase(s) paid beginning october 1, 2021, through june 30, 2022, for motor fuel used for on road. Web 9 rows highway use motor fuel refund claim for rate increases:

For additional information about the fuel tax refunds visit the missouri department of revenue. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Following the gas tax increase in october, missouri’s motor fuel tax rate. In addition to receipts, missouri drivers making a refund. Claims must be postmarked between july 1 and. Bulletins & faqs rate increase motor fuel transport. Web the refund form will be available on the missouri department of revenue website prior to july 1, 2022. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. Web state news june 24, 2022 kttn news two area legislators have provided details on submitting an application for a gas tax increase refund instead of making a. Web a refund claim form is expected be available on the department’s website prior to july 1.

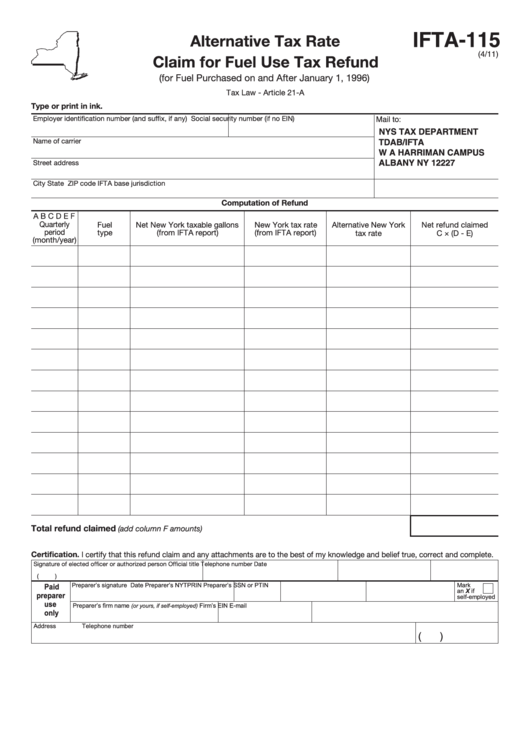

Missouri Ifta Tax Forms topfripdesigns

Web motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between oct. “does missouri have a highway gasoline tax refund for the. Register to file a motor fuel. In addition to receipts, missouri drivers making a refund. Claims must be postmarked between july 1 and.

