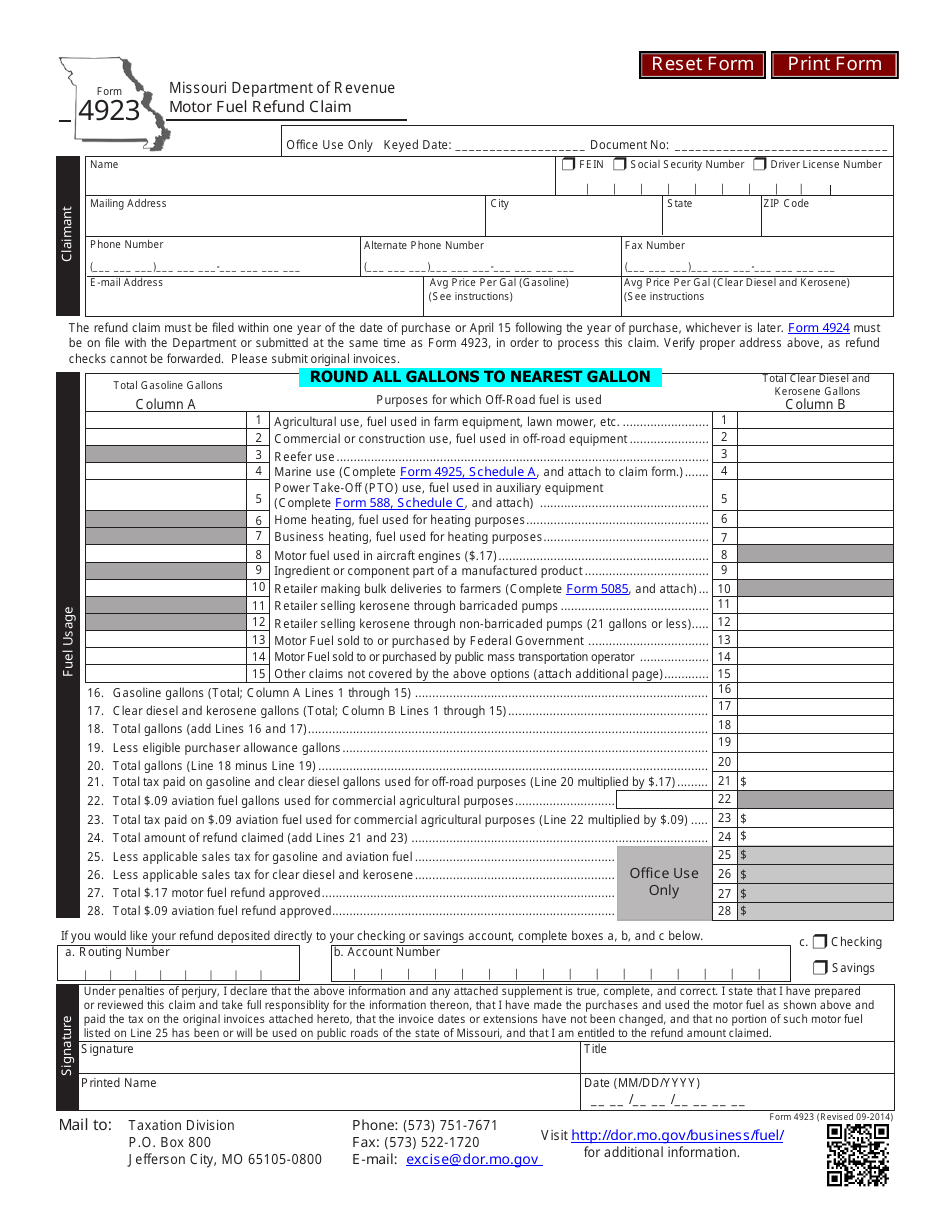

Mo Form 4923

Mo Form 4923 - This is where to put in your data. Sign it in a few clicks draw your. Statement of missouri fuel tax paid for non. Louis — you still have time to file a claim for a gas tax refund. Complete, edit or print tax forms instantly. Web motor fuel refund claim form 4923 the refund claim must be filed within one year of the date of purchase or april 15 following the year of purchase, whichever is later. You must complete the form in its entirety once. Web the best way to fill up mo dor 4923 quick and simple: Fill, sign, email mo 4923 & more fillable forms, register and subscribe now! Web motor fuel refund claim.

