Ohio Sd 100 Form

Ohio Sd 100 Form - Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. Save or instantly send your ready documents. Web we last updated ohio form it sd 100 in december 2022 from the ohio department of taxation. Web use whole dollars only. Edit your sd100 form online type text, add images, blackout confidential details, add comments, highlights and more. How do i make the adjustment for a traditional school district? Go to the state section; This form is for income earned in tax year 2022, with tax returns due in april. Web file a separate ohio sd 100 for each taxing school district in which you lived during the tax year. Web use the ohio sd 100es vouchers to make estimated school district income tax payments.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web form sd 100es is an ohio individual income tax form. Web school district income tax forms — this page contains the school district income tax return (sd 100) as well as support forms and instructions for the return. For taxable year 2015 and forward, this form encompasses the sd 100 and. This form is for income earned in tax year 2022, with tax returns due in april. Web use whole dollars only. 22020102 file a separate ohio sd 100 for each taxing school district in which you lived during the tax year. Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. For additional assistance, refer to the information. Include ohio form sd 40p (see.

Edit your sd100 form online type text, add images, blackout confidential details, add comments, highlights and more. Web if the changes to your school district return are due to an amended ohio it 1040, file your amended sd 100 at the same time. Web to avoid delinquency billings, the department of taxation recommends residents of a taxing school district file the sd 100, even if they are not required to file. Web 2019 ohio sd 100 school district income tax return. Web use whole dollars only. Include ohio form sd 40p (see. Web use the ohio sd 100es vouchers to make estimated school district income tax payments. This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it,. Web we last updated ohio form it sd 100 in december 2022 from the ohio department of taxation.

Top 6 Ohio Form Sd 100 Templates free to download in PDF format

22020102 file a separate ohio sd 100 for each taxing school district in which you lived during the tax year. Web if the changes to your school district return are due to an amended ohio it 1040, file your amended sd 100 at the same time. Ohio residents who lived/resided within a school district with an income tax in effect.

Ltc 100 Form Fill Online, Printable, Fillable, Blank pdfFiller

Web write your school district number, the last four numbers of your social security number and 2013 sd 100 on your paper check or money order. Get ready for this year's tax season quickly and safely with pdffiller! Web use whole dollars only. Sign it in a few clicks draw your signature, type it,. Web you may electronically file the.

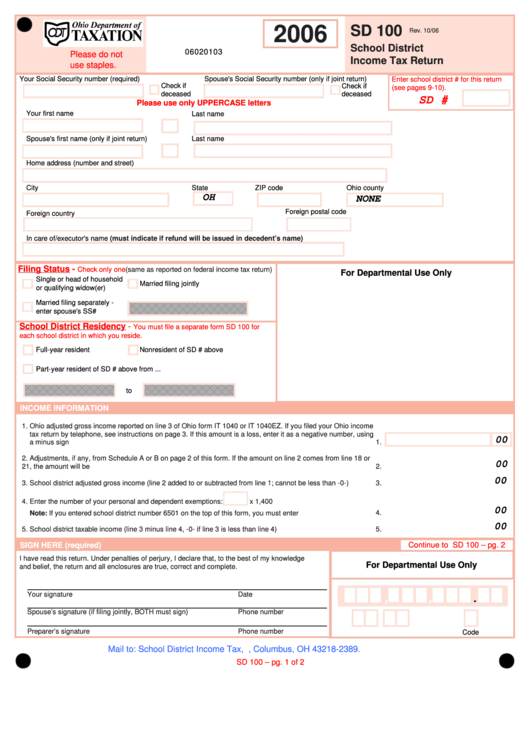

Fillable Form Sd 100 School District Tax Return Ohio

This form is for income earned in tax year 2022, with tax returns due in april. Save or instantly send your ready documents. For additional assistance, refer to the information. Joint filers should determine their combined estimated school district tax liability and. Web file a separate ohio sd 100 for each taxing school district in which you lived during the.