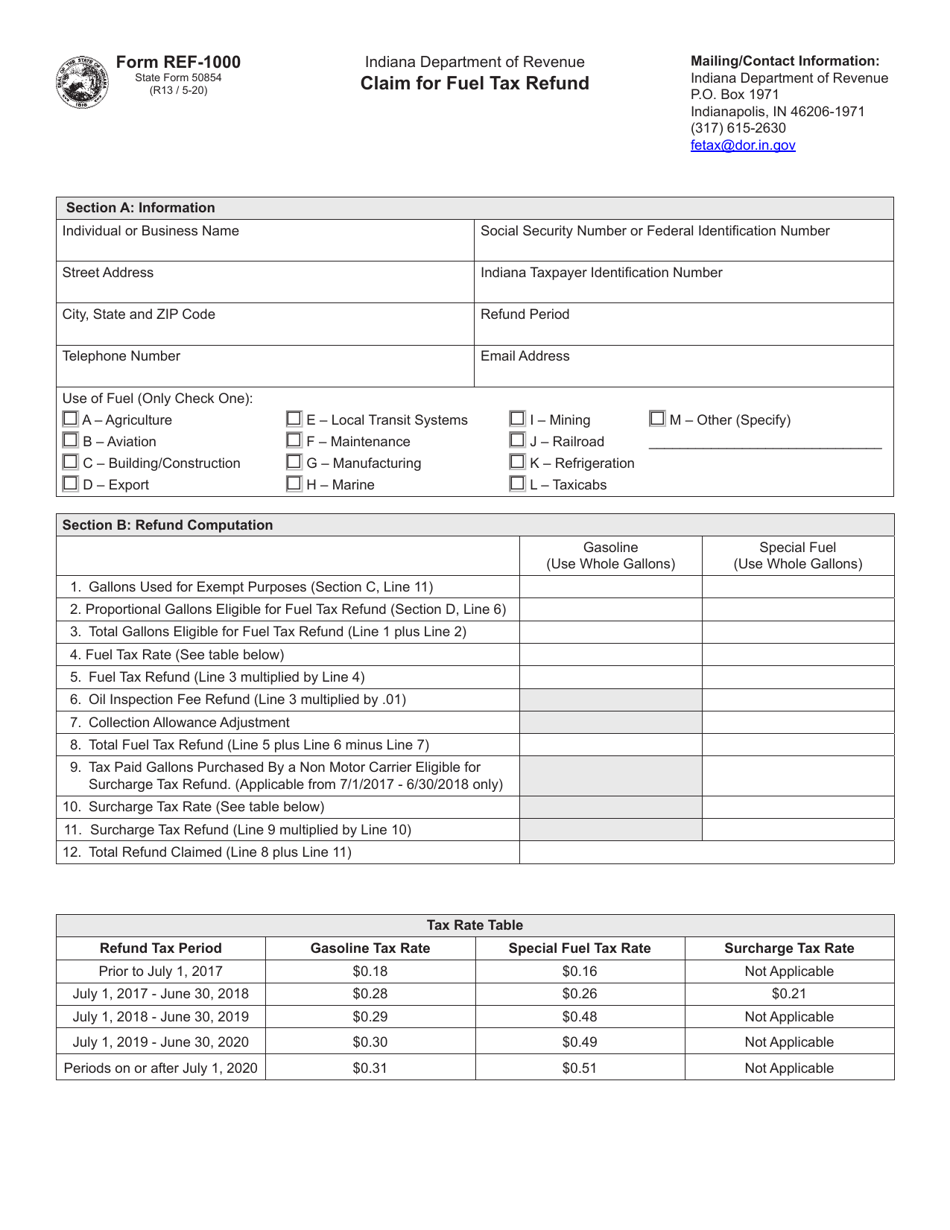

Form REF1000 (State Form 50854) Download Fillable PDF or Fill Online

Register to file a motor fuel. Bulletins & faqs rate increase motor fuel transport. The request for mail order forms may be used to order one copy or. Web a refund claim form will be available on the department of revenue’s website prior to july 1, 2022. 1, 2021, missouri increased its gas tax to $0.195 per gallon.

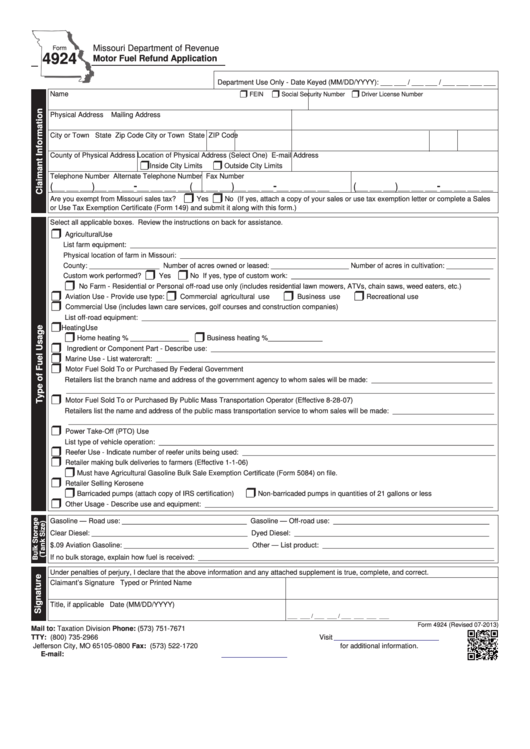

Fillable Form 4924 Motor Fuel Refund Application printable pdf download

“does missouri have a highway gasoline tax refund for the. A claim must be filed by the customer who purchased the fuel, and records of. Claims must be postmarked between july 1 and. For additional information about the fuel tax refunds visit the missouri department of revenue. Following the gas tax increase in october, missouri’s motor fuel tax rate.

