Oklahoma Form 511-A

Oklahoma Form 511-A - Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Web below is a list of income that needs to be added to your oklahoma return. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Oklahoma resident income tax return form • form. Ad download or email ok form 511 & more fillable forms, register and subscribe now! Agency code '695' form title: Oklahoma resident income tax return : Exemptions ($1,000 x total number of exemptions claimed above). Web oklahoma standard deduction or federal itemized deductions. Oklahoma resident income tax return • form 511:

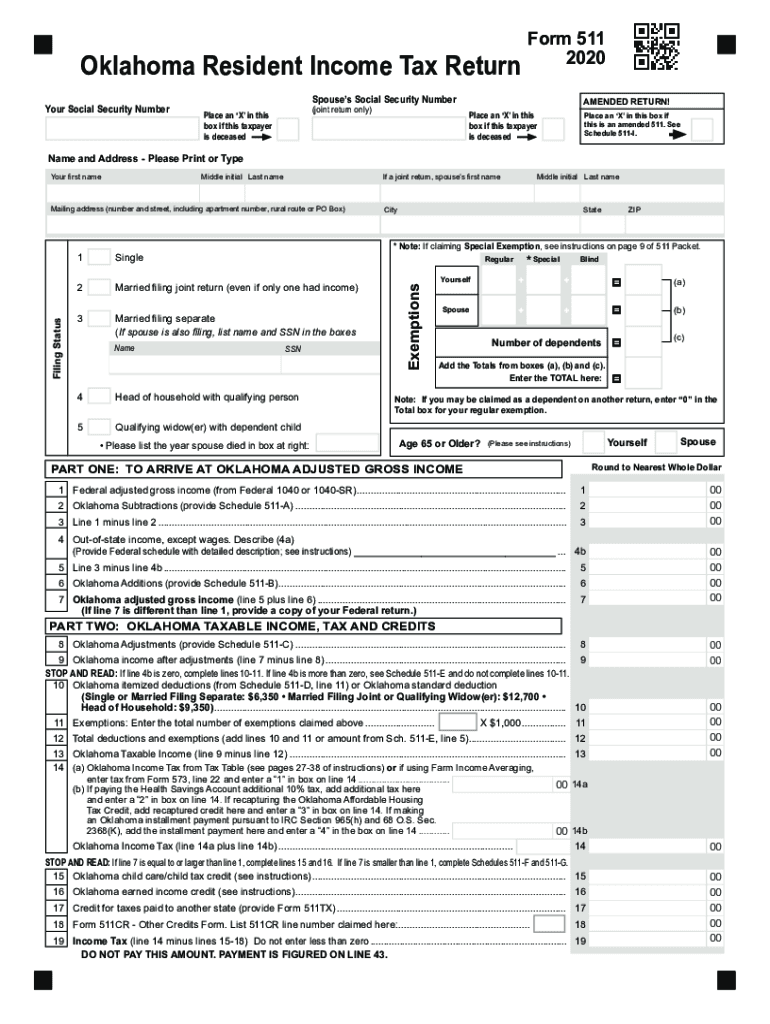

Exemptions ($1,000 x total number of exemptions claimed above). Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if spouse is name:also filing, list name and ssn in the boxes: Web below is a list of income that needs to be added to your oklahoma return. Oklahoma resident income tax return : Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. You will not be able to upload. Ad download or email ok form 511 & more fillable forms, register and subscribe now! • instructions for completing the form 511: Many adjustments required supporting documentation to be attached with your adjustment claim.

Many adjustments required supporting documentation to be attached with your adjustment claim. Web oklahoma standard deduction or federal itemized deductions. You will not be able to upload. If the internal revenue code (irc) of. Web the oklahoma eic is refundable beginning with tax year 2022. Exemptions ($1,000 x total number of exemptions claimed above). Web below is a list of income that needs to be added to your oklahoma return. Ad download or email ok form 511 & more fillable forms, register and subscribe now! Agency code '695' form title: Oklahoma resident income tax return form • form.

