Rhode Island Tax Form

Rhode Island Tax Form - Web ri 1040 h only expected refund: You can complete the forms with the help of. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and. The amount of your expected refund, rounded to the nearest dollar. Rifans and ocean state procures user forms. And you are filing a form. Individual tax forms are organized by tax type. Download all available tax forms from the rhode island division of taxation. Complete, edit or print tax forms instantly. Web read the summary of the latest tax changes;

Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. Select the tax type of the form you are looking for to be directed to that page. And you are filing a form. And you are not enclosing a payment, then use this address. Web if you live in rhode island. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. You can complete the forms with the help of. Web rhode island has a state income tax that ranges between 3.75% and 5.99%, which is administered by the rhode island division of taxation.

The amount of your expected refund, rounded to the nearest dollar. Web if you live in rhode island. Web rhode island tax forms. For example, if your expected refund is between $151.50. And you are not enclosing a payment, then use this address. And you are enclosing a payment, then. Complete, edit or print tax forms instantly. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for. And you are filing a form. Web if you are claiming a refund, mail your return to:

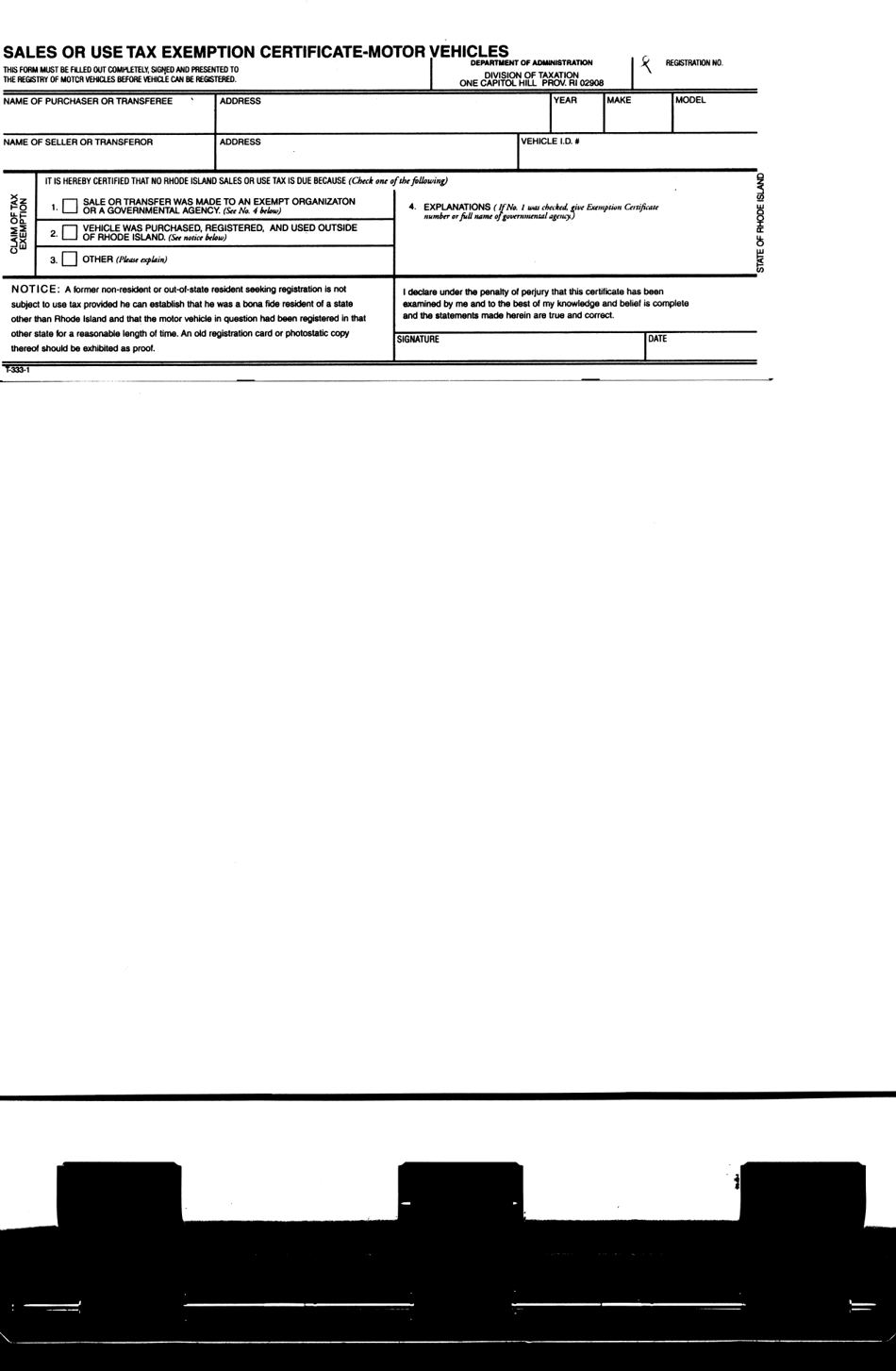

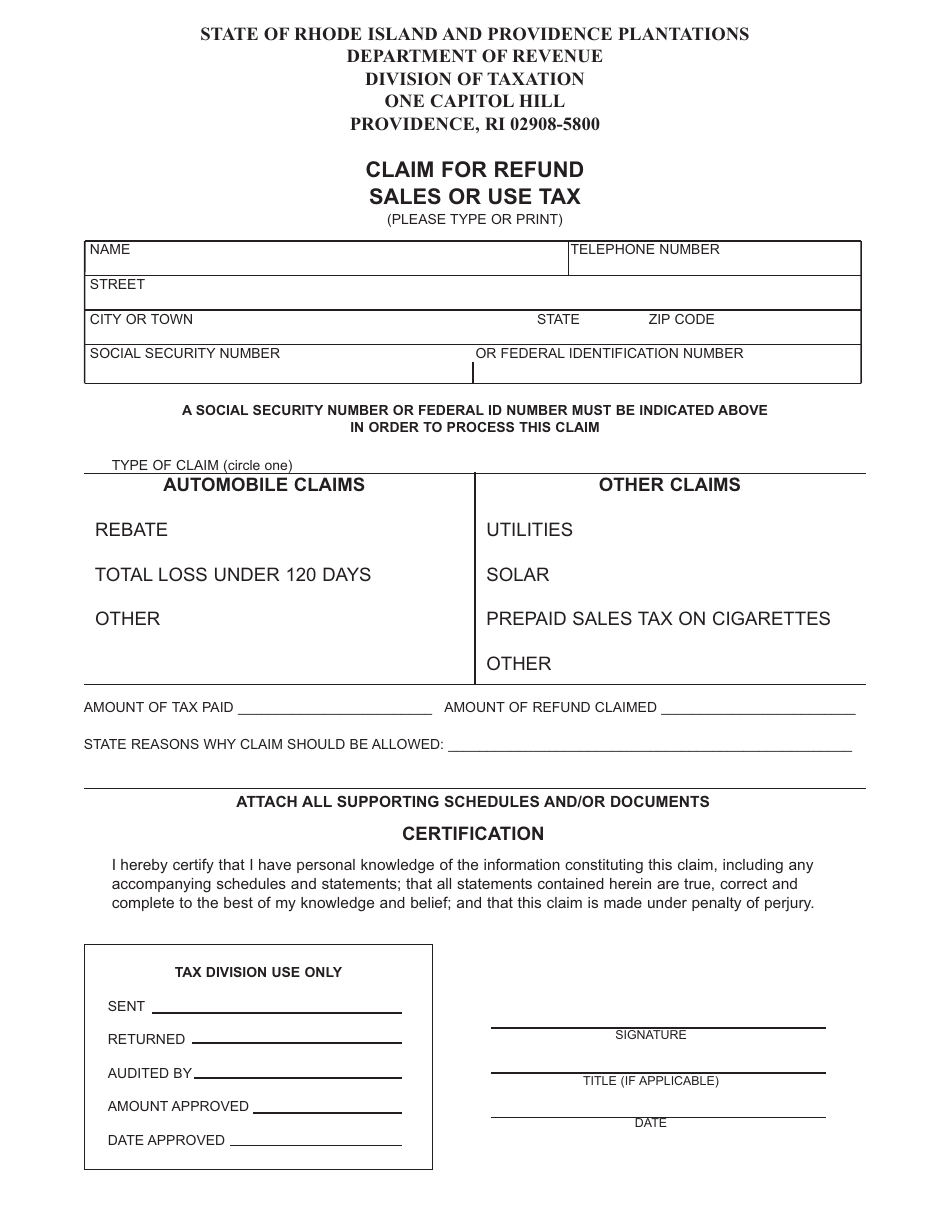

Form T3331 Download Printable PDF or Fill Online Sales or Use Tax

You can complete the forms with the help of. The amount of your expected refund, rounded to the nearest dollar. Rifans and ocean state procures user forms. Complete, edit or print tax forms instantly. And you are not enclosing a payment, then use this address.

