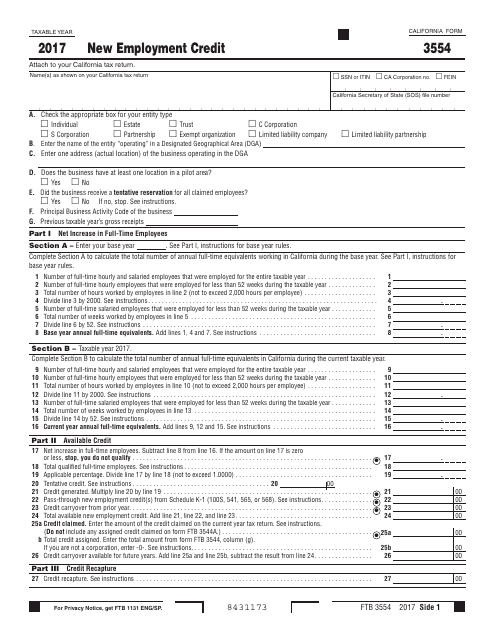

New Employment Credit Form 3554

New Employment Credit Form 3554 - Did the business receive a tentative reservation yes no if no, stop. Department of higher education and workforce development. Web taxable year california form 2020 new employment credit 3554 attach to your california tax return. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do not exceed 350%, of your california minimum wage. Credit carryover from prior year. I want to file an unemployment claim or view my claim information. An employee can earn qualified wages for 60. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. Web 2021 new employment credit taxable year california form 2021 new employment credit 3554 attach to your california tax return. Web california statutes require the ftb to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs created.

I need to register a. Businesses can receive up to $26k per eligible employee. Most likely what happened is when you got the portion of your ca state return that says credit and. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do not exceed 350%, of your california minimum wage. Web california law requires the franchise tax board (ftb) to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs. Did the business receive a tentative reservation yes no if no, stop. I am an employer and have a des employer account number. Credit carryover from prior year. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. I want to file an unemployment claim or view my claim information.

Claim the employee retention credit to get up to $26k per employee. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do not exceed 350%, of your california minimum wage. Web california law requires the franchise tax board (ftb) to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs. Download past year versions of this tax form as. Web for details about wotc, please contact: Businesses can receive up to $26k per eligible employee. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. I am an employer and have a des employer account number. Web pertaining to consumer reports pursuant to the fair credit reporting act (fcra) form 13340 catalog number 35089b (rev.