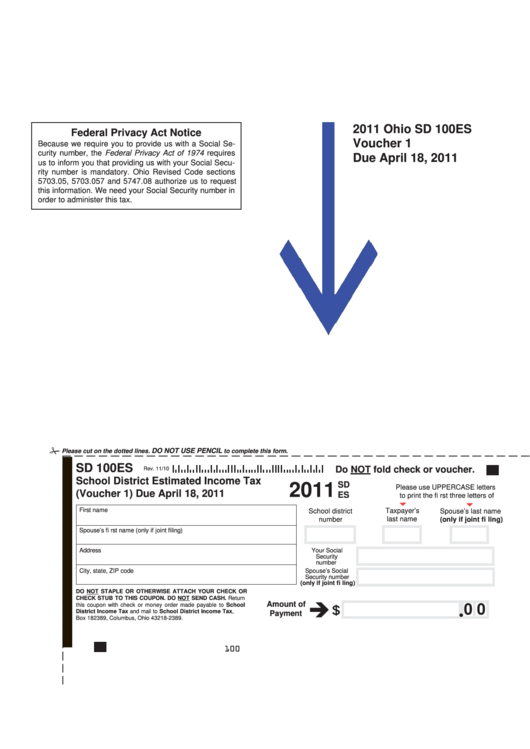

Fillable Form Sd 100es Ohio School District Estimated Tax

This form is for income earned in tax year 2022, with tax returns due in april. Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. How do i make the adjustment for a traditional school district? Web file a separate ohio sd 100 for each taxing school district in which.

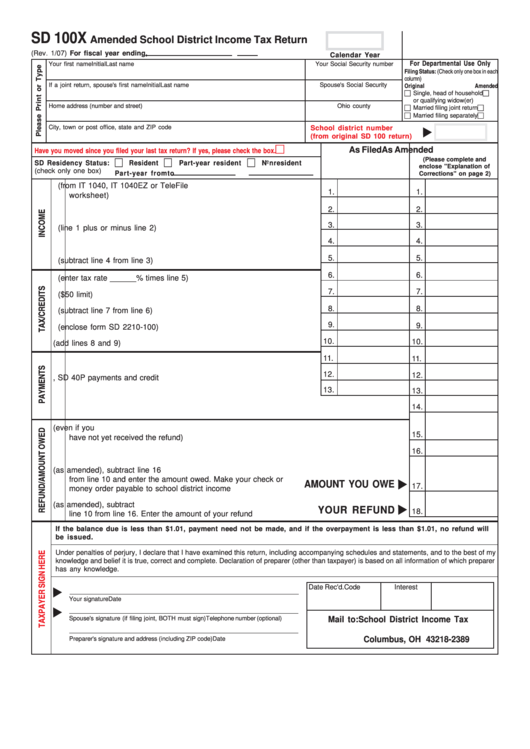

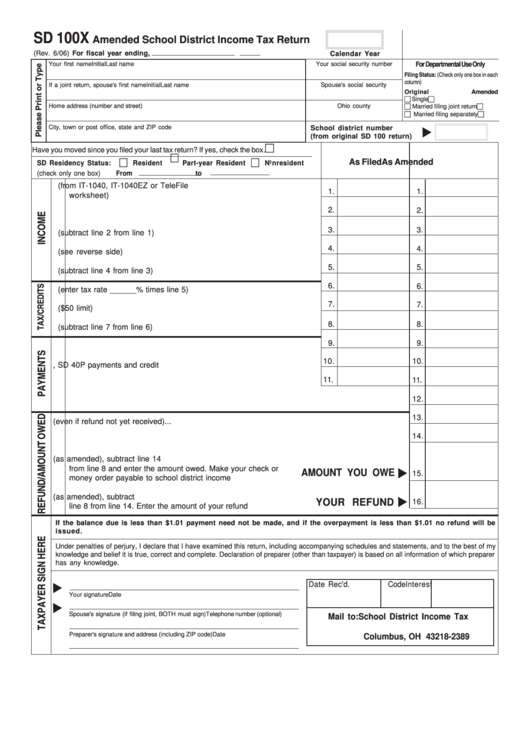

Fillable Form Sd 100x Amended School District Tax Return

Check here if this is an. See the filing tips on the next page as well as the. Web form sd 100es is an ohio individual income tax form. Save or instantly send your ready documents. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.

