On Return Form

On Return Form - Web get federal tax return forms and file by mail. Clones mourners form guard of honour as remains of teenager killed on way to debs return home kiea mccann (17) and dlava mohamed (16). An individual having salary income should collect. Or form 843, claim for refund and. Form 511 is the general income tax return for oklahoma residents. The first step of filing itr is to collect all the documents related to the process. Web the national hurricane center lowered the chances an atlantic system could form into the season’s next tropical depression or storm. Web once you visit the site and enter your information, the irs will display the status of your amended return as: Web 11 hours agomonaghan crash: Person filing form 8865, any required statements to qualify for the.

And transmittal of wage and tax statements: Web documents needed to file itr; Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web once you visit the site and enter your information, the irs will display the status of your amended return as: Then select an option from the reason for return menu. Web request for transcript of tax return. Or form 843, claim for refund and. Sign, mail form 511 or 511nr to. Web get federal tax return forms and file by mail. Web how to return or exchange | on visit on's help center and we'll help you answer any questions you may have regarding shipping, returns, warranty claims, and more.

An individual having salary income should collect. Person filing form 8865, any required statements to qualify for the. Do not file this form with the decedent’s income tax return. Web information about form 1040, u.s. Web how to return or exchange | on visit on's help center and we'll help you answer any questions you may have regarding shipping, returns, warranty claims, and more. Sign, mail form 511 or 511nr to. Web file form 507 after the decedent’s income tax return has been submitted. Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with. Form 511 is the general income tax return for oklahoma residents. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

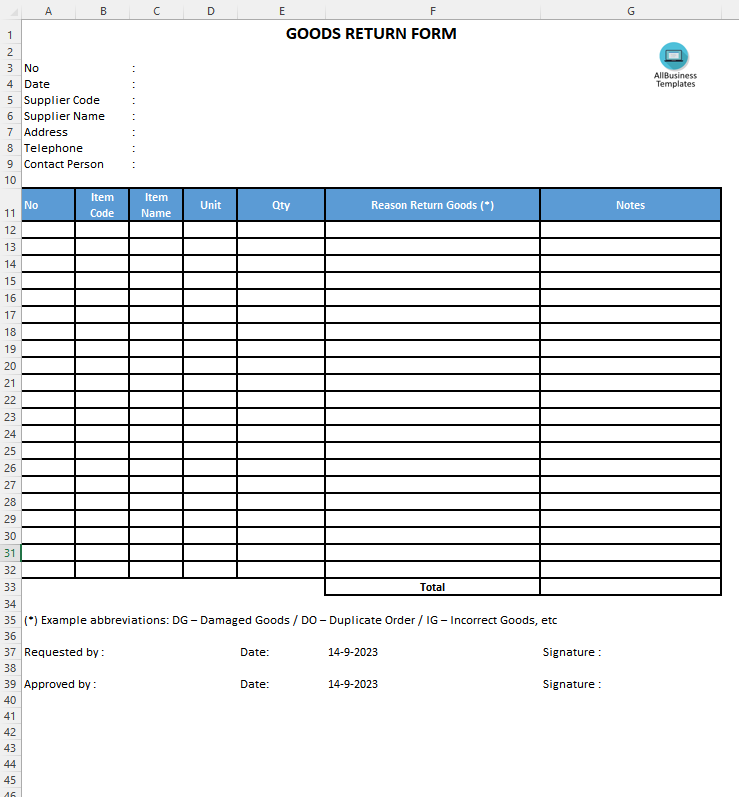

Goods Return Form Excel Templates at

And transmittal of wage and tax statements: Web the irs provides many forms and publications in accessible formats for current and prior tax years. Return the original refund check with this. Web choose the order and select return or replace items. Choose how to process your.