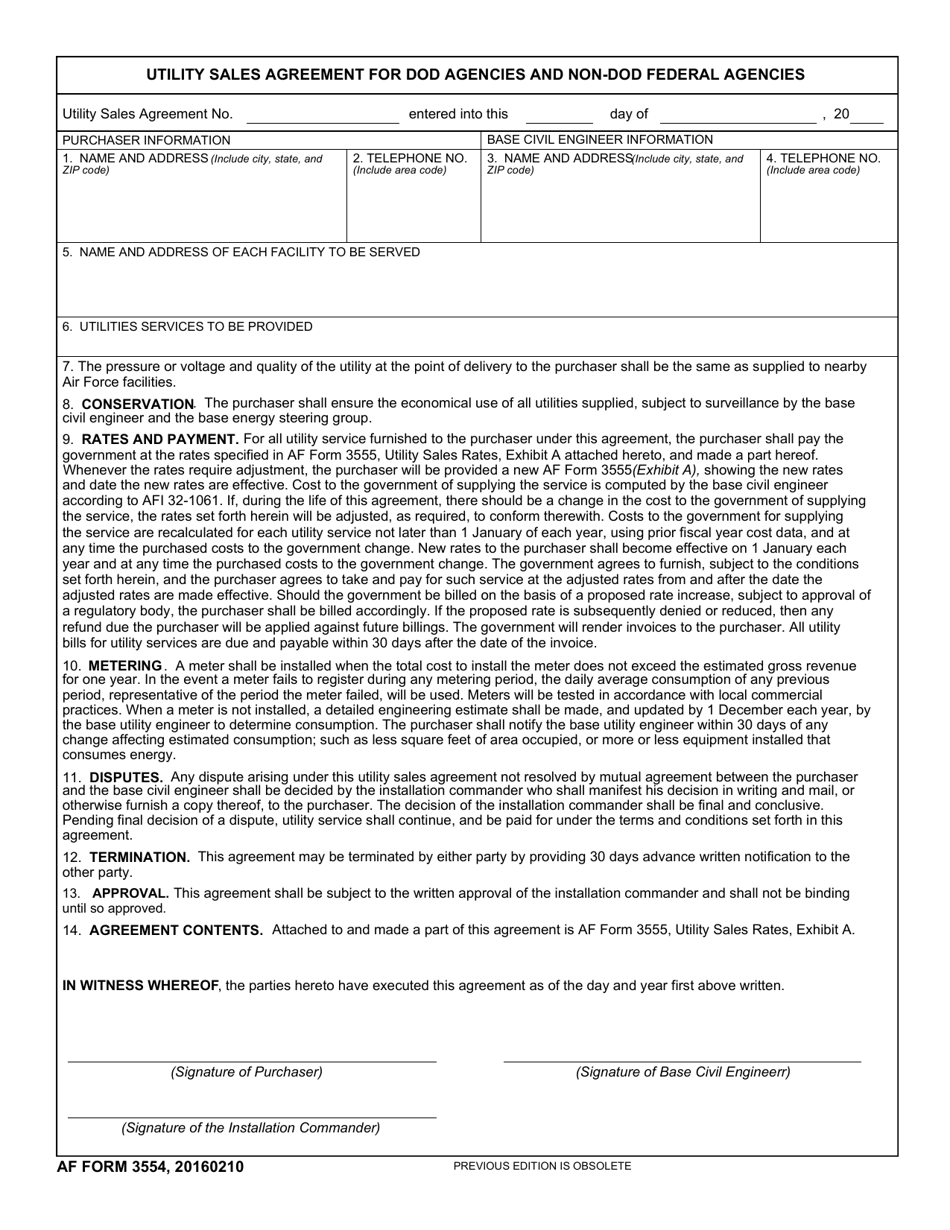

AF Form 3554 Download Fillable PDF or Fill Online Utility Sales

Web for details about wotc, please contact: Web how form 3554 was populated and how to remove: Claim the employee retention credit to get up to $26k per employee. I want to file an unemployment claim or view my claim information. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Form FTB3554 Download Printable PDF or Fill Online New Employment

Web california law requires the franchise tax board (ftb) to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs. Web taxable year california form 2020 new employment credit 3554 attach to your california tax return. Web california statutes require the ftb to report on ftb’s website the.

상품별 매출보고내역서(데이터누적) 엑셀데이터

An employee can earn qualified wages for 60. Web for details about wotc, please contact: I need to register a. I want to file an unemployment claim or view my claim information. Most likely what happened is when you got the portion of your ca state return that says credit and.

기준기검사 신청서 샘플, 양식 다운로드

Web taxable year california form 2020 new employment credit 3554 attach to your california tax return. Web for details about wotc, please contact: Did the business receive a tentative reservation yes no if no, stop. Department of higher education and workforce development. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do not exceed 350%,.

