Retirement Savings Credit Form 8880

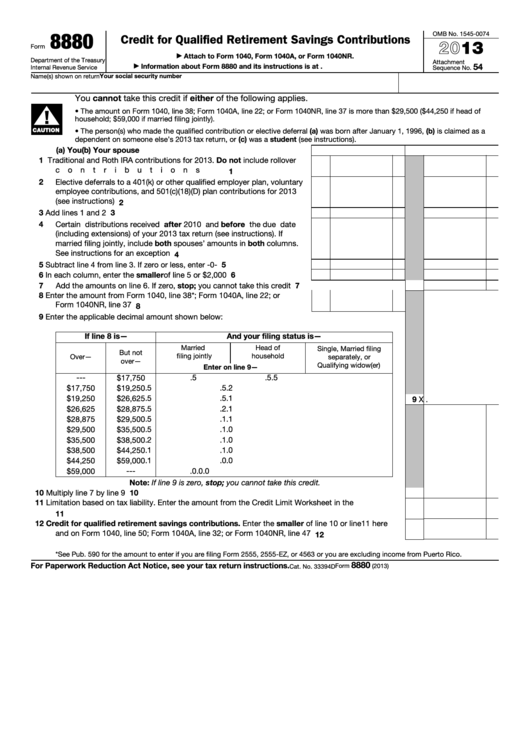

Retirement Savings Credit Form 8880 - Web saving for retirement living in retirement saver's credit: Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Complete, edit or print tax forms instantly. Eligible retirement plans contributions you make to any qualified retirement plan can. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating credit due to. Web in order to claim the retirement savings credit, you must use irs form 8880. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Create legally binding electronic signatures on any device. As of 2023, the credit is available to single taxpayers with a.