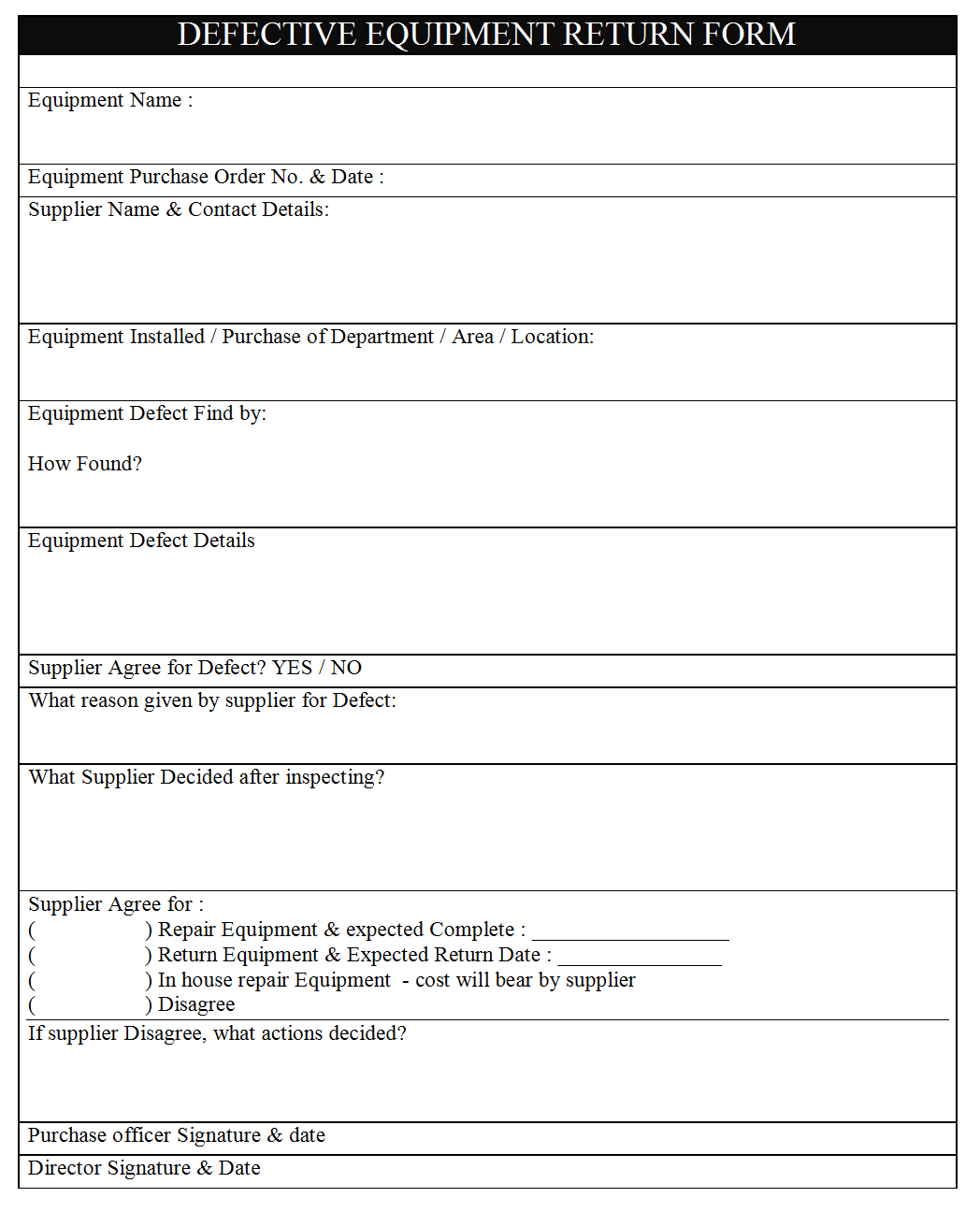

Defective Equipment Return form

Web the irs provides many forms and publications in accessible formats for current and prior tax years. Web request for transcript of tax return. Web information about form 1040, u.s. Web file form 507 after the decedent’s income tax return has been submitted. Person filing form 8865, any required statements to qualify for the.