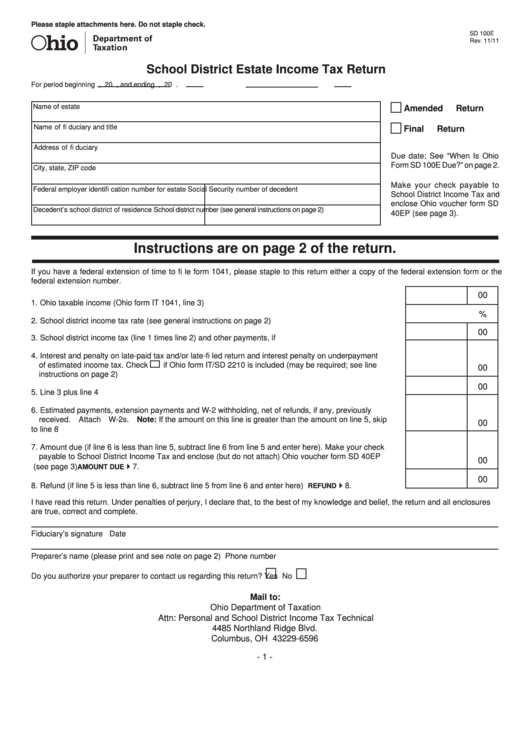

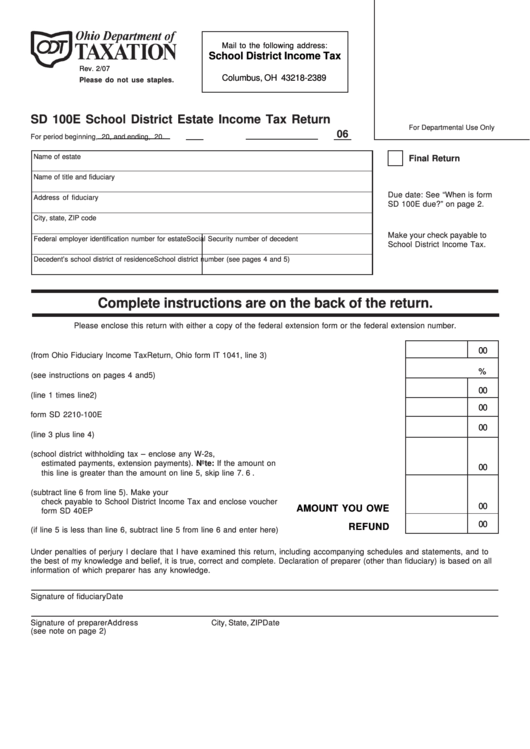

Fillable Form Sd 100e School District Estate Tax Return Form

Save or instantly send your ready documents. Web 2019 ohio sd 100 school district income tax return. Easily fill out pdf blank, edit, and sign them. Web we last updated ohio form it sd 100 in december 2022 from the ohio department of taxation. Web write your school district number, the last four numbers of your social security number and.

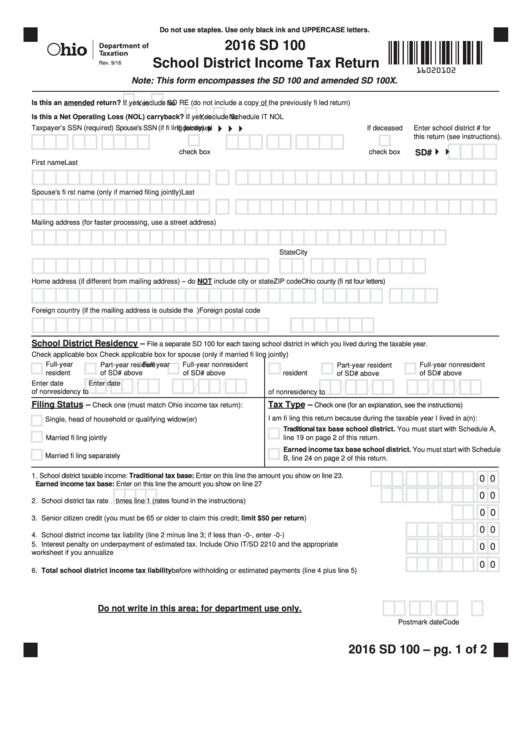

Form Sd 100 School District Tax Return Ohio 2016 printable

For taxable year 2015 and forward, this form encompasses the sd 100 and. Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web to avoid delinquency billings, the department of taxation recommends residents.