You must provide a separate worksheet detailing the fuel purchased for each vehicle by. Web how to get the refund. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. This form cannot be saved to be completed at a later time. Web the best way to fill up mo dor 4923 quick and simple: See the outlined fillable fields. Ad download or email mo 4923 & more fillable forms, register and subscribe now! In october 2021, missouri's motor fuel tax rose to 19.5 cents per. If you would like your. Edit your mo form 4923 fillable online type text, add images, blackout confidential details, add comments, highlights and more.

See the outlined fillable fields. In october 2021, missouri's motor fuel tax rose to 19.5 cents per. Statement of missouri fuel tax paid for non. You must provide a separate worksheet detailing the fuel purchased for each vehicle by. If you would like your. This form cannot be saved to be completed at a later time. Get ready for tax season deadlines by completing any required tax forms today. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Sign it in a few clicks draw your. Web how to get the refund.

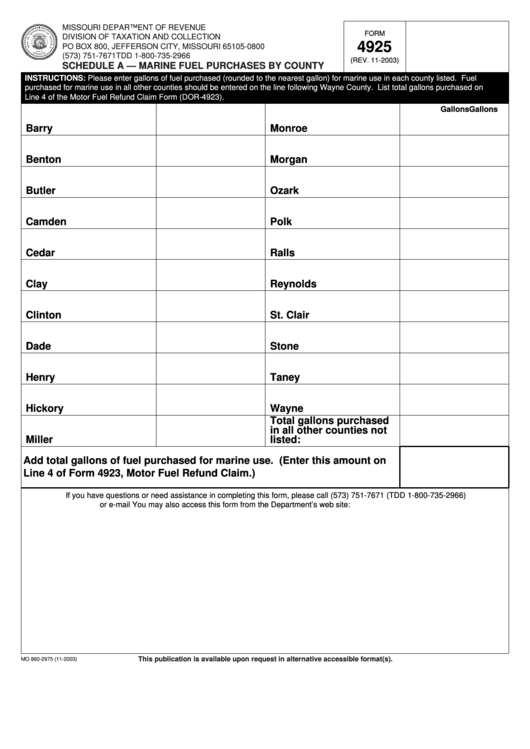

Form 4925 Schedule AMarine Fuel Purchases By County Division Of

Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Fill, sign, email.

20152022 Form MO DoR MOMWP Fill Online, Printable, Fillable, Blank

Edit your mo form 4923 fillable online type text, add images, blackout confidential details, add comments, highlights and more. Statement of missouri fuel tax paid for non. Fill, sign, email mo 4923 & more fillable forms, register and subscribe now! Web motor fuel refund claim form 4923 the refund claim must be filed within one year of the date of.