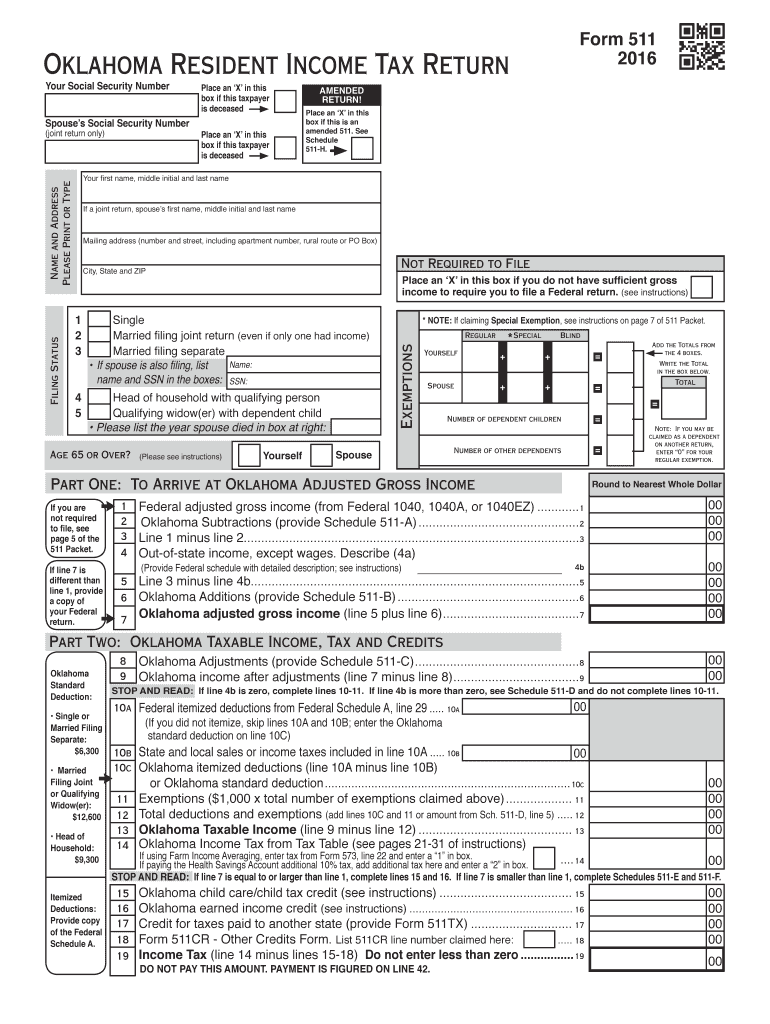

Form 511 Oklahoma Resident Tax Return and Sales Tax Relief

Oklahoma resident income tax return form • form. You will not be able to upload. Exemptions ($1,000 x total number of exemptions claimed above). • instructions for completing the form 511: Government obligations interest on us.

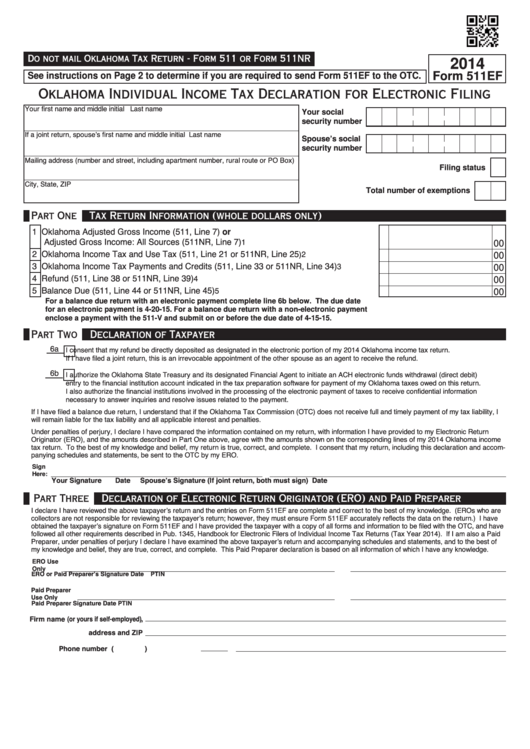

Fillable Form 511ef Oklahoma Individual Tax Declaration For

Web below is a list of income that needs to be added to your oklahoma return. Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if spouse is name:also filing, list name and ssn in the boxes: State and municipal bond interest. 2011 oklahoma resident individual income tax forms: Many adjustments required.