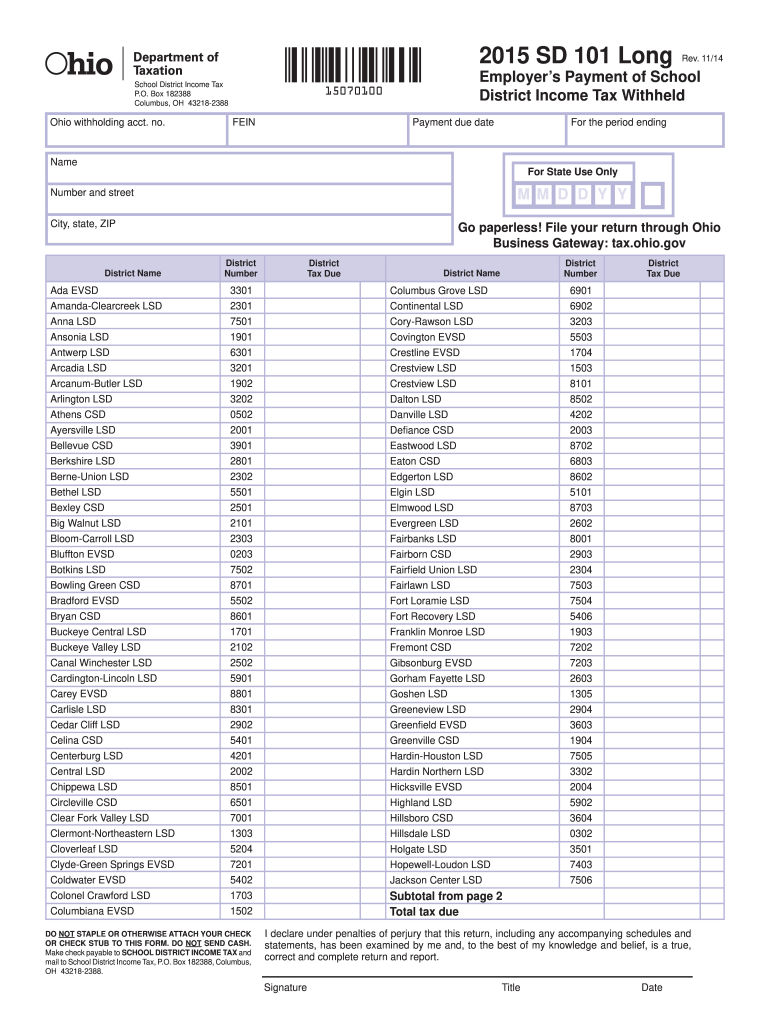

Ohio Sd 101 Form Fill Out and Sign Printable PDF Template signNow

Web 2019 ohio sd 100 school district income tax return. Get ready for this year's tax season quickly and safely with pdffiller! Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. Web use only black ink/uppercase letters.20020102file a separate ohio sd 100 for each taxing school district in which you.