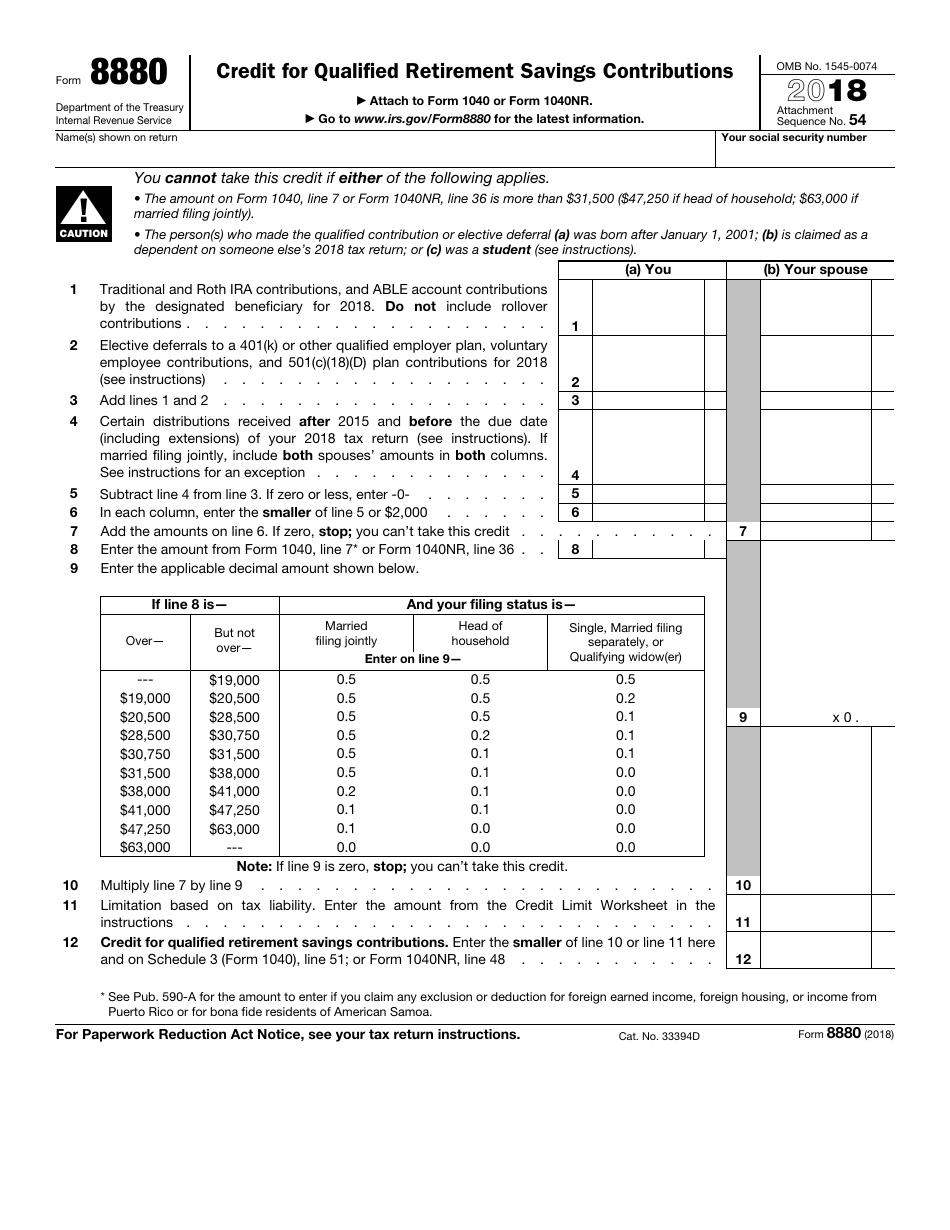

What you need to know find out if you can benefit from this tax credit. Depending on your adjusted gross income. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating credit due to. Ad access irs tax forms. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to. Web 8880 you cannot take this credit if either of the following applies. Web saving for retirement living in retirement saver's credit: Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs.

Ad access irs tax forms. Fidelity smart money key takeaways the saver's. As of 2023, the credit is available to single taxpayers with a. Web 8880 you cannot take this credit if either of the following applies. Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Web taxpayers use irs form 8880 for the qualified retirement savings contribution credit. Claim the credit on form 1040, u.s. What you need to know find out if you can benefit from this tax credit. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Ad complete irs tax forms online or print government tax documents.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Claim the credit on form 1040, u.s. Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Depending on your adjusted gross income. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income.

Fillable Form 8880 Credit For Qualified Retirement Savings

Web saving for retirement living in retirement saver's credit: Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Ad access.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to. Web see form 8880, credit for qualified retirement savings contributions, for more information. Ad access irs tax forms. Web 8880 you cannot take this credit if either of the following applies..

Pin on Retirement Planning

Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Web use form 8880 pdf to determine the rate and amount of the credit. Web saving for retirement living in retirement saver's credit: Web purpose of form use form 8880.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web see form 8880, credit for qualified retirement savings contributions, for more information. This credit can be claimed in addition to any ira. Web 8880 you cannot take this credit if either of the following applies. Eligible retirement plans contributions you make to any qualified retirement plan can. Web use form 8880 pdf to determine the rate and amount of.

Business Concept about Form 8880 Credit for Qualified Retirement

What you need to know find out if you can benefit from this tax credit. Ad complete irs tax forms online or print government tax documents. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Web use form 8880 pdf to determine the.