Solved I'm being asked for "Prior Year Rhode Island Tax"

Web ri 1040 h only expected refund: The amount of your expected refund, rounded to the nearest dollar. And you are not enclosing a payment, then use this address. Web if you live in rhode island. For example, if your expected refund is between $151.50.

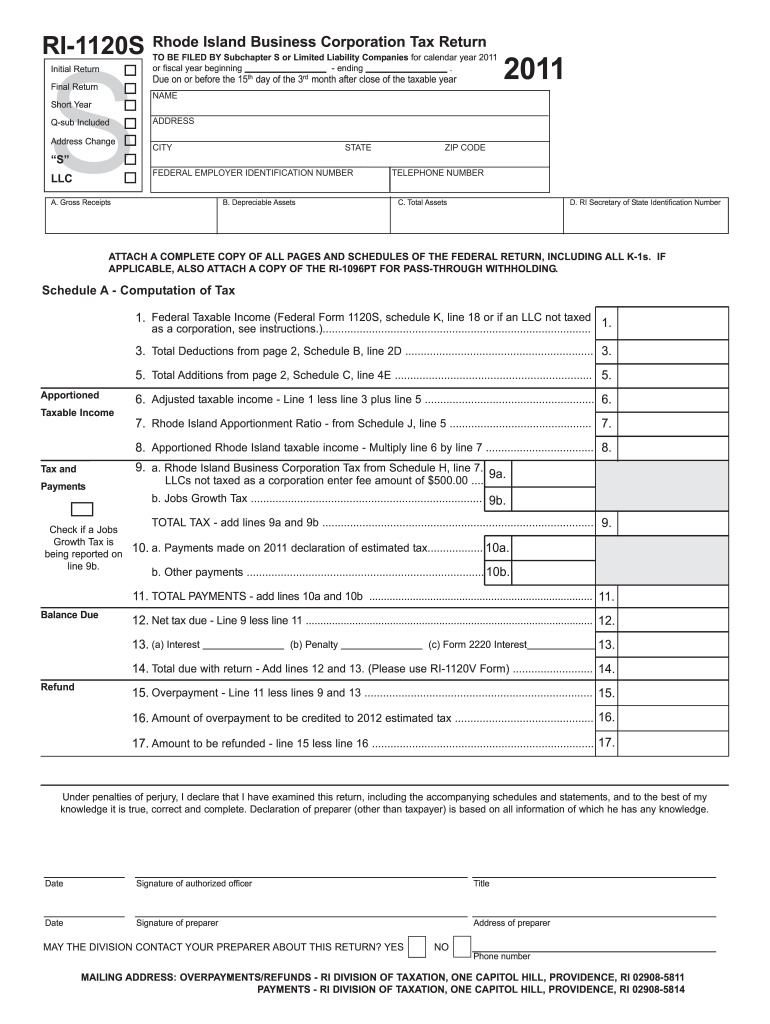

Form RI1120S Download Fillable PDF or Fill Online Subchapter S

Individual tax forms are organized by tax type. Web if you live in rhode island. And you are enclosing a payment, then. Complete, edit or print tax forms instantly. The amount of your expected refund, rounded to the nearest dollar.