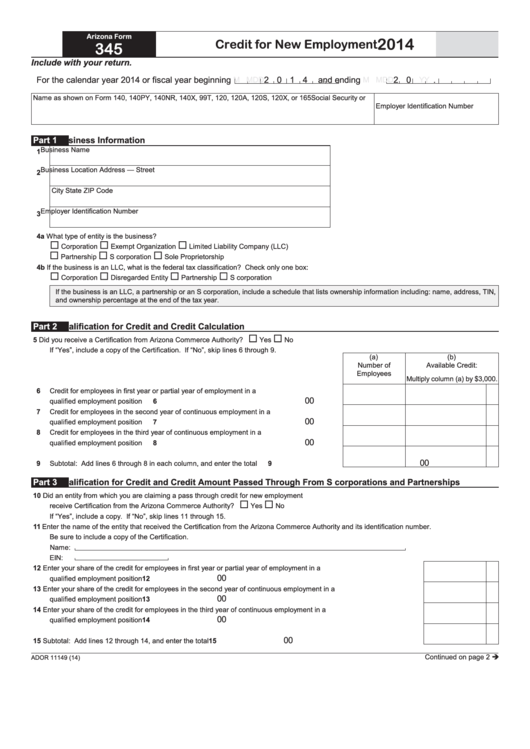

Fillable Form 345 Arizona Credit For New Employment 2014 printable

Web for details about wotc, please contact: Web california statutes require the ftb to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs created. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. I need to register a..

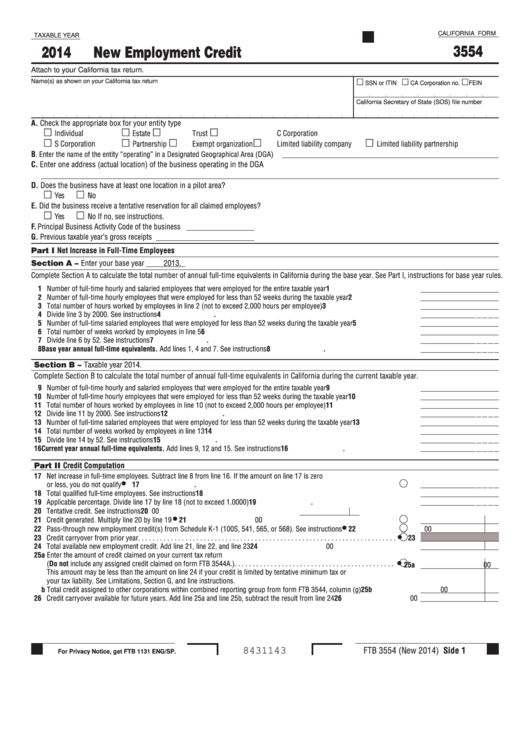

Form 3554 California New Employment Credit 2014 printable pdf download

Claim the employee retention credit to get up to $26k per employee. Department of higher education and workforce development. I want to file an unemployment claim or view my claim information. Web 2019 new employment credit california form 3554 attach to your california tax return. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do.

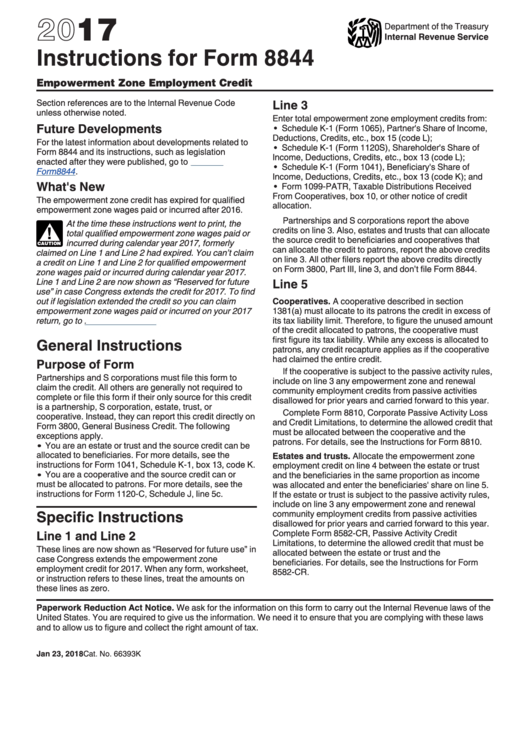

Instructions For Form 8844 Empowerment Zone Employment Credit 2017

I am an employer and have a des employer account number. Web pertaining to consumer reports pursuant to the fair credit reporting act (fcra) form 13340 catalog number 35089b (rev. Web california statutes require the ftb to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs created..