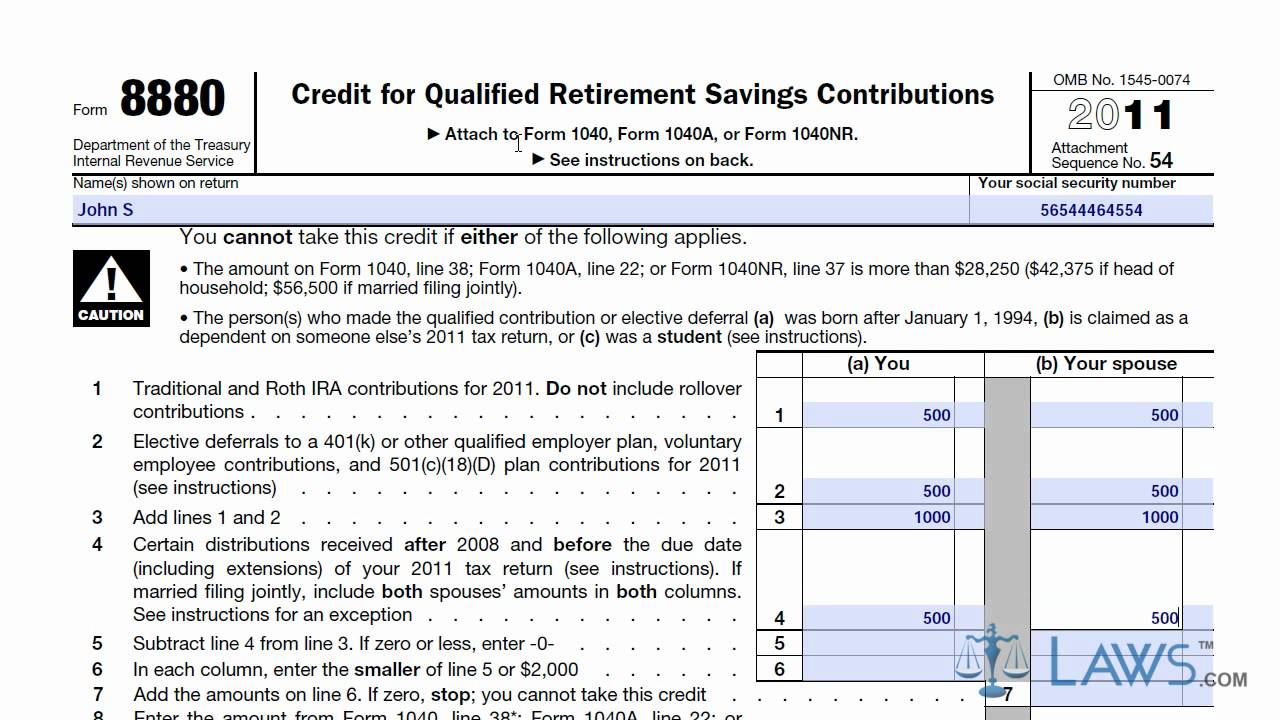

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Fidelity smart money key takeaways the saver's. Web 8880 you cannot take this credit if either of the following applies. Create legally binding electronic signatures on any device. Claim the credit on form 1040, u.s.

IRS Form 8880 Download Fillable PDF or Fill Online Credit for Qualified

Web in order to claim the retirement savings credit, you must use irs form 8880. Eligible retirement plans contributions you make to any qualified retirement plan can. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. As of 2023, the credit is available.

Credit Limit Worksheet 8880 —

Eligible retirement plans contributions you make to any qualified retirement plan can. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to. Web taxpayers use irs form 8880 for the qualified retirement savings contribution credit. Web 8880 you cannot take this.

Form 8880 Tax Incentives For Retirement Account —

Web saving for retirement living in retirement saver's credit: Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Web in order to claim the retirement savings credit, you must use irs form 8880. As of 2023, the credit is.

Web 8880 You Cannot Take This Credit If Either Of The Following Applies.

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Web form 8880 (2008) page 2 general instructions purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the.

Complete, Edit Or Print Tax Forms Instantly.

Fidelity smart money key takeaways the saver's. Depending on your adjusted gross income. Web common questions on form 8880 retirement saving contribution credit in lacerte screen 24, adjustments to income form 8880 not generating credit due to. Web use form 8880 pdf to determine the rate and amount of the credit.

Web A Retirement Savings Contribution Credit May Be Claimed For The Amount Of Contributions You, As The Designated Beneficiary Of An Able Account, Make Before January 1, 2026, To.

Create legally binding electronic signatures on any device. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. This credit can be claimed in addition to any ira.

Web Credit For Qualified Retirement Savings Contributions 8880 You Cannot Take This Credit If Either Of The Following Applies.

Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web federal credit for qualified retirement savings contributions form 8880 pdf form content report error it appears you don't have a pdf plugin for this browser. Eligible retirement plans contributions you make to any qualified retirement plan can. Web taxpayers use irs form 8880 for the qualified retirement savings contribution credit.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)