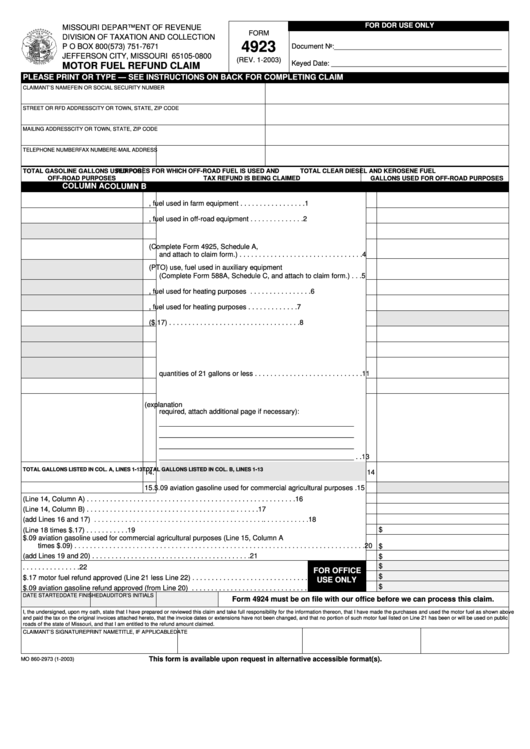

Fillable Form 4923 Motor Fuel Refund Claim Missouri Department Of

This government document is issued by department of revenue for use in missouri. See the outlined fillable fields. In the form drivers need to include the. You must provide a separate worksheet detailing the fuel purchased for each vehicle by. Louis — you still have time to file a claim for a gas tax refund.

MO Form MO1040A 20202022 Fill out Tax Template Online US Legal Forms

The missouri department of revenue said as of july 15, they’ve received 3,175 gas tax. Complete, edit or print tax forms instantly. You must complete the form in its entirety once. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used.

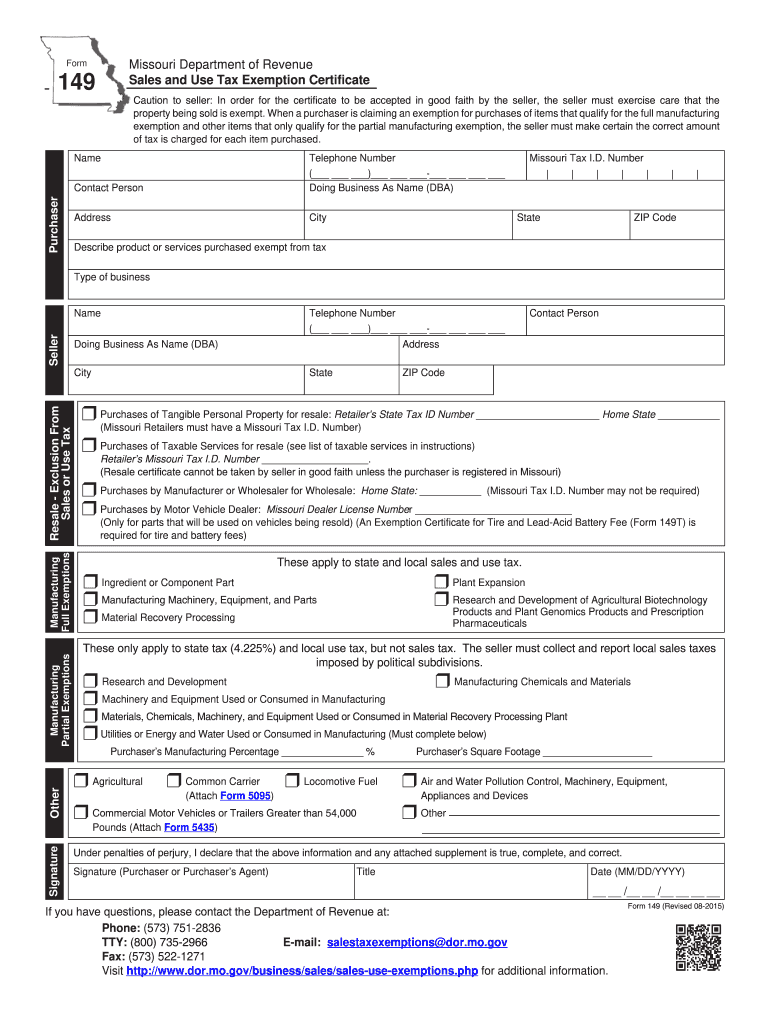

Mo tax exemption 2015 form Fill out & sign online DocHub

Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Fill, sign, email mo 4923 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. You must complete the form in its entirety once. See.

