Qcd Tax Form

Qcd Tax Form - Web qcd on form 1040, u.s. ɕ per irs code, you must be. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly by the trustee to a qualified charitable. Web to report a qualified charitable distribution on your form 1040 tax return, you generally report the full amount of the charitable distribution on the line for ira distributions. Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: If you have a tax dispute with the irs, there are ways you can resolve it. Learn what resources are available and how they can help. You must be age 70½ or older to make a. To report a qcd on your form 1040 tax return, you generally. Two 3 year contracts and are on our third contract.

ɕ per irs code, you must be. Web to report a qualified charitable distribution on your form 1040 tax return, you generally report the full amount of the charitable distribution on the line for ira distributions. Web resolve tax disputes. Under section 408(d)(8) of the internal revenue code (code), a taxpayer can exclude from gross. Ira application & instructions ira application information kit identify beneficiary. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Web qcd on form 1040, u.s. Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web the 100% carryover limit available in 2021 for certain qualified cash contributions made in 2020 no longer applies for carryovers of those contributions to 2022 or later years. Two 3 year contracts and are on our third contract.

Web qcd on form 1040, u.s. For inherited iras or inherited roth iras, the qcd will be reported as a. Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. Web resolve tax disputes. Web home » tax credits. If you have a tax dispute with the irs, there are ways you can resolve it. Two 3 year contracts and are on our third contract. Under section 408(d)(8) of the internal revenue code (code), a taxpayer can exclude from gross. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of.

Turbotax won't calculate tax. Received deferred co...

Web to report a qualified charitable distribution on your form 1040 tax return, you generally report the full amount of the charitable distribution on the line for ira distributions. Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Maximum state/local tax benefits indicated above are based on the treatment of.

QCD [PDF Document]

Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly by the trustee to a qualified charitable. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. Web to enter a qcd in taxslayer pro, from the.

QCD MTE Enerji Sistemleri

ɕ per irs code, you must be. Web ira qualified charitable distribution (qcd) form ira qcds or ira charitable rollovers, as they are sometimes called, are an increasingly popular way for donors 70. Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: You must be age 70½ or older to.