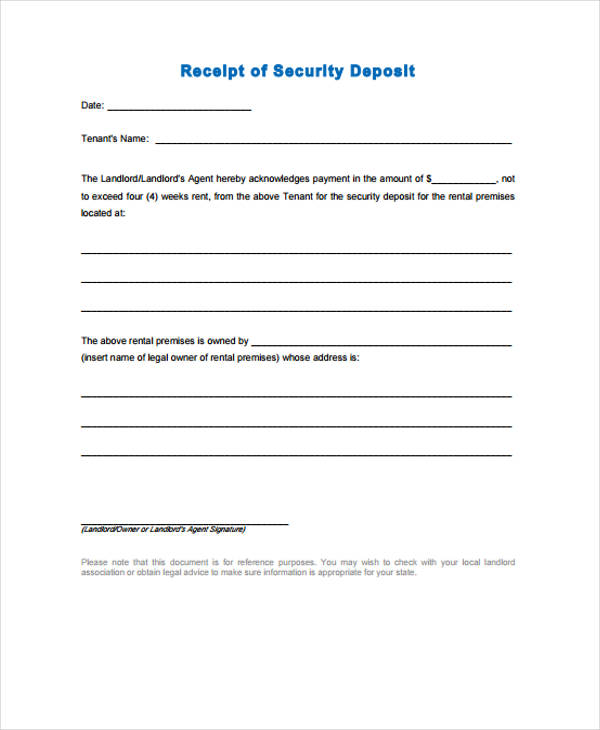

FREE 10+ Security Deposit Return Forms in PDF MS Word

Get section 508 accessible pdfs; Web 11 hours agomonaghan crash: Web information about form 1040, u.s. Clones mourners form guard of honour as remains of teenager killed on way to debs return home kiea mccann (17) and dlava mohamed (16). Select the item you want to return.

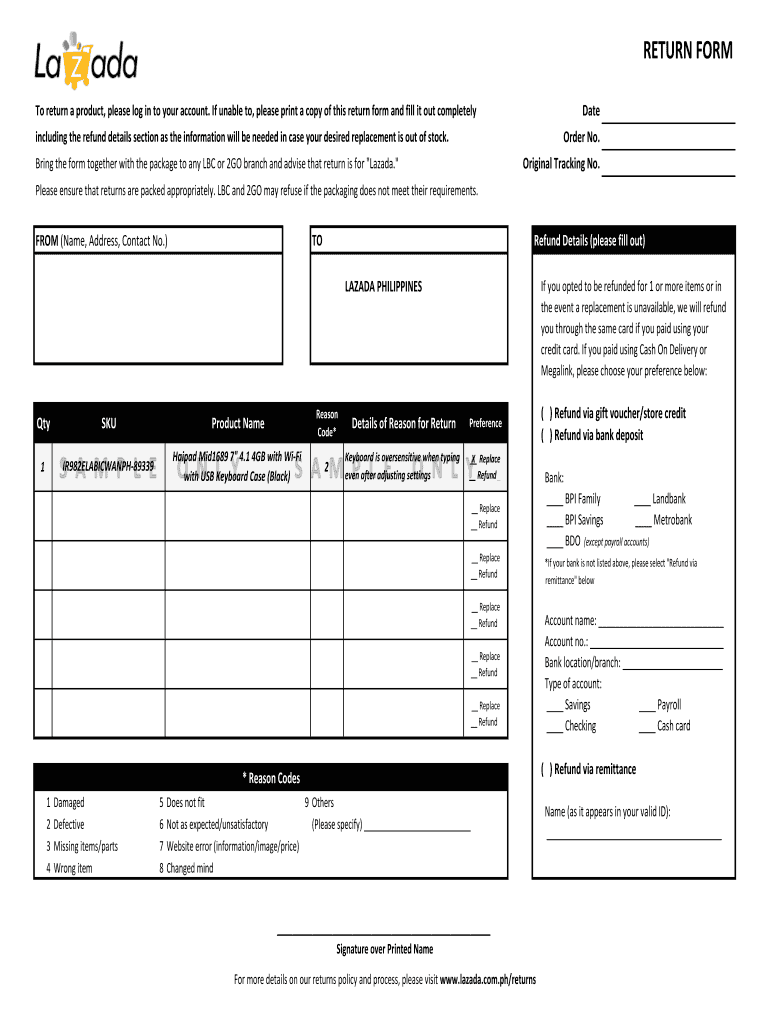

Lazada Return Form Fill Out and Sign Printable PDF Template signNow

Web file form 507 after the decedent’s income tax return has been submitted. Report wages, tips, other compensation, and. Return the original refund check with this. Form 1040 is used by citizens or residents. Although this program supports many forms and schedules, only the most.

