Oklahoma 1099 Form

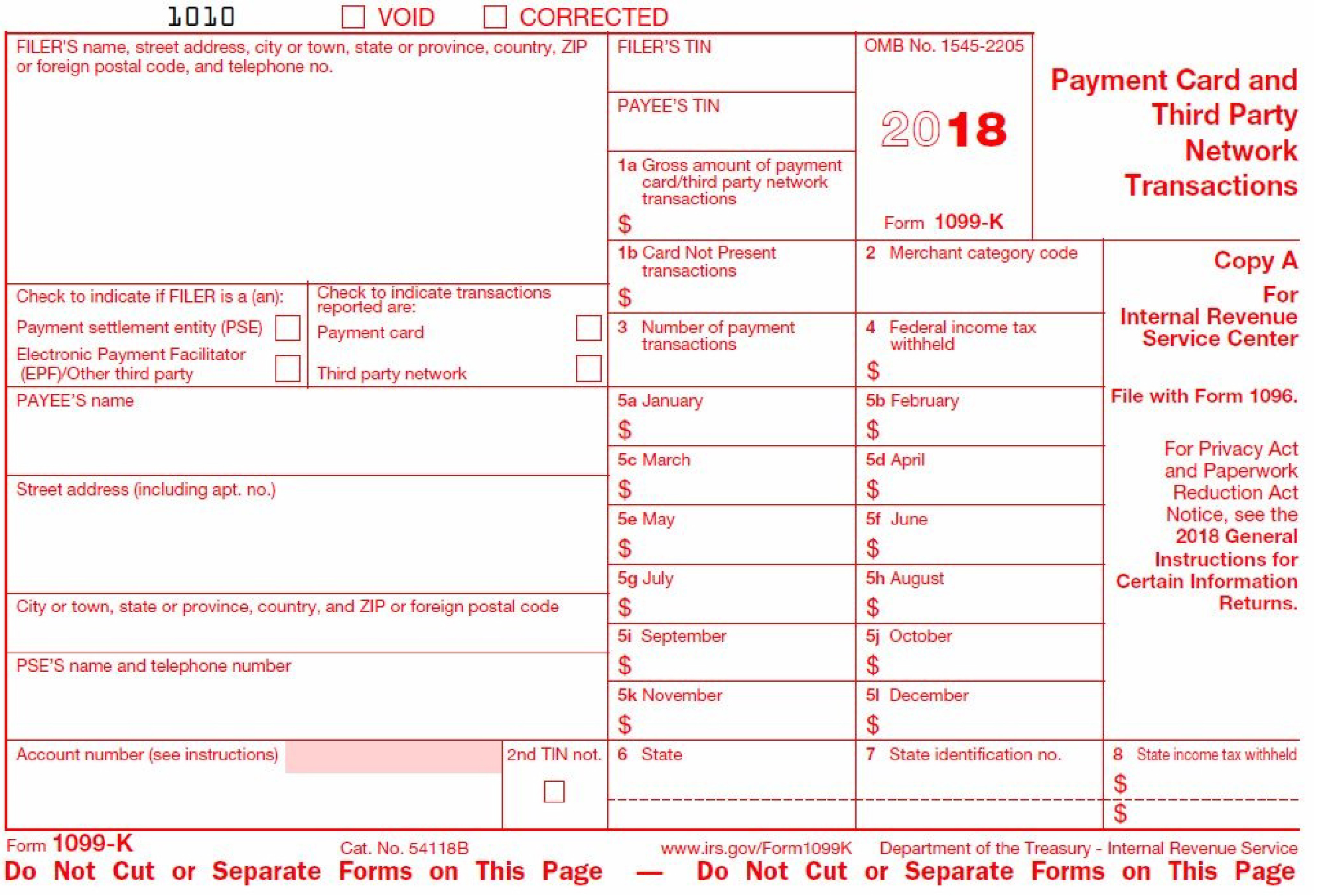

Oklahoma 1099 Form - Filers must report payments of $750 or more. 1099 forms if you paid an independent contractor during the year, you. Web a new hotline is available for oklahoma taxpayers who have questions about how unemployment benefits affect their tax returns. This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the oklahoma tax. Web form 501 (state of oklahoma annual information return summary) together with the 1099 forms being reposted must be sent to the tax commission by end. Web oklahoma 1099 filing requirements the sooner state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. Request for taxpayer identification number (tin) and. Each year, the teachers' retirement system of. Web normally, the oklahoma tax commission must receive copies of the 1099 forms and the applicable summary form no later than february 28 of the year following the tax year for. Web form 1099s combined federal and state filing the cf/sf program forwards original and corrected information returns filed electronically through the filing information returns.

Filers must report payments of $750 or more. Between you and bank of oklahoma. Web form 501 (state of oklahoma annual information return summary) together with the 1099 forms being reposted must be sent to the tax commission by end. Web oklahoma 1099 filing requirements the sooner state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the oklahoma tax. If payments made to an oklahoma resident exceed $750. Web apply for unemployment visit our unemployment portal to file an initial unemployment claim, file a weekly certification, verify your identity, check the status of a claim, or manage an open claim. 1099 forms if you paid an independent contractor during the year, you. Individual tax return form 1040 instructions; Web normally, the oklahoma tax commission must receive copies of the 1099 forms and the applicable summary form no later than february 28 of the year following the tax year for.

