Rrb 1099 Form

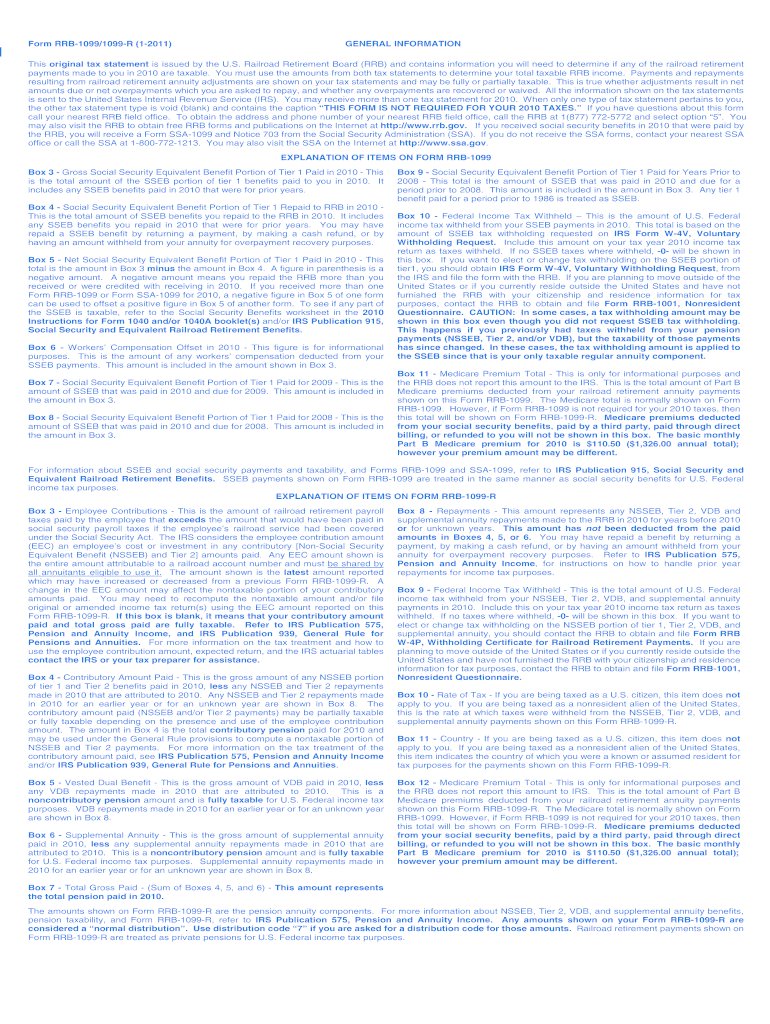

Rrb 1099 Form - Viewers with visual disabilities can go to adobe's access website for tools and information that will help make pdf files accessible. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the. Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. These forms (tax statements) report the amounts paid and repaid, and taxes withheld for a tax year. These payments are treated as private pensions. You will need to determine if any of the railroad retirement payments made to you are taxable. You may receive more than one of these forms for the same tax year. Citizen and nonresident alien beneficiaries. Enter the amount from box 5, net social security equivalent benefit portion of tier 1 paid in the current tax year, on the taxpayer's or. Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement.

These payments are treated as private pensions. These forms (tax statements) report the amounts paid and repaid, and taxes withheld for a tax year. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the. Citizen and nonresident alien beneficiaries. Web income tax downloadable forms to view and download pdf documents, you need the free acrobat reader. Enter the amount from box 5, net social security equivalent benefit portion of tier 1 paid in the current tax year, on the taxpayer's or. Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. You will need to determine if any of the railroad retirement payments made to you are taxable. Viewers with visual disabilities can go to adobe's access website for tools and information that will help make pdf files accessible. Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen.

