Molina Healthcare Tax Form 1095-A

Molina Healthcare Tax Form 1095-A - Complete, edit or print tax forms instantly. Universal prior authorizations medications form. Complete, edit or print tax forms instantly. Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. Web find helpful forms for molina healthcare members such as medical release forms, appeals request forms and more. Open or close your practice to new patients (. Change in tax id and/or npi. Please enter all the mandatory fields for the. By providing you with plans that meet your needs and guidance that makes the process. Add or terminate a provider.

Web at molina, our goal is simple: A blank medication pa re quest form may be obtained by accessing molinahealthcare.com or by calling (844). Add or terminate a provider. Ad access irs tax forms. Web individuals to allow them to: By providing you with plans that meet your needs and guidance that makes the process. Add or close a location. Web change office location, hours, phone, fax, or email. Web molina has provided the best healthcare quality and affordability for more than 30 years. Get ready for tax season deadlines by completing any required tax forms today.

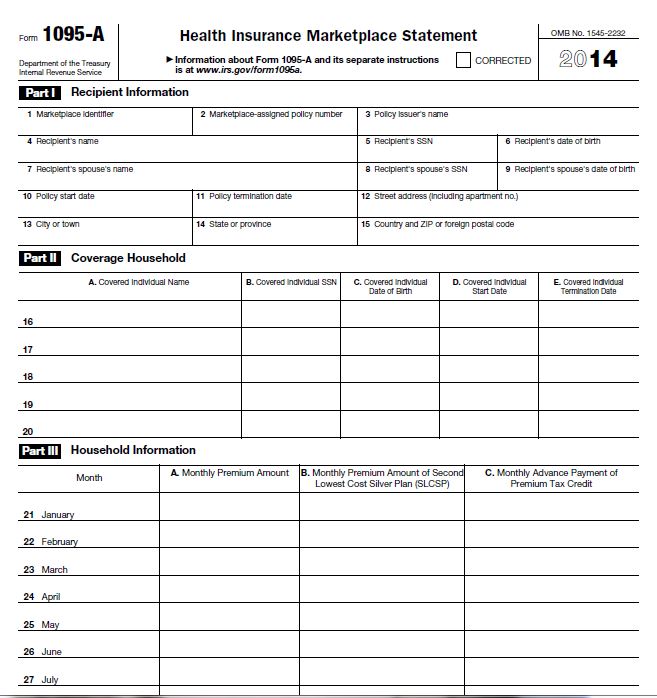

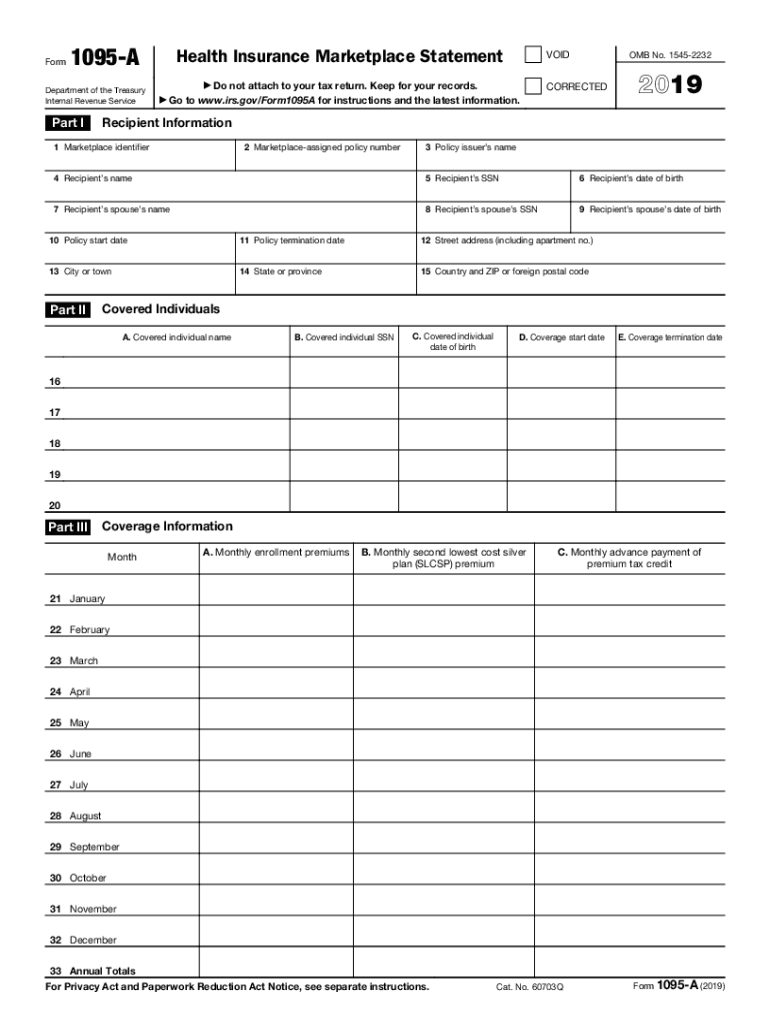

Complete, edit or print tax forms instantly. See what sets us apart. Web the form provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the. Ad access irs tax forms. Universal prior authorizations medications form. Web step 1 log into your marketplace account. Reconcile your premium tax credit; Step 3 select tax forms from. Web change office location, hours, phone, fax, or email. Add or terminate a provider.