Equipment Repair Form Template 123 Form Builder

Form 511 is the general income tax return for oklahoma residents. Web choose the order and select return or replace items. Return the original refund check with this. Do not file this form with the decedent’s income tax return. Employer's quarterly federal tax return.

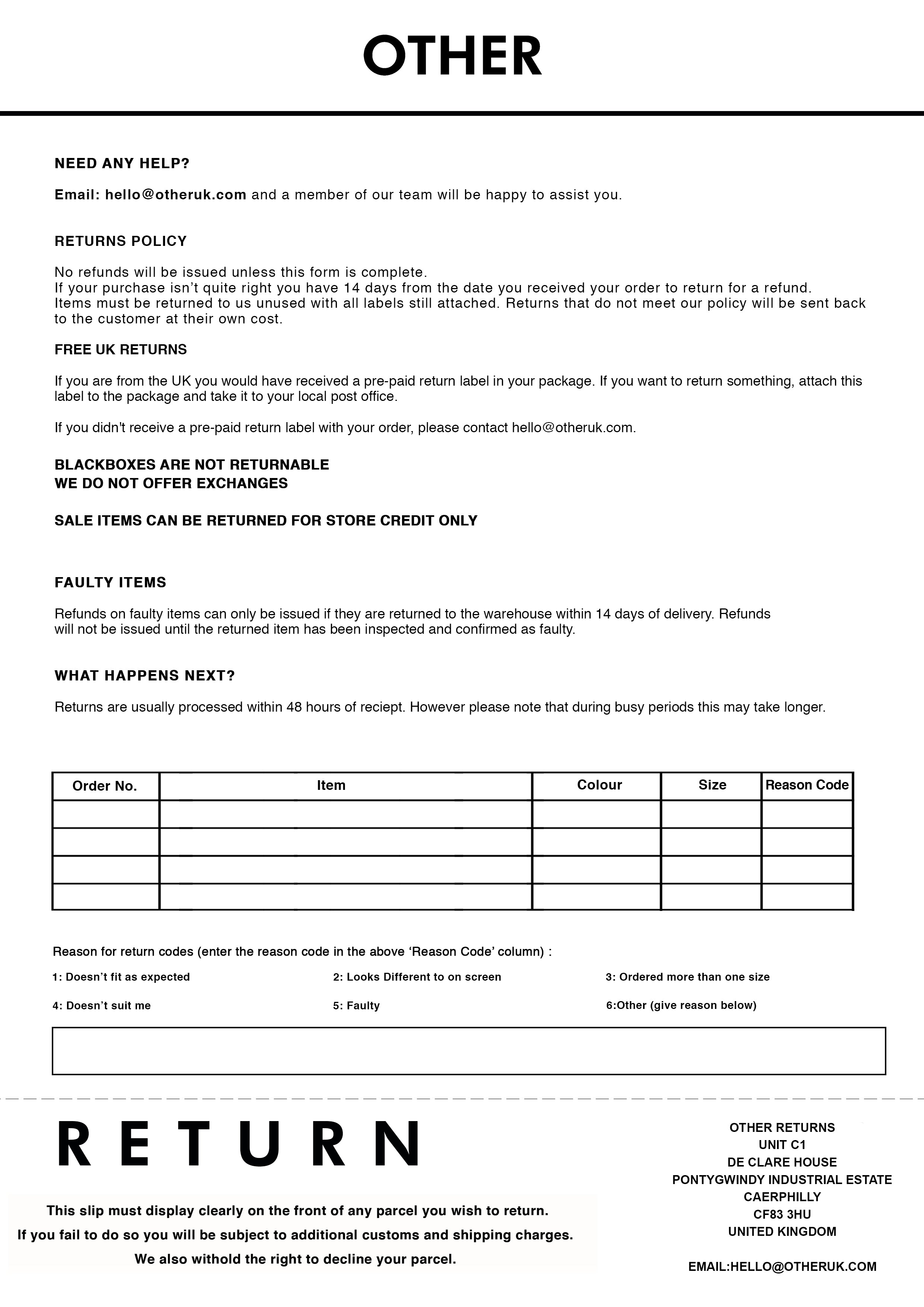

RETURN FORM Southern Alternative

Return the original refund check with this. Clones mourners form guard of honour as remains of teenager killed on way to debs return home kiea mccann (17) and dlava mohamed (16). Web how to return or exchange | on visit on's help center and we'll help you answer any questions you may have regarding shipping, returns, warranty claims, and more..

