Printable Credit Card Convenience Fee Sign

Printable Credit Card Convenience Fee Sign - Web merchants are free to develop their own signage that meets surcharging requirements and are permitted to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). Web the only common fees you might run into are outgoing wire transfer fees of up to $30, and fees of $7 and $11, respectively, for orders of 50 or 100 paper checks. It is considered a convenience because your business has provided the consumer another avenue to make a payment (outside of the standard payment channels). Accepting credit cards can be expensive for merchants. Web different types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Just download one, open it in a program that can display the pdf file format, and print. Web get this printable we take credit cards sign and let customers know before they reach the register that your business only accepts major credit cards and not cash. Web we accept credit cards sign. Web reviewed by whitney blair wyckoff | june 7, 2022, at 9:00 a.m. A convenience fee is a charge passed on to customers for the privilege of paying for a product or service using an alternative payment method that is not standard for a business.

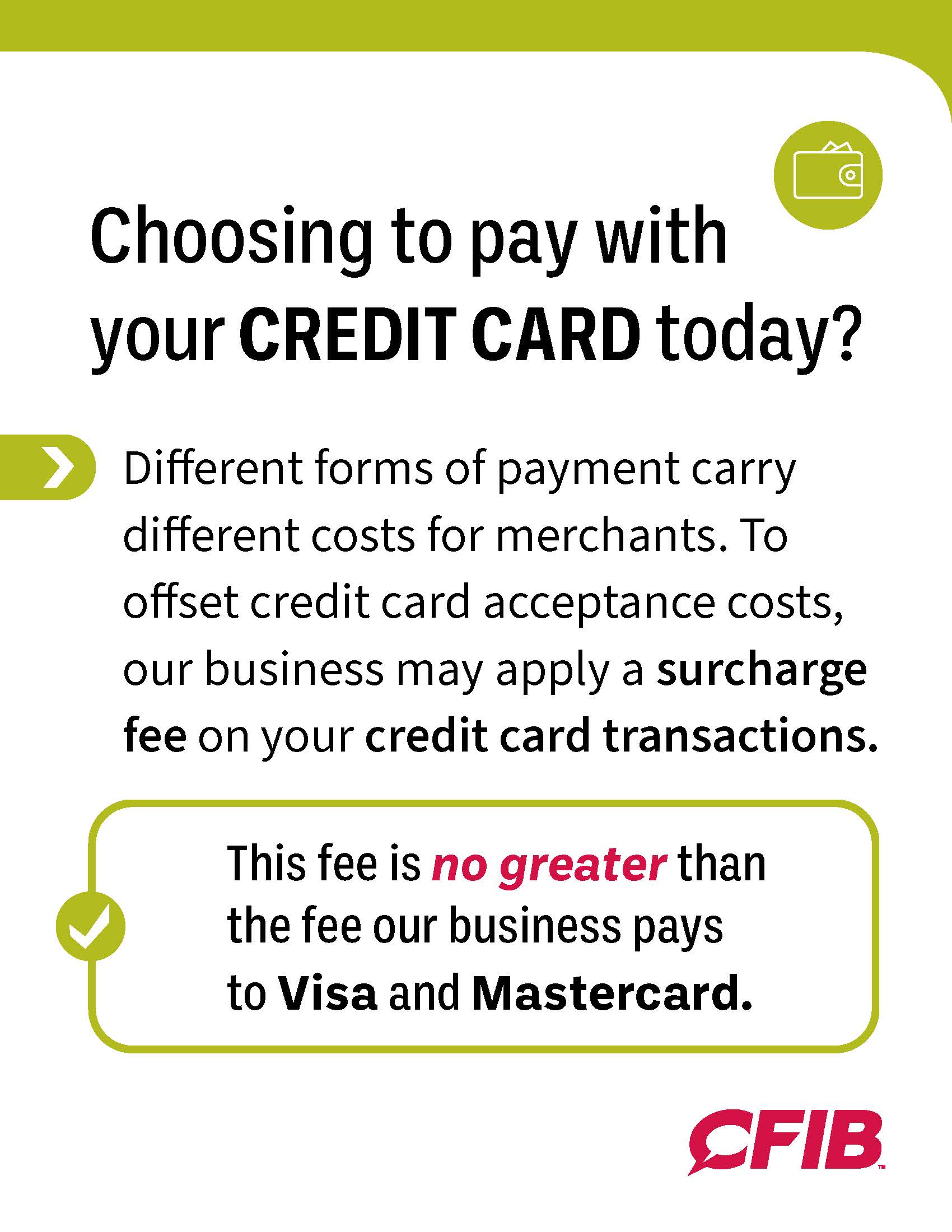

Web because convenience checks can be considered cash advances, they can come with fees and high interest rates. Depending on the payment network, they may need to pay a merchant fee of around 2% or higher every time a customer pays with a credit card. Web get the information you need to know about charging your customers a credit card convenience fee. Web different types of credit card fees that could be leveraged to reduce the cost of processing credit card payments. Also, your cash advance limit is typically less than your card's credit limit. Web merchants are free to develop their own signage that meets surcharging requirements and are permitted to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). Use these templates to indicate if you accept credit cards, cash, or checks. Web putting up a simple yet informative printable sign can get the job done with perfection. Web what is a convenience fee? Web november 10, 2022 in credit card processing, merchant tips and insights the world may prefer cards, but for many merchants, the fees for accepting them eat into critical profit margins.

