Mn 1099 Form

Mn 1099 Form - Contact us taxpayer rights privacy & security use of information link policy Web what types of 1099 forms does minnesota require? Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web taxes and 1099 forms mhcp reimbursement is payment in full prompt payment additional resources legal references please also review the following billing. This applies even if you participate in the federal/state combined. From the latest tech to workspace faves, find just what you need at office depot®! Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Traditionally, the filing deadlines for minnesota are as follows: Web use this form to register a minnesota limited liability company. The minnesota department of revenue must send you this information by january 31 of the.

Deadline to file minnesota filing. Web skip to main content. Contact us taxpayer rights privacy & security use of information link policy From the latest tech to workspace faves, find just what you need at office depot®! All 1099s will be mailed by january. Web you must send us any form 1099 information reporting minnesota withholding by january 31 each year. Minnesota requires the filing of the following 1099 forms only if there is a state tax withholding. Web what types of 1099 forms does minnesota require? The minnesota department of revenue must send you this information by january 31 of the. Find them all in one convenient place.

Use this tool to search for a specific tax form using the tax form number or name. Web frontline worker payments on minnesota tax return. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web what are the deadlines for minnesota 1099 reporting? Minnesota requires the filing of the following 1099 forms only if there is a state tax withholding. Web taxes and 1099 forms mhcp reimbursement is payment in full prompt payment additional resources legal references please also review the following billing. The minnesota department of revenue must send you this information by january 31 of the. Web skip to main content. From the latest tech to workspace faves, find just what you need at office depot®! Traditionally, the filing deadlines for minnesota are as follows:

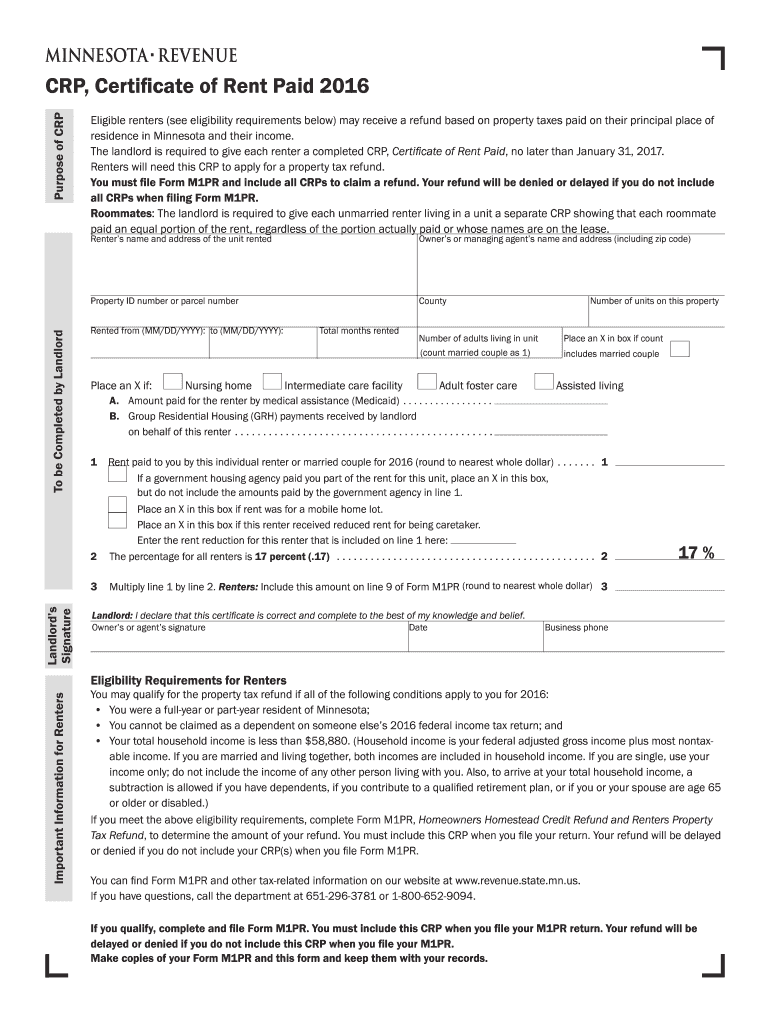

14 Form Mn Ten Great 14 Form Mn Ideas That You Can Share With Your

Find them all in one convenient place. Web you must send us any form 1099 information reporting minnesota withholding by january 31 each year. You can also look for forms by category below the search box. Minnesota requires the filing of the following 1099 forms only if there is a state tax withholding. Web taxes and 1099 forms mhcp reimbursement.