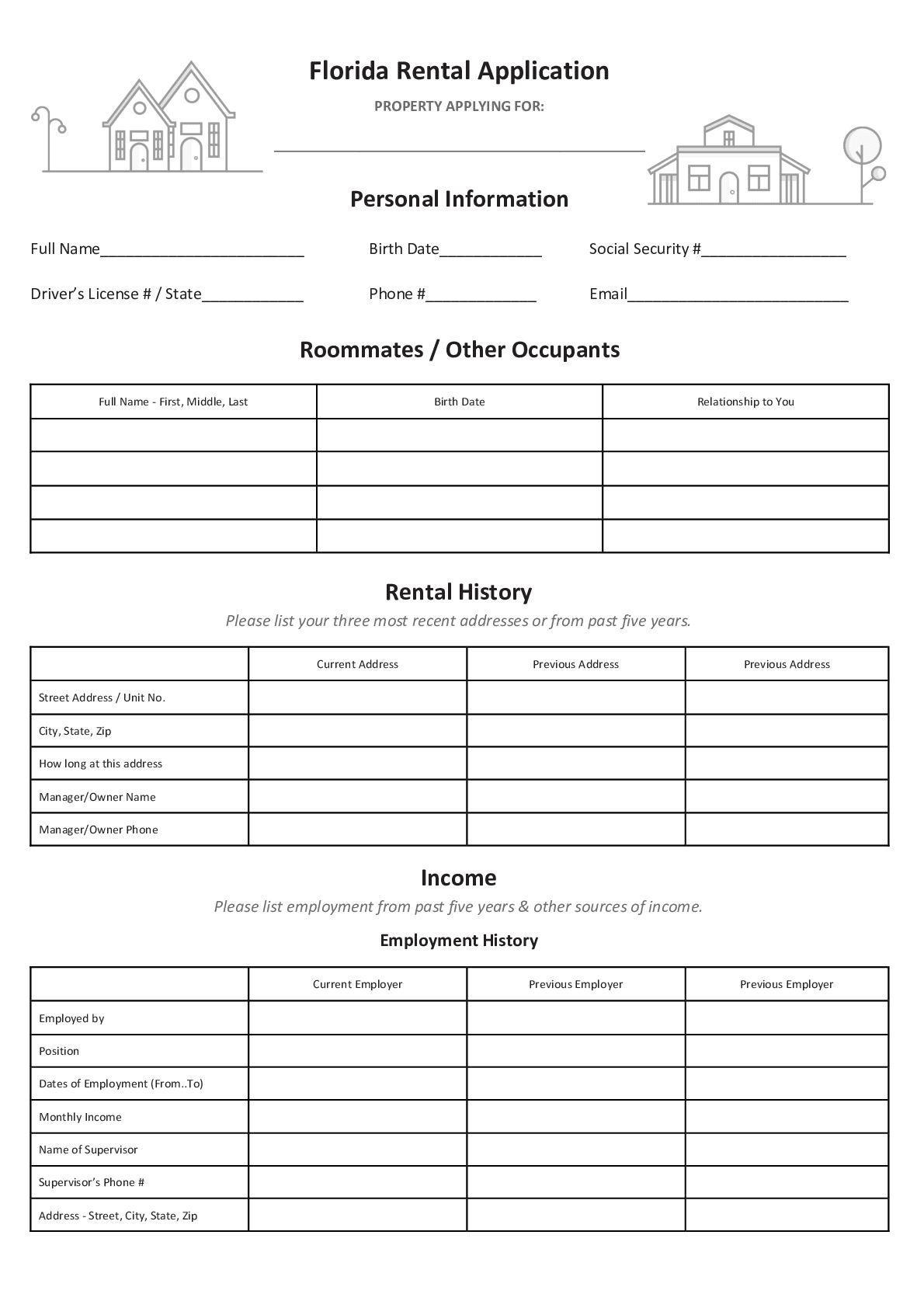

Free Connecticut Rental Application Form PDF & Word 2021 Version

Did the business receive a tentative reservation yes no if no, stop. Credit carryover from prior year. Web california law requires the franchise tax board (ftb) to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs. Web the actual wages paid to your qualified employee (s) that.