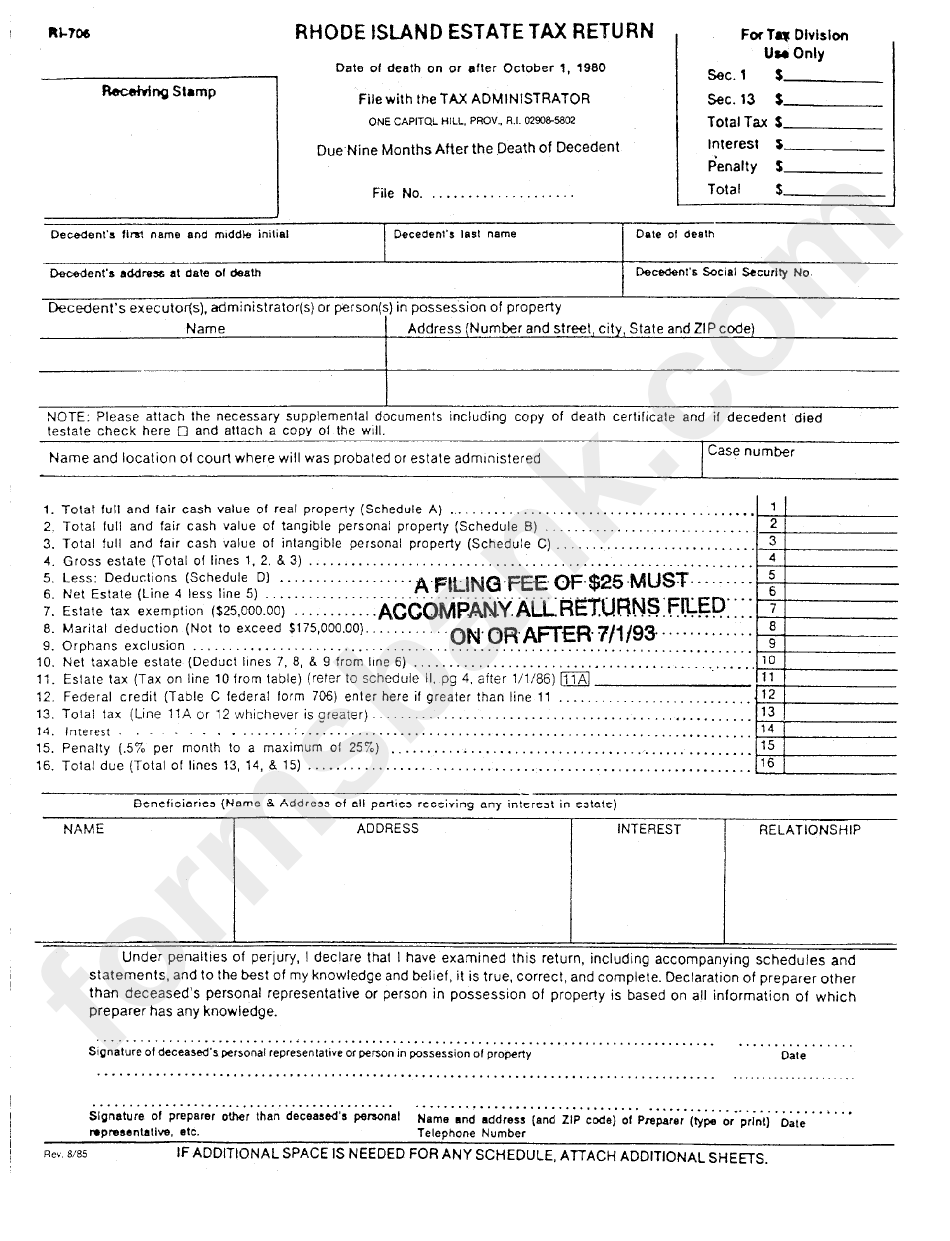

Fillable Form Ri706 Rhode Island Estate Tax Return printable pdf

Web ri 1040 h only expected refund: Select the tax type of the form you are looking for to be directed to that page. Complete, edit or print tax forms instantly. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. The amount of.