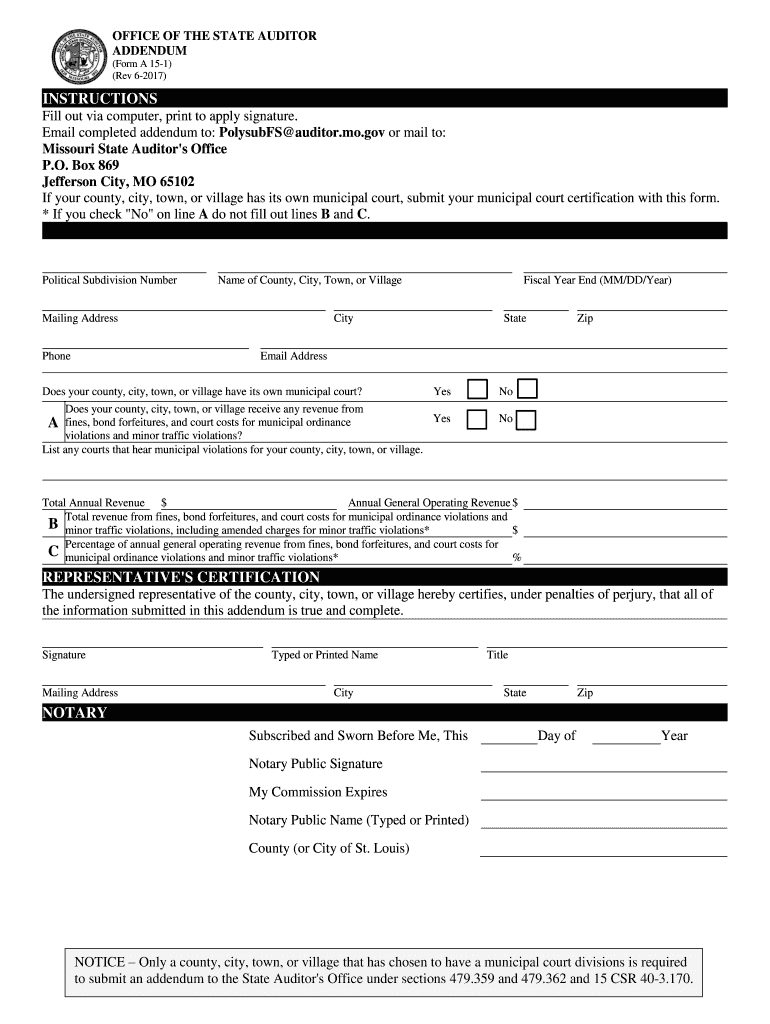

MO Form A 151 20172021 Fill and Sign Printable Template Online US

Complete, edit or print tax forms instantly. Access the pdf template in the editor. In october 2021, missouri's motor fuel tax rose to 19.5 cents per. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Ad download or email mo 4923 & more fillable forms,.

Form 4923H Download Fillable PDF or Fill Online Highway Use Motor Fuel

Web motor fuel refund claim. Web the best way to fill up mo dor 4923 quick and simple: Access the pdf template in the editor. You must complete the form in its entirety once. This form cannot be saved to be completed at a later time.

