Ri Form 1065

Ri Form 1065 - Web department of the treasury internal revenue service. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web 40 rows form to file filing deadline; To have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov. In some cases, the owners of an llc choose to. For calendar year 2022, or. Web edit, sign, and share 1065 rhode island online. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Web use a 2019 ri 1065 form 2020 template to make your document workflow more streamlined. We last updated rhode island form 1065 in february 2023 from the rhode.

Make use of the tips about how to fill in. Web use a 2019 ri 1065 form 2020 template to make your document workflow more streamlined. Web most forms are provided in a format allowing you to fill in the form and save it. In some cases, the owners of an llc choose to. Web edit, sign, and share 1065 rhode island online. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year 2022, or. For more information, check the dot website. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. To have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov.

For more information, check the dot website. No need to install software, just go to dochub, and sign up instantly and for free. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web where to file your taxes for form 1065. Web use a 2019 ri 1065 form 2020 template to make your document workflow more streamlined. If the partnership's principal business, office, or agency is located in: Ad file partnership and llc form 1065 fed and state taxes with taxact® business. To have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov. We last updated rhode island form 1065 in february 2023 from the rhode. And the total assets at the end of the tax year.

Form 1065X Amended Return or Administrative Adjustment Request (2012

For instructions and the latest information. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web use a 2019 ri 1065 form 2020 template to make your.

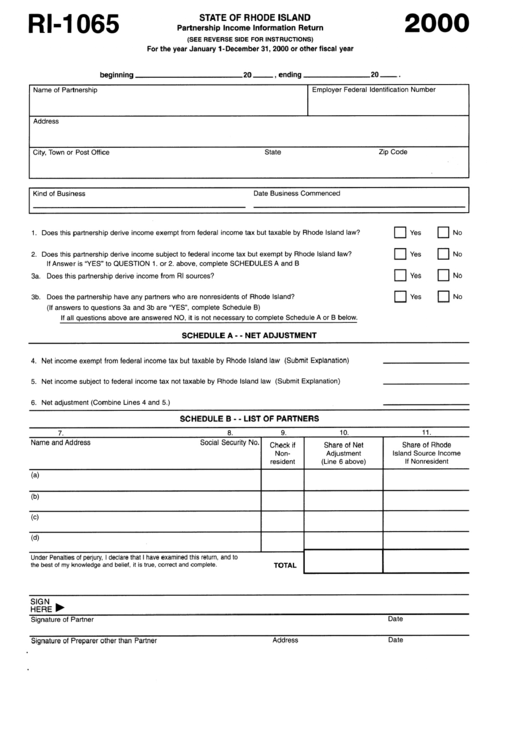

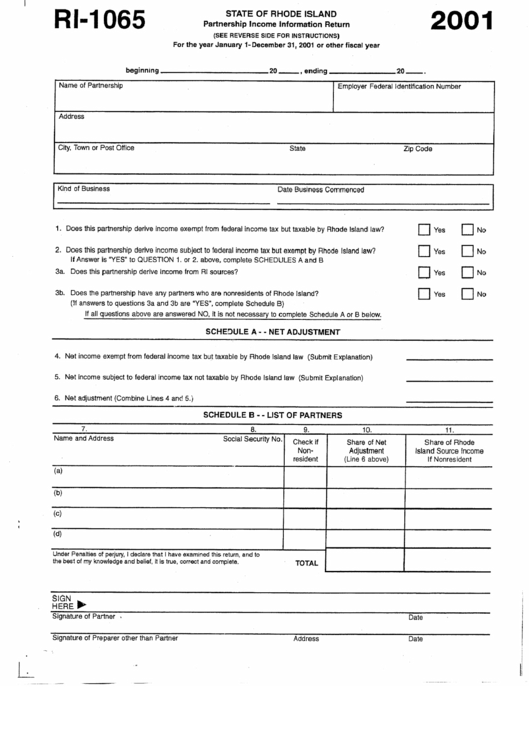

Form Ri1065 Partnership Information Return 2000 printable

Web 40 rows form to file filing deadline; For instructions and the latest information. No need to install software, just go to dochub, and sign up instantly and for free. Web form 1065v is a rhode island corporate income tax form. In some cases, the owners of an llc choose to.

