Oregon Form 40 N Instructions

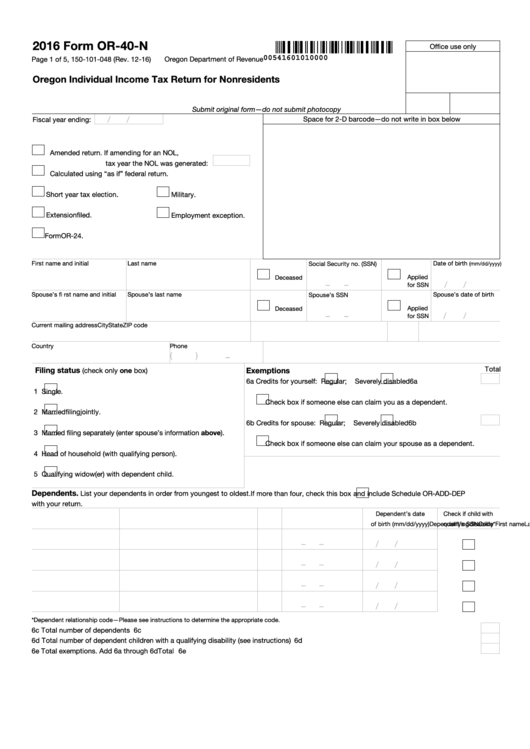

Oregon Form 40 N Instructions - Web use this instruction booklet to help you fill out and file your voucher/s. Web 65 or older 17d. Don’t submit photocopies or use. Web follow the simple instructions below: If you choose to file a joint return for oregon, use form 40n. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. • use blue or black ink. Include your payment with this return. Use blue or black ink. We last updated the nonresident individual income tax return in january 2023, so.

If you choose to file a joint return for oregon, use form 40n. You may need more information. Include your payment with this return. If more than four, check this box with your return. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation. We last updated the nonresident individual income tax return in january 2023, so. Web follow the simple instructions below: • print actual size (100%). Web the following tips can help you complete instructions for oregon form 40 easily and quickly: • use blue or black ink.

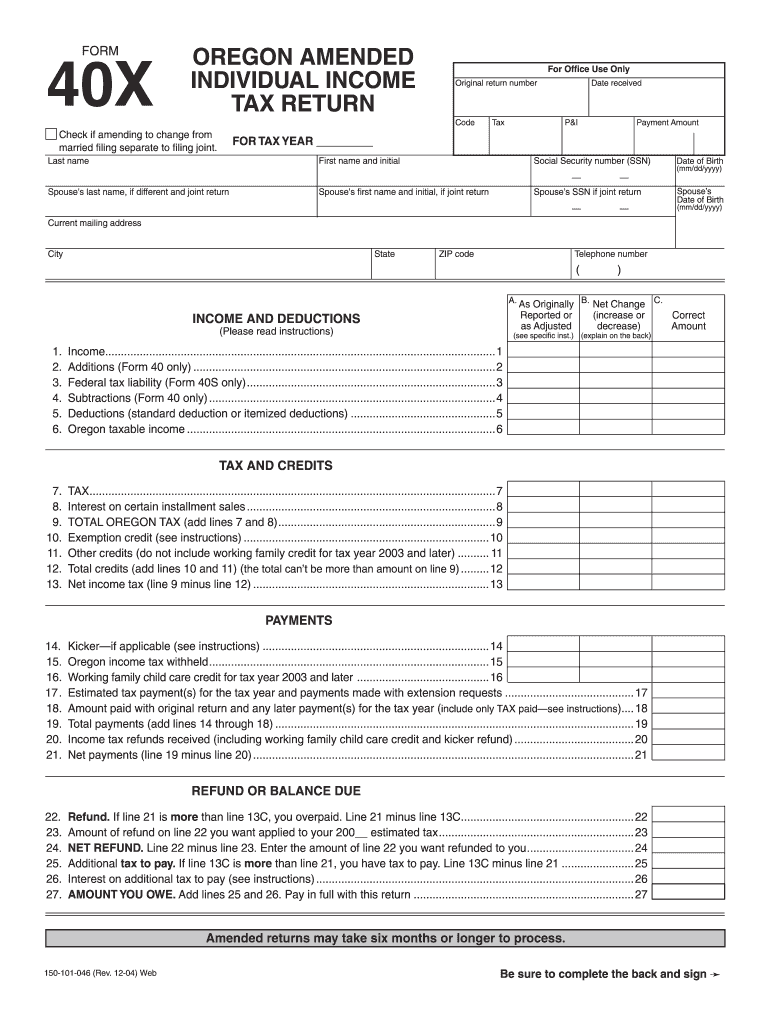

Web there’s a time limit for filing an amended return. Web 65 or older 17d. We last updated the nonresident individual income tax return in january 2023, so. Include your payment with this return. 01) • use uppercase letters. You may need more information. If more than four, check this box with your return. • use blue or black ink. To electronically sign a federal. Web form 40n requires you to list multiple forms of income, such as wages, interest, or alimony.