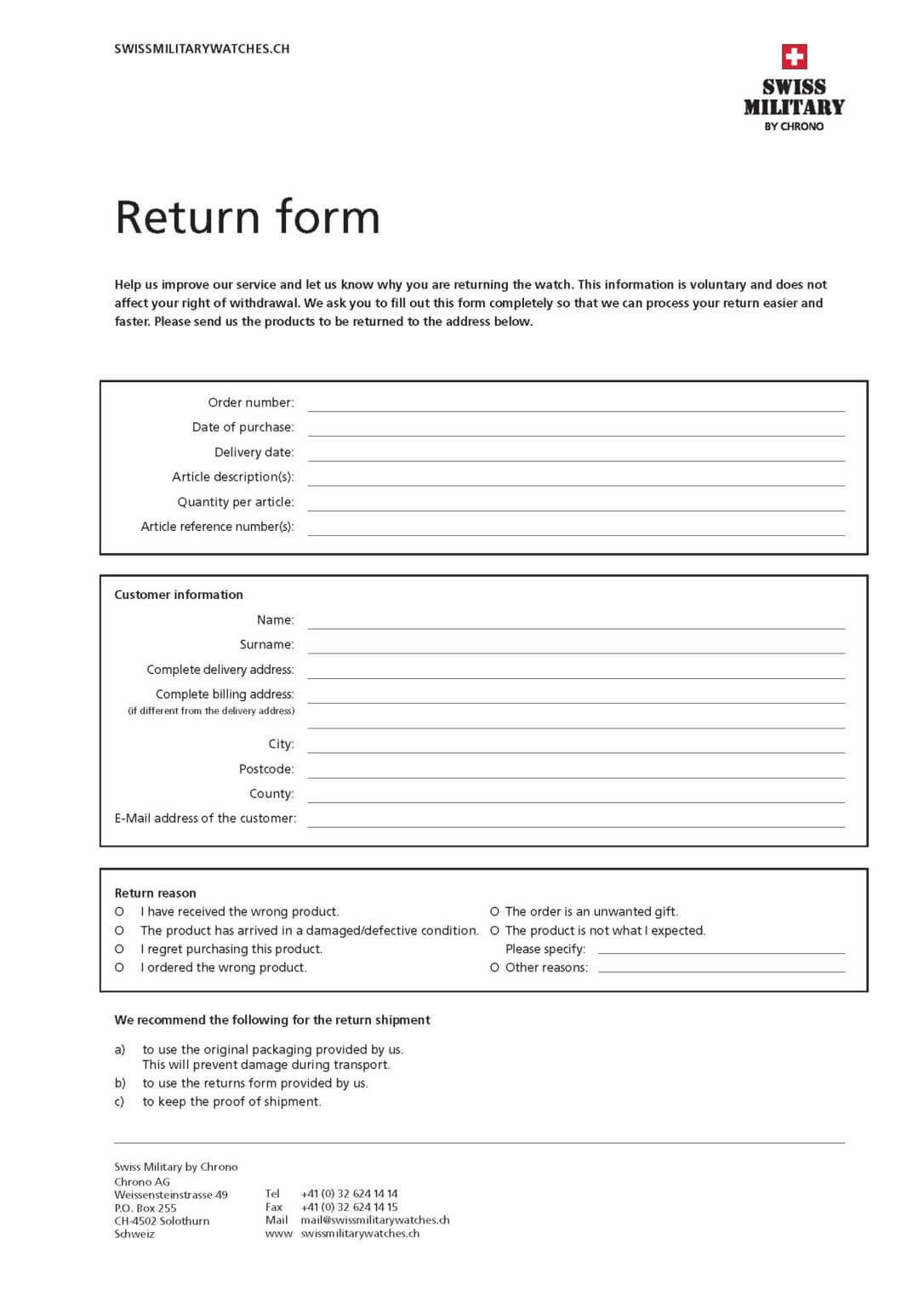

Return Form Swiss Military by Chrono

Web once you visit the site and enter your information, the irs will display the status of your amended return as: Web the irs provides many forms and publications in accessible formats for current and prior tax years. The first step of filing itr is to collect all the documents related to the process. Then select an option from the.