Enter the amount from box 5, net social security equivalent benefit portion of tier 1 paid in the current tax year, on the taxpayer's or. You may receive more than one of these forms for the same tax year. Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. These payments are treated as private pensions. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the. You will need to determine if any of the railroad retirement payments made to you are taxable. Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. Web income tax downloadable forms to view and download pdf documents, you need the free acrobat reader. We recommend using the latest version. These forms (tax statements) report the amounts paid and repaid, and taxes withheld for a tax year.

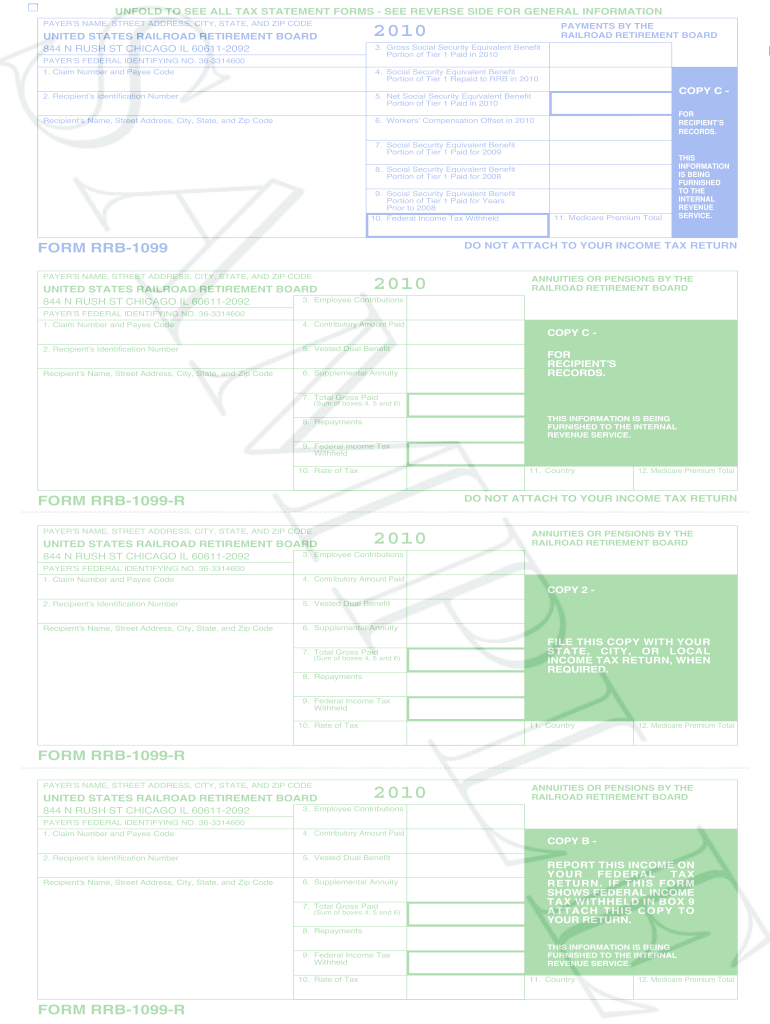

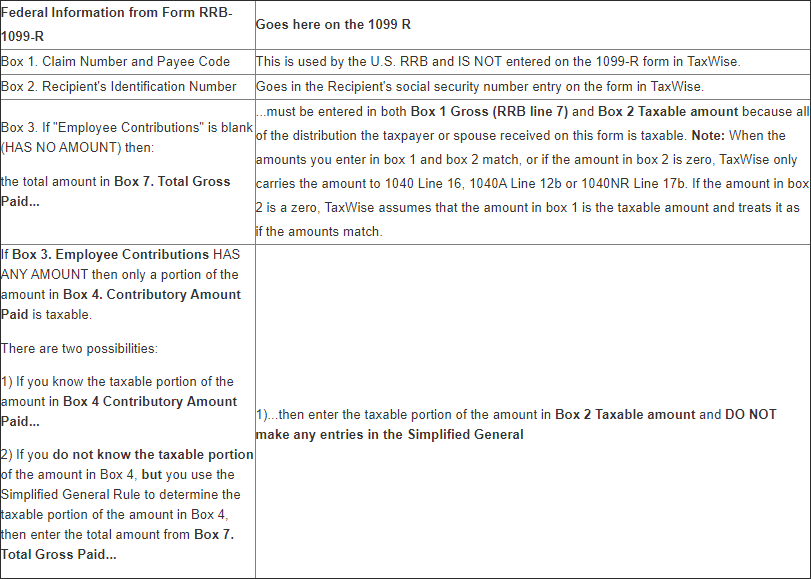

Form RRB1099R Railroad Retirement Benefits Keystone Support Center

Web income tax downloadable forms to view and download pdf documents, you need the free acrobat reader. You will need to determine if any of the railroad retirement payments made to you are taxable. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the. Web social security equivalent benefits, form rrb 1099 tier.