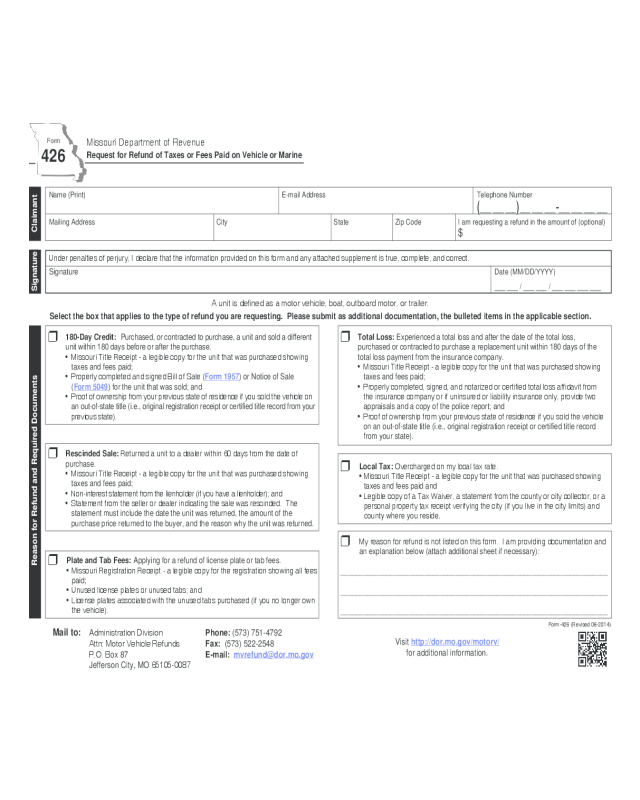

2022 Vehicle Tax Refund Form Fillable, Printable PDF & Forms Handypdf

“does missouri have a highway gasoline tax refund for the. Web a refund claim form is expected be available on the department’s website prior to july 1. A claim must be filed by the customer who purchased the fuel, and records of. Web find out how to get a refund. Web in 2021, the state of missouri started increasing the.

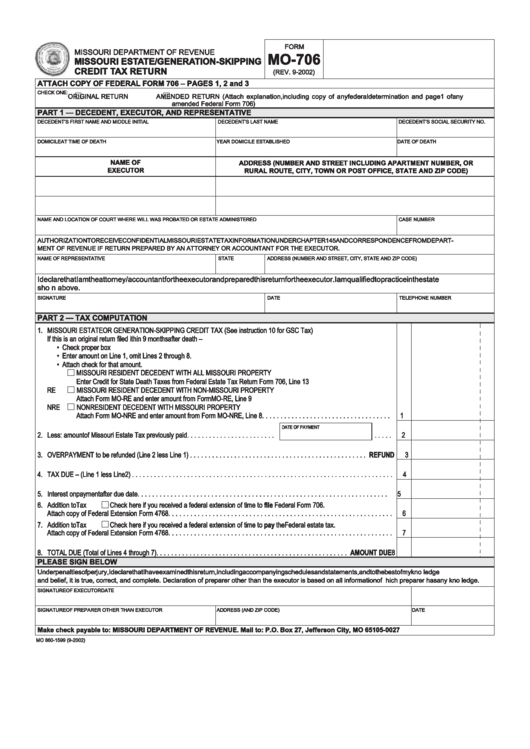

Form Mo706 Missouri Estate/generationSkipping Credit Tax Return

Web file a motor fuel consumer refund highway use claim online select this option to file a motor fuel consumer refund highway use claim. Following the gas tax increase in october, missouri’s motor fuel tax rate. Register to file a motor fuel. Web find out how to get a refund. A claim must be filed by the customer who purchased.

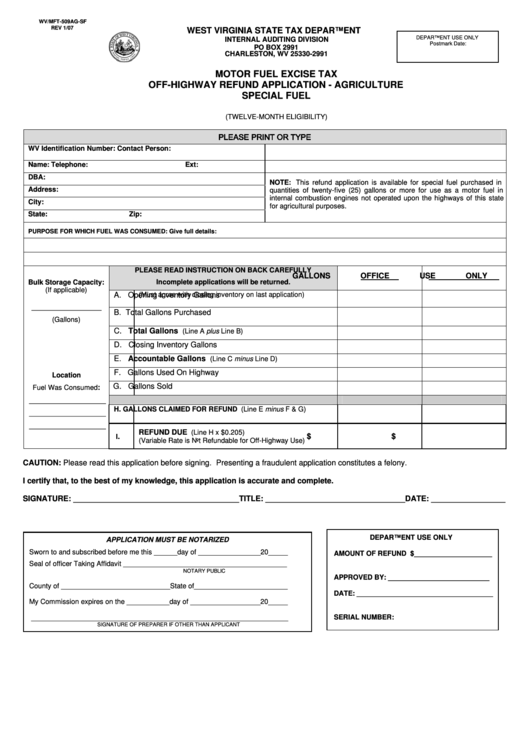

Form Wv/mft509agSf Motor Fuel Excise Tax OffHighway Refund

Register to file a motor fuel. Web a refund claim form is expected be available on the department’s website prior to july 1. In the form drivers need to include the vehicle identification. Web state news june 24, 2022 kttn news two area legislators have provided details on submitting an application for a gas tax increase refund instead of making.