2015 1095 Tax Form 1095A, 1095B and 1095C Tax Filing

Get ready for tax season deadlines by completing any required tax forms today. Please enter all the mandatory fields for the form to be. Web step 1 log into your marketplace account. Step 2 under my applications & coverage, select your 2022 application — not your 2023 application. Change in tax id and/or npi.

Latest HealthCare.gov mess 800,000 people's taxes are screwed up

Step 3 select tax forms from. Please enter all the mandatory fields for the. Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. See what sets us apart. Web change office location, hours, phone, fax, or email.

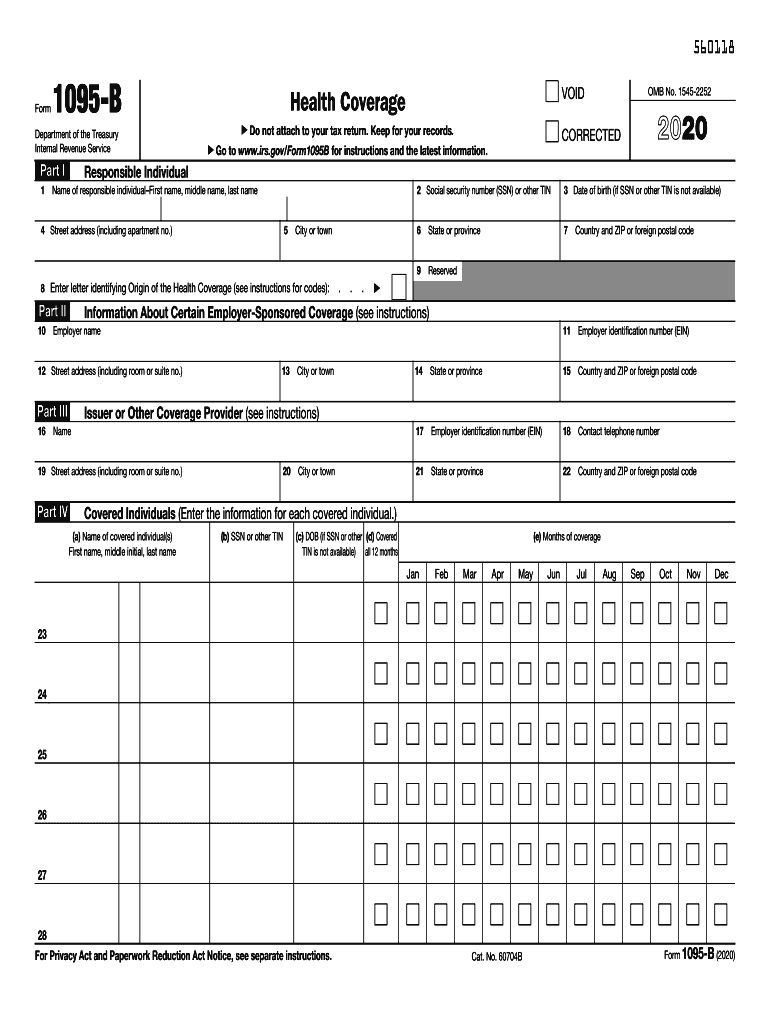

Form 1095 B Health Coverage Fill Out and Sign Printable PDF Template