Oklahoma form 2014 Fill out & sign online

Oklahoma resident income tax return • form 511: 2011 oklahoma resident individual income tax forms: Many adjustments required supporting documentation to be attached with your adjustment claim. Oklahoma resident income tax return • form 511: Web oklahoma standard deduction or federal itemized deductions.

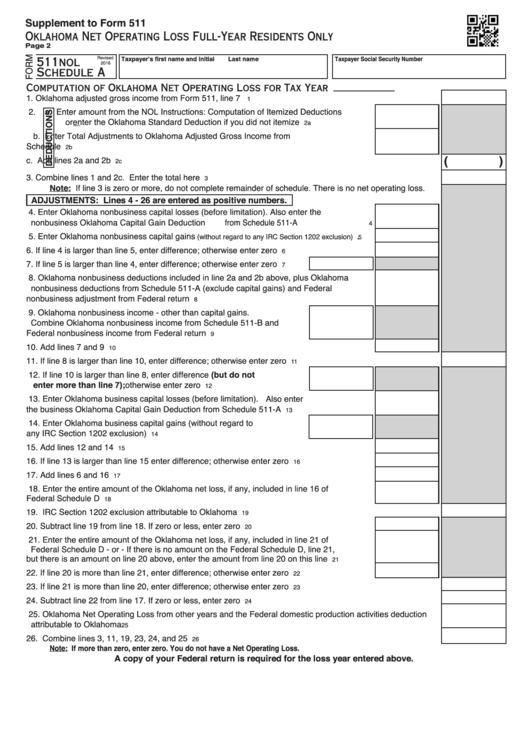

Fillable Form 511Nol Oklahoma Net Operating Loss FullYear Residents

Many adjustments required supporting documentation to be attached with your adjustment claim. Oklahoma resident income tax return form • form. Exemptions ($1,000 x total number of exemptions claimed above). Oklahoma resident income tax return form • form. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return.

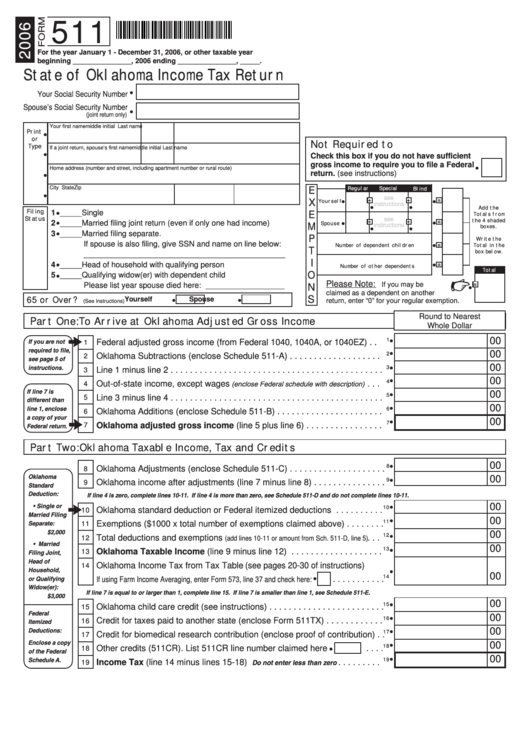

Form 511 State Of Oklahoma Tax Return 2006 printable pdf

When to file an amended return generally, to claim a. Web instructions for form 511x this form is for residents only. Oklahoma resident income tax return : Exemptions ($1,000 x total number of exemptions claimed above). Web below is a list of income that needs to be added to your oklahoma return.