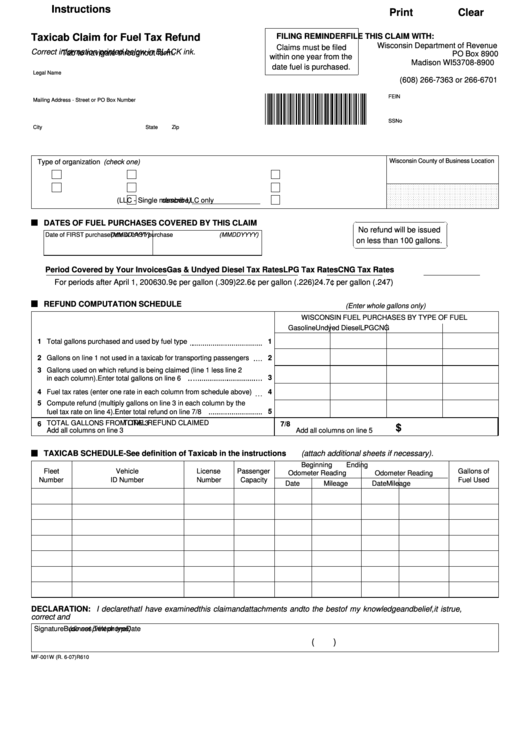

Fillable Form Mf001w Taxicab Claim For Fuel Tax Refund printable pdf

In addition to receipts, missouri drivers making a refund. “does missouri have a highway gasoline tax refund for the. The request for mail order forms may be used to order one copy or. Web find out how to get a refund. Web a refund claim form is expected be available on the department’s website prior to july 1.