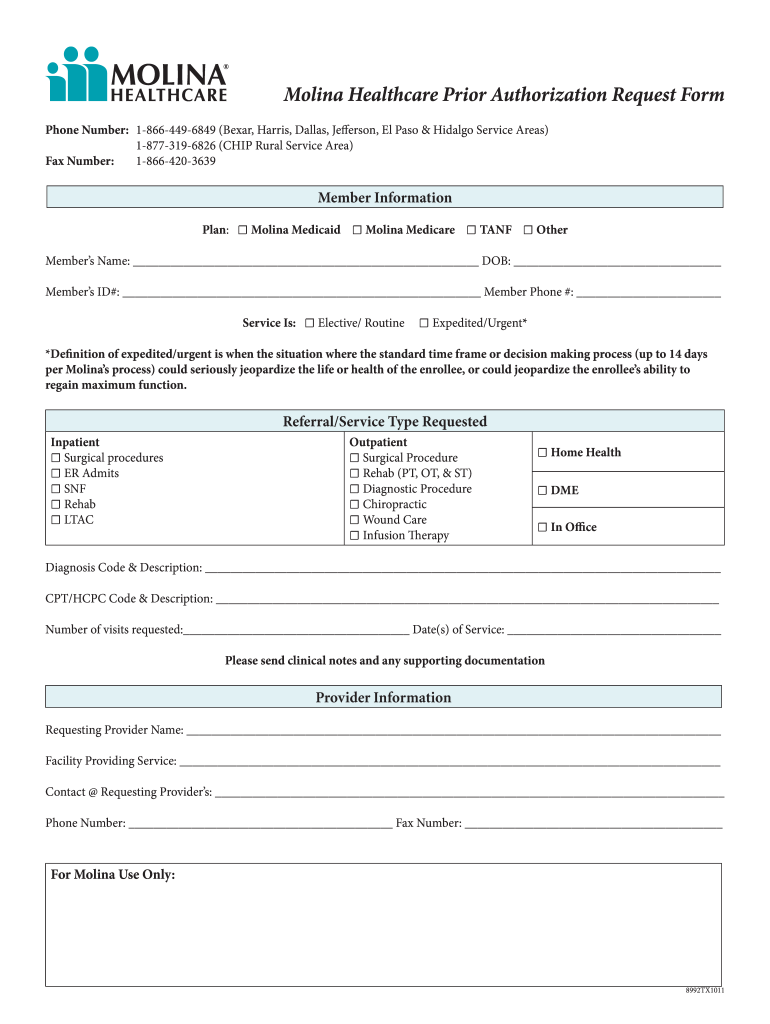

Universal prior authorizations medications form. Please enter all the mandatory fields for the form to be. By providing you with plans that meet your needs and guidance that makes the process. A blank medication pa re quest form may be obtained by accessing molinahealthcare.com or by calling (844). Add or terminate a provider.

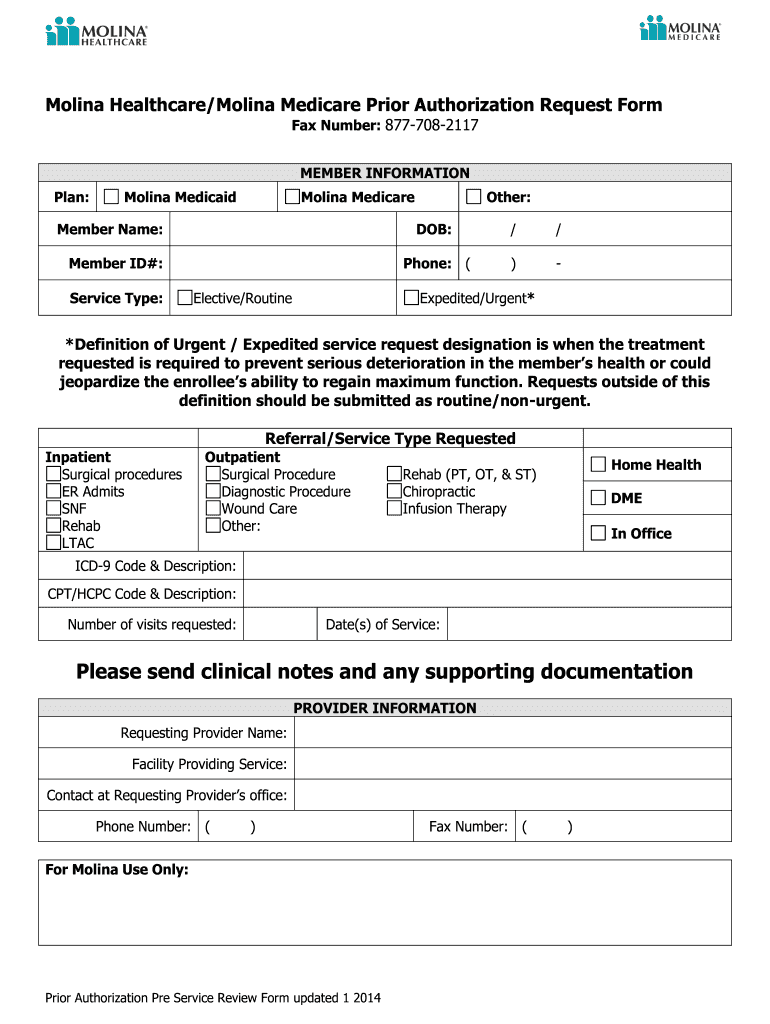

Molina Prior Authorization Form Fill Out and Sign Printable PDF

Please enter all the mandatory fields for the. Complete, edit or print tax forms instantly. 2022 taxes & your health insurance; Add or close a location. This form shows how much financial support was applied to your.