If payments made to an oklahoma resident exceed $750. Web normally, the oklahoma tax commission must receive copies of the 1099 forms and the applicable summary form no later than february 28 of the year following the tax year for. Individual tax return form 1040 instructions; The dedicated hotline, plus an. Filers must report payments of $750 or more. 1099 forms if you paid an independent contractor during the year, you. Web the oklahoma tax commission mandates the filing of the 1099 forms under the following conditions: This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the oklahoma tax. Web a new hotline is available for oklahoma taxpayers who have questions about how unemployment benefits affect their tax returns. Each year, the teachers' retirement system of.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Request for taxpayer identification number (tin) and. Web oklahoma 1099 filing requirements the sooner state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the oklahoma tax. Web normally, the.

How To Find 1099 G Form Online Paul Johnson's Templates

If payments made to an oklahoma resident exceed $750. Web an independent contractor is defined by law as one who engages to perform certain services for another, according to his own manner and method, free from control and. The dedicated hotline, plus an. Web normally, the oklahoma tax commission must receive copies of the 1099 forms and the applicable summary.

How To File Form 1099NEC For Contractors You Employ VacationLord

The dedicated hotline, plus an. Web apply for unemployment visit our unemployment portal to file an initial unemployment claim, file a weekly certification, verify your identity, check the status of a claim, or manage an open claim. 1099 forms if you paid an independent contractor during the year, you. Web normally, the oklahoma tax commission must receive copies of the.

IRS 1099S 2020 Fill and Sign Printable Template Online US Legal Forms

Web normally, the oklahoma tax commission must receive copies of the 1099 forms and the applicable summary form no later than february 28 of the year following the tax year for. Web form 1099s combined federal and state filing the cf/sf program forwards original and corrected information returns filed electronically through the filing information returns. This access level allows the.

Form 1099 g instructions

Web a new hotline is available for oklahoma taxpayers who have questions about how unemployment benefits affect their tax returns. Web the oklahoma tax commission mandates the filing of the 1099 forms under the following conditions: Web form 501 (state of oklahoma annual information return summary) together with the 1099 forms being reposted must be sent to the tax commission.

1099G Taxable? tax

Each year, the teachers' retirement system of. Web apply for unemployment visit our unemployment portal to file an initial unemployment claim, file a weekly certification, verify your identity, check the status of a claim, or manage an open claim. If payments made to an oklahoma resident exceed $750. Between you and bank of oklahoma. Web the oklahoma tax commission mandates.

Free Printable 1099 Misc Forms Free Printable

If payments made to an oklahoma resident exceed $750. 1099 forms if you paid an independent contractor during the year, you. The dedicated hotline, plus an. Each year, the teachers' retirement system of. Request for taxpayer identification number (tin) and.

Oklahoma DPS REAL ID Requirements Guide

Web oklahoma 1099 filing requirements the sooner state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. Filers must report payments of $750 or more. This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the oklahoma tax. Each year,.

How Not To Deal With A Bad 1099

Web apply for unemployment visit our unemployment portal to file an initial unemployment claim, file a weekly certification, verify your identity, check the status of a claim, or manage an open claim. Each year, the teachers' retirement system of. This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the.

1099NEC or 1099MISC What has changed and why it matters Pro News Report

Web apply for unemployment visit our unemployment portal to file an initial unemployment claim, file a weekly certification, verify your identity, check the status of a claim, or manage an open claim. Web oklahoma 1099 filing requirements the sooner state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. Individual.

Web The Oklahoma Tax Commission Mandates The Filing Of The 1099 Forms Under The Following Conditions:

Between you and bank of oklahoma. Each year, the teachers' retirement system of. Individual tax return form 1040 instructions; If payments made to an oklahoma resident exceed $750.

The Dedicated Hotline, Plus An.

Web a new hotline is available for oklahoma taxpayers who have questions about how unemployment benefits affect their tax returns. This access level allows the logon to view all information for an account, file returns, and exchange secure messages with the oklahoma tax. Web oklahoma 1099 filing requirements the sooner state requires filing for various 1099 forms based on amount of payment and whether state taxes were withheld or not. Web an independent contractor is defined by law as one who engages to perform certain services for another, according to his own manner and method, free from control and.

Web Form 1099S Combined Federal And State Filing The Cf/Sf Program Forwards Original And Corrected Information Returns Filed Electronically Through The Filing Information Returns.

Web apply for unemployment visit our unemployment portal to file an initial unemployment claim, file a weekly certification, verify your identity, check the status of a claim, or manage an open claim. Filers must report payments of $750 or more. 1099 forms if you paid an independent contractor during the year, you. Request for taxpayer identification number (tin) and.

Web Form 501 (State Of Oklahoma Annual Information Return Summary) Together With The 1099 Forms Being Reposted Must Be Sent To The Tax Commission By End.

Web normally, the oklahoma tax commission must receive copies of the 1099 forms and the applicable summary form no later than february 28 of the year following the tax year for.