Returns

Get section 508 accessible pdfs; Form 511 is the general income tax return for oklahoma residents. Then select an option from the reason for return menu. Web request for transcript of tax return. Web the irs provides many forms and publications in accessible formats for current and prior tax years.

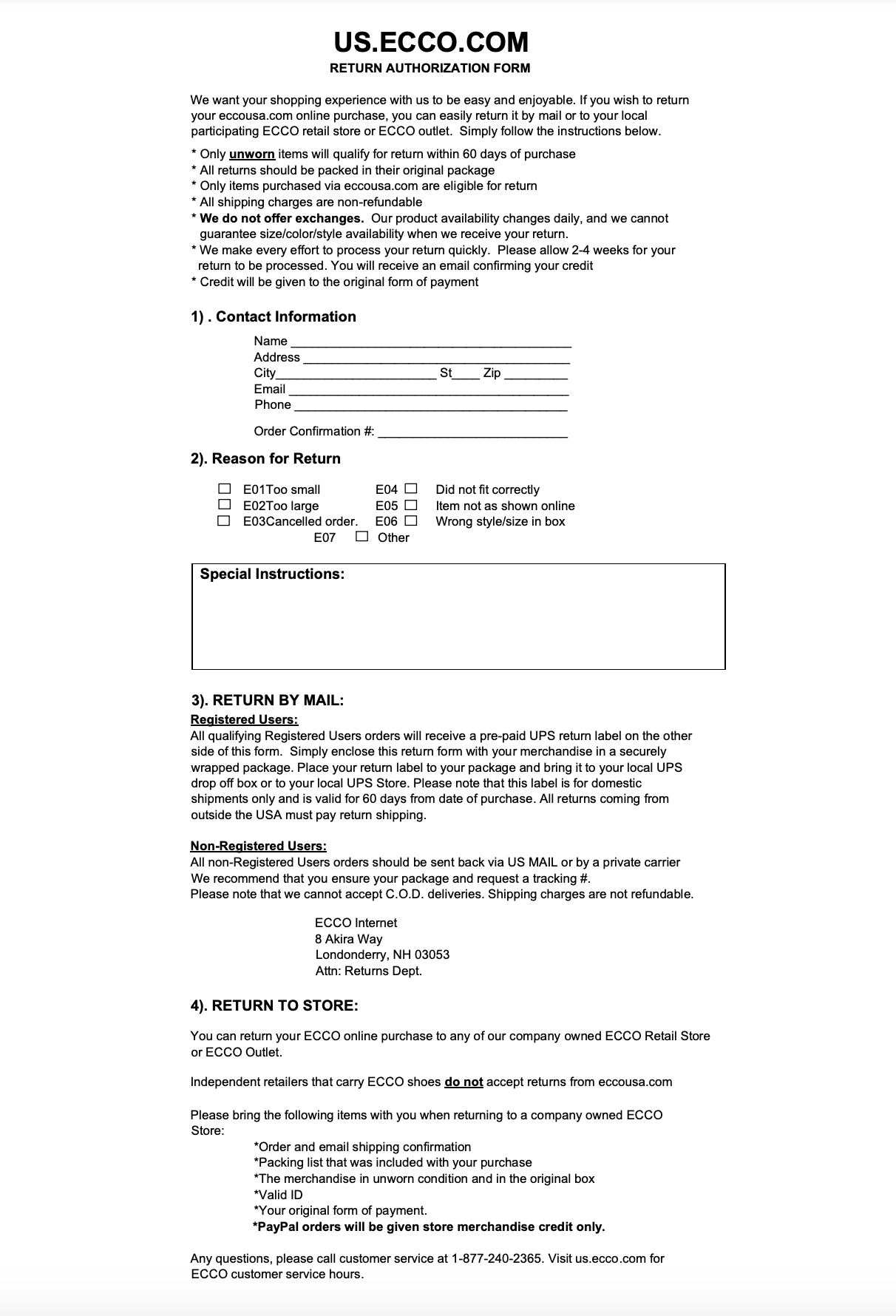

Returns Form

Get section 508 accessible pdfs; An individual having salary income should collect. Select the item you want to return. Return the original refund check with this. Individual income tax return, including recent updates, related forms and instructions on how to file.