1099 Form Printable Template Form Resume Examples djVaJ4dl2J

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web what are the deadlines for minnesota 1099 reporting? Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web frontline worker payments on minnesota tax return. The minnesota department of revenue must send you this information by.

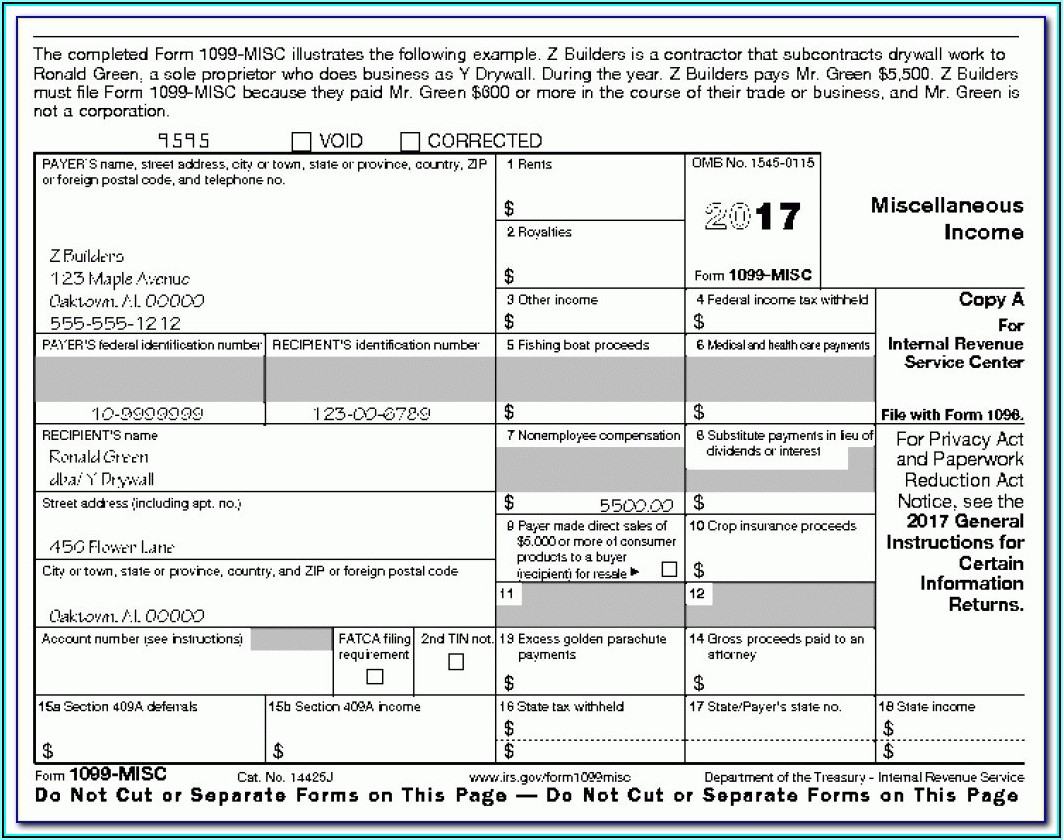

What is a 1099Misc Form? Financial Strategy Center

Web frontline worker payments on minnesota tax return. Find them all in one convenient place. Ad success starts with the right supplies. Use this tool to search for a specific tax form using the tax form number or name. The minnesota department of revenue must send you this information by january 31 of the.