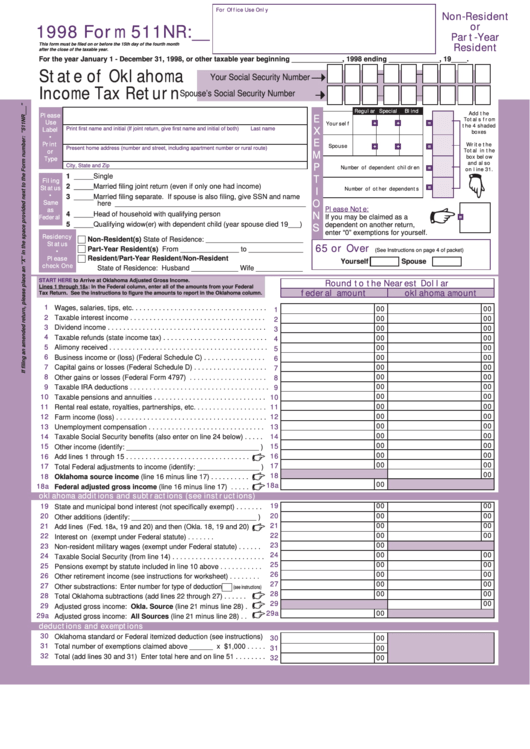

Fillable Form 511nr State Of Oklahoma Tax Return 1998

Agency code '695' form title: Oklahoma resident income tax return • form 511: 2011 oklahoma resident individual income tax forms: Name as shown on return: This form is for income earned in tax year 2022, with tax returns due in april 2023.

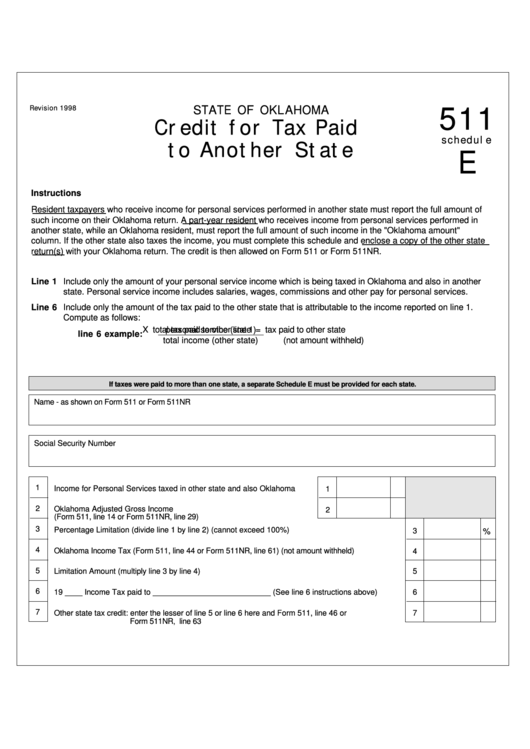

Fillable Form 511 Schedule E Credit For Tax Paid To Another State

2011 oklahoma resident individual income tax forms: Exemptions ($1,000 x total number of exemptions claimed above). If the internal revenue code (irc) of. Name as shown on return: Complete, edit or print tax forms instantly.

2020 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

2011 oklahoma resident individual income tax forms: Oklahoma resident income tax return • form 511: • instructions for completing the form 511: You will not be able to upload. Ad download or email ok form 511 & more fillable forms, register and subscribe now!

Form 511NR Oklahoma Nonresident Part Year Tax Return YouTube

Ad download or email ok form 511 & more fillable forms, register and subscribe now! State and municipal bond interest. This form is for income earned in tax year 2022, with tax returns due in april 2023. • instructions for completing the form 511: If the internal revenue code (irc) of.