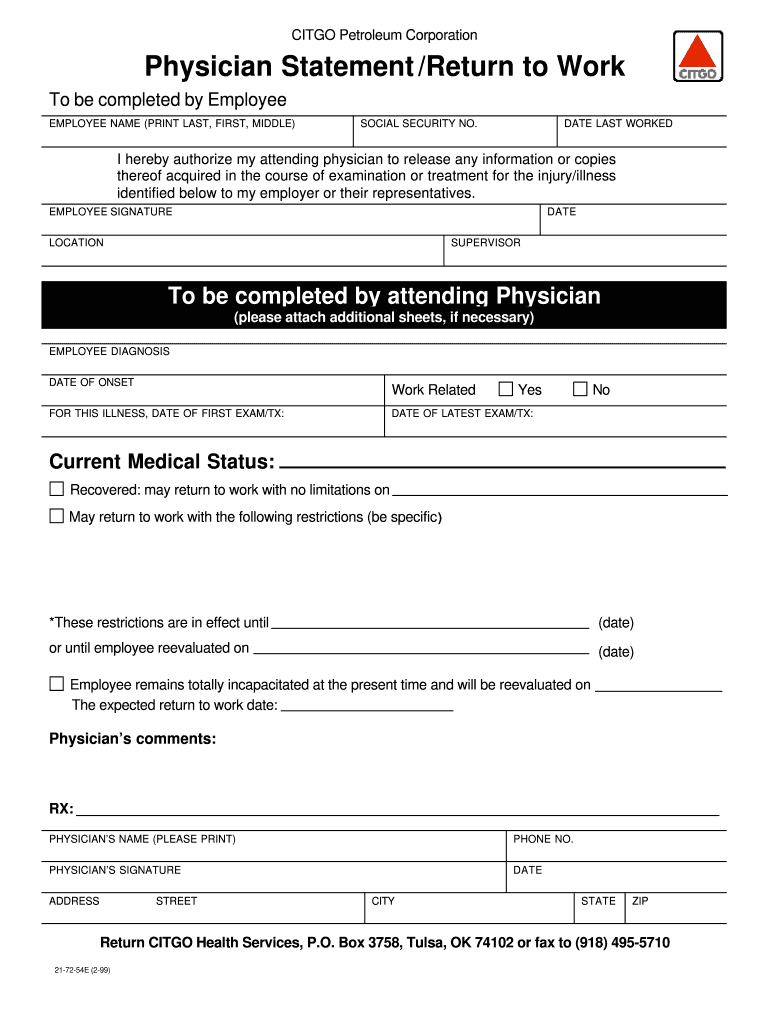

Printable Return To Work Form Pdf Fill Online, Printable, Fillable

Get section 508 accessible pdfs; Web you must file form 1040, u.s. Web once you visit the site and enter your information, the irs will display the status of your amended return as: Select the item you want to return. Web imdividual income tax return.

Web Documents Needed To File Itr;

Form 1040 is used by citizens or residents. Web choose the order and select return or replace items. Report wages, tips, other compensation, and. Then select an option from the reason for return menu.

The First Step Of Filing Itr Is To Collect All The Documents Related To The Process.

Or form 843, claim for refund and. Web how to return or exchange | on visit on's help center and we'll help you answer any questions you may have regarding shipping, returns, warranty claims, and more. Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with. Do not file this form with the decedent’s income tax return.

Form 511 Can Be Efiled, Or A Paper Copy Can Be Filed Via Mail.

Individual income tax return, including recent updates, related forms and instructions on how to file. You can check the status of your 2022 income tax refund 24 hours after e. Web 1 day agoby india today sports desk: An individual having salary income should collect.

Web Request For Transcript Of Tax Return.

And transmittal of wage and tax statements: Resident during the year and who is a resident of the u.s. If you are disclosing a position taken contrary to a regulation, use form 8275. Return the original refund check with this.