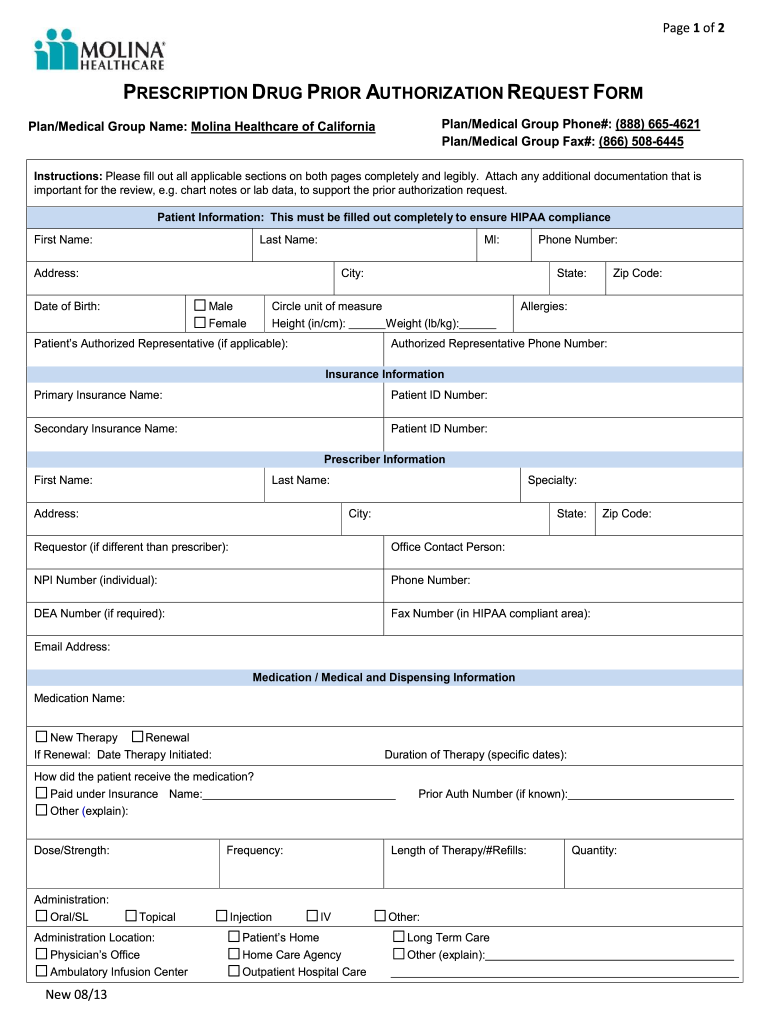

Drug Authorization Form Fill Out and Sign Printable PDF Template

Ad access irs tax forms. Complete, edit or print tax forms instantly. Please enter all the mandatory fields for the form to be. To help you feel better about your medicare coverage. Add or terminate a provider.

How To Get Form 1095 A Health Insurance Marketplace Statement PicsHealth

Add or close a location. To help you feel better about your medicare coverage. Web change office location, hours, phone, fax, or email. Web the form provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the. Web you can also complete an online secure form by clicking.

Form 1095 A Sample Amulette

Reconcile your premium tax credit; To help you feel better about your medicare coverage. Web you can also complete an online secure form by clicking here. Web step 1 log into your marketplace account. Please enter all the mandatory fields for the form to be.

Form 1095A Health Insurance Marketplace Statement (2015) Free Download

See what sets us apart. Add or terminate a provider. Reconcile your premium tax credit; Ad access irs tax forms. Universal prior authorizations medications form.

Molina Prior Authorization Form 2021 Fill Online, Printable, Fillable

Reconcile your premium tax credit; Step 3 select tax forms from. Add or terminate a provider. 2022 taxes & your health insurance; Complete, edit or print tax forms instantly.

2019 Form IRS 1095A Fill Online, Printable, Fillable, Blank pdfFiller

Web change office location, hours, phone, fax, or email. Get ready for tax season deadlines by completing any required tax forms today. See what sets us apart. Complete, edit or print tax forms instantly. Web the form provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the.

Web Molina Has Provided The Best Healthcare Quality And Affordability For More Than 30 Years.

Web find helpful forms for molina healthcare members such as medical release forms, appeals request forms and more. Complete, edit or print tax forms instantly. Step 3 select tax forms from. Web at molina, our goal is simple:

Universal Prior Authorizations Medications Form.

Please enter all the mandatory fields for the. Add or close a location. Web step 1 log into your marketplace account. Change in tax id and/or npi.

Add Or Terminate A Provider.

This form shows how much financial support was applied to your. Open or close your practice to new patients (. Ad access irs tax forms. Step 2 under my applications & coverage, select your 2022 application — not your 2023 application.

A Blank Medication Pa Re Quest Form May Be Obtained By Accessing Molinahealthcare.com Or By Calling (844).

Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. Complete, edit or print tax forms instantly. Web the form provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the. 2022 taxes & your health insurance;