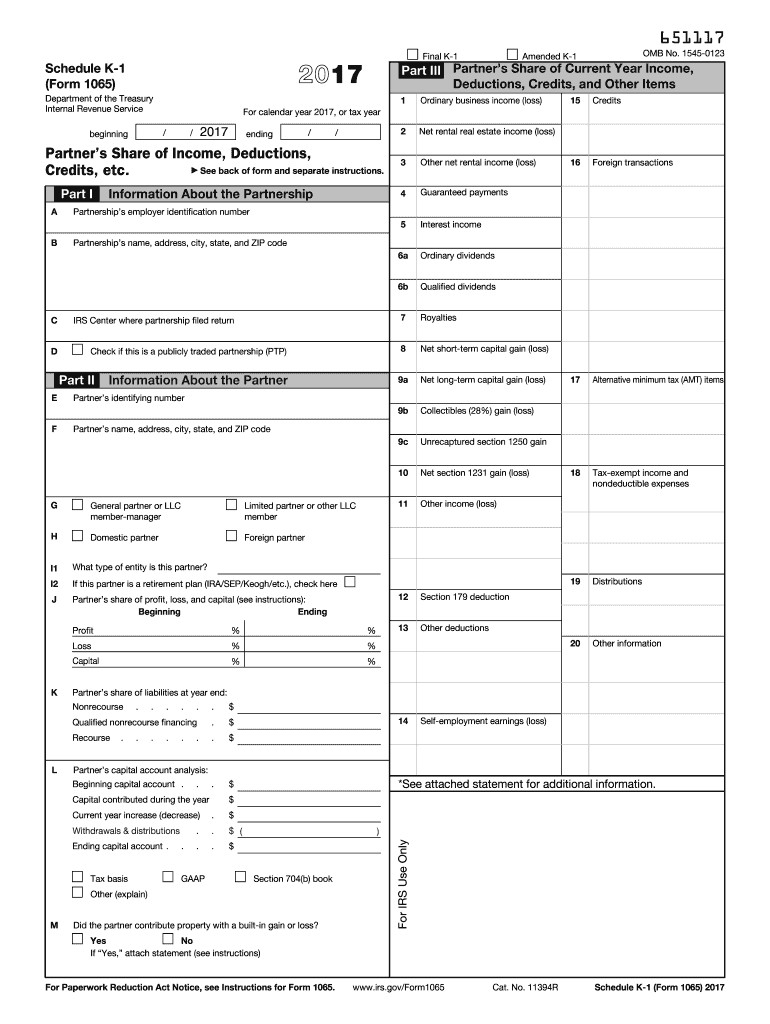

IRS 1065 Schedule K1 2017 Fill out Tax Template Online US Legal

Web 40 rows form to file filing deadline; If the partnership's principal business, office, or agency is located in: Make use of the tips about how to fill in. Web most forms are provided in a format allowing you to fill in the form and save it. In some cases, the owners of an llc choose to.

Form 1065B U.S. Return of for Electing Large Partnerships

For more information, check the dot website. Make use of the tips about how to fill in. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web use a 2019 ri 1065 form 2020 template to make.

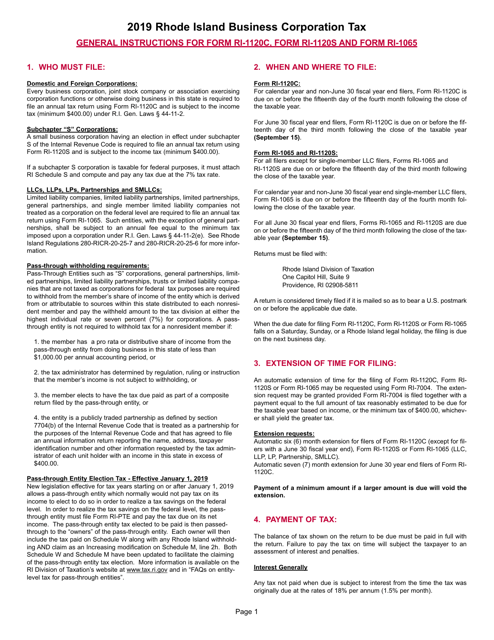

Download Instructions for Form RI1120C, RI1120S, RI1065 PDF, 2019

No need to install software, just go to dochub, and sign up instantly and for free. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web 40 rows form to file filing deadline; In some cases, the owners of an llc choose to. For more.