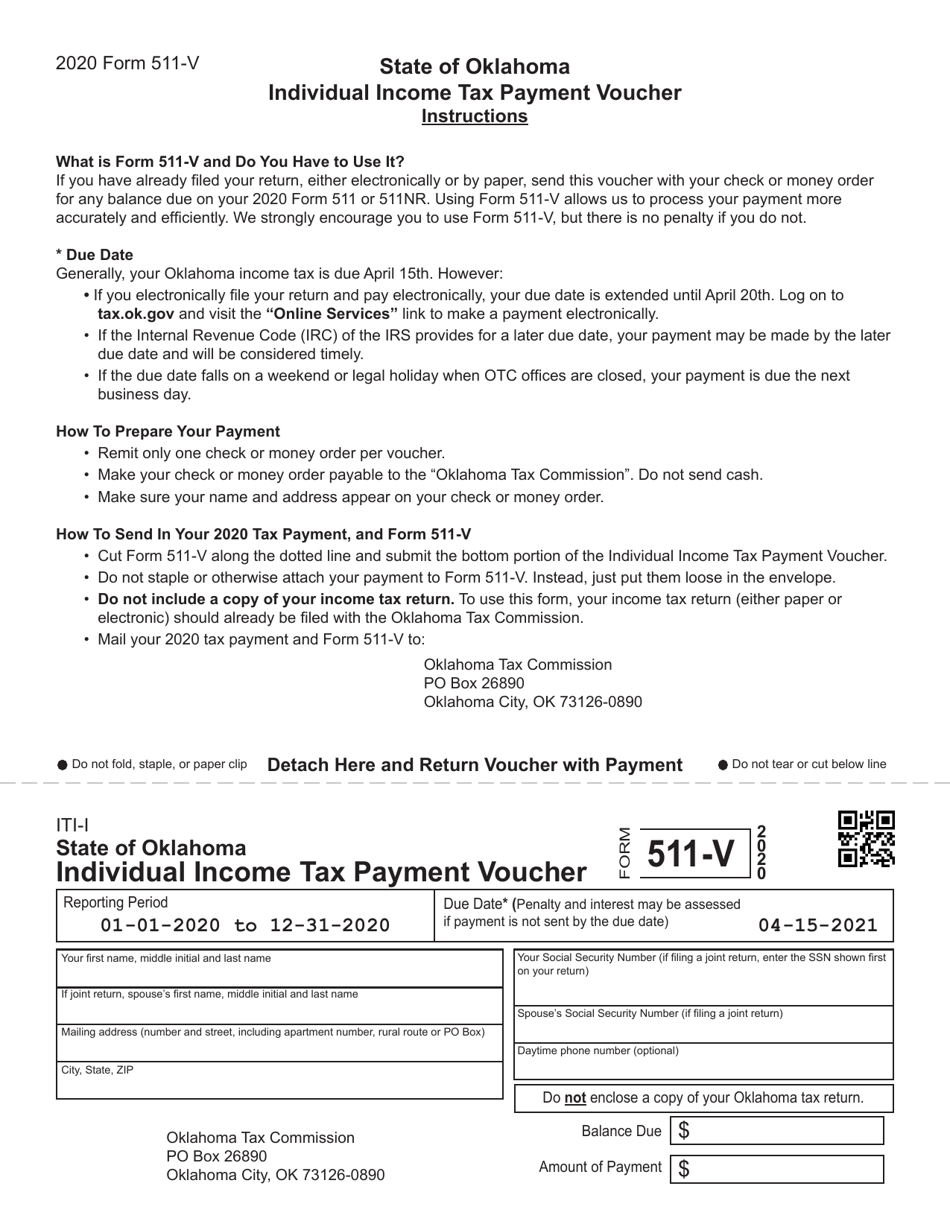

Form 511V Download Fillable PDF or Fill Online Individual Tax

If the internal revenue code (irc) of. Ad download or email ok form 511 & more fillable forms, register and subscribe now! Oklahoma resident income tax return • form 511: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web 1 single 2married filing joint return (even if only one had income).

Web And Is Deducted In The “Oklahoma Amount Column.” Note:

Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Web oklahoma standard deduction or federal itemized deductions. 2011 oklahoma resident individual income tax forms: You will not be able to upload.

• Instructions For Completing The Form 511:

Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Web below is a list of income that needs to be added to your oklahoma return. State and municipal bond interest. Name as shown on return:

Web We Last Updated Oklahoma Form 511 In January 2023 From The Oklahoma Tax Commission.

Complete, edit or print tax forms instantly. Government obligations interest on us. If the internal revenue code (irc) of. Web instructions for form 511x this form is for residents only.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Web the oklahoma eic is refundable beginning with tax year 2022. Oklahoma resident income tax return • form 511: • instructions for completing the form 511: Ad download or email ok form 511 & more fillable forms, register and subscribe now!