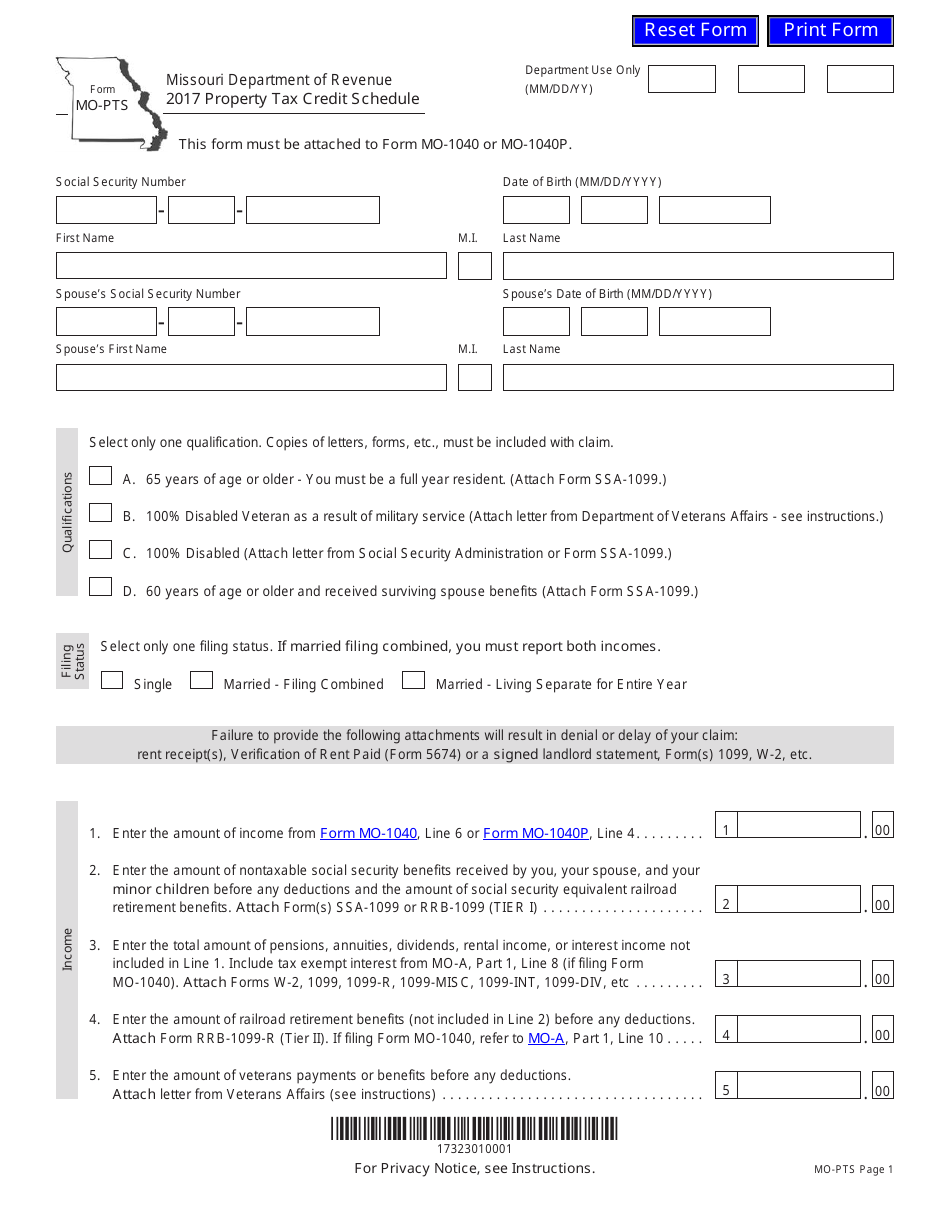

Form MOPTS Download Fillable PDF or Fill Online Property Tax Credit

In october 2021, missouri's motor fuel tax rose to 19.5 cents per. If you would like your. Complete, edit or print tax forms instantly. You must provide a separate worksheet detailing the fuel purchased for each vehicle by. In the form drivers need to include the.