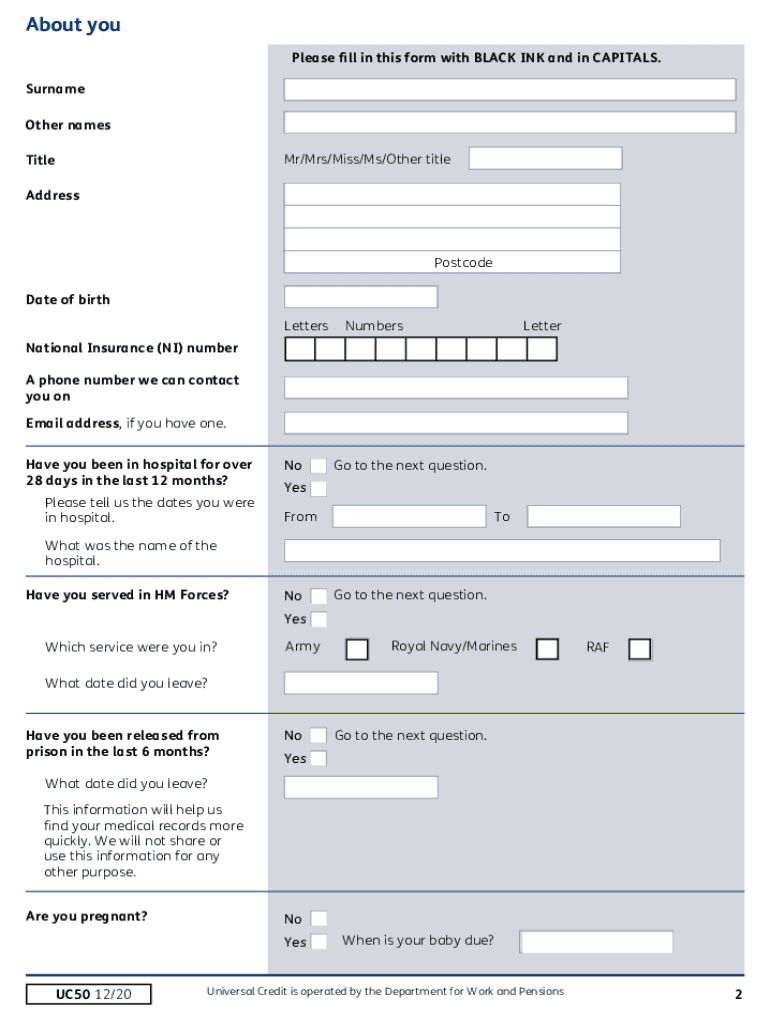

Uc50 Form Fill Online, Printable, Fillable, Blank pdfFiller

I need to register a. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do not exceed 350%, of your california minimum wage. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. Did the business receive a.

기준기검사 신청서 샘플, 양식 다운로드

Department of higher education and workforce development. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. I need to register a. Web taxable year california form 2020 new employment credit 3554 attach to your california tax return. Web california law requires the.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web how form 3554 was populated and how to remove: Did the business receive a tentative reservation yes no if no, stop. Claim the employee retention credit to get up to $26k per employee. Web for details about wotc, please contact:

Web California Statutes Require The Ftb To Report On Ftb’s Website The Names Of Employers Claiming The Credit, The Amount Of The Credit, And The Number Of New Jobs Created.

An employee can earn qualified wages for 60. Web california law requires the franchise tax board (ftb) to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs. Department of higher education and workforce development. Web taxable year california form 2020 new employment credit 3554 attach to your california tax return.

Businesses Can Receive Up To $26K Per Eligible Employee.

Did the business receive a tentative reservation yes no if no, stop. Most likely what happened is when you got the portion of your ca state return that says credit and. I want to file an unemployment claim or view my claim information. I need to register a.

I Am An Employer And Have A Des Employer Account Number.

The missouri department of revenue online withholding calculator is provided as a service for employees, employers, and tax professionals. Web the actual wages paid to your qualified employee (s) that exceed 150%, but do not exceed 350%, of your california minimum wage. Download past year versions of this tax form as. Credit carryover from prior year.