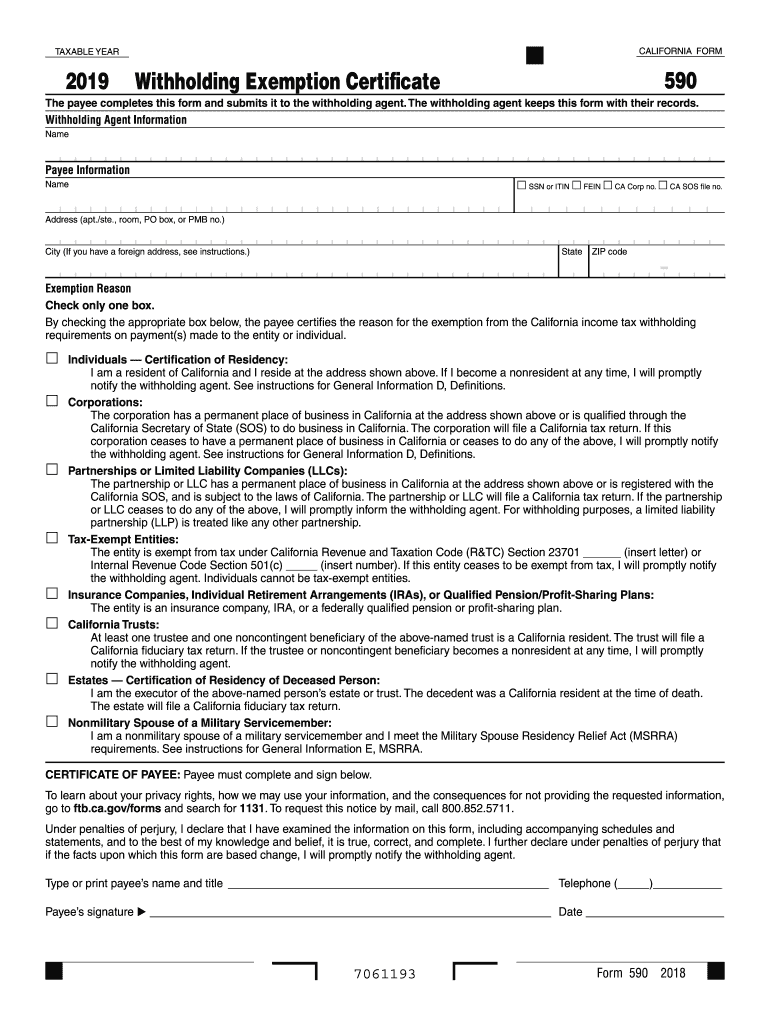

Ca590 Fill Out and Sign Printable PDF Template signNow

Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. For inherited iras or inherited roth iras, the qcd will be reported as a. Web resolve tax disputes. Web a qualified charitable distribution (qcd) is a distribution from your individual retirement account (ira) to a qualified charity. Bexar.

Tax Benefits of Making a QCD Fisher

Learn what resources are available and how they can help. Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. Web see below for additional information. Web to enter a qcd.

1099R Software EFile TIN Matching Print and Mail 1099R Forms

Web ruth rideout, office manager, qcd client since 2007; Web qcd on form 1040, u.s. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. Web home » tax credits. ɕ per irs code, you must be.

QCD Form S MTE Enerji Sistemleri

Web to enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web home » tax credits. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. You must be age 70½ or older to make a. Web a qualified charitable.

Tax Tip From Our Tax Planners How To Report A QCD On Your Tax Form

For inherited iras or inherited roth iras, the qcd will be reported as a. Web the 100% carryover limit available in 2021 for certain qualified cash contributions made in 2020 no longer applies for carryovers of those contributions to 2022 or later years. Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms..

QCD Sample Comments

Web qcd is listed in the world's largest and most authoritative dictionary database of abbreviations and acronyms. Two 3 year contracts and are on our third contract. If you have a tax dispute with the irs, there are ways you can resolve it. The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including.

Tax Benefits of making a QCD Ryan Financial, Inc.

Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of. Web to report a qualified charitable distribution on your form 1040 tax return, you generally report the full amount of the charitable distribution on the line for ira distributions. You must be age 70½ or older to make.

Web To Enter A Qcd In Taxslayer Pro, From The Main Menu Of The Tax Return (Form 1040) Select:

Ira application & instructions ira application information kit identify beneficiary. Web ira qualified charitable distribution (qcd) form ira qcds or ira charitable rollovers, as they are sometimes called, are an increasingly popular way for donors 70. Learn what resources are available and how they can help. If you have a tax dispute with the irs, there are ways you can resolve it.

You Must Be Age 70½ Or Older To Make A.

Two 3 year contracts and are on our third contract. For inherited iras or inherited roth iras, the qcd will be reported as a. To report a qcd on your form 1040 tax return, you generally. Web to report a qualified charitable distribution on your form 1040 tax return, you generally report the full amount of the charitable distribution on the line for ira distributions.

Web Qcd Is Listed In The World's Largest And Most Authoritative Dictionary Database Of Abbreviations And Acronyms.

Web see below for additional information. Under section 408(d)(8) of the internal revenue code (code), a taxpayer can exclude from gross. Web qcd on form 1040, u.s. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of.

Web A Qualified Charitable Distribution (Qcd) Is A Distribution Of Funds From Your Ira (Other Than A Sep Or Simple Ira) Directly By The Trustee To A Qualified Charitable.

The miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of. ɕ per irs code, you must be. Web donor advised funds and private foundations do not qualify for qcd treatment. Web the 100% carryover limit available in 2021 for certain qualified cash contributions made in 2020 no longer applies for carryovers of those contributions to 2022 or later years.

![QCD [PDF Document]](https://cdn.vdocuments.net/img/1200x630/reader020/image/20190926/5531f927550346dd568b4bde.png?t=1614207426)