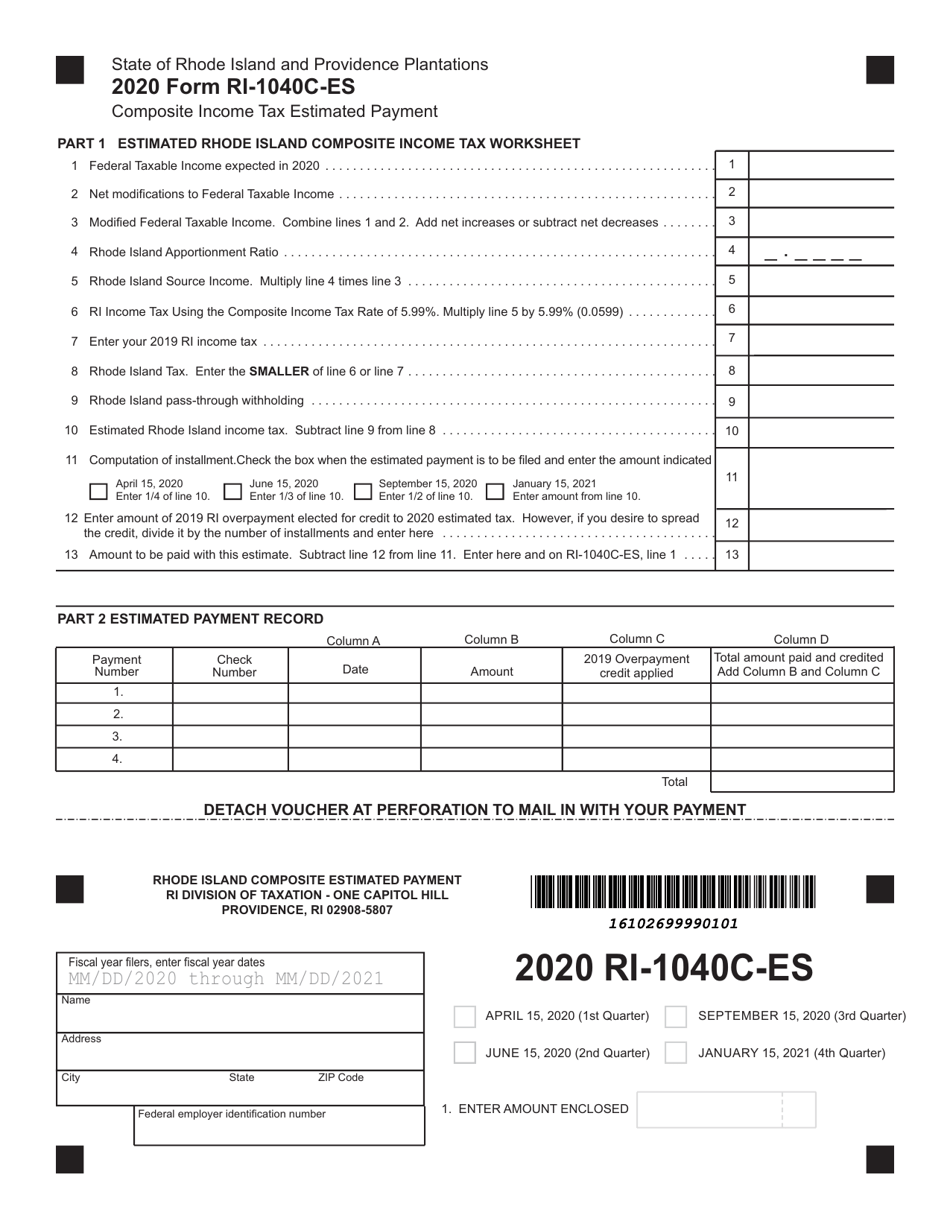

Form RI1040CES Download Fillable PDF or Fill Online Composite

Web file now with turbotax. Complete, edit or print tax forms instantly. Web ri 1040 h only expected refund: Select the tax type of the form you are looking for to be directed to that page. Web rhode island has a state income tax that ranges between 3.75% and 5.99%, which is administered by the rhode island division of taxation.