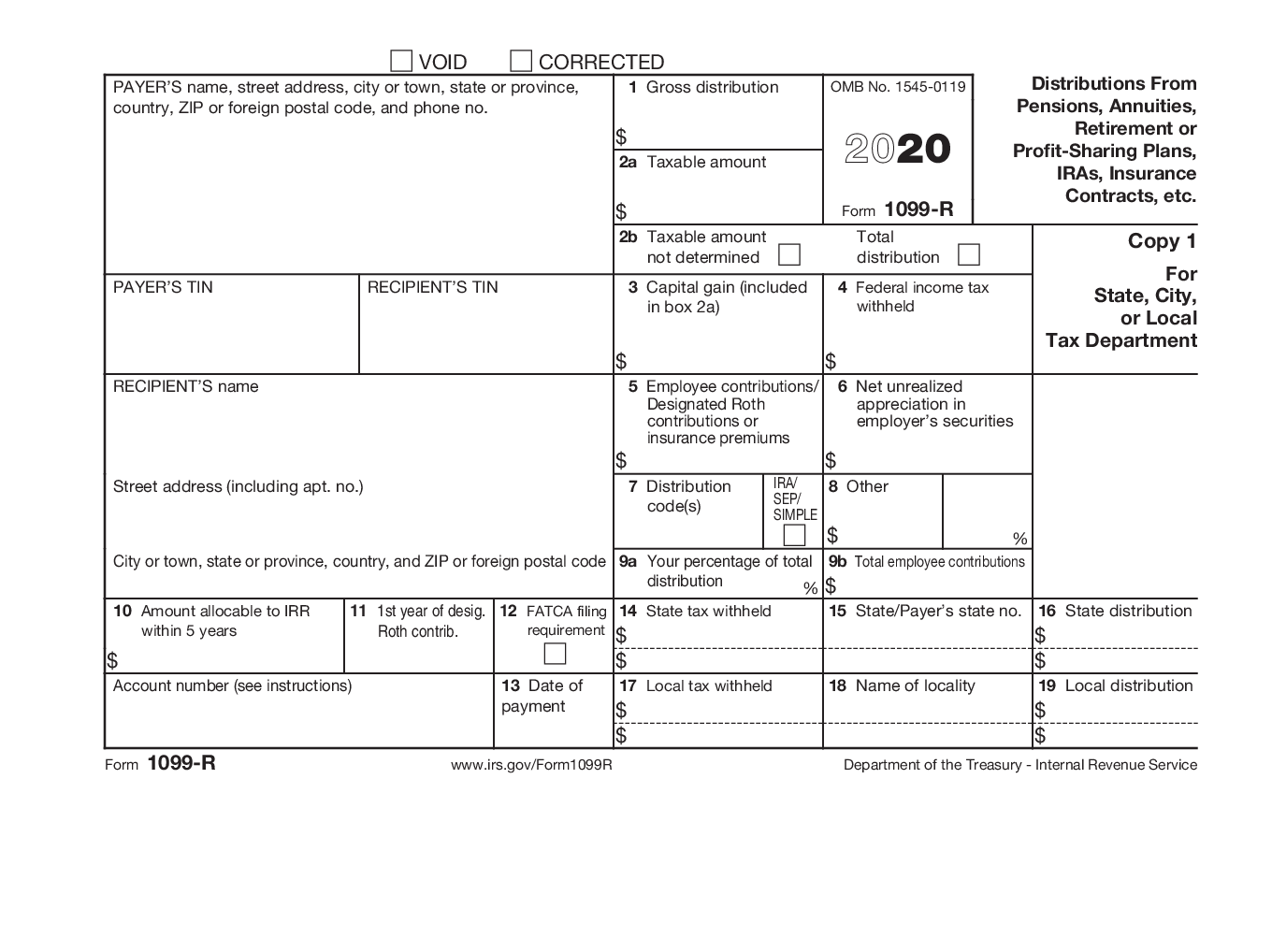

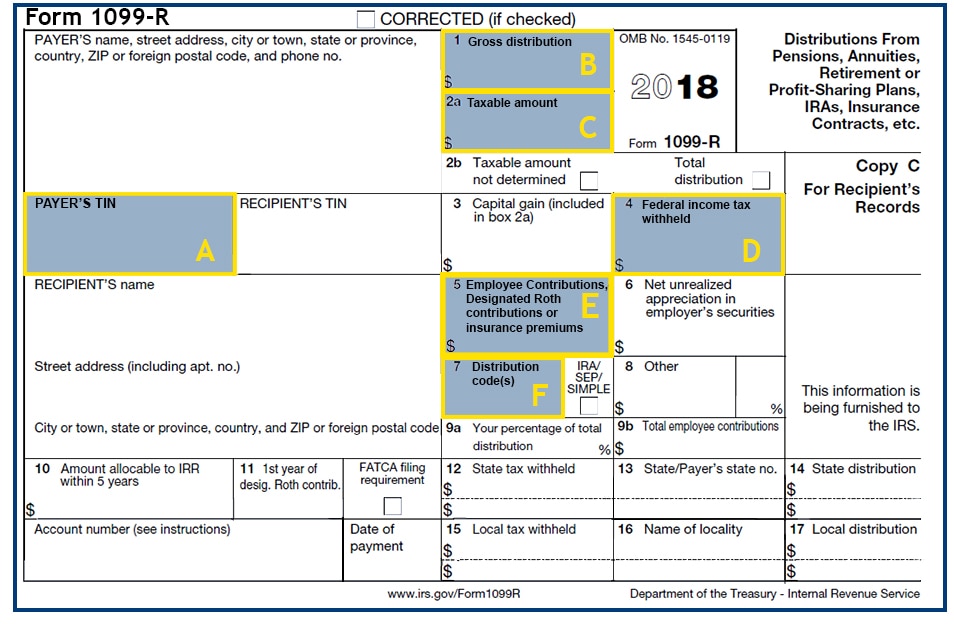

Form 1099R

From within your taxact return ( online or desktop), click federal (on smaller devices, click in the. Web income tax downloadable forms to view and download pdf documents, you need the free acrobat reader. You may receive more than one of these forms for the same tax year. These forms (tax statements) report the amounts paid and repaid, and taxes.

Efile 2022 Form 1099R Report the Distributions from Pensions

You will need to determine if any of the railroad retirement payments made to you are taxable. These payments are treated as private pensions. These forms (tax statements) report the amounts paid and repaid, and taxes withheld for a tax year. We recommend using the latest version. Web income tax downloadable forms to view and download pdf documents, you need.

form rrb 1099 r images Fill out & sign online DocHub

You will need to determine if any of the railroad retirement payments made to you are taxable. These payments are treated as private pensions. We recommend using the latest version. You may receive more than one of these forms for the same tax year. Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on.