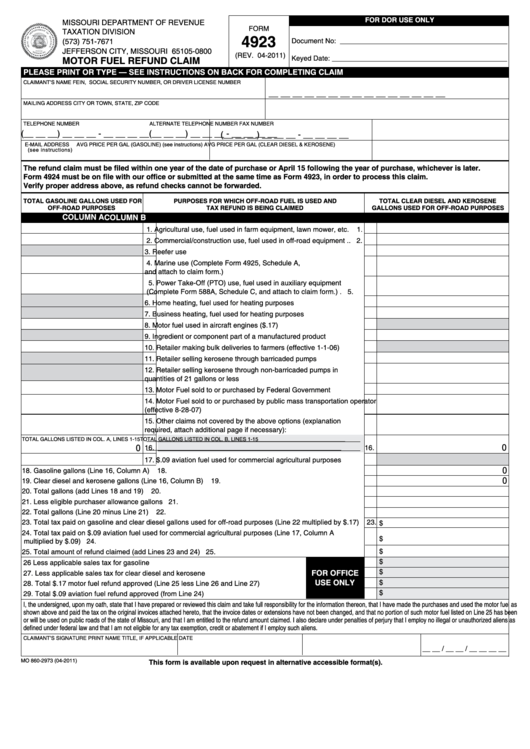

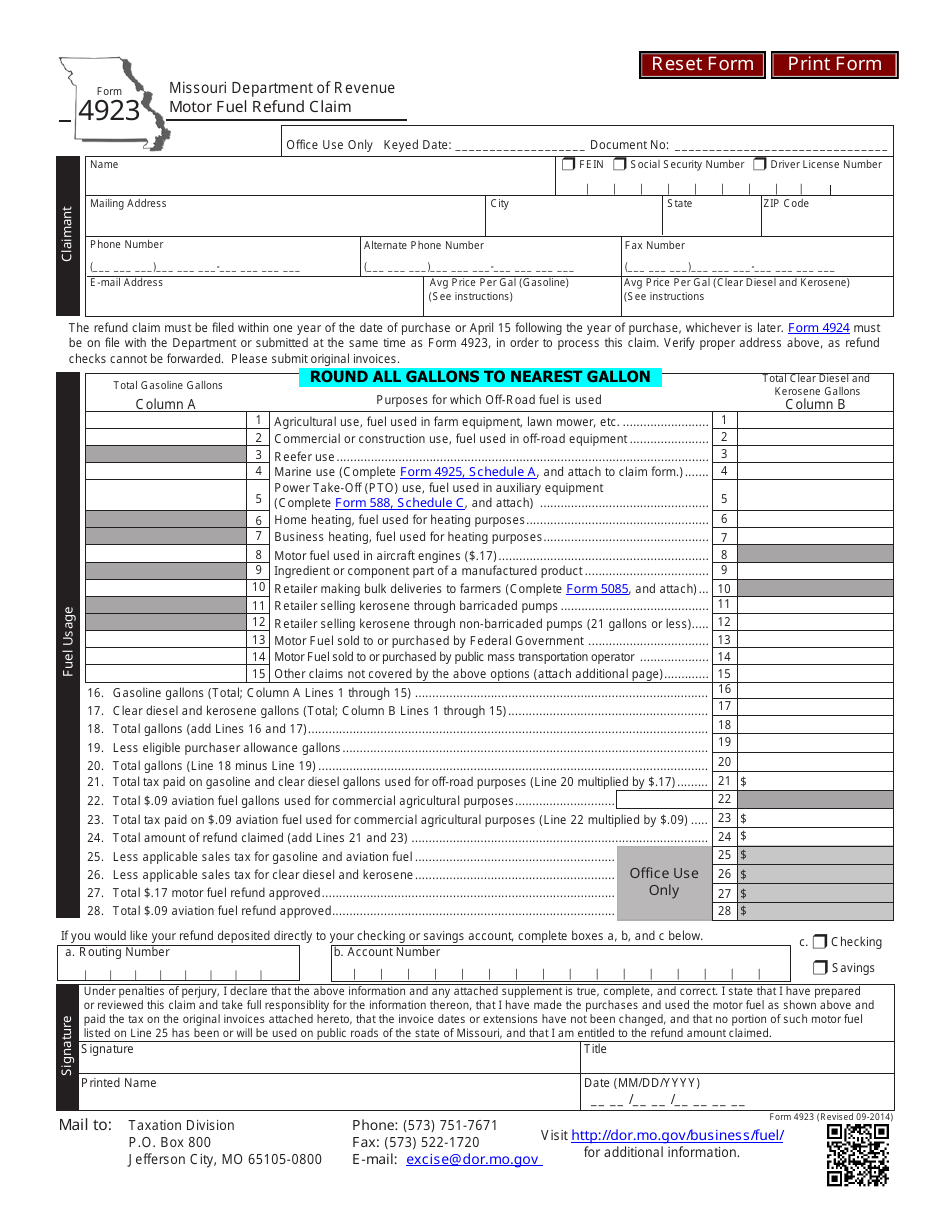

Fillable Form 4923 Motor Fuel Refund Claim printable pdf download

Register to file a motor fuel. In the form drivers need to include the vehicle identification. Bulletins & faqs rate increase motor fuel transport. Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. The request for mail order forms may be used to.

Military Journal Missouri 500 Tax Refund If the total amount of

Web according to the legislation, missourians seeking an exemption and refund for the fuel tax are required to provide the missouri department of revenue a statement. Web click here for the missouri fuel tax refund claim form. On july 1, 2022, the gas tax will rise again to $0.22 per gallon. Web state news june 24, 2022 kttn news two.

Missouri Gas Tax Refund Form » Veche.info 28

Web file a motor fuel consumer refund highway use claim online select this option to file a motor fuel consumer refund highway use claim. On july 1, 2022, the gas tax will rise again to $0.22 per gallon. Claims must be postmarked between july 1 and. Web find out how to get a refund. Web use this form to file.

Web Motorists Are Eligible To Receive A Refund Of 2.5 Cents For Each Gallon Of Fuel Purchased Between Oct.

For additional information about the fuel tax refunds visit the missouri department of revenue. In addition to receipts, missouri drivers making a refund. A claim must be filed by the customer who purchased the fuel, and records of. Bulletins & faqs rate increase motor fuel transport.

Web State News June 24, 2022 Kttn News Two Area Legislators Have Provided Details On Submitting An Application For A Gas Tax Increase Refund Instead Of Making A.

Claims must be postmarked between july 1 and. Web find out how to get a refund. Web a refund claim form will be available on the department of revenue’s website prior to july 1, 2022. On july 1, 2022, the gas tax will rise again to $0.22 per gallon.

1, 2021, Missouri Increased Its Gas Tax To $0.195 Per Gallon.

Web click here for the missouri fuel tax refund claim form. Web file a motor fuel consumer refund highway use claim online select this option to file a motor fuel consumer refund highway use claim. Register to file a motor fuel. “does missouri have a highway gasoline tax refund for the.

Web Use This Form To File A Refund Claim For The Missouri Motor Fuel Tax Increase(S) Paid Beginning October 1, 2021, Through June 30, 2022, For Motor Fuel Used For On Road.

Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web 9 rows highway use motor fuel refund claim for rate increases: Web the refund form will be available on the missouri department of revenue website prior to july 1, 2022. Business name or first name mi last.