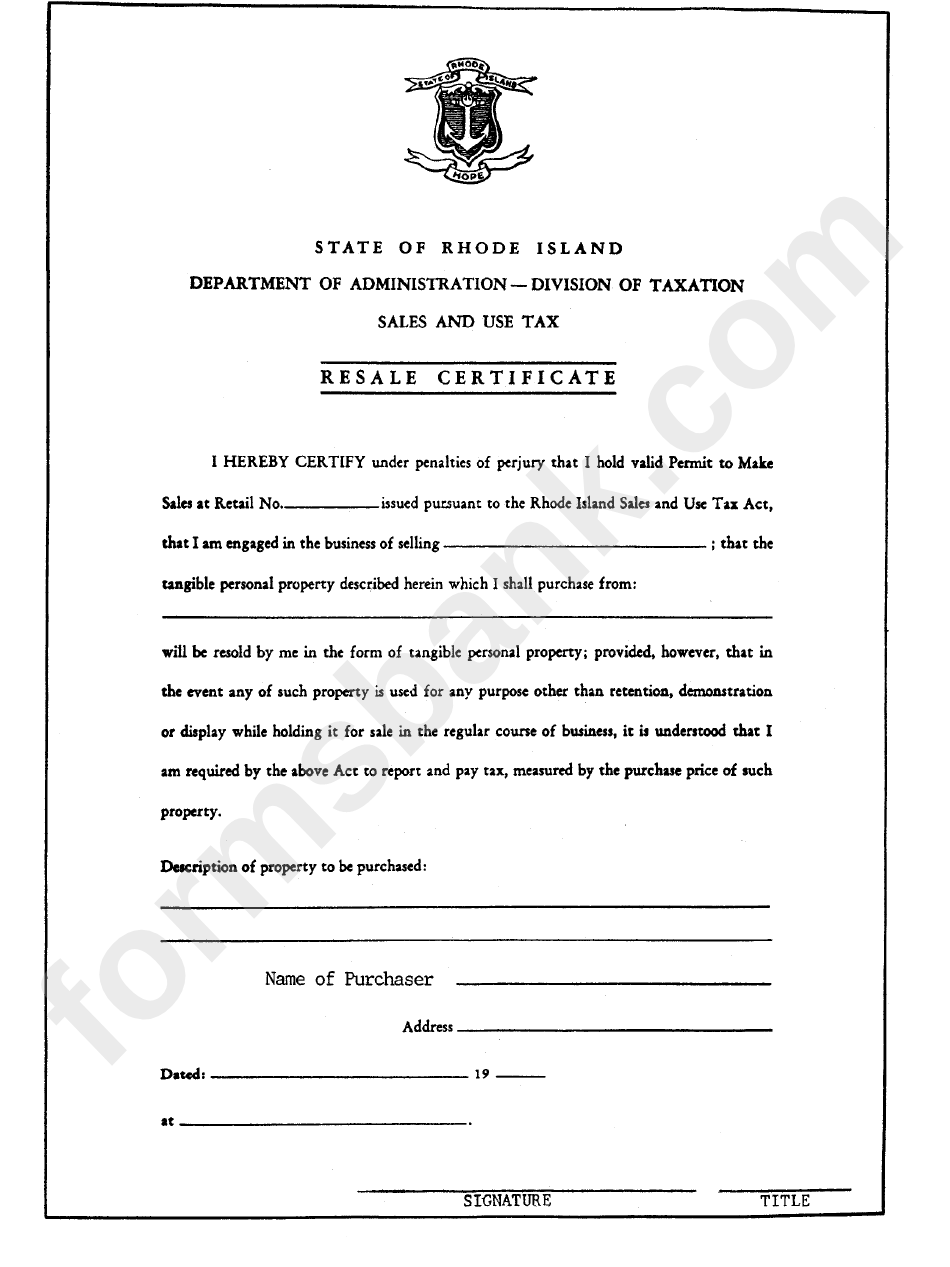

Fillable Sales And Use Tax State Of Rhode Island printable pdf download

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. This form is for income. Rifans and ocean state procures user forms. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and.

Form STM Download Fillable PDF or Fill Online Sales & Use Tax Return

We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for. Complete, edit or print tax forms instantly. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and. Select the tax type of.

Rhode Island Claim for Refund Sales or Use Tax Download Printable PDF

Web ri 1040 h only expected refund: You can complete the forms with the help of. Individual tax forms are organized by tax type. And you are not enclosing a payment, then use this address. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed.

Ri 1120S Fill Out and Sign Printable PDF Template signNow

And you are not enclosing a payment, then use this address. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Rifans and ocean state procures user forms. The amount of your expected refund, rounded to the nearest dollar.