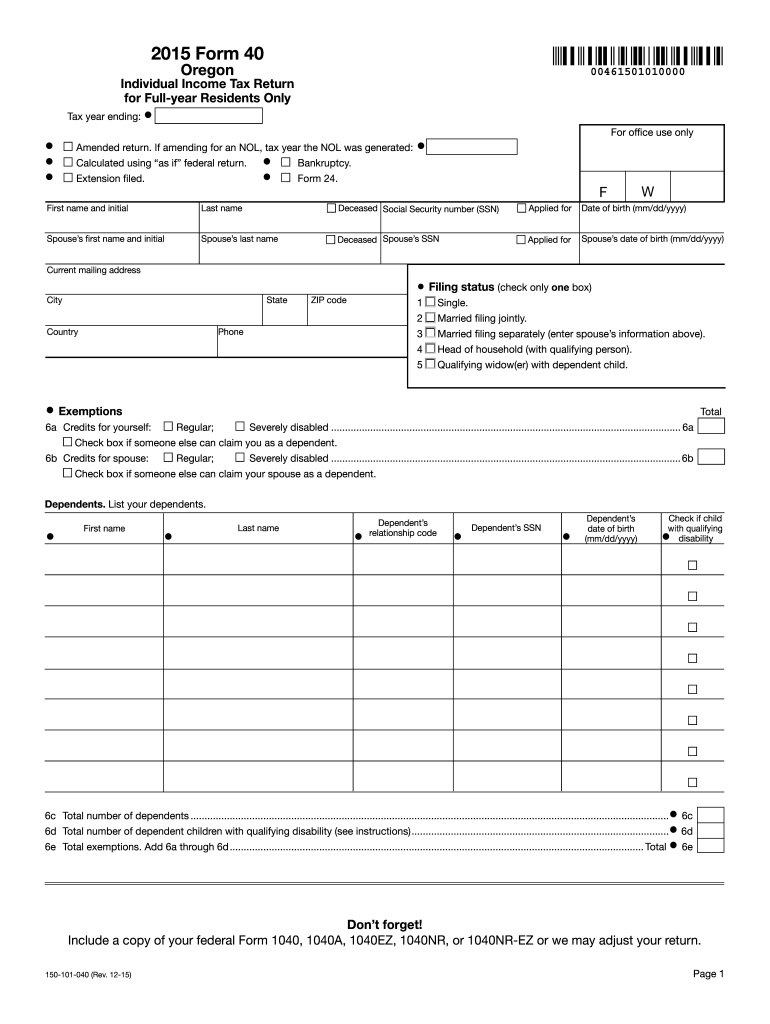

Oregon gov dor forms Fill out & sign online DocHub

• print actual size (100%). We last updated the nonresident individual income tax return in january 2023, so. Web list your dependents in order from youngest to oldest. Web 65 or older 17d. For more information, see “amended.