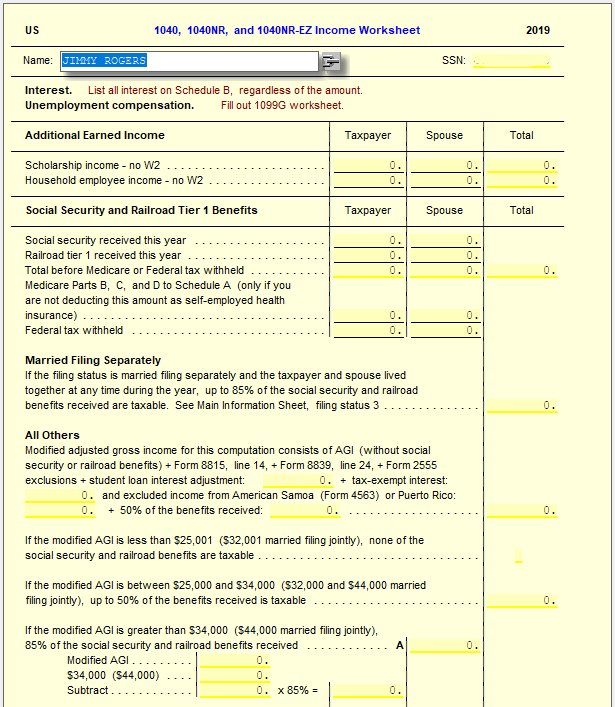

Railroad Benefits (RRB1099) UltimateTax Solution Center

You will need to determine if any of the railroad retirement payments made to you are taxable. These payments are treated as private pensions. Viewers with visual disabilities can go to adobe's access website for tools and information that will help make pdf files accessible. Railroad retirement board (rrb) and represents payments made to you in the tax year indicated.

Rrb 1099 R Form Fill Out and Sign Printable PDF Template signNow

Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. These payments are treated as private pensions. You will need to determine if any of the railroad retirement payments made to you are taxable. We recommend using the latest version. Web income tax downloadable forms to view and download pdf documents, you.

Sample 12r Form Filled Out You Should Experience Sample 12r Form

Enter the amount from box 5, net social security equivalent benefit portion of tier 1 paid in the current tax year, on the taxpayer's or. We recommend using the latest version. Citizen and nonresident alien beneficiaries. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the. Web income tax downloadable forms to view.

Form RRB1099R Railroad Retirement Benefits Keystone Support Center

Enter the amount from box 5, net social security equivalent benefit portion of tier 1 paid in the current tax year, on the taxpayer's or. These forms (tax statements) report the amounts paid and repaid, and taxes withheld for a tax year. Citizen and nonresident alien beneficiaries. You will need to determine if any of the railroad retirement payments made.

Railroad Benefits (RRB1099) UltimateTax Solution Center

Citizen and nonresident alien beneficiaries. You may receive more than one of these forms for the same tax year. Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. We recommend using the latest version. Railroad retirement board (rrb) and represents payments made to you in the tax year indicated.

Example Of Non Ssa 1099 Form / How To Fill Out A 1099 Nec Box By Box

Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. Viewers with visual disabilities can go to adobe's access website for tools and information that will help make pdf files accessible. We.

From Within Your Taxact Return ( Online Or Desktop), Click Federal (On Smaller Devices, Click In The.

Viewers with visual disabilities can go to adobe's access website for tools and information that will help make pdf files accessible. Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. These payments are treated as private pensions. You may receive more than one of these forms for the same tax year.

Railroad Retirement Board (Rrb) And Represents Payments Made To You In The Tax Year Indicated On The Statement.

Web income tax downloadable forms to view and download pdf documents, you need the free acrobat reader. Citizen and nonresident alien beneficiaries. We recommend using the latest version. Enter the amount from box 5, net social security equivalent benefit portion of tier 1 paid in the current tax year, on the taxpayer's or.

You Will Need To Determine If Any Of The Railroad Retirement Payments Made To You Are Taxable.

These forms (tax statements) report the amounts paid and repaid, and taxes withheld for a tax year.