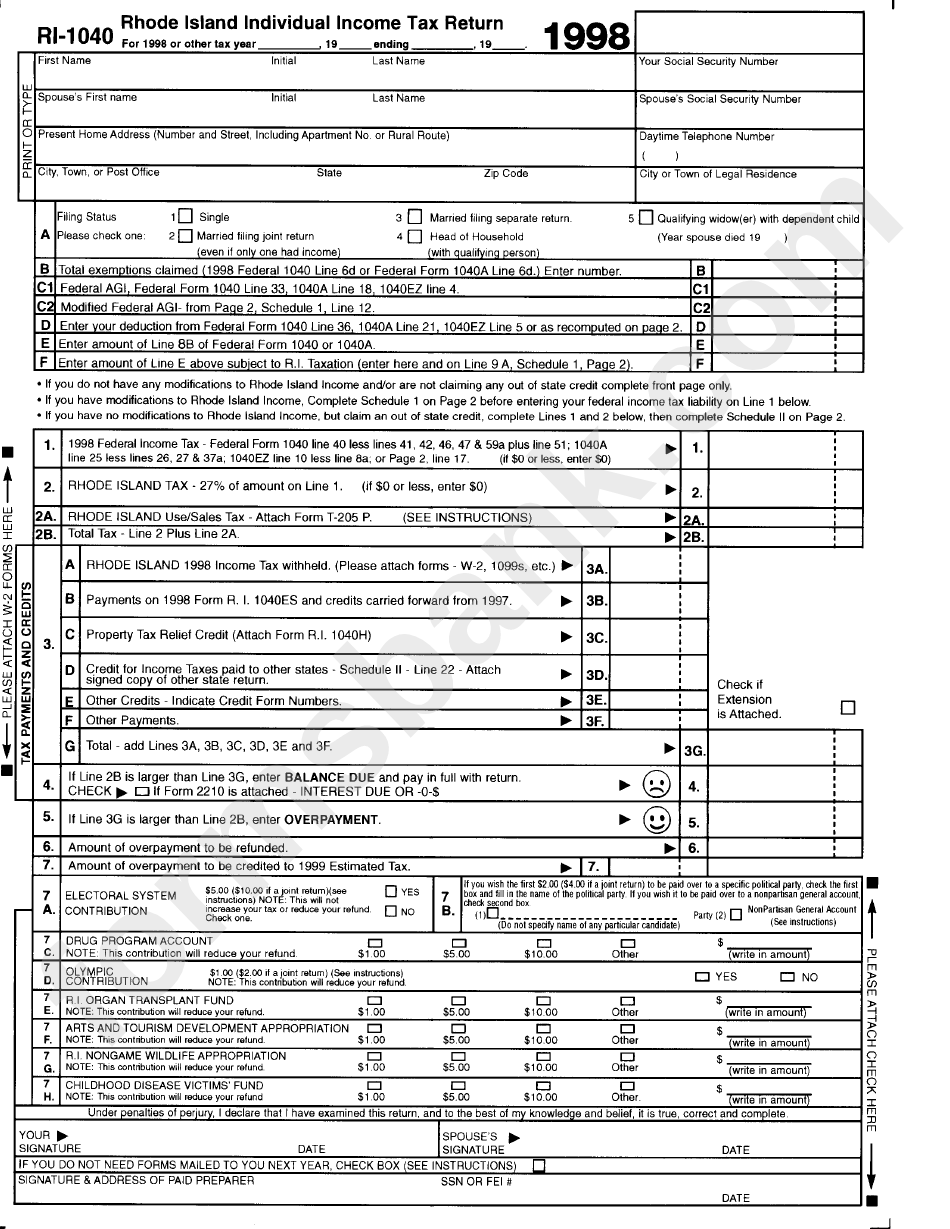

Fillable Form Ri1040 Rhode Island Individual Tax Return

For example, if your expected refund is between $151.50. Web file now with turbotax. Web rhode island tax forms. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and. Web if you are claiming a refund, mail your return to:

Rifans And Ocean State Procures User Forms.

Download all available tax forms from the rhode island division of taxation. Web rhode island tax forms. Web if you are claiming a refund, mail your return to: Web rhode island has a state income tax that ranges between 3.75% and 5.99%, which is administered by the rhode island division of taxation.

This Form Is For Income.

Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. Select the tax type of the form you are looking for to be directed to that page. Web ri 1040 h only expected refund: The amount of your expected refund, rounded to the nearest dollar.

In Accordance With Changes Signed Into Law In June Of 2022, A Larger Business Registrant Will Be Required To Use Electronic Means To File Returns And.

Web read the summary of the latest tax changes; And you are filing a form. Individual tax forms are organized by tax type. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for.

And You Are Not Enclosing A Payment, Then Use This Address.

Web if you live in rhode island. You can complete the forms with the help of. For example, if your expected refund is between $151.50. And you are enclosing a payment, then.