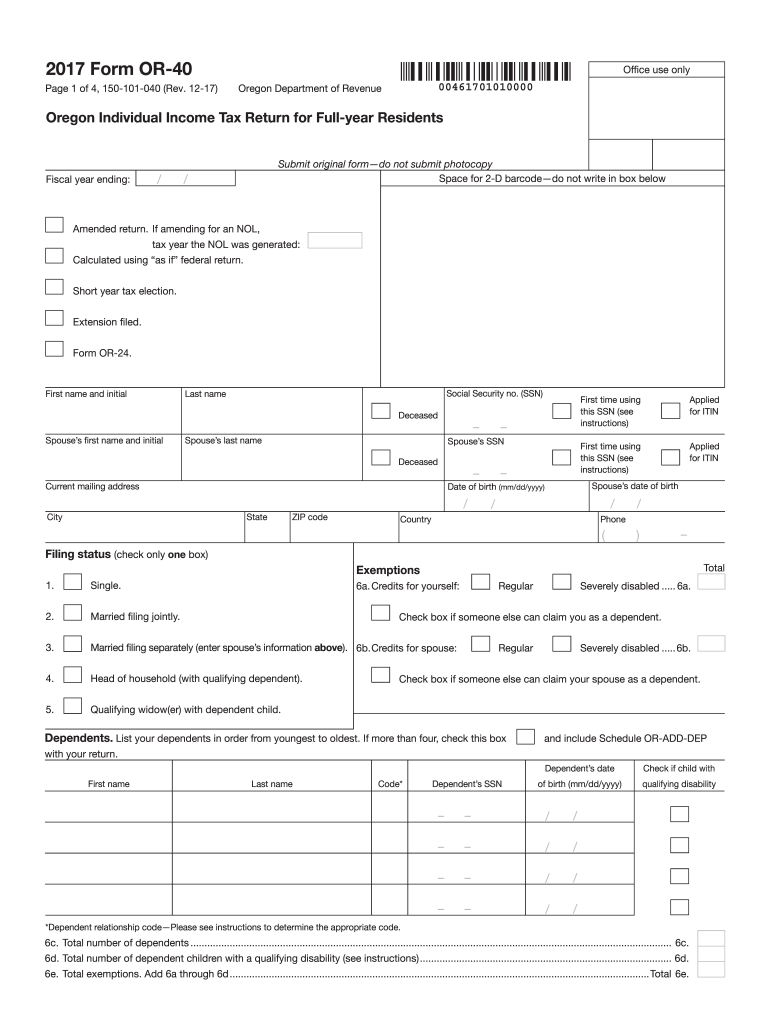

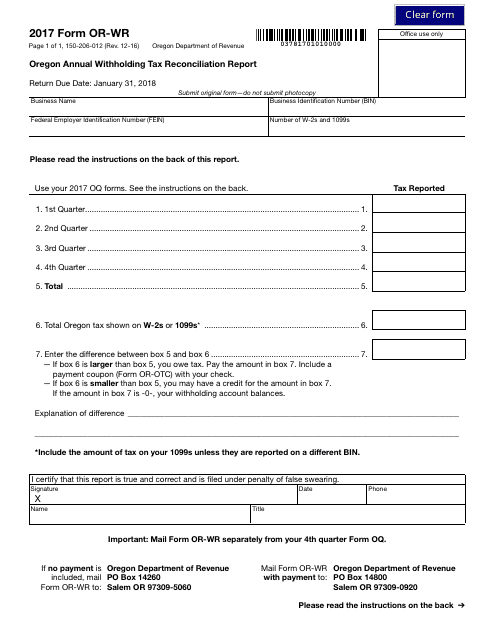

Oregon 2017 Fill In Form Tax Fill Out and Sign Printable PDF

You may need more information. Web list your dependents in order from youngest to oldest. We last updated the nonresident individual income tax return in january 2023, so. Web use this instruction booklet to help you fill out and file your voucher/s. Web the following tips can help you complete instructions for oregon form 40 easily and quickly:

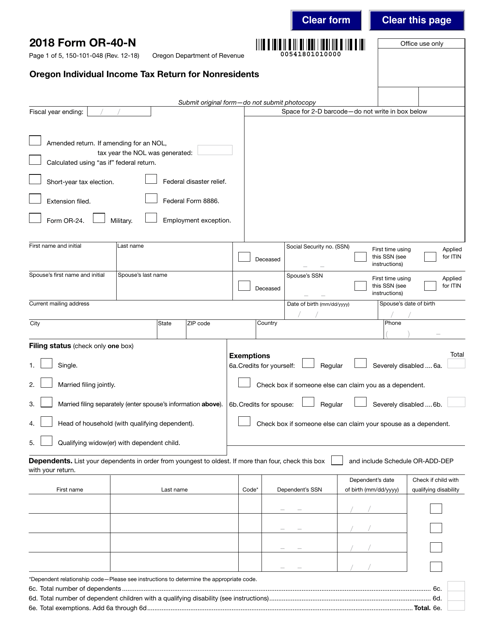

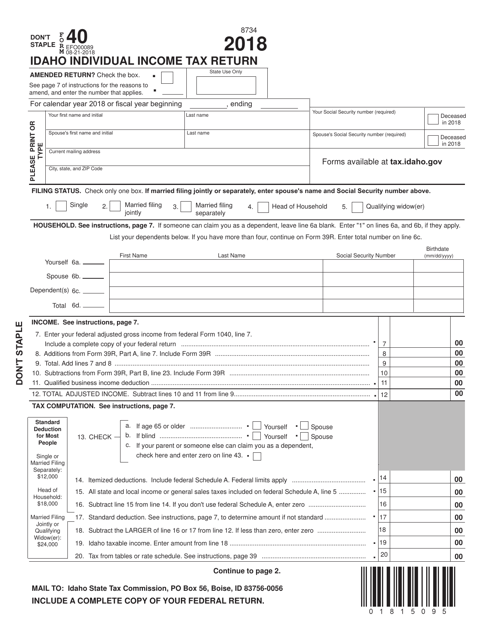

Oregon Form 40 Instructions 2018 slidesharedocs

Does oregon require an e file authorization form? We last updated the nonresident individual income tax return in january 2023, so. If you choose to file a joint return for oregon, use form 40n. 01) • use uppercase letters. Oregon 529 college savings network and able account credits.

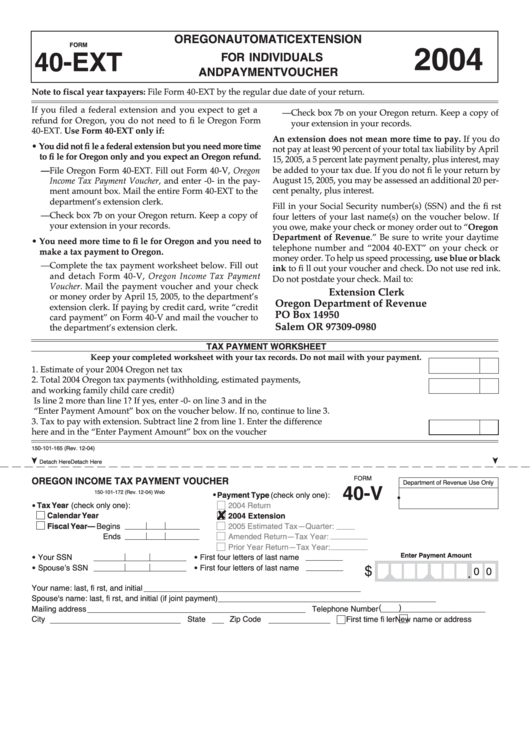

Fillable Form 40Ext Oregon Automatic Extension For Individuals And

Don’t submit photocopies or use. Blind standard deductions single married filing jointly married filing separately qualifying surviving spouse head of household $2,420 $4,840 $2,420 or. Web • these instructions are not a complete statement of laws and oregon department of revenue rules. Web the following tips can help you complete instructions for oregon form 40 easily and quickly: To electronically.

Oregon Form 40 Instructions 2018 slidesharedocs

01) • use uppercase letters. Web 65 or older 17d. Web list your dependents in order from youngest to oldest. Web follow the simple instructions below: Don’t use the form or.

Top 8 Oregon Form 40 Templates free to download in PDF format

01) • use uppercase letters. • use blue or black ink. Use blue or black ink. Don’t use the form or. If more than four, check this box with your return.

Oregon Form 40 Instructions 2017 slidesharedocs

Web the following tips can help you complete instructions for oregon form 40 easily and quickly: Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax. Include your payment with this return. Does oregon require an e file authorization form? Web use this instruction booklet to help you fill out and file your.

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

Include your payment with this return. • use blue or black ink. Web use this instruction booklet to help you fill out and file your voucher/s. If more than four, check this box with your return. Web • these instructions are not a complete statement of laws and oregon department of revenue rules.

Oregon Form 40 Instructions 2018 slidesharedocs

Use blue or black ink. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation. Web list your dependents in order from youngest to oldest. Don’t use the form or. • use blue or black ink.

Oregon form 40 v Fill out & sign online DocHub

Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax. 01) • use uppercase letters. You may need more information. Web there’s a time limit for filing an amended return. We last updated the nonresident individual income tax return in january 2023, so.

01) • Use Uppercase Letters.

You may need more information. Web form 40n requires you to list multiple forms of income, such as wages, interest, or alimony. Blind standard deductions single married filing jointly married filing separately qualifying surviving spouse head of household $2,420 $4,840 $2,420 or. Don’t submit photocopies or use.

• Use Blue Or Black Ink.

Include your payment with this return. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation. For more information, see “amended. • print actual size (100%).

Web Use This Instruction Booklet To Help You Fill Out And File Your Voucher/S.

Web follow the simple instructions below: If more than four, check this box with your return. Web 65 or older 17d. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment.

If You Choose To File A Joint Return For Oregon, Use Form 40N.

Web • these instructions are not a complete statement of laws and oregon department of revenue rules. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax. Does oregon require an e file authorization form? Web there’s a time limit for filing an amended return.