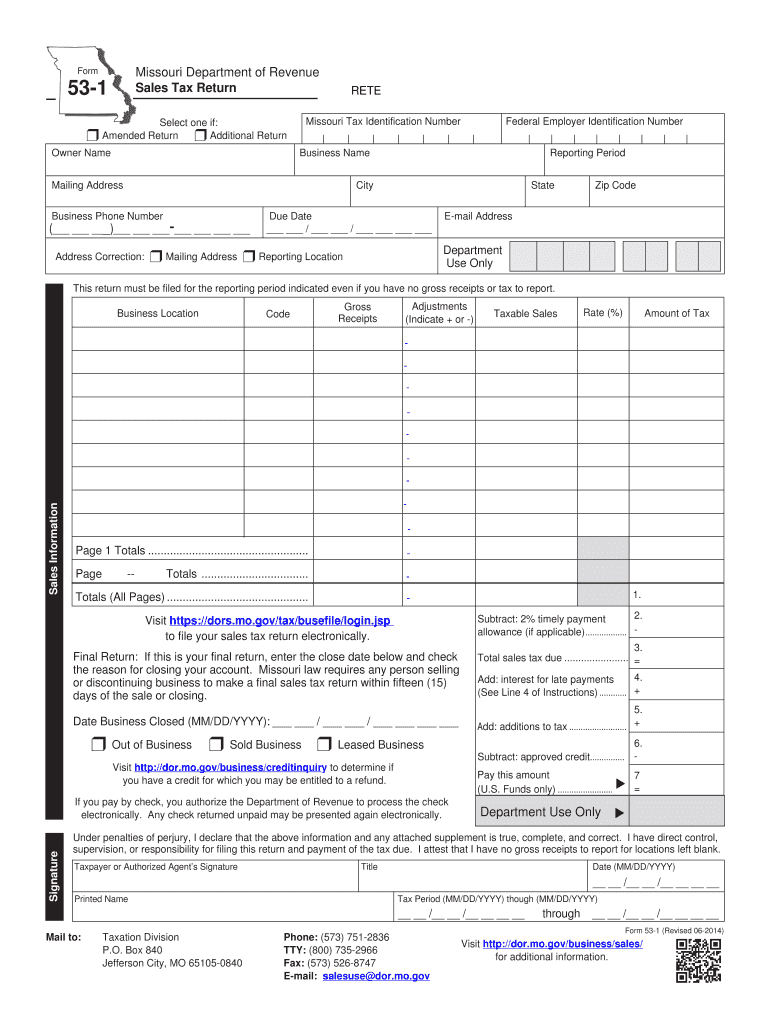

Missouri form 53 1 2014 Fill out & sign online DocHub

In the form drivers need to include the. Statement of missouri fuel tax paid for non. The missouri department of revenue said as of july 15, they’ve received 3,175 gas tax. Get ready for tax season deadlines by completing any required tax forms today. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation.

Form 4923 Download Fillable PDF or Fill Online Motor Fuel Refund Claim

Web motor fuel refund claim form 4923 the refund claim must be filed within one year of the date of purchase or april 15 following the year of purchase, whichever is later. In october 2021, missouri's motor fuel tax rose to 19.5 cents per. See the outlined fillable fields. This government document is issued by department of revenue for use.

If Additional Lines Are Needed Please Attach An Additional Worksheet.

Show details we are not. Complete, edit or print tax forms instantly. The missouri department of revenue said as of july 15, they’ve received 3,175 gas tax. See the outlined fillable fields.

Web Use This Form To File A Refund Claim For The Missouri Motor Fuel Tax Increase Paid Beginning July 1, 2022, Through June 30, 2023, For Motor Fuel Used For On Road Purposes.

In the form drivers need to include the. Ad download or email mo 4923 & more fillable forms, register and subscribe now! You must provide a separate worksheet detailing the fuel purchased for each vehicle by. Web how to get the refund.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Access the pdf template in the editor. In october 2021, missouri's motor fuel tax rose to 19.5 cents per. You must complete the form in its entirety once. Web sep 26, 2022 friday will be the last day to submit receipts to collect gas tax refunds in missouri.

This Is Where To Put In Your Data.

This form cannot be saved to be completed at a later time. Louis — you still have time to file a claim for a gas tax refund. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Web motor fuel refund claim form 4923 the refund claim must be filed within one year of the date of purchase or april 15 following the year of purchase, whichever is later.