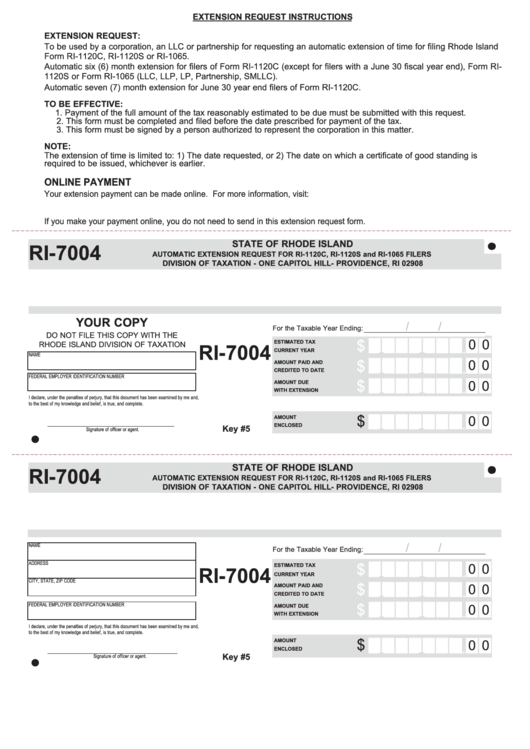

Fillable Form Ri7004 Automatic Extension Request For Ri1120c, Ri

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. For instructions and the latest information. In some cases, the owners of an llc choose to. Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in:

Form Ri1065 Partnership Information Return printable pdf download

Web where to file your taxes for form 1065. We last updated rhode island form 1065 in february 2023 from the rhode. And the total assets at the end of the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year.

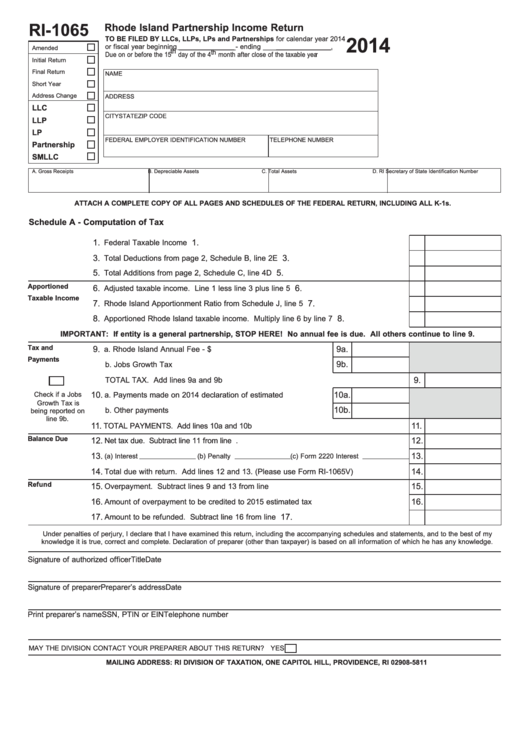

Form Ri1065 Rhode Island Partnership Return 2014 printable

Make use of the tips about how to fill in. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. For a fiscal year or a short tax year, fill in the.

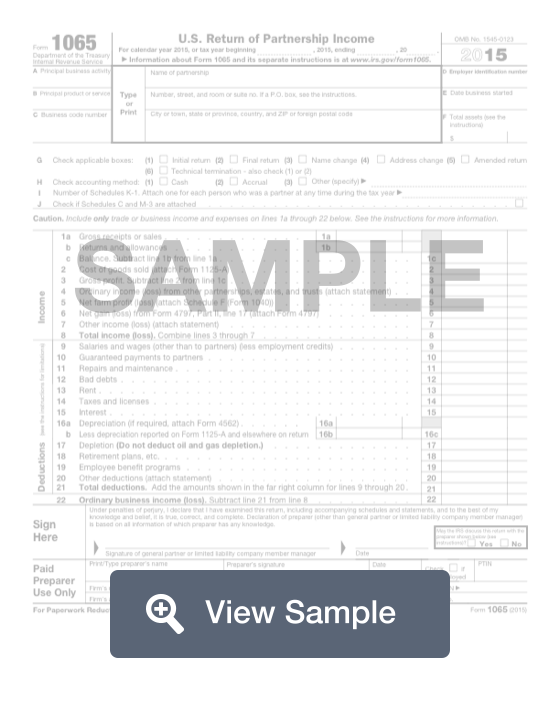

Form 1065 Partnership Tax Return Fill Out Onlne PDF FormSwift

For a fiscal year or a short tax year, fill in the tax year. Web edit, sign, and share 1065 rhode island online. Web use a 2019 ri 1065 form 2020 template to make your document workflow more streamlined. Web 40 rows form to file filing deadline; Web department of the treasury internal revenue service.