1099 Int Tax Form Printable Form Resume Examples AjYdk6w9l0

Contact us taxpayer rights privacy & security use of information link policy You can also look for forms by category below the search box. Web taxes and 1099 forms mhcp reimbursement is payment in full prompt payment additional resources legal references please also review the following billing. If you received a frontline worker payment of $487.45 in 2022, minnesota will.

Form 1099NEC Returns Form 1099MISC Minneapolis St Paul (MN)

Use this tool to search for a specific tax form using the tax form number or name. Contact us taxpayer rights privacy & security use of information link policy You can get minnesota tax forms either by mail or in person. Deadline to file minnesota filing. Traditionally, the filing deadlines for minnesota are as follows:

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

You can also look for forms by category below the search box. Deadline to file minnesota filing. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ad success starts with the right supplies. The minnesota department of revenue must send you this information by january 31 of the.

How Not To Deal With A Bad 1099

Find them all in one convenient place. Web frontline worker payments on minnesota tax return. One or more persons may form a minnesota limited liability company (llc) under chapter 322c by filing articles. Contact us taxpayer rights privacy & security use of information link policy Ad success starts with the right supplies.

1099 Int Tax Form Printable Universal Network

You will need this information when filing your annual. Ad success starts with the right supplies. All 1099s will be mailed by january. You can get minnesota tax forms either by mail or in person. Find them all in one convenient place.

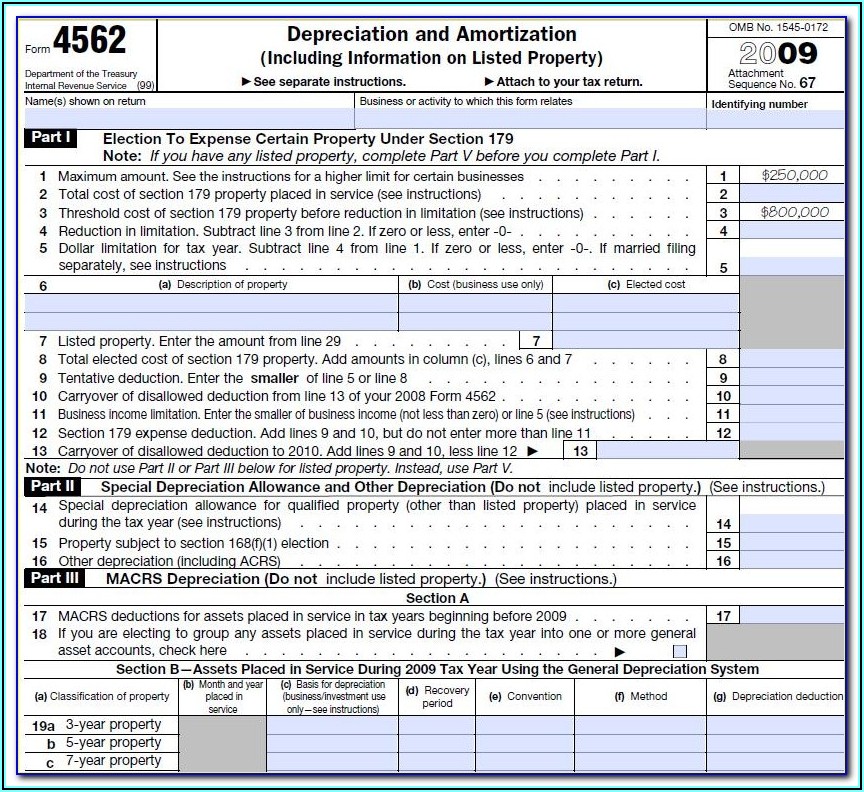

How To File Form 1099NEC For Contractors You Employ VacationLord

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web taxes and 1099 forms mhcp reimbursement is payment in full prompt payment additional resources legal references please also review the following billing. Minnesota requires the filing of the following 1099 forms only if there is a state tax withholding. Use this tool to.