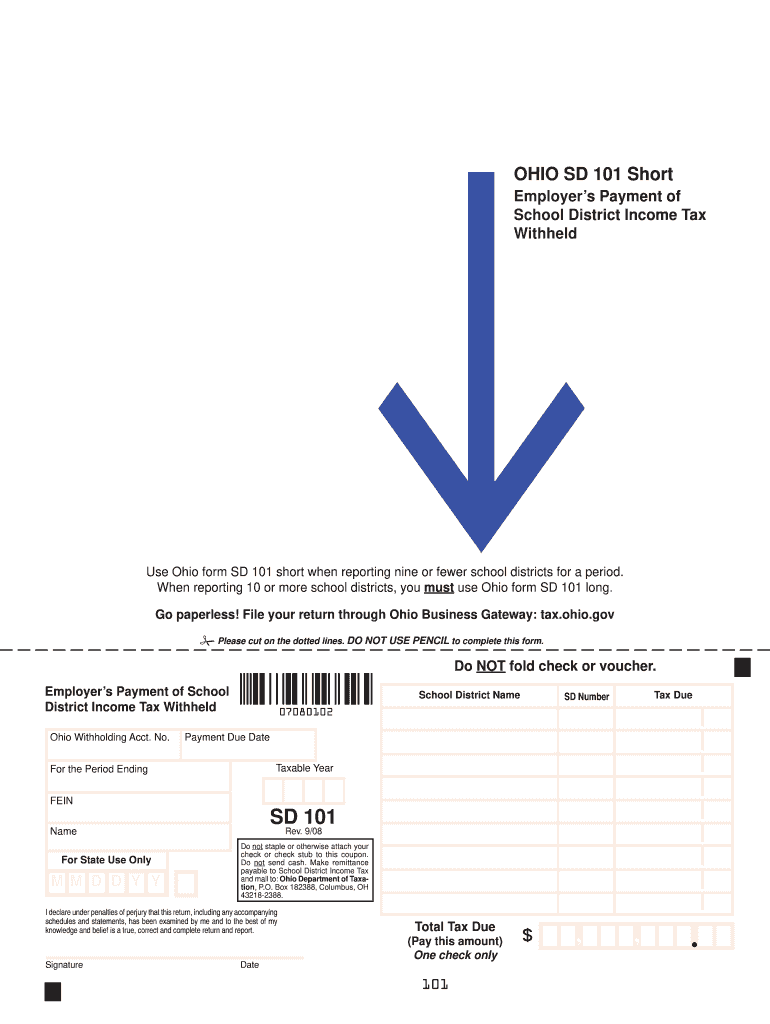

2008 Form OH SD 101 Short Fill Online, Printable, Fillable, Blank

Web you can look up your school district here. Get ready for this year's tax season quickly and safely with pdffiller! Save or instantly send your ready documents. Go to the state section; Complete the ohio sd 100 (checking the amended return box) and include this form with documentation to.

Fillable Form Sd 100x Amended School District Tax Return

Web use the ohio sd 100es vouchers to make estimated school district income tax payments. For additional assistance, refer to the information. Web if the changes to your school district return are due to an amended ohio it 1040, file your amended sd 100 at the same time. Complete the ohio sd 100 (checking the amended return box) and include.

Web To Avoid Delinquency Billings, The Department Of Taxation Recommends Residents Of A Taxing School District File The Sd 100, Even If They Are Not Required To File.

Web use only black ink/uppercase letters.20020102file a separate ohio sd 100 for each taxing school district in which you lived during the tax year. 22020102 file a separate ohio sd 100 for each taxing school district in which you lived during the tax year. Web write your school district number, the last four numbers of your social security number and 2013 sd 100 on your paper check or money order. Joint filers should determine their combined estimated school district tax liability and.

How Do I Make The Adjustment For A Traditional School District?

00 2019 ohio sd 100 school district. Web school district income tax forms — this page contains the school district income tax return (sd 100) as well as support forms and instructions for the return. This form is for income earned in tax year 2022, with tax returns due in april. For taxable year 2015 and forward, this form encompasses the sd 100 and.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

Check here if this is an. Ohio residents who lived/resided within a school district with an income tax in effect for all or part of the. Sign it in a few clicks draw your signature, type it,. Web file a separate ohio sd 100 for each taxing school district in which you lived during the tax year.

Save Or Instantly Send Your Ready Documents.

Web we last updated ohio form it sd 100 in december 2022 from the ohio department of taxation. Web form sd 100es is an ohio individual income tax form. Web use the ohio sd 100es vouchers to make estimated school district income tax payments. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.