Print these posters with your logo, hang them on your store wall next to the counter or upload them on your website. Download this printable we accept credit cards sign and use it to inform and remind customers that your business accepts credit cards so you can easily make purchases. Surcharge disclosure signage should be clear, The free version is available in.pdf format: Web get this printable we take credit cards sign and let customers know before they reach the register that your business only accepts major credit cards and not cash. Convenience fees what is a convenience fee? Use these templates to indicate if you accept credit cards, cash, or checks. On the sign there are four famous major credit cards, american express, mastercard, visa and discover. A convenience fee of [insert fee amount] will be charged for all credit card transactions. Web as a merchant, you will need to provide customers with a surcharge disclosure, also known as a checkout fee, when including additional fees for accepting a credit card.

Town Clerk & Public Meetings Clerk Highgate, Vermont

Web as a merchant, you will need to provide customers with a surcharge disclosure, also known as a checkout fee, when including additional fees for accepting a credit card. Download this printable we accept credit cards sign and use it to inform and remind customers that your business accepts credit cards so you can easily make purchases. Participants in the.

NOTICE NEW CREDIT CARD FEES City of Flowery Branch

Web create your poster to show the payment methods you accept. Convenience fees may be worth paying if you use your card enough to earn rewards. 183t03802ru conveniently display your fee notice with this informative sign! Is it legal to charge a fee? On or after may 1, 2023:

Village Hall Archives Village of Third LakeVillage of Third Lake

How do you calculate that fee? Web we accept credit cards sign. Web while credit card convenience fees are added on for completing a transaction remotely — like online, via mobile app or over the phone — surcharges are fees that merchants impose for using a credit card rather than. For merchants that take credit card payments frequently, such as.

Pay Taxes With Credit Card Lowest Fee Rates and LimitedTime

Web merchants are free to develop their own signage that meets surcharging requirements and are permitted to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). Sadly, cash use is down year on year, and no credit card transaction is free. What are credit card convenience fees? Buy now & save 📣 only.

Payment Options Progressive Family and Cosmetic Dentistry

Web november 10, 2022 in credit card processing, merchant tips and insights the world may prefer cards, but for many merchants, the fees for accepting them eat into critical profit margins. For merchants that take credit card payments frequently, such as a grocery store, this fee is. Web as a merchant, you will need to provide customers with a surcharge.

Pay Your Water Bill Online City of Carrollton, TX

On or after may 1, 2023: The $3.99 version can be edited. Also, your cash advance limit is typically less than your card's credit limit. Print these posters with your logo, hang them on your store wall next to the counter or upload them on your website. Web different types of credit card fees that could be leveraged to reduce.

Surcharging and What It Means For Your Business

Compliance with visa’s requirements does not imply compliance with any relevant state laws. The free version is available in.pdf format: Credit and debit card payments will only be accepted online. Print these posters with your logo, hang them on your store wall next to the counter or upload them on your website. Web check out our credit card fee sign.

Guide On Charging Credit Card Convenience Fees PDCflow Blog

By using this sign template, you can avoid creating confusion and can speed up things. Buy now & save 📣 only 00days:00hours:00minutes:00seconds Web what is a convenience fee? Web reviewed by whitney blair wyckoff | june 7, 2022, at 9:00 a.m. A convenience fee is a fee that a merchant charges a customer for paying in a manner that’s not.

Convenience Fees and the Fair Debt Collection Practices Act

For merchants that take credit card payments frequently, such as a grocery store, this fee is. On the sign there are four famous major credit cards, american express, mastercard, visa and discover. Download this printable we accept credit cards sign and use it to inform and remind customers that your business accepts credit cards so you can easily make purchases..

Cash Discount Program Credit Card Processing Leap Payments

It is considered a convenience because your business has provided the consumer another avenue to make a payment (outside of the standard payment channels). Is it legal to charge a fee? Print these posters with your logo, hang them on your store wall next to the counter or upload them on your website. Accepting credit cards can be expensive for.

Web Conveniencefees12032006 5 Card Association Regulations:

Web get this printable we take credit cards sign and let customers know before they reach the register that your business only accepts major credit cards and not cash. Web while credit card convenience fees are added on for completing a transaction remotely — like online, via mobile app or over the phone — surcharges are fees that merchants impose for using a credit card rather than. Also, your cash advance limit is typically less than your card's credit limit. Is it legal to charge a fee?

Web Get The Information You Need To Know About Charging Your Customers A Credit Card Convenience Fee.

Print these posters with your logo, hang them on your store wall next to the counter or upload them on your website. Web what is a convenience fee? Web subscribe to the free printable newsletter. *fee amount * required fields $19.83 quantity add to cart email to a friend add to favorites description reviews

Compliance With Visa’s Requirements Does Not Imply Compliance With Any Relevant State Laws.

A convenience fee is a fee that a merchant charges a customer for paying in a manner that’s not standard for the business (for example, by mail or over the. By using this sign template, you can avoid creating confusion and can speed up things. Convenience fees what is a convenience fee? On or after may 1, 2023:

Buy Now & Save 📣 Only 00Days:00Hours:00Minutes:00Seconds

Web a surcharge over 4% of the purchase price is illegal and any surcharges are illegal in 10 of the 50 states — california, colorado, connecticut, florida, kansas, maine, massachusetts, new york,. This collection of 20+ printable designs on we accept credit cards have unique outlooks that are presented in easily understandable and readable approaches, which can quickly spread the message among the people with clarity. Web merchants are free to develop their own signage that meets surcharging requirements and are permitted to combine brand messages if more than one credit card brand is surcharged (e.g., visa and mastercard). Sadly, cash use is down year on year, and no credit card transaction is free.