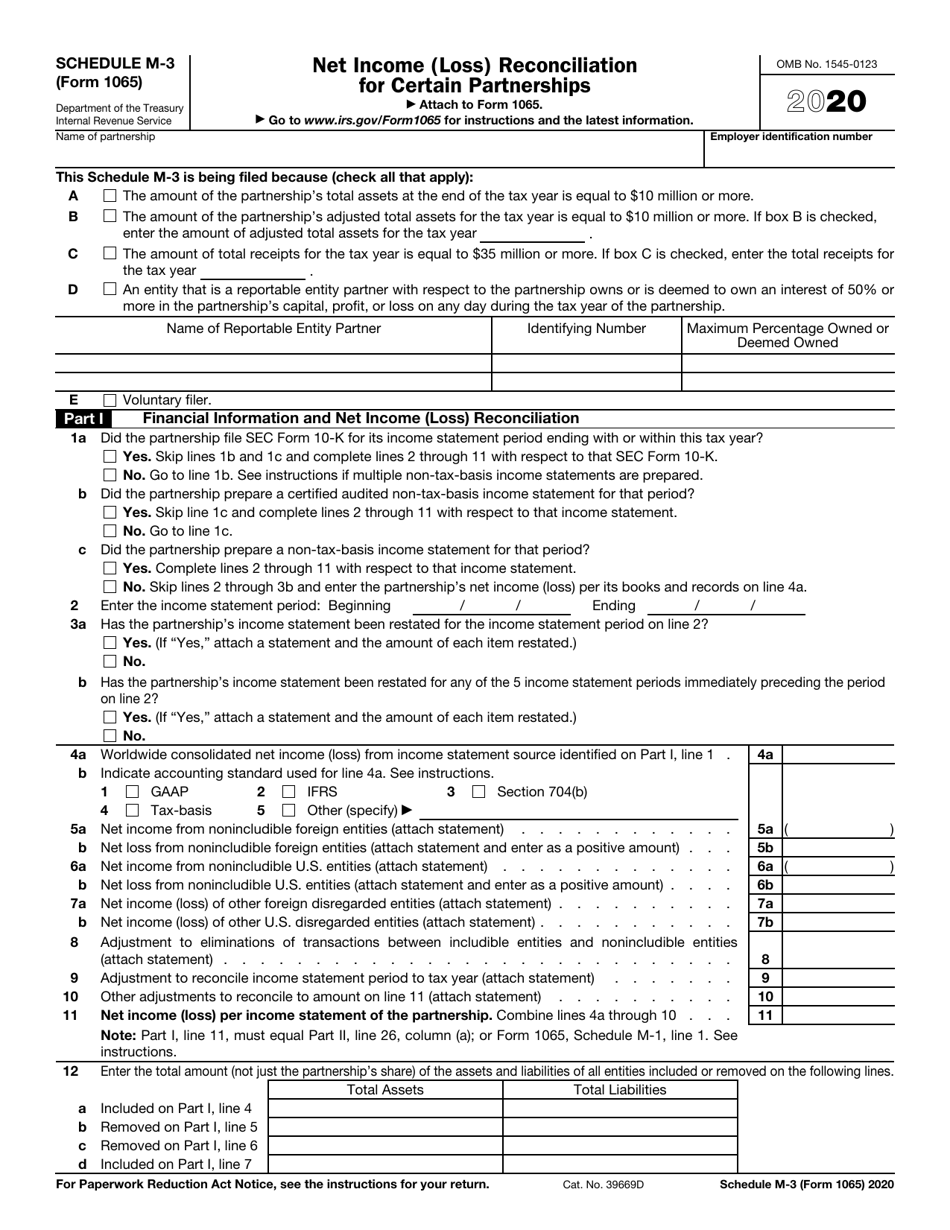

IRS Form 1065 Schedule M3 Download Fillable PDF or Fill Online Net

Web edit, sign, and share 1065 rhode island online. Web most forms are provided in a format allowing you to fill in the form and save it. Web use a 2019 ri 1065 form 2020 template to make your document workflow more streamlined. We last updated rhode island form 1065 in february 2023 from the rhode. No need to install.

Web Edit, Sign, And Share 1065 Rhode Island Online.

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. To have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov. In some cases, the owners of an llc choose to. For a fiscal year or a short tax year, fill in the tax year.

Web Where To File Your Taxes For Form 1065.

Make use of the tips about how to fill in. And the total assets at the end of the tax year. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web department of the treasury internal revenue service.

We Last Updated Rhode Island Form 1065 In February 2023 From The Rhode.

If the partnership's principal business, office, or agency is located in: Web form 1065v is a rhode island corporate income tax form. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. For calendar year 2022, or.

Web 40 Rows Form To File Filing Deadline;

For instructions and the latest information. Web use a 2019 ri 1065 form 2020 template to make your document workflow more streamlined. For more information, check the dot website. No need to install software, just go to dochub, and sign up instantly and for free.