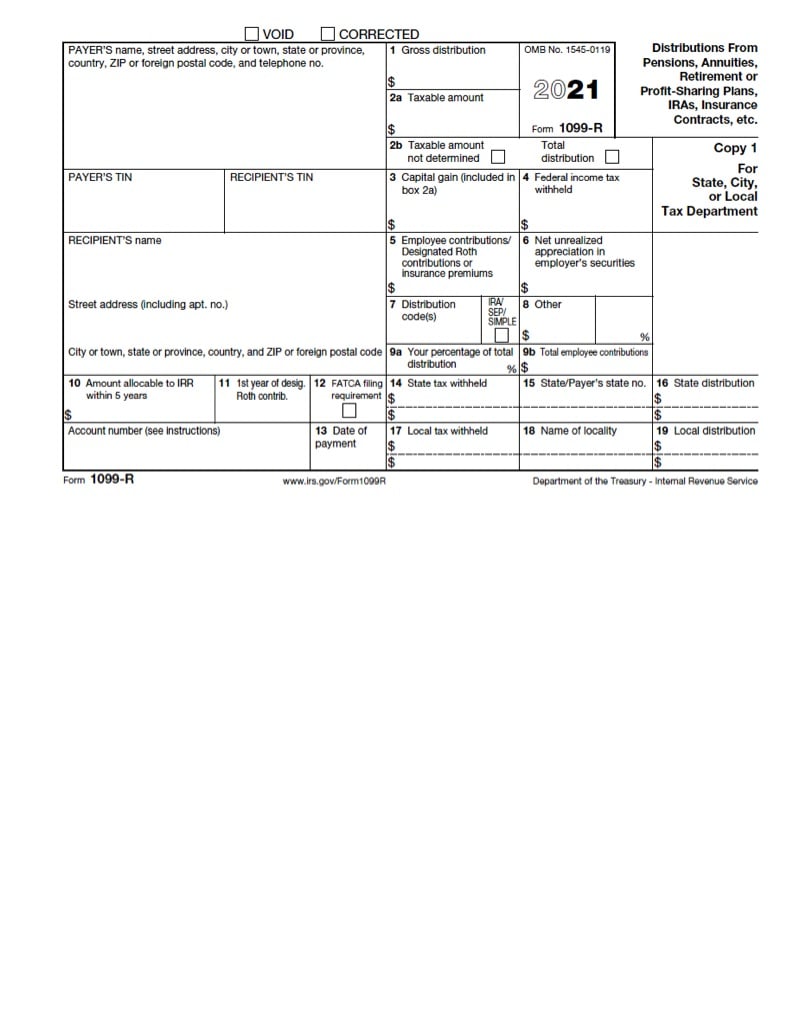

Tax form 1099R

Deadline to file minnesota filing. Contact us taxpayer rights privacy & security use of information link policy Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. One or more persons may form a minnesota limited liability company (llc) under chapter 322c by filing articles. This applies even if you participate in the federal/state.

If You Received A Frontline Worker Payment Of $487.45 In 2022, Minnesota Will Not Send You A Federal Form 1099 To.

Web what are the deadlines for minnesota 1099 reporting? Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Traditionally, the filing deadlines for minnesota are as follows: From the latest tech to workspace faves, find just what you need at office depot®!

One Or More Persons May Form A Minnesota Limited Liability Company (Llc) Under Chapter 322C By Filing Articles.

The minnesota department of revenue must send you this information by january 31 of the. You can also look for forms by category below the search box. Web frontline worker payments on minnesota tax return. Contact us taxpayer rights privacy & security use of information link policy

Web Skip To Main Content.

Ad success starts with the right supplies. Use this tool to search for a specific tax form using the tax form number or name. Find them all in one convenient place. Web what types of 1099 forms does minnesota require?

You Will Need This Information When Filing Your Annual.

This applies even if you participate in the federal/state combined. Web use this form to register a minnesota limited liability company. Deadline to file minnesota filing. Web you must send us any form 1099 information reporting minnesota withholding by january 31 each year.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)